Apple Vs. Trump Tariffs: Will Buffett's Top Tech Stock Crack?

Table of Contents

The Trump Tariffs and Their Impact on Apple's Supply Chain

The Trump-era tariffs significantly impacted Apple's intricate global supply chain, triggering a ripple effect across its operations.

Increased Production Costs

The tariffs, primarily targeting goods imported from China, directly increased Apple's manufacturing costs. Key components like displays, memory chips, and other crucial parts faced hefty import duties. For example, tariffs on certain components reached as high as 25%, significantly impacting the overall bill of materials for Apple products. This increase in "manufacturing costs" directly affected Apple's profit margins and overall profitability. The complex nature of "Apple's supply chain" meant that even seemingly minor tariffs could have substantial cascading effects.

- Tariffs increased the cost of numerous imported components.

- This directly translated into higher production costs for Apple.

- The impact was felt across the entire product line.

Diversification Strategies

In response to the tariff challenges, Apple actively pursued "supply chain diversification" strategies. This involved shifting some production to countries outside of China, including India and Vietnam. This "offshoring" and exploration of "reshoring" presented both opportunities and significant hurdles. Apple faced challenges in establishing new manufacturing facilities, training workers, and adapting to different regulatory environments. Managing "geopolitical risk" became a crucial aspect of Apple's strategic planning.

- Apple invested in manufacturing facilities in other countries.

- This diversification helped mitigate some of the tariff-related risks.

- However, the transition proved complex and time-consuming.

Consumer Impact and Demand for Apple Products

The impact of the Trump tariffs extended beyond Apple's internal operations, directly affecting consumers and the competitive landscape.

Price Increases

While Apple absorbed some of the increased costs, it also passed some onto consumers through higher prices. This "Apple pricing strategy" was a calculated risk, balancing profit margins with the potential impact on "consumer demand." The "price elasticity" of demand for Apple products played a crucial role in determining the extent to which price increases could be implemented without significantly impacting sales. "Inflationary pressures" further complicated the pricing equation.

- Apple increased prices on some products to offset higher production costs.

- The impact on consumer demand varied depending on the product and market segment.

- Price sensitivity played a crucial role in the pricing decisions.

Market Share and Competition

The tariffs also affected Apple's competitive positioning within the tech market. While Apple maintained its strong "market share," the increased costs could have provided a competitive advantage to rivals like Samsung and Huawei, who might have had more diversified supply chains or lower manufacturing costs. Analyzing "market competition" during this period is crucial to understanding the full impact of the tariffs.

- Increased costs potentially impacted Apple's competitive advantage.

- Competitors may have gained ground due to more geographically diverse sourcing.

- Apple's strong brand loyalty, however, helped mitigate some of the negative impacts.

Warren Buffett's Investment and the Long-Term Outlook

Warren Buffett's investment in Apple is a testament to his faith in the company's long-term prospects.

Buffett's Investment Strategy

Buffett's "value investing" philosophy focuses on identifying fundamentally strong companies with enduring competitive advantages. His decision to invest heavily in Apple reflects his belief in Apple's brand strength and market dominance. Whether the tariffs significantly altered his "long-term investment" thesis is a matter of ongoing debate; the impact was likely absorbed by Apple's overall strength and performance. The "stock valuation" remained a key consideration.

- Buffett's investment reflected his long-term confidence in Apple's business model.

- Tariffs likely had a limited impact on his overall investment thesis.

- Apple's resilience demonstrates the strength of its brand and products.

Apple's Resilience

Despite the challenges posed by the Trump tariffs, Apple demonstrated considerable resilience. Factors such as sustained "product demand," "Apple innovation," and robust "brand loyalty" all contributed to its continued success. The sheer scale of Apple's "market capitalization" speaks to its overall strength and ability to navigate economic headwinds.

- Apple's strong brand and loyal customer base helped offset tariff impacts.

- Continuous innovation maintained product demand and competitiveness.

- Apple's overall performance demonstrates its inherent resilience.

Conclusion: Assessing the Future of Apple in a Changing Global Landscape

The Trump-era tariffs presented a significant challenge to Apple's supply chain and profitability. While increased production costs and price adjustments impacted the company, Apple demonstrated remarkable resilience. Its diversification strategies, strong brand, and innovative products helped mitigate the negative effects of the trade war. Buffett’s continued confidence in Apple underscores this resilience. Looking ahead, Apple’s future prospects remain bright, although navigating geopolitical complexities and supply chain volatility will remain a key challenge. Stay informed about the ongoing effects of global trade policies on tech giants like Apple. Conduct your own research and stay updated on the latest developments concerning Apple stock and its performance in the face of economic fluctuations. Utilize resources that offer detailed "Apple stock analysis" to inform your understanding of the relationship between "tariff impact on technology" and "Buffett's investment strategy" to better understand "Apple's future."

Featured Posts

-

Brest Urban Trail Les Visages De L Evenement Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail Les Visages De L Evenement Benevoles Artistes Et Partenaires

May 24, 2025 -

Umfjoellun Um Nyju 100 Rafmagnsutgafu Porsche Macan

May 24, 2025

Umfjoellun Um Nyju 100 Rafmagnsutgafu Porsche Macan

May 24, 2025 -

Seattles Green Spaces A Haven During The Early Pandemic

May 24, 2025

Seattles Green Spaces A Haven During The Early Pandemic

May 24, 2025 -

Najvaecsie Nemecke Firmy Prepustaju Tisice Ludi Bez Prace

May 24, 2025

Najvaecsie Nemecke Firmy Prepustaju Tisice Ludi Bez Prace

May 24, 2025 -

A Relaxing Escape To The Country Choosing The Right Location

May 24, 2025

A Relaxing Escape To The Country Choosing The Right Location

May 24, 2025

Latest Posts

-

Negotiating A Final Job Offer Is It Possible

May 24, 2025

Negotiating A Final Job Offer Is It Possible

May 24, 2025 -

What Sam Altman Revealed About His New Device With Jony Ive

May 24, 2025

What Sam Altman Revealed About His New Device With Jony Ive

May 24, 2025 -

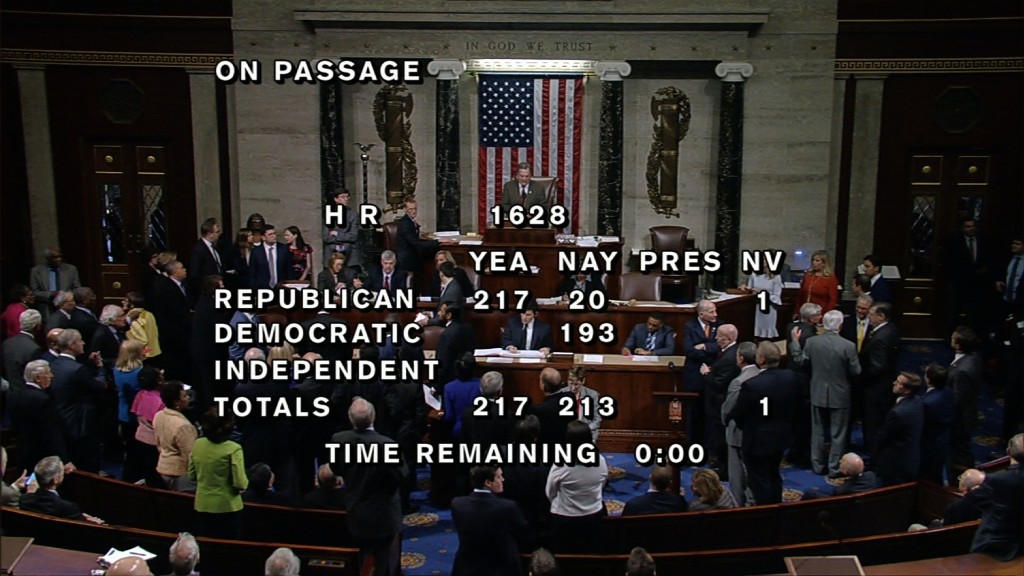

Market Reaction House Tax Bill Passage Affects Bonds Stocks And Bitcoin

May 24, 2025

Market Reaction House Tax Bill Passage Affects Bonds Stocks And Bitcoin

May 24, 2025 -

How Alix Earle Conquered Gen Z Marketing On Dancing With The Stars

May 24, 2025

How Alix Earle Conquered Gen Z Marketing On Dancing With The Stars

May 24, 2025 -

House Tax Bill Passes Impact On Stock Market Bonds And Bitcoin

May 24, 2025

House Tax Bill Passes Impact On Stock Market Bonds And Bitcoin

May 24, 2025