Barrick Gold Disputes Mali's Takeover Bid: Legal Challenges Ahead

Table of Contents

Mali's Justification for the Takeover Bid

The Malian government's justification for its attempt to seize control of Barrick Gold's assets rests on several pillars. Their primary argument centers on maximizing revenue generation from the nation's substantial gold reserves, aiming for greater control over the "Mali gold mining" sector and its considerable wealth. This is a classic case of resource nationalism, where a government prioritizes national interests above foreign corporate entities. The Malian government also cites concerns over environmental impact, alleging that Barrick's mining practices have not adhered to sufficient environmental standards. Furthermore, accusations of contract non-compliance and accusations of unfair practices have been leveled against Barrick Gold.

- Increased Revenue for Mali: The government seeks to increase its share of profits from gold extraction.

- Environmental Concerns: Allegations of environmental damage caused by Barrick's operations.

- Contract Disputes: Claims that Barrick has failed to comply with the terms of its mining contracts.

- Nationalization of Resources: Assertion of sovereign rights over the nation's natural resources, aligning with the broader trend of "resource control" in many developing nations.

Barrick Gold's Response and Legal Strategy

Barrick Gold has vehemently rejected the Malian government's actions, firmly stating that the takeover is unlawful and violates international investment agreements. The company has vowed to pursue all available legal avenues to protect its assets and investments in Mali. This includes potentially initiating international arbitration proceedings under relevant investment treaties, leveraging established mechanisms for "dispute resolution." Barrick's legal strategy is centered around highlighting the illegality of the seizure, the potential damage to its reputation and its shareholders, and the significant negative impact on investor confidence in Mali.

- International Arbitration: Barrick is expected to pursue arbitration under bilateral investment treaties.

- Legal Challenges: The company will use all legal means to challenge the legality of the takeover.

- Defense of Investment Agreements: Barrick will assert violations of international investment agreements protecting foreign investment.

- Damage Claims: The company will likely seek substantial compensation for losses incurred.

Potential Implications for International Investment in Mali

The Barrick Gold Disputes Mali's Takeover Bid carries profound implications for foreign investment in Mali's mining sector and potentially across Africa. The actions of the Malian government could significantly deter future foreign investment in the country's mining industry. This sends a negative signal to other mining companies considering investment, raising concerns about "political risk" and the security of investments in resource-rich nations. The ripple effect could extend beyond Mali, impacting investor confidence across the African continent. The uncertainty created by this dispute could lead to a decline in "Foreign investment Mali," affecting economic growth and development.

- Deterrence of Future Investment: The dispute could discourage foreign investment in Mali’s mining sector.

- Increased Risk Perception: Investors may perceive higher political and legal risks in Mali.

- Economic Consequences: A decline in foreign investment could negatively impact Mali's economic growth.

- Reputational Damage: Mali's reputation as a stable investment destination could suffer.

Impact on the Global Gold Market

The disruption of Barrick Gold's operations in Mali could have a noticeable impact on the "global gold market." As one of the world's largest gold producers, Barrick's output contributes significantly to the global gold supply. A prolonged shutdown or reduced production could lead to tighter supply and potentially push up "gold prices." The situation also introduces uncertainty into the global gold supply chain, potentially affecting jewelry manufacturers, investors, and central banks that rely on stable gold supplies. This illustrates how events within one country can swiftly influence "commodity prices" on a global scale.

- Potential Gold Price Increases: Reduced gold supply could lead to higher gold prices.

- Supply Chain Disruptions: Uncertainty in Mali could affect the global gold supply chain.

- Market Volatility: The situation is likely to create volatility in the gold market.

Conclusion

The Barrick Gold Disputes Mali's Takeover Bid highlights the complex interplay between national sovereignty, international investment law, and the global commodity markets. The potential legal battles ahead will have significant ramifications for both Barrick Gold and the Malian economy. Mali's actions risk deterring crucial foreign investment, while Barrick faces substantial financial losses and reputational damage. The outcome of this dispute will undoubtedly shape future investment decisions in the African mining sector and influence the global gold market. To stay informed about this evolving situation and the ongoing legal battle between Barrick Gold and the Malian government, subscribe to our newsletter or follow us on social media for the latest updates on the Barrick Gold Mali dispute.

Featured Posts

-

Fenerbahce Nin Cristiano Ronaldo Teklifi Gercek Mi Yalan Mi

May 28, 2025

Fenerbahce Nin Cristiano Ronaldo Teklifi Gercek Mi Yalan Mi

May 28, 2025 -

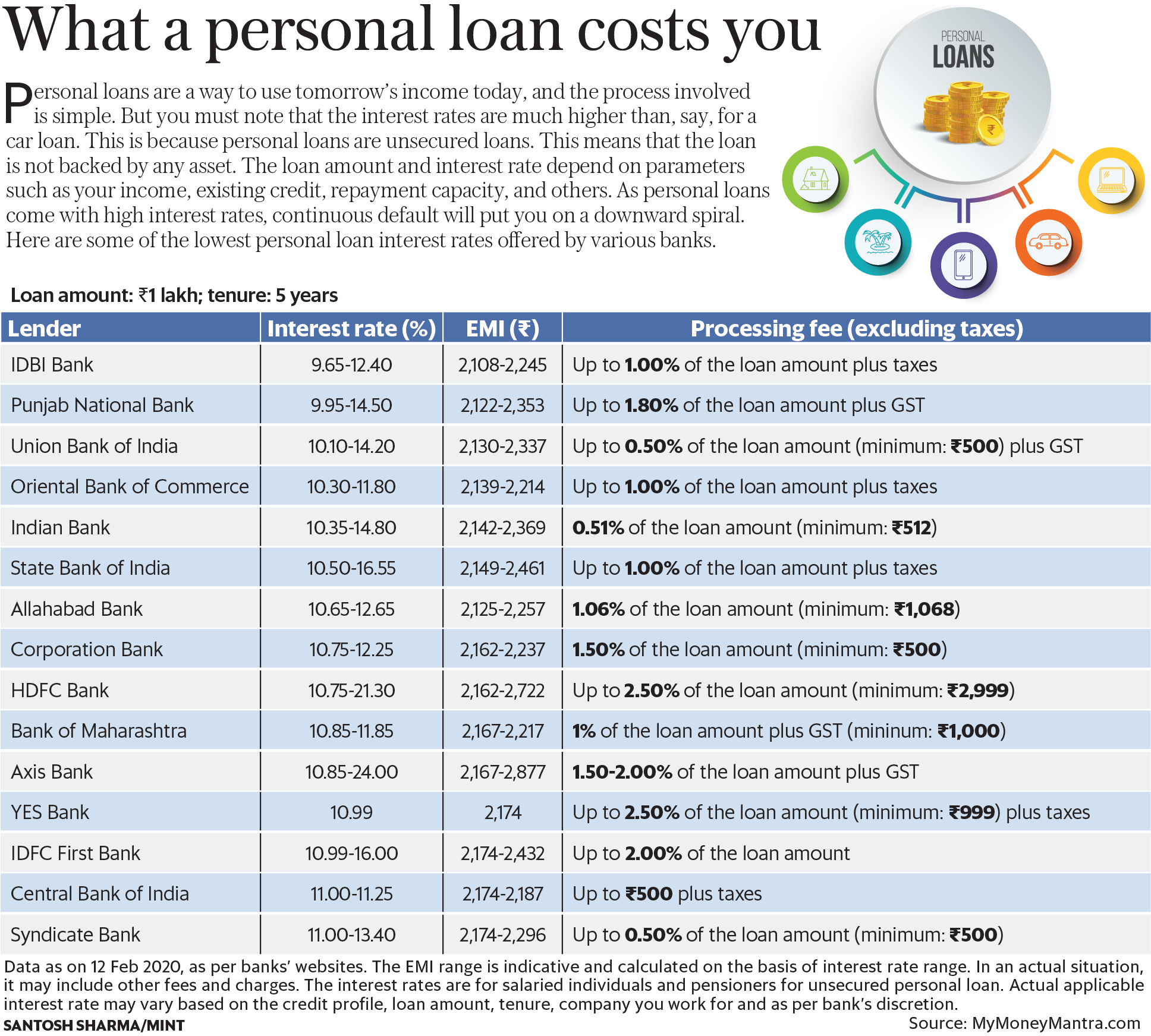

Compare Todays Best Personal Loan Interest Rates

May 28, 2025

Compare Todays Best Personal Loan Interest Rates

May 28, 2025 -

Ues Anderson Rabotaet Nad Novym Filmom

May 28, 2025

Ues Anderson Rabotaet Nad Novym Filmom

May 28, 2025 -

K Pop Stars Shine At The Amas Rose Rm Jimin Ateez And Stray Kids Nominated

May 28, 2025

K Pop Stars Shine At The Amas Rose Rm Jimin Ateez And Stray Kids Nominated

May 28, 2025 -

Student Loan Debt And The Economy A Looming Crisis

May 28, 2025

Student Loan Debt And The Economy A Looming Crisis

May 28, 2025

Latest Posts

-

Ulasan Mendalam Kawasaki W175 Dan Honda St 125 Dax Perbedaan Fitur Dan Harga

May 30, 2025

Ulasan Mendalam Kawasaki W175 Dan Honda St 125 Dax Perbedaan Fitur Dan Harga

May 30, 2025 -

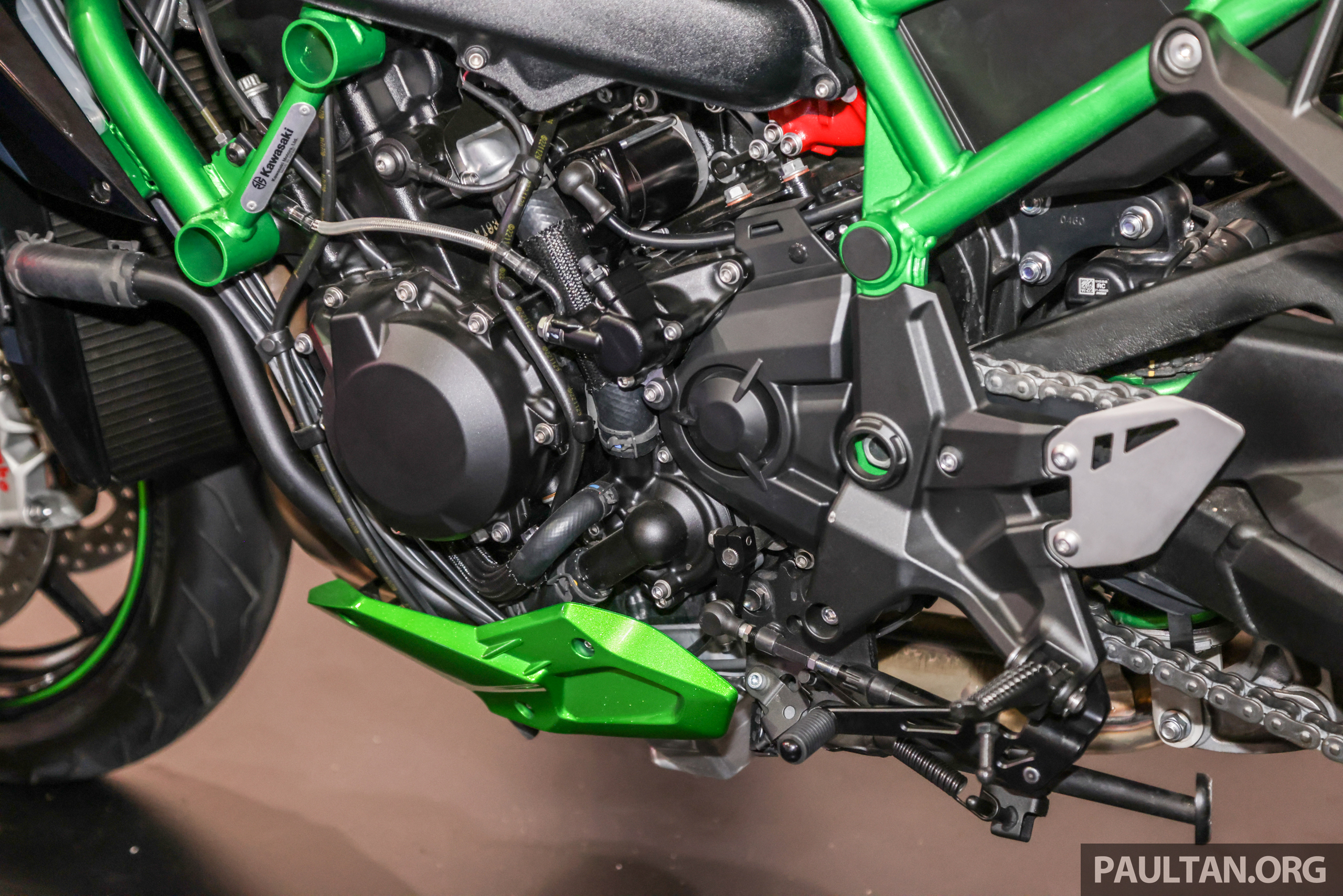

Motor Sport 197 Hp Mengapa Kawasaki Z H2 Tidak Dijual Di Indonesia

May 30, 2025

Motor Sport 197 Hp Mengapa Kawasaki Z H2 Tidak Dijual Di Indonesia

May 30, 2025 -

Pilih Mana Perbandingan Lengkap Kawasaki W175 Dan Honda St 125 Dax

May 30, 2025

Pilih Mana Perbandingan Lengkap Kawasaki W175 Dan Honda St 125 Dax

May 30, 2025 -

Kawasaki Z H2 197 Hp Alasan Di Balik Ketiadaannya Di Pasar Indonesia

May 30, 2025

Kawasaki Z H2 197 Hp Alasan Di Balik Ketiadaannya Di Pasar Indonesia

May 30, 2025 -

Honda St 125 Dax Vs Kawasaki W175 Gaya Klasik Vs Modern Mana Pilihan Anda

May 30, 2025

Honda St 125 Dax Vs Kawasaki W175 Gaya Klasik Vs Modern Mana Pilihan Anda

May 30, 2025