Bitcoin Price Increase: Analyzing The Impact Of Trump's Economic Moves And Fed Policy

Table of Contents

Trump's Economic Policies and Their Ripple Effect on Bitcoin

Trump's economic agenda, characterized by significant tax cuts and a focus on deregulation, had a profound, albeit complex, effect on the Bitcoin market. Let's explore the key aspects.

Tax Cuts and Their Impact on Bitcoin Investment

The 2017 Tax Cuts and Jobs Act in the US, significantly lowering corporate and individual tax rates, potentially fueled a Bitcoin price increase. This is because:

- Increased Disposable Income: Lower taxes left more money in the hands of individuals, some of whom channeled this increased disposable income into alternative investments, including Bitcoin.

- Potential Tax Avoidance Strategies: Although highly debated and legally complex, some speculated that cryptocurrencies like Bitcoin could be used for tax avoidance, although this is highly discouraged and risky given current regulations.

- Increased Investment in Risk Assets: A general feeling of economic optimism spurred by the tax cuts led to increased investment in riskier assets, including cryptocurrencies perceived as having high growth potential.

While direct causality is difficult to definitively prove, Bitcoin's price did see a considerable surge following the implementation of the tax cuts, although other factors were undoubtedly at play. Further research is needed to quantify the precise impact.

Trade Wars and the Safe-Haven Appeal of Bitcoin

Trump's trade policies, characterized by tariffs and trade disputes with China and other countries, created significant global economic uncertainty. This uncertainty drove investors towards Bitcoin as a safe-haven asset:

- Increased Market Volatility: Trade wars increased overall market volatility, making investors seek assets perceived as less susceptible to macroeconomic fluctuations.

- Flight to Safety: Amidst uncertainty, investors often "flee to safety" – moving their capital from riskier assets to those deemed less volatile. Bitcoin, with its decentralized nature, was perceived by some as such an asset.

- Bitcoin's Decentralized Nature as a Hedge: Bitcoin's independence from traditional financial systems and governments made it attractive to investors seeking a hedge against geopolitical risks.

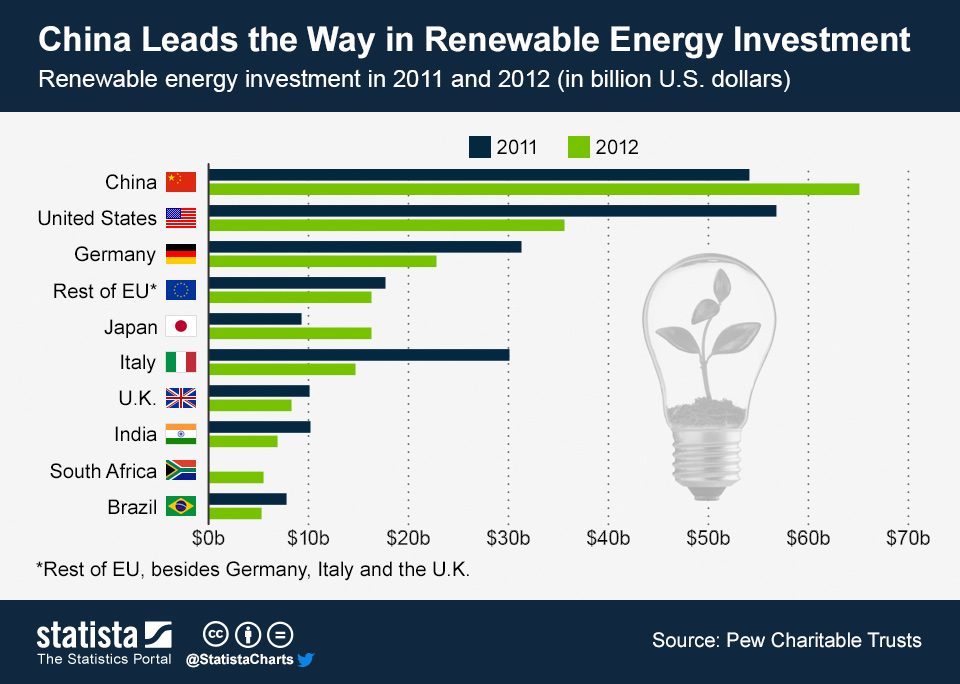

Charts showing Bitcoin's price behavior during periods of heightened trade tension often reveal a surge in value, suggesting a strong correlation between trade uncertainty and Bitcoin's safe-haven appeal.

Deregulation and its Influence on Crypto Markets

Trump's administration's relatively hands-off approach to cryptocurrency regulation created a more permissive environment for the crypto market, potentially fostering growth and influencing the Bitcoin price increase. However, this also carries risks:

- Increased Adoption: Reduced regulatory hurdles made it easier for individuals and businesses to enter the crypto market, boosting adoption rates.

- Ease of Access to Crypto Markets: Less stringent regulations simplified access to cryptocurrency exchanges and trading platforms.

- Potential Risks Associated with Deregulation: While deregulation can boost innovation and growth, it can also lead to increased market volatility and potential risks for investors due to a lack of regulatory oversight and consumer protection.

The impact of deregulation remains a subject of debate. While some argue it spurred growth, others caution against the potential risks associated with a lack of robust regulatory frameworks.

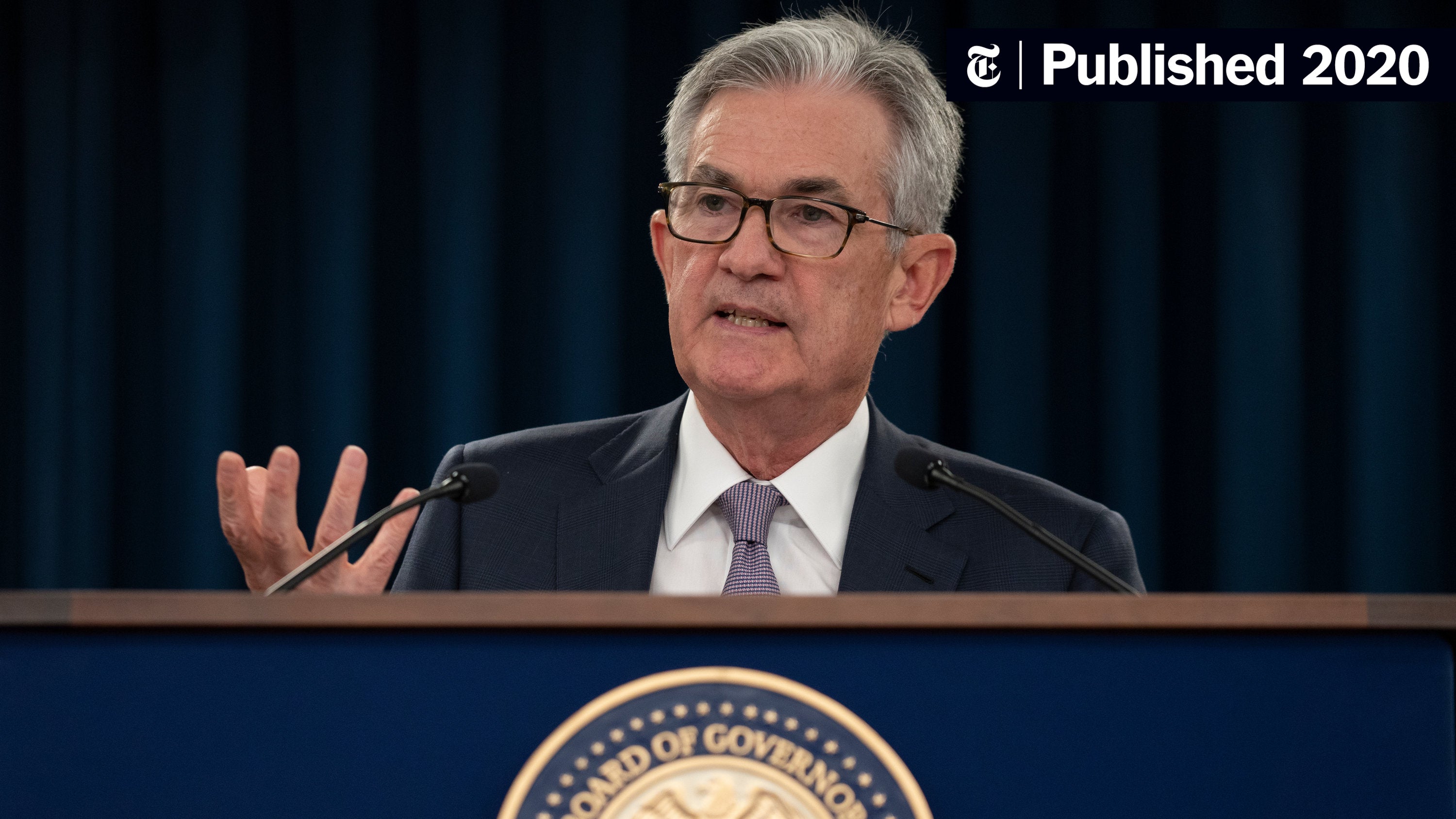

The Federal Reserve's Monetary Policy and Bitcoin's Price

The Federal Reserve's monetary policy, particularly its interest rate decisions and quantitative easing (QE) programs, also played a significant role in shaping Bitcoin's price.

Interest Rate Hikes and Bitcoin's Price Volatility

Interest rate hikes by the Federal Reserve often lead to decreased appetite for riskier assets:

- Impact on Investor Sentiment: Higher interest rates can shift investor sentiment away from riskier assets like Bitcoin towards more stable, interest-bearing investments.

- Decreased Appetite for Risk Assets: Higher interest rates make it more expensive to borrow money, potentially reducing investment in riskier assets.

- Potential Capital Flight into Bitcoin: Despite the above, some might still view Bitcoin as a hedge against inflation even with rising interest rates, creating a complex dynamic.

Data analyzing the correlation between interest rate changes and Bitcoin price movements often shows an inverse relationship, although the correlation is not always straightforward.

Quantitative Easing (QE) and Bitcoin's Price Appreciation

The Federal Reserve's quantitative easing programs, designed to stimulate the economy by increasing the money supply, can have indirect effects on Bitcoin's price:

- Increased Money Supply: QE leads to an increase in the money supply, potentially leading to inflation.

- Inflation Concerns: Fear of inflation can drive investors towards assets like Bitcoin, viewed as a potential hedge against inflation.

- Potential for Bitcoin as an Inflation Hedge: Bitcoin's fixed supply of 21 million coins makes it an attractive asset for those concerned about inflation eroding the purchasing power of fiat currencies.

The long-term impact of QE on Bitcoin's price remains a topic of ongoing discussion among economists and market analysts.

Impact of Inflation on Bitcoin Demand

Inflation, influenced by Fed policy and other factors, significantly impacts demand for Bitcoin:

- Hedge against Inflation: Bitcoin is often touted as a hedge against inflation, as its value may increase as the value of fiat currencies decreases due to inflation.

- Purchasing Power Preservation: In inflationary periods, investors may turn to Bitcoin to preserve their purchasing power.

- Comparison to Traditional Assets: The performance of Bitcoin during inflationary periods is often compared to that of traditional assets like gold.

Data on inflation rates and their correlation with Bitcoin price fluctuations often reveal a positive correlation, suggesting that Bitcoin's price tends to rise during periods of higher inflation.

Conclusion: Understanding the Factors Driving Bitcoin Price Increase

This article has explored the complex interplay between Trump's economic policies, Federal Reserve actions, and Bitcoin's price. We've seen how tax cuts, trade wars, deregulation, interest rate hikes, quantitative easing, and inflation all played a role in shaping the volatile Bitcoin market. Understanding these relationships is crucial for investors and traders seeking to navigate the complexities of the cryptocurrency world. By understanding the complex interplay between Trump's economic legacy, Federal Reserve policies, and the Bitcoin price increase, investors can make more informed decisions. Conduct further research, stay informed about macroeconomic events and their potential impact on the Bitcoin price, and consider the implications for your investment strategies. Remember to diversify your portfolio and always proceed with caution in the volatile cryptocurrency market.

Featured Posts

-

Chinas Energy Strategy Middle Eastern Lpg As A Us Tariff Alternative

Apr 24, 2025

Chinas Energy Strategy Middle Eastern Lpg As A Us Tariff Alternative

Apr 24, 2025 -

Ella Bleu Travoltas Fashion Magazine Cover A Daughters Daring Transformation

Apr 24, 2025

Ella Bleu Travoltas Fashion Magazine Cover A Daughters Daring Transformation

Apr 24, 2025 -

Us Dollar Gains Ground Against Major Peers Amid Easing Trump Powell Tensions

Apr 24, 2025

Us Dollar Gains Ground Against Major Peers Amid Easing Trump Powell Tensions

Apr 24, 2025 -

A Practical Review Of The Lg C3 77 Inch Oled Television

Apr 24, 2025

A Practical Review Of The Lg C3 77 Inch Oled Television

Apr 24, 2025 -

Warriors Hand Hornets Seventh Straight Defeat

Apr 24, 2025

Warriors Hand Hornets Seventh Straight Defeat

Apr 24, 2025