BofA's View: Why Elevated Stock Market Valuations Shouldn't Deter Investors

Table of Contents

BofA's Rationale: Underlying Economic Strength and Growth Prospects

BofA's optimistic stance is rooted in their assessment of the underlying economic strength and future growth prospects. Their analysts point to several key economic indicators that support a bullish view, even with higher stock market valuations. This positive outlook isn't simply blind optimism; it's based on a thorough analysis of the current economic landscape.

- Robust Corporate Earnings Growth: BofA projects continued strong corporate earnings growth, fueled by sustained consumer demand and increasing business investment. This translates to a solid foundation for future stock market performance, even at current valuations.

- Positive Consumer Confidence: Despite inflationary pressures, consumer confidence remains relatively high, suggesting continued spending and economic activity. This consistent consumer spending is a crucial driver of economic growth and corporate profitability.

- Supportive Government Policies: Government policies aimed at infrastructure development and economic stimulus can further boost economic growth and create a favorable environment for corporate investment and expansion. This is contributing to positive business sentiment and overall economic strength.

These factors, combined, paint a picture of a resilient economy with significant growth potential, in BofA's view, justifying their bullishness despite high stock market valuations. BofA's economic forecast suggests a continued upward trajectory, mitigating the concerns many investors have around current market prices.

Managing Valuation Risk: A Balanced Approach to Investing

Acknowledging the concerns around high valuations is crucial. BofA doesn't dismiss the risks; instead, they advocate for a balanced approach to investing that emphasizes risk management. Their strategies for mitigating risk in this environment include:

- Diversification Across Asset Classes: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) reduces the impact of any single asset's underperformance. This diversification helps to balance potential losses.

- Focus on Quality Companies with Strong Fundamentals: Investing in companies with a proven track record, solid financials, and sustainable business models minimizes the risk associated with overvalued stocks. This approach is a cornerstone of value investing.

- Long-Term Investment Horizon: A long-term perspective allows investors to ride out short-term market volatility and benefit from the long-term growth potential of the market. This patience is essential in navigating fluctuating stock market valuations.

- Regular Portfolio Rebalancing: Periodically adjusting your portfolio to maintain your desired asset allocation helps to manage risk and capitalize on market opportunities. This active management contributes to a more resilient investment strategy.

By adopting these risk management strategies, investors can participate in the market's potential upside while mitigating the risks associated with elevated stock market valuations. BofA's approach emphasizes a strategic, long-term perspective.

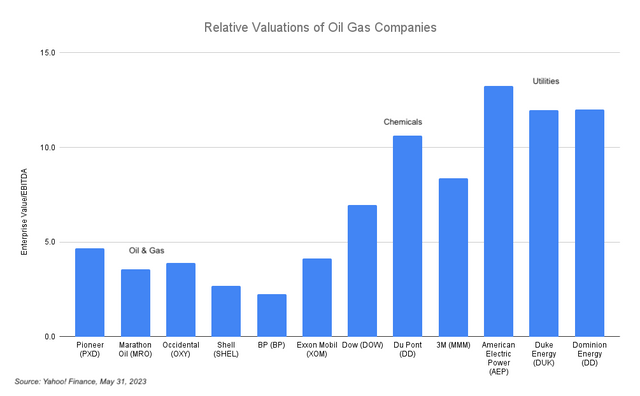

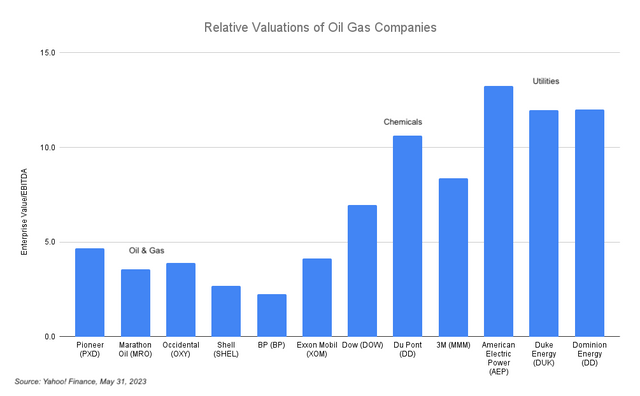

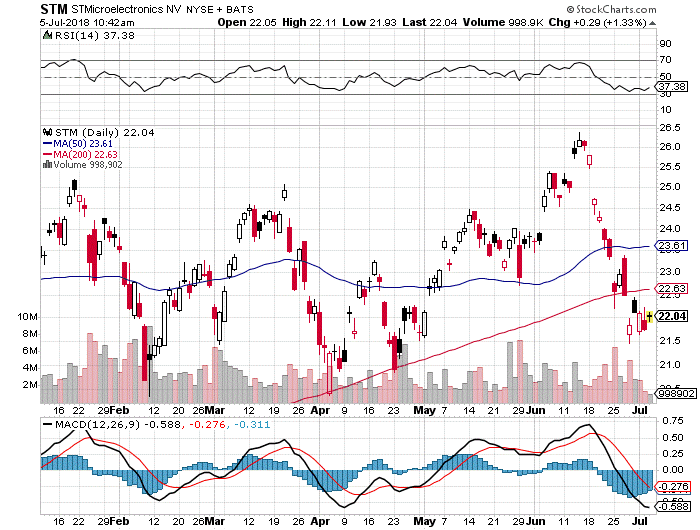

Beyond P/E Ratios: Looking at Other Key Metrics

While the Price-to-Earnings (P/E) ratio is a commonly used valuation metric, relying solely on it can be misleading. BofA advocates for a more holistic approach, incorporating other key metrics to gain a comprehensive understanding of a company's valuation and potential.

- PEG Ratio: This metric considers both the P/E ratio and the company's growth rate, providing a more nuanced perspective on valuation. It accounts for a company's future earnings potential.

- Dividend Yield: The dividend yield indicates the annual dividend payment relative to the stock price, offering insight into the potential for income generation. This offers a passive income stream to help balance potential losses.

- Free Cash Flow: Free cash flow represents the cash a company generates after covering its operating expenses and capital expenditures, providing a direct measure of its financial health. This is a crucial indicator of a company’s financial stability.

By analyzing these metrics in conjunction with the P/E ratio, investors can gain a more accurate assessment of a company's true value and identify potentially undervalued opportunities, even in a market with high overall stock market valuations. This multifaceted approach to fundamental analysis improves investment decision making.

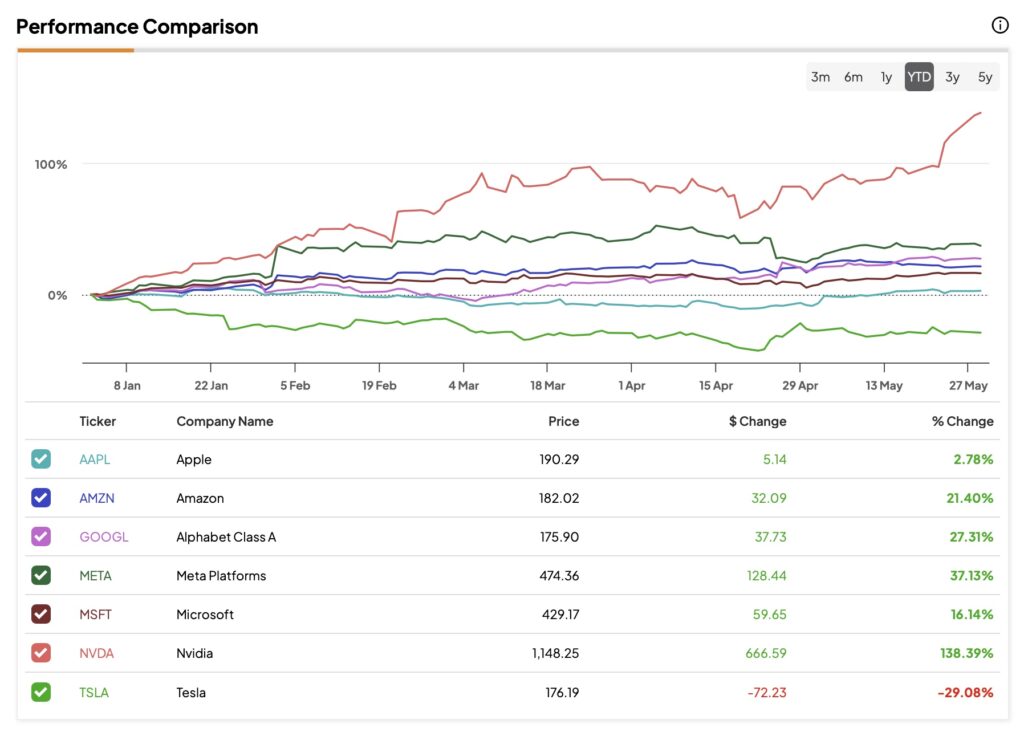

Historical Context: High Valuations and Past Market Performance

Looking at historical market data reveals that periods of high valuations have often been followed by continued market growth. Understanding this historical context is essential for putting current market conditions into perspective.

- Past Examples of High Valuations and Subsequent Growth: Numerous instances throughout history demonstrate that high valuations, while posing risks, don't necessarily preclude further market expansion. This highlights the importance of a long-term strategy.

- Long-Term Market Trends: Focusing on long-term trends rather than short-term fluctuations is crucial for successful investing. High valuations can be temporary, while long-term growth often persists.

This historical context suggests that while elevated stock market valuations warrant caution, they shouldn't automatically deter investors with a well-defined, long-term strategy.

Conclusion: Don't Let High Stock Market Valuations Deter Your Investment Strategy

BofA's analysis suggests that while current stock market valuations are high, the underlying economic strength and growth prospects warrant a cautiously optimistic outlook. By focusing on a balanced investment approach, incorporating various valuation metrics, and understanding historical market trends, investors can effectively manage risk and participate in the market's potential for future growth. Don't let high stock market valuations derail your investment strategy. Consider BofA's perspective, diversify your portfolio, focus on quality companies, and maintain a long-term view. For more in-depth analysis and personalized advice tailored to your specific financial situation, consult with a qualified financial advisor. Remember, effective investing requires a well-informed strategy, especially when navigating challenging stock market valuations.

Featured Posts

-

Apple Price Target Lowered But Is Wedbush Right To Remain Bullish

May 24, 2025

Apple Price Target Lowered But Is Wedbush Right To Remain Bullish

May 24, 2025 -

Glastonbury 2025 Lineup Confirmed Acts Include Olivia Rodrigo And The 1975

May 24, 2025

Glastonbury 2025 Lineup Confirmed Acts Include Olivia Rodrigo And The 1975

May 24, 2025 -

40 Svadeb Na Kharkovschine Kakaya Data Stala Samoy Populyarnoy Foto

May 24, 2025

40 Svadeb Na Kharkovschine Kakaya Data Stala Samoy Populyarnoy Foto

May 24, 2025 -

Auto Tariff Relief Speculation Lifts European Markets Lvmh Experiences Significant Drop

May 24, 2025

Auto Tariff Relief Speculation Lifts European Markets Lvmh Experiences Significant Drop

May 24, 2025 -

Heineken Exceeds Revenue Forecasts Maintains Positive Outlook Amid Trade Tensions

May 24, 2025

Heineken Exceeds Revenue Forecasts Maintains Positive Outlook Amid Trade Tensions

May 24, 2025

Latest Posts

-

Astrologia Semanal Horoscopo Del 11 Al 17 De Marzo De 2025

May 24, 2025

Astrologia Semanal Horoscopo Del 11 Al 17 De Marzo De 2025

May 24, 2025 -

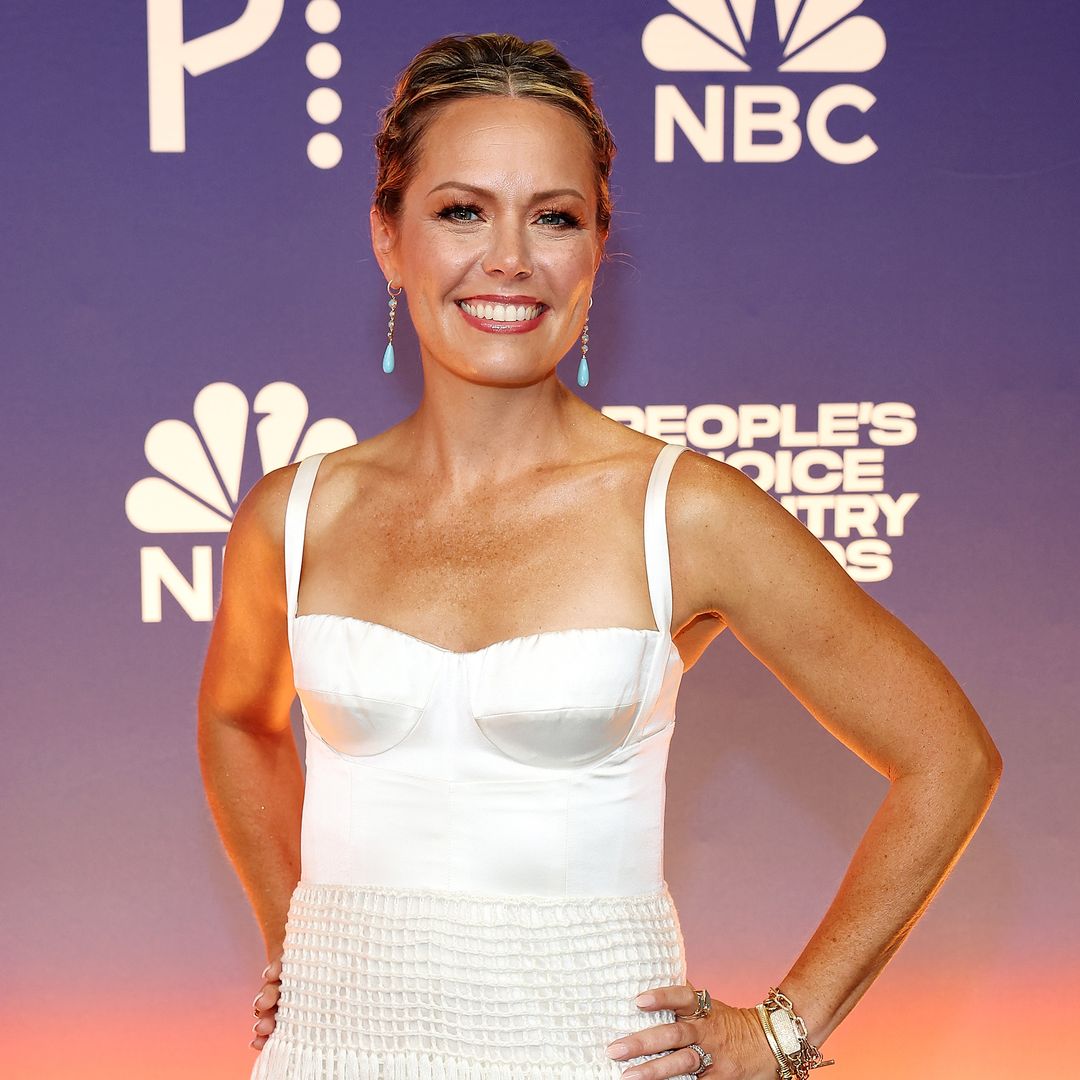

Dylan Dreyers Son Post Operation Update From The Hospital

May 24, 2025

Dylan Dreyers Son Post Operation Update From The Hospital

May 24, 2025 -

Dylan Dreyer Family Celebrates A Joyful Update

May 24, 2025

Dylan Dreyer Family Celebrates A Joyful Update

May 24, 2025 -

Pronostico Astrologico Horoscopo 11 17 Marzo 2025

May 24, 2025

Pronostico Astrologico Horoscopo 11 17 Marzo 2025

May 24, 2025 -

Did A Mishap Cause A Rift Between Dylan Dreyer And Her Today Show Co Stars

May 24, 2025

Did A Mishap Cause A Rift Between Dylan Dreyer And Her Today Show Co Stars

May 24, 2025