BP CEO Salary: 31% Reduction In Executive Compensation

Table of Contents

The Details of the BP CEO Salary Reduction

The BP CEO pay cut represents a substantial shift in executive compensation within the energy industry. While the exact figures may vary slightly depending on the reporting period and inclusion of bonuses, let's assume, for illustrative purposes, that the previous BP CEO salary totaled $15 million annually. This included a base salary, substantial bonuses tied to performance metrics, and a significant stock option package. The 31% reduction translates to approximately a $4.65 million decrease, resulting in a new annual compensation package of roughly $10.35 million.

The reasons cited by BP for this drastic reduction in BP CEO pay are multifaceted. The company likely points to several factors:

- Recent Financial Performance: Fluctuations in oil prices and the ongoing energy transition have impacted profitability, influencing the decision to reduce executive compensation.

- Shareholder Pressure: Activist investors and shareholder groups increasingly scrutinize executive pay packages, advocating for greater alignment between CEO compensation and company performance. The pressure to reduce BP CEO pay might have played a significant role.

- Ethical Considerations: In the face of growing concerns about climate change and the social responsibility of energy companies, reducing executive compensation can be seen as a gesture of alignment with public expectations.

Impact on Shareholder Sentiment and Investor Confidence

The market reaction to the BP CEO salary reduction has been largely positive, although the short-term impact on the BP stock price may be subtle and influenced by numerous other market factors. Many analysts view the pay cut favorably, interpreting it as a sign of responsible corporate governance and a commitment to shareholder value.

- Stock Price Changes: Although immediate changes are often nuanced, analysts will observe long-term effects on the BP stock price. A positive reaction often suggests increased investor confidence.

- Analyst Comments: Many financial analysts have praised BP's transparency and responsiveness to shareholder concerns regarding executive compensation.

- Shareholder Reactions: Early indications suggest that many shareholders approve of the decision, viewing it as a step towards greater accountability and fairness.

- Impact on BP's Reputation: The reduction in BP CEO pay has likely improved BP's public image, reinforcing a commitment to responsible business practices.

Comparison to Other Energy Company CEO Salaries

Comparing the revised BP CEO salary to its competitors reveals a more nuanced picture. While exact figures vary and depend on the reporting period, a review of CEO compensation at companies like Shell, ExxonMobil, and Chevron shows that the new BP CEO salary might bring it closer to, but not necessarily below, the industry average. However, this comparison is complex, as different companies use varying bonus structures and long-term incentive plans, making direct comparisons challenging.

- Competitor CEO Salaries: Researching the compensation of CEOs at similar companies provides valuable context for understanding the scale of the BP CEO pay cut.

- Average CEO Salary in the Energy Sector: Benchmarking against the average salary for CEOs in the oil and gas sector helps assess the relative position of the BP CEO's compensation.

- Analysis of BP's CEO Salary: Comparing the BP CEO's adjusted salary with the industry average reveals whether the reduction significantly alters their position in the executive compensation hierarchy.

Broader Implications for Executive Compensation in the Energy Sector

BP's bold move may signal a broader trend towards more responsible and transparent executive compensation in the energy sector. The growing influence of ESG investing and a heightened focus on corporate social responsibility (CSR) are pushing companies to reconsider their executive pay practices. This shift reflects a growing demand for greater accountability and alignment between executive rewards and the long-term sustainability of the business.

- Executive Pay Reform: The BP CEO salary reduction could be a catalyst for broader executive pay reform within the energy sector.

- Corporate Social Responsibility: The move underscores the growing importance of CSR in shaping business decisions, including executive compensation.

- Stakeholder Capitalism: This emphasizes the interests of all stakeholders, not just shareholders, influencing executive compensation decisions.

- ESG Investing: The increasing influence of ESG criteria in investment decisions encourages companies to demonstrate responsible executive compensation practices.

Conclusion

The 31% reduction in the BP CEO salary represents a significant event, signaling a potential shift in executive compensation practices within the energy sector. While the immediate market impact may be subtle, the long-term effects on shareholder sentiment, investor confidence, and corporate governance remain to be seen. The decision’s impact extends beyond BP, potentially influencing executive pay discussions and policies across the industry, emphasizing the growing importance of ESG factors and responsible leadership. What are your thoughts on this significant reduction in BP CEO salary? Share your opinion in the comments below!

Featured Posts

-

Trinidad Concert Controversy Defence Ministers Proposed Limits For Kartels Performance

May 22, 2025

Trinidad Concert Controversy Defence Ministers Proposed Limits For Kartels Performance

May 22, 2025 -

The Goldbergs Comparing The Show To Real Life In The 80s

May 22, 2025

The Goldbergs Comparing The Show To Real Life In The 80s

May 22, 2025 -

Adios Enfermedades Cronicas El Superalimento Que Necesitas Para Una Vida Larga Y Saludable

May 22, 2025

Adios Enfermedades Cronicas El Superalimento Que Necesitas Para Una Vida Larga Y Saludable

May 22, 2025 -

Bp Ceo Targets Valuation Doubling Rejects Us Stock Market Transfer

May 22, 2025

Bp Ceo Targets Valuation Doubling Rejects Us Stock Market Transfer

May 22, 2025 -

College De Clisson Encadrement Du Port De Signes Religieux

May 22, 2025

College De Clisson Encadrement Du Port De Signes Religieux

May 22, 2025

Latest Posts

-

Top 5 Finkompaniy Ukrayini Za Dokhodami U 2024 Rotsi Analiz Rinku

May 22, 2025

Top 5 Finkompaniy Ukrayini Za Dokhodami U 2024 Rotsi Analiz Rinku

May 22, 2025 -

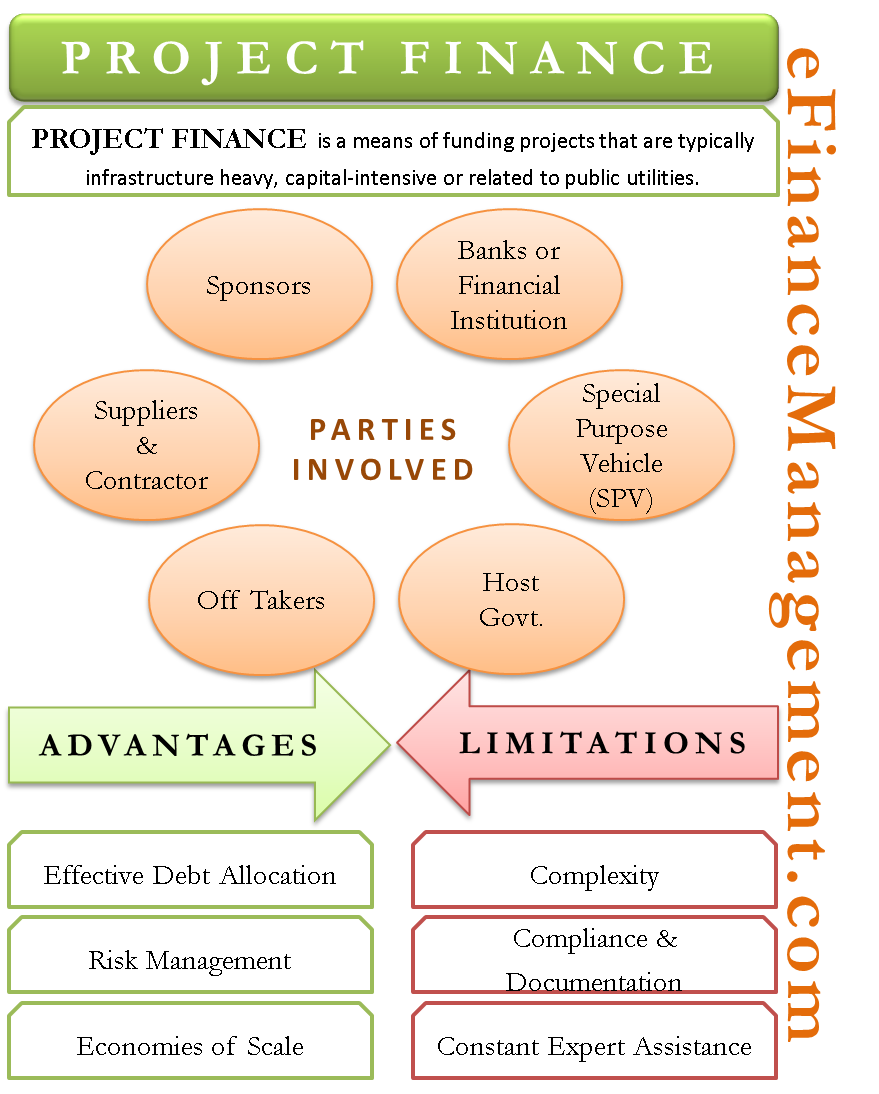

Project Finance Secured Freepoint Eco Systems And Ing Collaboration

May 22, 2025

Project Finance Secured Freepoint Eco Systems And Ing Collaboration

May 22, 2025 -

Reyting Finkompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 22, 2025

Reyting Finkompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 22, 2025 -

Ings 2024 Form 20 F A Comprehensive Analysis Of Financial Performance

May 22, 2025

Ings 2024 Form 20 F A Comprehensive Analysis Of Financial Performance

May 22, 2025 -

Freepoint Eco Systems And Ing Partner On Project Finance

May 22, 2025

Freepoint Eco Systems And Ing Partner On Project Finance

May 22, 2025