Canadian Dollar Fluctuations: A Deep Dive Into Recent Market Trends

Table of Contents

Factors Influencing Canadian Dollar Fluctuations

Several interconnected factors influence the value of the Canadian dollar. Understanding these dynamics is key to anticipating future movements.

Commodity Prices (Oil & Gas)

The Canadian economy is heavily reliant on its natural resources sector. Consequently, the CAD has a strong positive correlation with commodity prices, especially crude oil and natural gas. Global oil demand significantly impacts the CAD. Increased global demand typically leads to higher oil prices, boosting the Canadian dollar. Conversely, decreased demand or OPEC production cuts can weaken the CAD.

- Global oil demand: Strong global economic growth usually translates to higher oil demand, strengthening the CAD.

- OPEC decisions: Decisions by the Organization of the Petroleum Exporting Countries (OPEC) regarding oil production quotas directly affect crude oil prices and, subsequently, the CAD.

- Canadian oil production: Changes in Canadian oil production, due to factors such as pipeline capacity or technological advancements, also influence the CAD.

- WTI Crude Prices: The price of West Texas Intermediate (WTI) crude oil serves as a key benchmark, directly impacting the CAD's value. A rise in WTI usually translates to a stronger CAD.

- Energy Sector Performance: The overall performance of the Canadian energy sector significantly influences the CAD's value.

Interest Rate Differentials

The Bank of Canada (BoC) plays a crucial role in influencing the CAD through its monetary policy decisions. Interest rate differentials between Canada and other major economies, particularly the United States, significantly impact capital flows and, consequently, the CAD's exchange rate.

- Monetary Policy: The BoC's monetary policy decisions, including interest rate hikes or cuts, influence the attractiveness of the Canadian dollar to foreign investors. Higher interest rates generally attract foreign investment, strengthening the CAD.

- Interest Rate Hikes: When the BoC raises interest rates, it makes Canadian bonds more attractive, leading to increased demand for the CAD.

- Quantitative Easing: Conversely, periods of quantitative easing (QE) in other major economies can weaken the CAD relative to those currencies.

Geopolitical Events

Global political instability and trade tensions significantly affect investor sentiment and can lead to substantial Canadian dollar fluctuations. Uncertainty in global markets often leads to a flight to safety, potentially weakening the CAD against more stable currencies like the US dollar.

- Global Uncertainty: Events such as wars, political upheavals, or major international crises can create uncertainty in global markets, negatively impacting the CAD.

- Trade Tensions: Trade disputes, particularly between Canada and its major trading partners (e.g., the US), can significantly impact the CAD.

- US-Canada Relations: The economic relationship between the US and Canada is crucial. Strained relations can negatively impact the Canadian dollar.

US Dollar Strength

The USD/CAD exchange rate is an important indicator. There is generally an inverse relationship between the US dollar and the Canadian dollar. A strengthening US dollar typically leads to a weakening Canadian dollar, and vice versa.

- USD/CAD Exchange Rate: This is the most frequently traded pair involving the CAD, highlighting the importance of the USD's strength.

- US Economic Data: Strong US economic data can boost the USD, consequently weakening the CAD.

- Dollar Index: The US Dollar Index (DXY), which measures the USD against a basket of other major currencies, provides a broader context for USD strength and its impact on the CAD.

Analyzing Recent Trends in the Canadian Dollar

Understanding both short-term volatility and long-term projections is crucial for navigating the CAD market.

Short-Term Volatility

Recent months have witnessed significant short-term volatility in the CAD, largely driven by fluctuating commodity prices and shifting market sentiment. (Insert chart or graph visualizing recent CAD fluctuations here).

- CAD Volatility: Factors like unexpected geopolitical events or sudden shifts in commodity prices can cause significant short-term swings in the CAD's value.

- Short-Term Trading: Traders often exploit short-term volatility through various currency trading strategies.

- Currency Trading Strategies: Strategies like scalping or day trading can be employed to profit from short-term CAD movements.

Long-Term Outlook

Predicting the long-term trajectory of the CAD is challenging, but analyzing the underlying economic factors can provide some insight. The long-term outlook will likely depend on sustained growth in the Canadian economy, the performance of the energy sector, and global economic conditions.

- Long-Term Forecast: Economic forecasts suggest a moderate growth trajectory for the Canadian economy, which should support the CAD in the long term. However, this is contingent upon various factors.

- Economic Outlook: A strong global economic outlook will likely positively impact the CAD, whereas a global recession may weaken it.

- Currency Projections: While specific projections vary among analysts, the overall consensus points towards a relatively stable CAD in the long term, with moderate fluctuations based on the factors discussed.

Strategies for Navigating Canadian Dollar Fluctuations

Businesses and individuals can employ different strategies to manage the risks associated with Canadian dollar fluctuations.

Hedging Strategies for Businesses

Businesses involved in international trade face significant currency risk. Implementing effective hedging strategies is essential to mitigate potential losses.

- Currency Hedging: Various techniques exist, including forward contracts and options contracts, to lock in exchange rates and reduce exposure to currency fluctuations.

- Foreign Exchange Risk: Businesses need to actively manage their foreign exchange risk to protect their profits.

- Risk Management: A comprehensive risk management strategy should be implemented to address currency risk, including diversification of markets and counterparties.

Investment Strategies for Individuals

Individuals can also incorporate strategies to manage their exposure to CAD volatility in their investment portfolios.

- Currency Trading: Experienced investors might consider trading CAD pairs based on their market analysis. However, this carries substantial risk.

- Investment Portfolio: A well-diversified investment portfolio, including assets denominated in different currencies, can help reduce overall risk.

- Diversification Strategy: Diversification remains a key strategy for mitigating risk associated with currency fluctuations.

Conclusion

Canadian dollar fluctuations are influenced by a complex interplay of factors including commodity prices (particularly oil and gas), interest rate differentials, geopolitical events, and US dollar strength. Understanding these factors is crucial for making informed financial decisions. Recent trends show significant short-term volatility, while the long-term outlook remains relatively stable, contingent upon various economic and political factors. Businesses can utilize hedging strategies to mitigate currency risk, and individuals can benefit from diversification strategies. Stay updated on market trends and consult with a financial advisor to develop a strategy that aligns with your specific needs. Understanding Canadian dollar fluctuations is key to effective financial planning.

Featured Posts

-

Newsom Calls For Oil Industry Collaboration Amidst Soaring California Gas Prices

Apr 24, 2025

Newsom Calls For Oil Industry Collaboration Amidst Soaring California Gas Prices

Apr 24, 2025 -

India Market Update Tailwinds Driving Nifty Gains

Apr 24, 2025

India Market Update Tailwinds Driving Nifty Gains

Apr 24, 2025 -

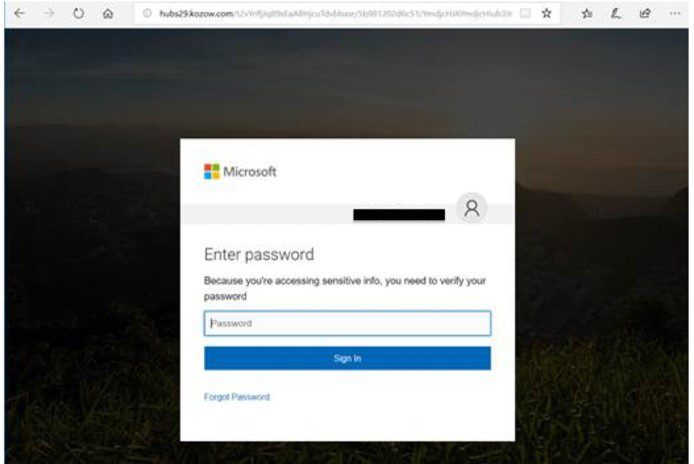

Office365 Executive Inbox Compromise Leads To Multi Million Dollar Theft

Apr 24, 2025

Office365 Executive Inbox Compromise Leads To Multi Million Dollar Theft

Apr 24, 2025 -

Over The Counter Birth Control A Post Roe Game Changer

Apr 24, 2025

Over The Counter Birth Control A Post Roe Game Changer

Apr 24, 2025 -

Gambling On Disaster Examining The Los Angeles Wildfire Betting Market

Apr 24, 2025

Gambling On Disaster Examining The Los Angeles Wildfire Betting Market

Apr 24, 2025