CNN Exposes "Just Contact Us": TikTok's Role In Tariff Avoidance Strategies

Table of Contents

How "Just Contact Us" Facilitates Illegal Import Practices

The "Just Contact Us" method operates as a silent signal for sellers to offer cheaper goods outside official channels, thereby evading import duties and taxes. Sellers use this phrase in their TikTok listings to discreetly communicate a willingness to bypass standard e-commerce procedures. The CNN report highlighted numerous instances where this tactic was employed to import goods at significantly under-declared values, often mislabeled to obscure their true nature.

TikTok's features, particularly its private messaging system, facilitate this under-the-radar operation. Sellers and buyers can negotiate details such as reduced prices and alternative shipping methods outside the platform's public view, circumventing any automated checks or oversight. This covert communication network allows for sophisticated TikTok smuggling tactics to flourish.

- Under-declared values: Goods are declared at a fraction of their actual value to reduce import duties.

- Mislabeled goods: Items are misrepresented as different products to evade tariffs specific to certain categories.

- Use of private messaging: Negotiations and transactions occur outside the public platform, making them difficult to track.

- Circumvention of import duties and taxes: Significant revenue is lost to governments through these underhanded practices.

The Scale of the Problem: Assessing the Impact of TikTok Tariff Avoidance

The financial implications of TikTok tariff avoidance are staggering. While precise figures are difficult to obtain due to the clandestine nature of these operations, estimates suggest billions of dollars in lost revenue for governments worldwide. Legitimate businesses face a significant competitive disadvantage as they struggle to compete against sellers who avoid their fair share of import costs.

Consumers purchasing goods obtained through these methods also face considerable risks. These risks extend beyond simple price discrepancies and often include receiving counterfeit products, endangering consumer safety and rights, and creating disruptions in legitimate supply chains.

- Lost revenue for governments: Significant budget shortfalls are attributed to this widespread evasion.

- Unfair competition for legitimate businesses: Undercutting of prices due to tariff avoidance creates an uneven playing field.

- Risks to consumer safety and rights: Counterfeit and substandard goods pose significant health and safety concerns.

- Potential for supply chain disruptions: The clandestine nature of these transactions can lead to unpredictable supply chain issues.

TikTok's Response and Potential Future Regulatory Actions

TikTok has yet to release a comprehensive statement directly addressing the specifics of the CNN report's allegations concerning widespread TikTok tariff avoidance. While they emphasize their commitment to complying with all applicable laws and regulations, the lack of specific actions to combat this issue raises concerns.

The potential regulatory consequences for TikTok are substantial, ranging from hefty fines to legal challenges from governments worldwide. This situation will likely spur further scrutiny of major e-commerce platforms and social media companies, leading to new regulations and stricter enforcement of existing social media import regulations. This case could set a precedent for how social media companies handle similar issues and could result in a significant shift in the future of e-commerce.

- TikTok's statement and counter-arguments: Awaiting a clear and detailed official response is crucial.

- Potential for platform liability: TikTok may face legal action for its alleged role in facilitating illegal activities.

- Government crackdowns on social media-facilitated tariff evasion: Expect increased regulatory scrutiny and enforcement.

- New regulations and compliance measures for e-commerce: The industry is likely to undergo significant changes in response to this scandal.

Lessons Learned and Best Practices for Businesses and Consumers

Businesses must prioritize compliance with import regulations. Thorough due diligence on suppliers is critical to avoiding involvement in these practices. Transparency in pricing and the origin of goods is paramount to building trust and ensuring ethical operations.

Consumers should be aware of potential red flags such as unusually low prices or vague product descriptions. Reporting suspicious activity to the relevant authorities is vital for combating this form of illegal trade.

- Due diligence on suppliers: Thoroughly vet suppliers to ensure their compliance with import regulations.

- Transparency in pricing and origin of goods: Open communication fosters trust and avoids suspicion.

- Awareness of consumer rights and protections: Know your rights and where to report fraudulent activities.

- Reporting suspicious activity to authorities: Help curb illegal activity by reporting suspicious sellers and transactions.

Conclusion: The Future of E-Commerce and the Fight Against TikTok Tariff Avoidance

The CNN exposé has shed light on the alarming scale of TikTok tariff avoidance facilitated by the seemingly innocuous "Just Contact Us" method. The potential consequences for businesses, governments, and consumers are severe, necessitating a concerted effort to combat this illicit activity. Increased regulation and stricter enforcement of import laws are crucial in the age of e-commerce. Combating TikTok tariff evasion requires proactive measures from both platforms and governing bodies. Preventing TikTok smuggling must be a priority.

We urge you to stay informed about this ongoing development, and to report any suspicious activity related to TikTok tariff avoidance. Let's work together to promote responsible e-commerce practices and ensure a fair and ethical marketplace for everyone.

Featured Posts

-

Trumps Economic Agenda Who Pays The Price

Apr 22, 2025

Trumps Economic Agenda Who Pays The Price

Apr 22, 2025 -

Secret Service Closes Investigation Into White House Cocaine Incident

Apr 22, 2025

Secret Service Closes Investigation Into White House Cocaine Incident

Apr 22, 2025 -

Open Ai Unveils Easy Voice Assistant Development Tools

Apr 22, 2025

Open Ai Unveils Easy Voice Assistant Development Tools

Apr 22, 2025 -

Ftc Appeals Activision Blizzard Acquisition Ruling Whats Next

Apr 22, 2025

Ftc Appeals Activision Blizzard Acquisition Ruling Whats Next

Apr 22, 2025 -

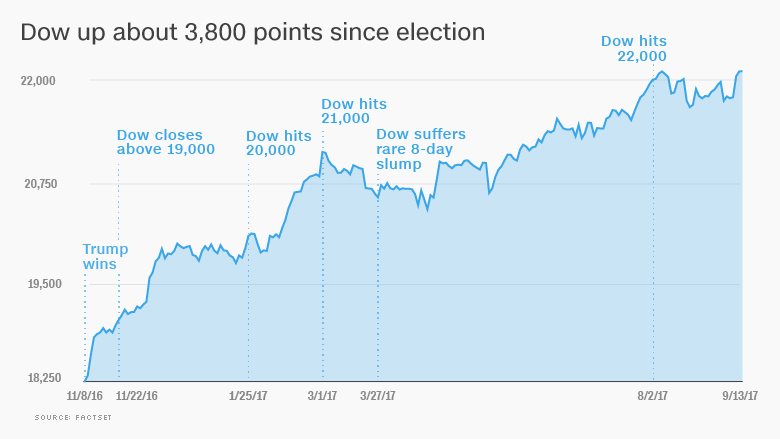

Analyzing The Long Term Effects Of Trumps Trade Policies On Us Finance

Apr 22, 2025

Analyzing The Long Term Effects Of Trumps Trade Policies On Us Finance

Apr 22, 2025

Latest Posts

-

Ufcs Shevchenko Debuts Custom Dragon Designed Apparel

May 12, 2025

Ufcs Shevchenko Debuts Custom Dragon Designed Apparel

May 12, 2025 -

Valentina Shevchenkos Dragon Themed Fight Outfit Revealed

May 12, 2025

Valentina Shevchenkos Dragon Themed Fight Outfit Revealed

May 12, 2025 -

Complete Ufc 315 Main Card Unveiled Muhammad Faces Della Maddalena

May 12, 2025

Complete Ufc 315 Main Card Unveiled Muhammad Faces Della Maddalena

May 12, 2025 -

Ufc 315 Fight Card Muhammad Della Maddalena And More

May 12, 2025

Ufc 315 Fight Card Muhammad Della Maddalena And More

May 12, 2025 -

The Climb Manon Fiorots Pursuit Of Ufc Gold

May 12, 2025

The Climb Manon Fiorots Pursuit Of Ufc Gold

May 12, 2025