Dax Performance: The Influence Of German Politics And Economics

Table of Contents

The Impact of German Economic Growth on Dax Performance

Germany's GDP growth directly impacts DAX performance. Robust economic growth typically translates to higher corporate profits, boosting investor confidence and driving up the DAX. Conversely, economic slowdowns or recessions negatively affect corporate earnings, leading to a decline in the index. Analyzing key economic indicators is vital for understanding and predicting these fluctuations.

- Strong GDP growth correlates with higher DAX values. A thriving economy means increased consumer spending and business investment, directly benefiting companies listed on the DAX.

- Inflation rates influence corporate pricing strategies and consumer spending, impacting DAX performance. High inflation can erode purchasing power, dampening consumer demand and impacting corporate profits. Conversely, low and stable inflation can foster a positive economic environment.

- Unemployment figures reflect consumer confidence and spending power. Low unemployment generally indicates a healthy economy with strong consumer spending, positively affecting DAX performance.

- Business investment is a key driver of economic growth and DAX performance. Companies reinvesting profits and expanding operations signal confidence in the future, which boosts the DAX.

- Analyzing economic indicators like PMI (Purchasing Managers' Index) is crucial for predicting DAX trends. The PMI provides insights into the manufacturing and services sectors, offering valuable forward-looking information about economic activity and its potential impact on the DAX. Other crucial indicators include industrial production figures and consumer confidence indices.

Political Stability and its Influence on the Dax

Political stability and clear policy direction are paramount for investor confidence. Significant political events, such as elections or changes in government, can induce market volatility. Uncertainty surrounding policy changes, particularly those affecting businesses, can negatively impact the DAX. Germany's role within the European Union and its response to global geopolitical events also significantly influence investor sentiment.

- Clear policy frameworks enhance investor confidence, leading to stable DAX performance. Predictable regulations and a stable political landscape create a favorable environment for investment.

- Political instability and uncertainty can trigger DAX volatility. Major political shifts, such as unexpected election results or coalition government negotiations, can create uncertainty and lead to market fluctuations.

- Major elections often lead to short-term fluctuations in the DAX. The period leading up to and immediately following elections often sees increased market volatility as investors react to potential policy changes.

- EU policies and regulations have a significant impact on German businesses and the DAX. Decisions made within the EU, such as those concerning trade, environmental regulations, or monetary policy, directly affect German companies and their performance.

- Geopolitical risks can affect investor sentiment and impact DAX performance. Global events, such as international conflicts or trade wars, can influence investor confidence and lead to fluctuations in the DAX.

Key Sectors Driving Dax Performance

The DAX comprises leading German companies across various sectors. The performance of these sectors significantly influences the overall DAX index. Understanding the strengths and weaknesses of key sectors – such as the automotive, industrial production, and technology sectors – is essential for analyzing DAX performance. Monitoring the market capitalization of individual DAX constituents offers a detailed view of sector-specific contributions to the overall index.

- The automotive sector remains a significant contributor to DAX performance. Major German automakers play a crucial role in the DAX, and their performance is closely linked to global automotive industry trends.

- The performance of industrial giants heavily influences the DAX. Germany's strong industrial base, with companies excelling in engineering and manufacturing, contributes significantly to the DAX.

- The technology sector's growth is increasingly impacting the DAX. As Germany invests more in technology and digitalization, the influence of this sector on the DAX is expected to grow.

- Fluctuations in energy prices can significantly affect related DAX companies. Companies involved in energy production and distribution are sensitive to price fluctuations, influencing their contribution to the DAX.

- Analyzing the performance of individual DAX constituents is crucial for understanding overall market trends. By examining the performance of specific companies within different sectors, investors can gain a granular understanding of the factors driving the DAX's overall performance.

Conclusion

DAX performance is a complex interplay of German economic growth, political stability, and the performance of its constituent sectors. Understanding these factors is crucial for investors to make informed decisions. Analyzing economic indicators, political landscapes, and sector-specific trends provides a more comprehensive view of the DAX and its future potential.

Call to Action: Stay informed about the latest developments in the German economy and politics to effectively track DAX performance and make well-informed investment decisions. Regularly monitor key economic indicators and political events to better understand the forces shaping DAX performance. Understanding the nuances of Dax performance can lead to better investment strategies and potentially higher returns.

Featured Posts

-

Swarovski Campaign Showcases Ariana Grandes Unique Dip Dyed Hairstyle

Apr 27, 2025

Swarovski Campaign Showcases Ariana Grandes Unique Dip Dyed Hairstyle

Apr 27, 2025 -

Indian Wells Cerundolo Accede A Cuartos Tras Bajas De Fritz Y Gauff

Apr 27, 2025

Indian Wells Cerundolo Accede A Cuartos Tras Bajas De Fritz Y Gauff

Apr 27, 2025 -

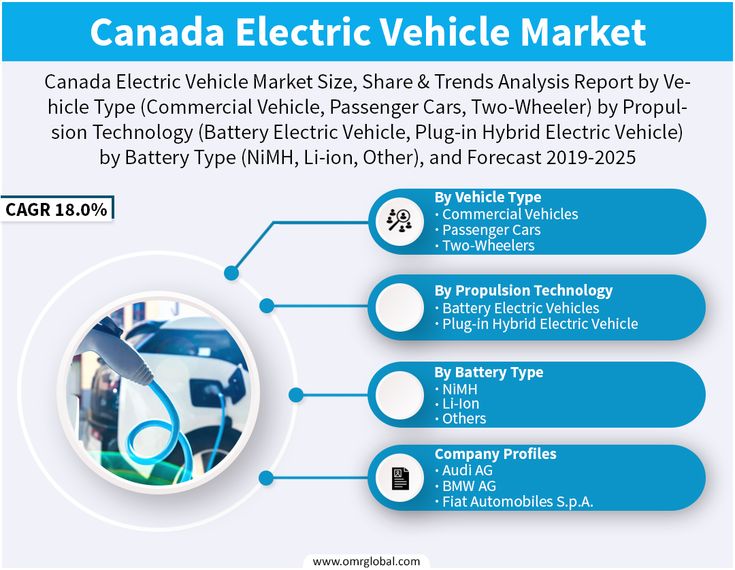

Is The Canadian Ev Market Cooling Three Years Of Declining Interest

Apr 27, 2025

Is The Canadian Ev Market Cooling Three Years Of Declining Interest

Apr 27, 2025 -

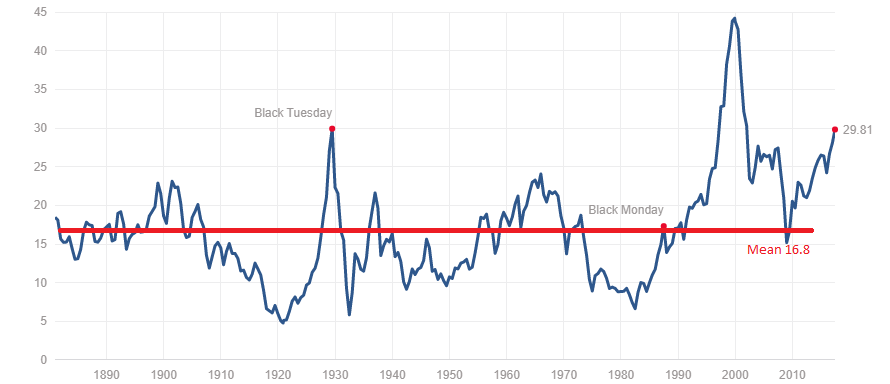

High Stock Market Valuations A Bof A Analysts Rationale For Calm

Apr 27, 2025

High Stock Market Valuations A Bof A Analysts Rationale For Calm

Apr 27, 2025 -

Dax Bundestag Elections And Economic Indicators

Apr 27, 2025

Dax Bundestag Elections And Economic Indicators

Apr 27, 2025

Latest Posts

-

January 6th Hearings Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 28, 2025

January 6th Hearings Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 28, 2025 -

Cassidy Hutchinsons Upcoming Memoir Insights Into The January 6th Hearings

Apr 28, 2025

Cassidy Hutchinsons Upcoming Memoir Insights Into The January 6th Hearings

Apr 28, 2025 -

Ftc Probe Into Open Ai Implications For Ai Development

Apr 28, 2025

Ftc Probe Into Open Ai Implications For Ai Development

Apr 28, 2025 -

Cassidy Hutchinson Key Witness To January 6th Announces Memoir

Apr 28, 2025

Cassidy Hutchinson Key Witness To January 6th Announces Memoir

Apr 28, 2025 -

Open Ai And Chat Gpt An Ftc Investigation Begins

Apr 28, 2025

Open Ai And Chat Gpt An Ftc Investigation Begins

Apr 28, 2025