Dutch Stocks Slump Amidst Escalating US Trade War

Table of Contents

Impact of US Tariffs on Dutch Exports

The US trade war's impact on Dutch exports is multifaceted and substantial, affecting several key sectors.

Key Dutch Export Sectors Affected

The imposition of US tariffs has directly impacted crucial sectors of the Dutch economy:

- Agriculture: Dutch agricultural exports, particularly dairy and horticultural products, have faced significant tariffs, leading to reduced demand and lower export volumes. Estimates suggest a potential loss of €X million in export revenue for the dairy sector alone. Companies like [Name a relevant Dutch dairy company] have reported decreased profits due to these tariffs.

- Manufacturing: The manufacturing sector, including producers of machinery and high-tech equipment, has also been affected by increased tariffs on imported components and reduced demand from the US market. [Name a relevant Dutch manufacturing company] has publicly acknowledged challenges related to the trade war.

- Chemicals: The chemical industry, a major contributor to the Dutch economy, faces increased tariffs on certain chemical products exported to the US, resulting in reduced competitiveness and potential job losses.

These tariffs have resulted in:

- A significant decrease in export volume across affected sectors.

- A reduction in profitability for Dutch companies reliant on the US market.

- Increased pressure on supply chains and production costs.

Supply Chain Disruptions

The US trade war has significantly disrupted Dutch supply chains. Many Dutch companies rely on US components for their production processes or depend heavily on the US market for sales. This reliance leaves them vulnerable to the tariffs and uncertainties created by the trade war.

- Increased production costs due to higher import prices of US components.

- Delayed production schedules due to disrupted supply chains.

- Reduced competitiveness in the global market due to higher prices.

- Companies exploring alternative sourcing strategies, which require significant investments and time.

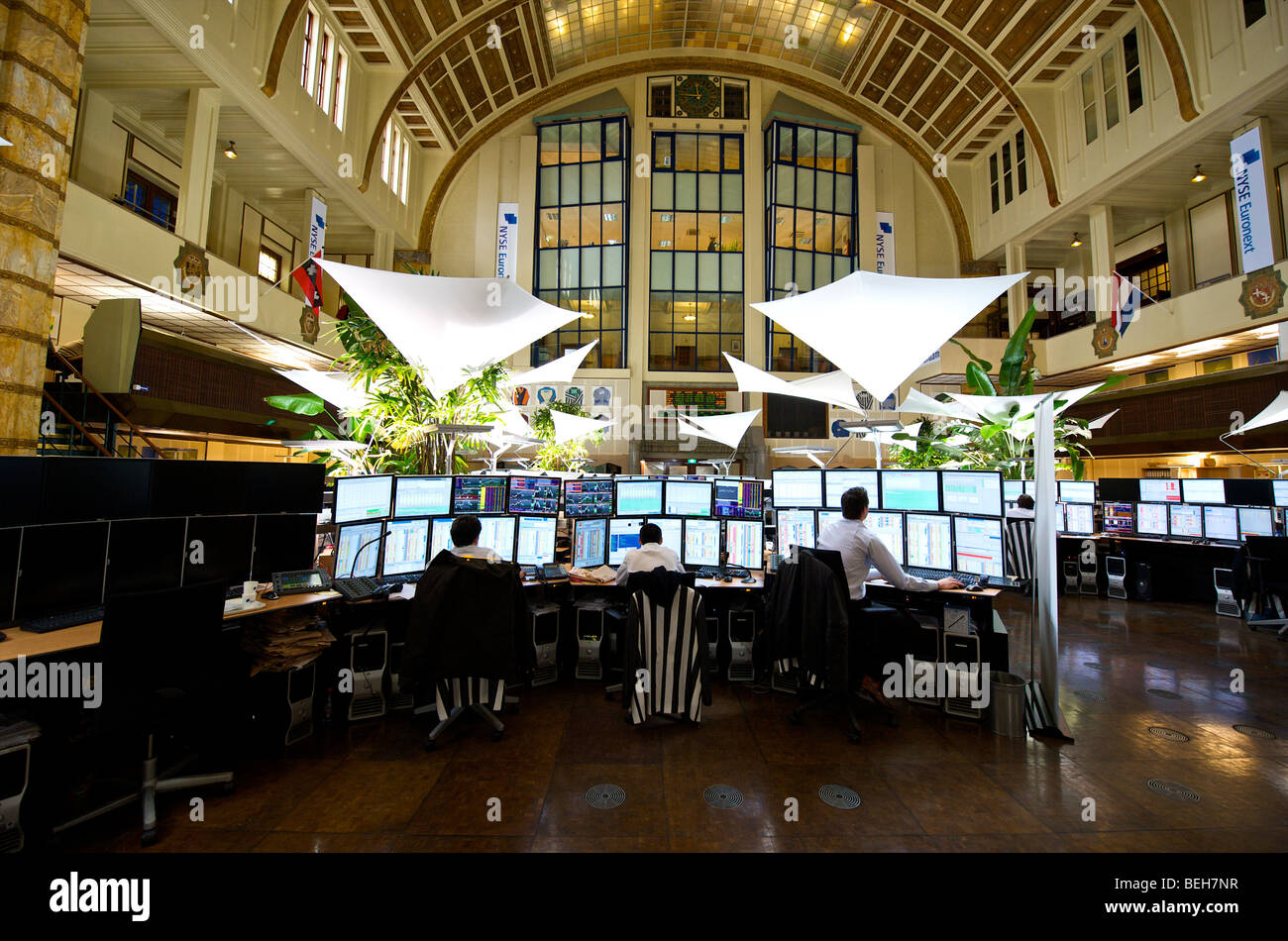

Investor Sentiment and Market Volatility

The escalating US trade war and the subsequent "Dutch Stocks Slump" have significantly impacted investor sentiment and increased market volatility.

Decreased Investor Confidence

The uncertainty surrounding the trade war has eroded investor confidence in the Dutch stock market. This is evidenced by:

- Decreased foreign direct investment (FDI) in the Netherlands.

- A potential outflow of capital from the Dutch market as investors seek safer havens.

- Increased market speculation and negative news coverage, further exacerbating the slump.

Fluctuations in the Euro

Fluctuations in the Euro against the US dollar have further complicated the situation. A weaker Euro can make Dutch exports more competitive in the global market, but it also increases the cost of imported goods, potentially impacting inflation and profitability.

- Recent Euro/Dollar exchange rate movements have shown increased volatility, impacting the valuations of Dutch stocks.

- A weaker Euro can help offset some of the impact of US tariffs, but this effect is limited and uncertain.

Government Response and Potential Mitigation Strategies

The Dutch government has taken steps to mitigate the negative impact of the US trade war, although the effectiveness of these measures remains to be seen.

Government Measures to Support Businesses

The Dutch government has implemented several measures aimed at supporting businesses affected by the trade war:

- Financial aid and subsidies for affected sectors.

- Initiatives to promote Dutch exports to other markets.

- Increased engagement in international trade negotiations to resolve trade disputes.

Long-Term Economic Outlook

The long-term economic consequences of the US trade war on the Netherlands remain uncertain. The outcome will heavily depend on:

- The resolution of the trade conflict between the US and other countries.

- The ability of Dutch businesses to adapt to the changing global trade landscape.

- The effectiveness of government policies in mitigating the negative effects. A prolonged trade war could lead to a sustained "Dutch stocks slump" and long-term economic slowdown.

Conclusion

The "Dutch Stocks Slump" is a direct consequence of the escalating US trade war, impacting key export sectors, decreasing investor confidence, and increasing market volatility. While the Dutch government is implementing mitigation strategies, the long-term economic outlook remains uncertain. Stay informed about the developments in the US trade war and its impact on Dutch stocks. Consult a financial advisor to discuss your investment strategy in this volatile market, and carefully consider diversification to mitigate the risks associated with the ongoing Dutch stocks slump and global trade tensions.

Featured Posts

-

Cac 40 Weekly Performance Slight Dip Maintaining Steady Position March 7 2025

May 25, 2025

Cac 40 Weekly Performance Slight Dip Maintaining Steady Position March 7 2025

May 25, 2025 -

Euronext Amsterdam Stock Market Up 8 Following U S Tariff Suspension

May 25, 2025

Euronext Amsterdam Stock Market Up 8 Following U S Tariff Suspension

May 25, 2025 -

The Rtx 5060 Debacle Lessons Learned For Gamers And Tech Reviewers

May 25, 2025

The Rtx 5060 Debacle Lessons Learned For Gamers And Tech Reviewers

May 25, 2025 -

Significant Bangladesh Business Event Expected In Netherlands

May 25, 2025

Significant Bangladesh Business Event Expected In Netherlands

May 25, 2025 -

Facing Retribution The High Cost Of Challenging The Status Quo

May 25, 2025

Facing Retribution The High Cost Of Challenging The Status Quo

May 25, 2025

Latest Posts

-

Real Madrid In Doert Oyuncusuna Uefa Sorusturmasi Neler Oluyor

May 25, 2025

Real Madrid In Doert Oyuncusuna Uefa Sorusturmasi Neler Oluyor

May 25, 2025 -

Uefa Real Madrid In Doert Yildizina Sorusturma Baslatti Detaylar Ve Gelismeler

May 25, 2025

Uefa Real Madrid In Doert Yildizina Sorusturma Baslatti Detaylar Ve Gelismeler

May 25, 2025 -

Queen Wen Courts Paris Again Fashion Diplomacy And Influence

May 25, 2025

Queen Wen Courts Paris Again Fashion Diplomacy And Influence

May 25, 2025 -

Paris Welcomes Queen Wen Again Highlights Of The Royal Appearance

May 25, 2025

Paris Welcomes Queen Wen Again Highlights Of The Royal Appearance

May 25, 2025 -

Sabalenka Falls To Zheng In Rome Gauff To Face Zheng In Semifinals

May 25, 2025

Sabalenka Falls To Zheng In Rome Gauff To Face Zheng In Semifinals

May 25, 2025