Elon Musk's Private Companies: A Potential Side Hustle For Investors

Table of Contents

Navigating the Complexities of Investing in Private Companies

Investing in private companies differs significantly from investing in publicly traded stocks. While public companies offer readily available information, transparency, and liquidity through established stock exchanges, private companies present a unique set of challenges and opportunities. The higher risk associated with private investments often translates into the potential for higher rewards, but it’s crucial to understand the inherent complexities.

The illiquidity of private markets is a key factor. Unlike publicly traded stocks, you can't easily sell your shares whenever you choose. This requires a long-term investment horizon and a tolerance for potentially lengthy periods before realizing any returns.

- Limited access to information: Financial details and performance metrics are not publicly available.

- Difficulty in valuing private companies: Determining the true worth of a private company is significantly more challenging than for publicly traded companies.

- Longer investment timelines: Exiting investments in private companies often takes considerably longer than selling public stocks.

- Potential for illiquidity: Selling your shares might be difficult or impossible for extended periods.

- Higher due diligence requirements: Thorough research and investigation are essential before investing.

Key Players in Musk's Private Company Portfolio

Several of Elon Musk's private companies represent intriguing, albeit risky, investment prospects. Let's explore some of the key players:

SpaceX: Reaching for the Stars (and Investment Returns)

SpaceX, arguably Musk's most well-known private venture, aims to revolutionize space exploration and transportation. Its innovative reusable rocket technology and ambitious goals have attracted significant attention. The company's Starlink satellite internet service is already generating substantial revenue, and future prospects, including space tourism and government contracts, suggest considerable growth potential.

- Satellite internet (Starlink): A major current revenue stream with vast expansion potential.

- Space tourism: A burgeoning market with significant future revenue potential.

- Government contracts and partnerships: Secure revenue streams through collaborations with government agencies.

- Technological advancements: Continuous innovation drives SpaceX's competitive edge. Investment opportunities in SpaceX are extremely limited and typically involve significant wealth and connections.

The Boring Company: Digging into Innovation and Investment

The Boring Company tackles the challenge of urban transportation through innovative tunnel construction. Its aim is to create efficient, high-speed underground transportation systems to alleviate traffic congestion. While still in its early stages of development, the potential for growth in the infrastructure sector is substantial.

- Tunnel construction and transportation systems: The core business model with significant scalability potential.

- Potential for expansion into other cities and countries: Global expansion presents a huge growth opportunity.

- Innovation in tunnel boring technology: Continued advancements could revolutionize the industry.

- Environmental benefits: Underground transportation offers potential environmental advantages compared to surface traffic. Investment opportunities are, like SpaceX, extremely limited to accredited investors and specialized funds.

Neuralink: Exploring the Frontier of Brain-Computer Interfaces

Neuralink's mission is arguably the most ambitious: to develop advanced brain-computer interfaces (BCIs). This technology holds immense potential for treating neurological disorders and enhancing human capabilities. However, it also involves significant scientific and ethical challenges, making it a high-risk, high-reward proposition.

- Medical applications: Potential for breakthroughs in treating neurological conditions.

- Ethical considerations and regulatory hurdles: Navigating ethical concerns and regulatory approvals will be crucial.

- Long-term potential for significant market disruption: Successful development could revolutionize the healthcare and technology sectors.

- High risk, high reward investment profile: This venture carries substantial risk alongside the potential for enormous returns. Investment opportunities are extremely rare and likely restricted to highly sophisticated investors.

Strategies for Accessing Elon Musk's Private Company Investments

Gaining access to investment opportunities in these private companies is challenging, requiring significant capital and often specialized networks. Accredited investor status is typically a prerequisite. Potential avenues include:

- Networking with venture capitalists: Building relationships with venture capitalists who invest in these types of companies.

- Participation in private equity funds: Investing through funds that specialize in private company investments.

- Exploring secondary markets for existing shares (if available): This is a rare opportunity and requires significant due diligence.

- Understanding regulatory requirements: Private investments are subject to specific regulations depending on jurisdiction.

Conclusion: Investing in Elon Musk's Vision: A High-Risk, High-Reward Venture

Investing in Elon Musk's private companies offers the potential for extraordinary returns, but it’s crucial to acknowledge the significant risks involved. The limited liquidity, lack of transparency, and inherent volatility require a high-risk tolerance and a long-term investment horizon. Thorough due diligence, diversification of your investment portfolio, and professional financial advice are paramount. Explore the world of Elon Musk's private company investments and potentially unlock exciting opportunities. However, remember to conduct thorough research and seek professional financial advice before making any investment decisions.

Featured Posts

-

Point72 Traders Exit As Emerging Markets Focused Fund Closes

Apr 26, 2025

Point72 Traders Exit As Emerging Markets Focused Fund Closes

Apr 26, 2025 -

Los Angeles Wildfires And The Ethics Of Disaster Gambling

Apr 26, 2025

Los Angeles Wildfires And The Ethics Of Disaster Gambling

Apr 26, 2025 -

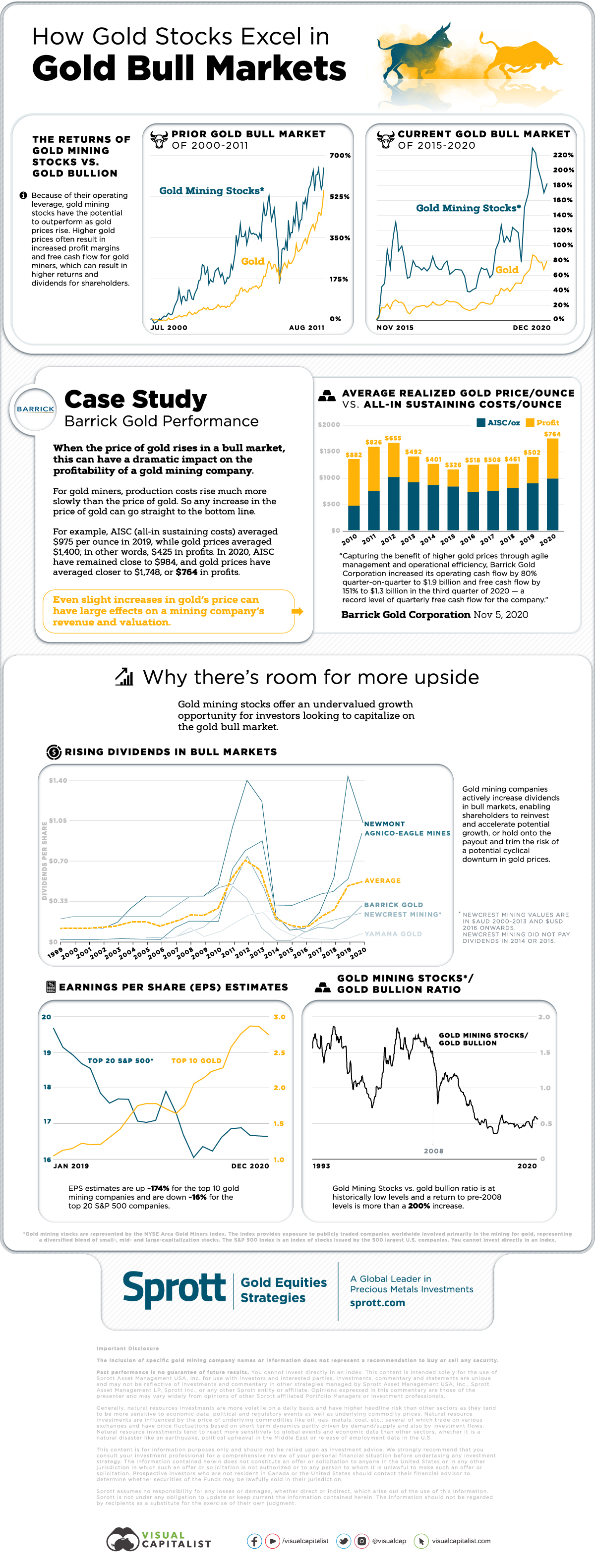

Why Is Gold Soaring Trade Wars And The Bullion Market Explained

Apr 26, 2025

Why Is Gold Soaring Trade Wars And The Bullion Market Explained

Apr 26, 2025 -

Human Centered Ai An Interview With Microsofts Design Chief

Apr 26, 2025

Human Centered Ai An Interview With Microsofts Design Chief

Apr 26, 2025 -

A Conservative Harvard Professor On Reforming Higher Education

Apr 26, 2025

A Conservative Harvard Professor On Reforming Higher Education

Apr 26, 2025

Latest Posts

-

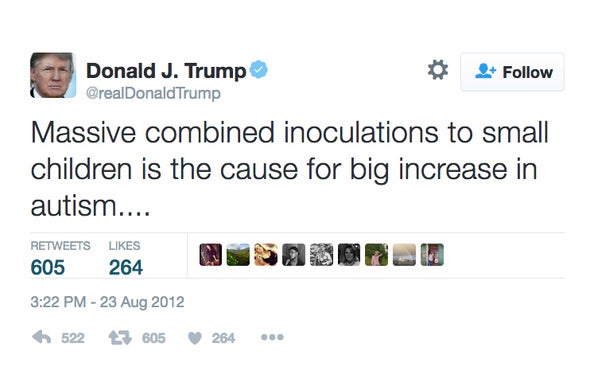

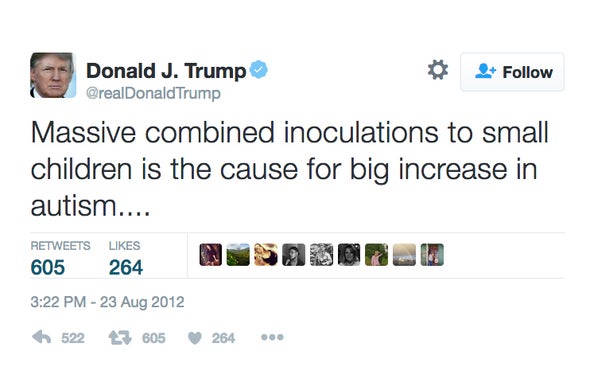

Anti Vaccine Advocate Review Of Autism Vaccine Connection Sparks Outrage Nbc 10 Philadelphia Reports

Apr 27, 2025

Anti Vaccine Advocate Review Of Autism Vaccine Connection Sparks Outrage Nbc 10 Philadelphia Reports

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Claims

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025 -

Anti Vaccine Activist Review Of Autism Vaccine Link Sparks Outrage Nbc Chicago Sources

Apr 27, 2025

Anti Vaccine Activist Review Of Autism Vaccine Link Sparks Outrage Nbc Chicago Sources

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Connection

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Connection

Apr 27, 2025