Escape To The Country: How Nicki Chapman Made £700,000 On A Property Investment

Table of Contents

Identifying the Right Property Investment Opportunity

Before embarking on any property investment journey, meticulous research and due diligence are paramount. This is especially true when venturing into the potentially unique and challenging rural property market.

Research and Due Diligence

Thorough market research forms the bedrock of successful property investment. This involves more than just browsing online property portals.

- Online Property Portals: Utilize sites like Rightmove, Zoopla, and others to understand pricing trends, property types available, and time on market in your target area.

- Local Estate Agents: Building relationships with local estate agents provides invaluable on-the-ground knowledge of the market, including insights into upcoming developments and local demand.

- Comparable Property Analysis: Analyzing comparable properties (comps) that have recently sold helps determine fair market value and identify undervalued opportunities. This is crucial for negotiating a good purchase price.

Beyond pricing, consider the surrounding area's viability:

- Access to Amenities: Proximity to essential services like shops, schools, and healthcare facilities is vital for attracting tenants or achieving a higher resale value.

- Transport Links: Consider the ease of access to major towns and cities. Good transport links significantly increase a property's desirability.

- Future Development: Research potential future developments in the area, such as infrastructure improvements or planned housing schemes, which can impact property values positively.

Understanding the Rural Property Market

Investing in rural properties offers unique rewards and challenges compared to urban areas.

- Slower Sales Cycles: Rural properties may take longer to sell than urban counterparts, but this is often offset by higher capital appreciation.

- Seasonal Fluctuations: Demand for rural properties can fluctuate seasonally, impacting both rental income and sales prices.

- Higher Capital Appreciation: Rural properties often appreciate in value at a faster rate than urban properties over the long term.

- Planning Restrictions and Environmental Considerations: Be aware of strict planning regulations and potential environmental constraints that might impact development or renovation projects.

Nicki Chapman's Investment Strategy

While the specifics of Nicki Chapman's investment strategy remain private, we can deduce likely approaches based on general property investment principles and the characteristics of successful rural property investments.

Property Selection and Renovation

Nicki Chapman likely focused on properties with significant renovation potential – potentially undervalued properties, fixer-uppers, or those requiring modernisation.

- Fixer-Uppers and Undervalued Properties: These offer opportunities to add substantial value through strategic renovations.

- Smart Renovations: Prioritizing renovations that appeal to a wide target market is key. This might include updating kitchens and bathrooms, improving energy efficiency (which is increasingly important), or creating modern, stylish living spaces that blend seamlessly with the character of a rural property. Investing in energy-efficient upgrades can significantly boost rental income or resale value.

Financing the Investment

Securing suitable financing is essential for any property investment project.

- Mortgages: A mortgage is the most common financing method, but securing favorable terms is crucial. This requires a strong credit history and a comprehensive financial plan.

- Equity Release: If you own other properties, equity release might be an option, but carefully weigh the long-term implications.

- Joint Ventures: Partnering with other investors can reduce individual risk and leverage combined resources.

- Professional Financial Advice: Seek advice from a qualified financial advisor to determine the most suitable financing option for your circumstances.

Maximizing Returns on Rural Property Investment

Once you've acquired a property, implementing effective strategies is key to maximizing returns.

Rental Income Strategies

If renting is part of your strategy, maximize rental income through:

- Marketing Strategies: Utilize effective marketing channels to attract high-quality tenants, including online property portals and local advertising.

- Property Management: Consider hiring a property management company to handle tenant communication, rent collection, and maintenance, freeing up your time. Alternatively, familiarise yourself with responsible landlord practices.

- Holiday Lets: If your property is suitable, consider offering it as a holiday let, which can generate higher rental income than long-term lettings but requires more management.

Capital Appreciation

Capital appreciation is a key component of long-term property investment success.

- Market Timing: While impossible to perfectly time the market, understanding current market trends and anticipating future growth is crucial.

- Property Improvements: Regular maintenance and strategic improvements enhance the property's value, ensuring it remains competitive in the market.

- Long-Term Growth Potential: Rural properties often demonstrate strong long-term growth potential, particularly in desirable locations.

Conclusion: Learn from Nicki Chapman's Success – Your Escape to Country Property Investment Awaits!

Nicki Chapman's impressive £700,000 property investment success underscores the lucrative potential of the rural property market. By combining thorough research, strategic property selection, smart renovations, and effective management, you can unlock substantial returns. Remember, successful property investment involves careful planning, due diligence, and a sound understanding of the market. Begin your escape to the country; start your property investment journey today and unlock the potential of rural property investments. Don't delay – your own country property investment success story awaits!

Featured Posts

-

Glastonbury 2025 Lineup A Comprehensive Guide To Must See Artists

May 24, 2025

Glastonbury 2025 Lineup A Comprehensive Guide To Must See Artists

May 24, 2025 -

Dax Falls Below 24 000 Frankfurt Stock Market Closing Losses

May 24, 2025

Dax Falls Below 24 000 Frankfurt Stock Market Closing Losses

May 24, 2025 -

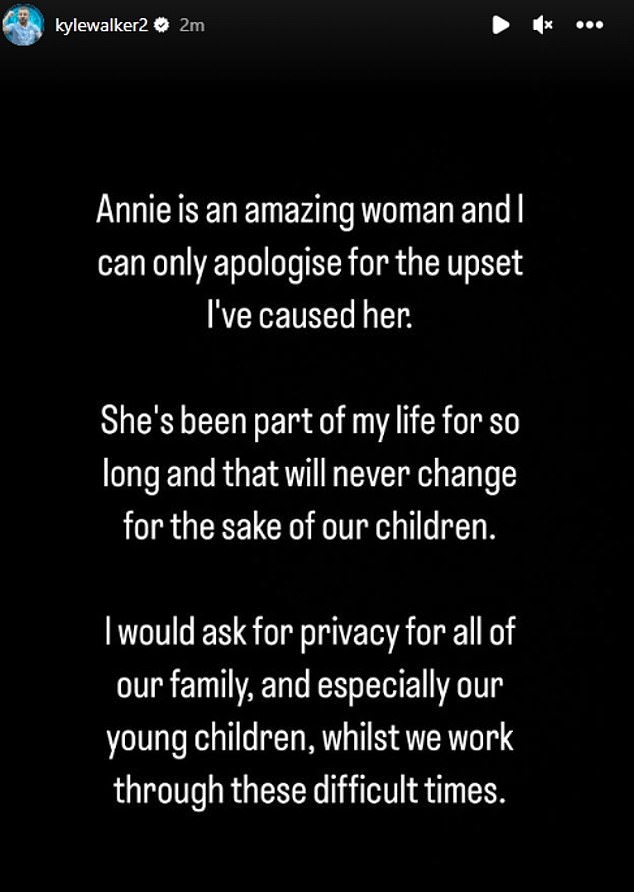

Annie Kilners Solo Outing Strawberry Snack After Kyle Walkers Night Out

May 24, 2025

Annie Kilners Solo Outing Strawberry Snack After Kyle Walkers Night Out

May 24, 2025 -

Allegations Against Annie Kilner After Kyle Walkers Night Out

May 24, 2025

Allegations Against Annie Kilner After Kyle Walkers Night Out

May 24, 2025 -

Porsche Di Indonesia Classic Art Week 2025 Perpaduan Seni And Mobil Klasik

May 24, 2025

Porsche Di Indonesia Classic Art Week 2025 Perpaduan Seni And Mobil Klasik

May 24, 2025

Latest Posts

-

Amundi Djia Ucits Etf A Detailed Look At Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Detailed Look At Net Asset Value Nav

May 24, 2025 -

News Corp Undervalued And Underappreciated Analyzing The Potential

May 24, 2025

News Corp Undervalued And Underappreciated Analyzing The Potential

May 24, 2025 -

Tracking The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Tracking The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Is News Corp An Undervalued Asset A Deeper Look At Its Business Units

May 24, 2025

Is News Corp An Undervalued Asset A Deeper Look At Its Business Units

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025