Ethereum's Resilient Price: Signs Of An Upcoming Surge?

Table of Contents

Ethereum's Underlying Strength: Beyond the Price Fluctuations

Ethereum's inherent strength extends far beyond its fluctuating price. Several key factors contribute to its long-term potential and suggest a possible price upswing.

The Growing Ethereum Ecosystem

The Ethereum ecosystem is a powerhouse of decentralized applications (dApps) and innovation, driving demand for ETH. This vibrant ecosystem is constantly expanding, attracting developers and users alike.

- Increased DeFi TVL: The total value locked (TVL) in decentralized finance (DeFi) protocols built on Ethereum continues to grow, indicating strong user engagement and confidence in the platform. This increased usage directly fuels demand for ETH.

- Growth in NFT Trading Volume: The non-fungible token (NFT) market, largely built on Ethereum, has experienced periods of significant growth, showcasing the platform's versatility and ability to support innovative applications. The high transaction volume in NFTs translates to higher ETH demand.

- Examples of Enterprise Ethereum Adoption: Major corporations are increasingly exploring Ethereum's potential for enterprise solutions, such as supply chain management and secure data storage. This adoption signals a broader acceptance of Ethereum's technology and long-term viability.

Ethereum's Technological Advancements

Ethereum's ongoing development and technological advancements are critical to its long-term success and price stability. Upgrades like Ethereum 2.0 are addressing scalability issues and enhancing the overall user experience.

- Explanation of Sharding: Ethereum 2.0's sharding mechanism will significantly improve scalability by dividing the network into smaller, more manageable parts, leading to faster transaction processing.

- Benefits of Proof-of-Stake: The transition to a proof-of-stake (PoS) consensus mechanism reduces energy consumption and enhances the network's security and efficiency. This makes Ethereum more environmentally friendly and cost-effective to operate.

- Reduced Transaction Fees: Sharding and PoS will contribute to significantly lower transaction fees, making Ethereum more accessible to a wider range of users and applications.

- Improved Network Speed: The overall network speed will increase drastically, leading to a better user experience and potentially increased adoption.

Macroeconomic Factors Influencing Ethereum's Price

Broader macroeconomic trends significantly impact cryptocurrency prices, including Ethereum. Understanding these factors is crucial to predicting potential price movements.

Inflation and the Search for Alternative Assets

Rising inflation often drives investors to seek alternative assets that can hedge against the erosion of purchasing power. Cryptocurrencies, including Ethereum, are increasingly seen as such an asset.

- Correlation between Inflation Rates and Cryptocurrency Prices: Historically, there's been a correlation between periods of high inflation and increased demand for cryptocurrencies as a store of value.

- Ethereum as a Store of Value: Ethereum's limited supply and growing adoption make it a potential long-term store of value, attracting investors seeking to protect their wealth.

Regulatory Landscape and its Impact

The evolving regulatory environment for cryptocurrencies is a key factor influencing investor sentiment and Ethereum's price. Clear and consistent regulations could increase confidence, while uncertainty or overly restrictive measures could negatively impact the market.

- Examples of Positive Regulatory Developments: Clear regulatory frameworks could legitimize the cryptocurrency space, attracting institutional investors and increasing market maturity.

- Examples of Negative Regulatory Developments: Overly restrictive or unclear regulations could stifle innovation and negatively impact investor confidence, leading to price volatility.

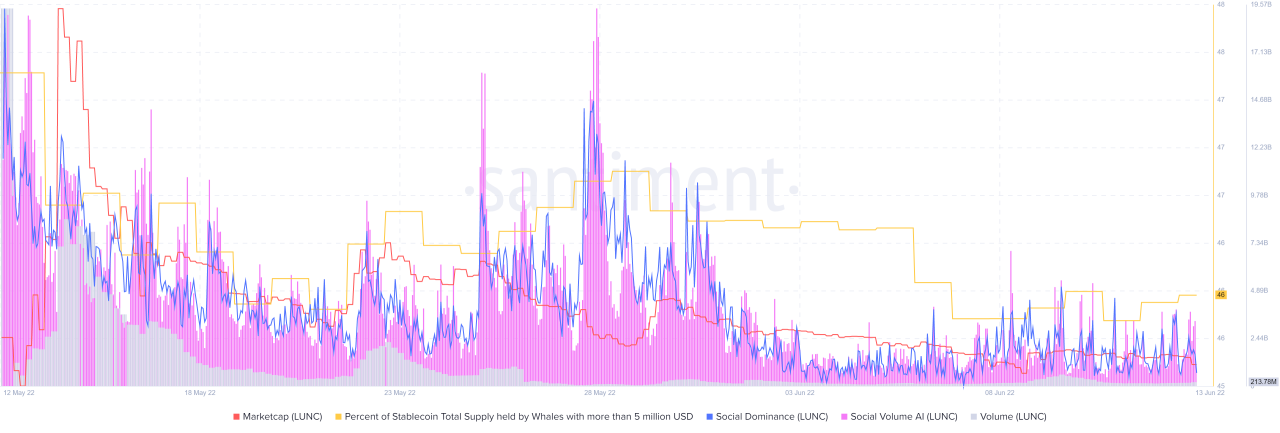

Technical Analysis: Chart Patterns and Indicators Suggesting an Upcoming Surge

Technical analysis provides valuable insights into potential price movements by studying past price trends and using various indicators.

Analyzing Key Support and Resistance Levels

Identifying key support and resistance levels on the ETH chart can help predict future price movements. Support levels represent price points where buying pressure is expected to outweigh selling pressure, while resistance levels represent the opposite. (Insert chart showing support and resistance levels here)

- Key Support Levels: Identifying these levels allows traders to anticipate potential buying opportunities.

- Key Resistance Levels: Breaking through key resistance levels often signals a potential upward trend.

Interpreting Indicators (e.g., RSI, MACD)

Technical indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can provide further insights into market momentum and potential price reversals. (Insert charts illustrating RSI and MACD here)

- RSI: The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD: The MACD identifies changes in momentum by comparing two moving averages.

Conclusion

Ethereum's resilient price is underpinned by its robust ecosystem, continuous technological advancements, and its position as an alternative asset in an inflationary environment. While the regulatory landscape remains a factor, the confluence of positive indicators suggests a potential for significant upward movement in Ethereum's price. While no one can predict the future with certainty, the analysis of Ethereum's underlying strength, macroeconomic trends, and technical indicators point towards a potentially bullish outlook for Ethereum's price. Stay informed on market trends, deepen your research into Ethereum's potential, and consider its role in your diversified investment portfolio. Understanding the factors driving Ethereum's price is crucial for informed investment decisions.

Featured Posts

-

Steve Sarkisians Spring Injury Report Texas Longhorns Football

May 08, 2025

Steve Sarkisians Spring Injury Report Texas Longhorns Football

May 08, 2025 -

Confronting Rogue Exiles In Path Of Exile 2

May 08, 2025

Confronting Rogue Exiles In Path Of Exile 2

May 08, 2025 -

Berkshire Hathaways Investment Boosts Japan Trading House Share Prices

May 08, 2025

Berkshire Hathaways Investment Boosts Japan Trading House Share Prices

May 08, 2025 -

Ethereum Reaches New Highs 2 000 On The Horizon

May 08, 2025

Ethereum Reaches New Highs 2 000 On The Horizon

May 08, 2025 -

Billions In Bitcoin And Ethereum Options Expire Market Volatility Expected

May 08, 2025

Billions In Bitcoin And Ethereum Options Expire Market Volatility Expected

May 08, 2025