Federal Reserve Holds Rates: Balancing Inflation And Unemployment Challenges

Table of Contents

The Inflationary Landscape: Persistent Pressure or Temporary Spike?

Inflation remains a significant concern for the Federal Reserve. The Consumer Price Index (CPI) and Producer Price Index (PPI) continue to reflect elevated consumer prices, impacting consumer spending and overall economic confidence. Contributing factors are multifaceted, ranging from persistent supply chain issues impacting the availability of goods, to soaring energy prices driven by geopolitical events. The debate continues to rage between those who believe inflation is a temporary phenomenon ("transitory inflation") and those who predict more persistent inflationary pressures. Understanding this nuance is key to deciphering the Fed's strategy.

- Recent Inflation Data Breakdown: The most recent CPI and PPI reports show [insert latest data and percentage change here]. This represents [interpret the data – e.g., a slight decrease/increase compared to the previous month/year].

- Analysis of Specific Contributing Factors: Supply chain bottlenecks, particularly in [mention specific sectors, e.g., semiconductors, shipping], continue to contribute to higher prices. Additionally, the ongoing war in Ukraine has exacerbated energy prices, leading to increased costs for consumers and businesses.

- Expert Opinions on the Future Trajectory of Inflation: Economists are divided, with some predicting a gradual decline in inflation as supply chain issues ease, while others warn of the risk of persistent inflation driven by strong demand and wage growth.

Unemployment Rates: A Tight Labor Market and its Implications

The current unemployment rate sits at [insert latest unemployment rate data here], reflecting a historically tight labor market. This low unemployment rate, while positive for workers, presents a challenge for the Federal Reserve. A tight labor market often leads to increased wage growth, which can, in turn, fuel inflationary pressures. Raising interest rates to combat inflation risks triggering job losses and increased unemployment. The Fed needs to carefully navigate this precarious balance.

- Statistics on Job Creation and Unemployment Claims: [Insert relevant data on job creation numbers and unemployment claims]. These figures suggest [interpret the data – e.g., a robust/weakening labor market].

- Discussion of Wage Pressures and their Relationship to Inflation: Wage growth has accelerated in recent months, contributing to upward pressure on inflation. The Fed is closely monitoring wage increases to gauge their impact on overall price stability.

- Potential Scenarios for Employment under Different Interest Rate Policies: Raising interest rates could cool down the economy and potentially lead to job losses. Maintaining current rates carries the risk of allowing inflation to persist.

The Federal Reserve's Decision: A Cautious Approach to Monetary Policy

The Federal Reserve's decision to hold interest rates steady reflects a cautious approach to monetary policy. The Federal Open Market Committee (FOMC) likely weighed the risks of both raising and lowering rates, considering the potential impact on inflation and unemployment. Their communication strategy emphasizes a data-dependent approach, indicating a willingness to adjust policy based on future economic developments. This cautious stance reflects the uncertainty surrounding the future economic trajectory.

- Summary of the FOMC Statement: The FOMC statement [summarize the key points from the official statement – emphasizing the rationale behind holding rates].

- Analysis of the Economic Projections Presented by the Fed: The Fed's economic projections [summarize the Fed's forecasts for inflation, unemployment, and economic growth].

- Discussion of the Fed's Future Policy Intentions: The Fed indicated [explain the Fed's forward guidance regarding future policy decisions, emphasizing data dependency].

Alternative Economic Scenarios and Their Implications

The future economic landscape presents several potential scenarios. A "soft landing" – a scenario where inflation gradually decreases without triggering a significant rise in unemployment – remains a possibility. However, the risk of a recession, or even stagflation (a combination of high inflation and slow economic growth), cannot be ruled out. These scenarios will significantly influence the Federal Reserve’s future decisions on interest rates.

Conclusion: Navigating the Future with Prudent Federal Reserve Interest Rate Policy

The Federal Reserve's decision to hold interest rates underscores the complexities of managing the current economic climate. Balancing the need to control inflation with the imperative to avoid a surge in unemployment presents a significant challenge. The ongoing uncertainty highlights the need for continued monitoring of key economic indicators, and a flexible approach to monetary policy. Staying informed about future Federal Reserve interest rate decisions and their impact is crucial for individuals, businesses, and investors alike. For further insights into monetary policy, we recommend exploring resources from the Federal Reserve Board website and reputable economic publications.

Featured Posts

-

Understanding The Recent Increase In Bitcoin Mining Operations

May 09, 2025

Understanding The Recent Increase In Bitcoin Mining Operations

May 09, 2025 -

Daycare Concerns A Working Parents Perspective

May 09, 2025

Daycare Concerns A Working Parents Perspective

May 09, 2025 -

The Trade Wars Impact Predicting Crypto Market Winners And Losers

May 09, 2025

The Trade Wars Impact Predicting Crypto Market Winners And Losers

May 09, 2025 -

Colapintos Monza Alpine Test A Private Run Revealed

May 09, 2025

Colapintos Monza Alpine Test A Private Run Revealed

May 09, 2025 -

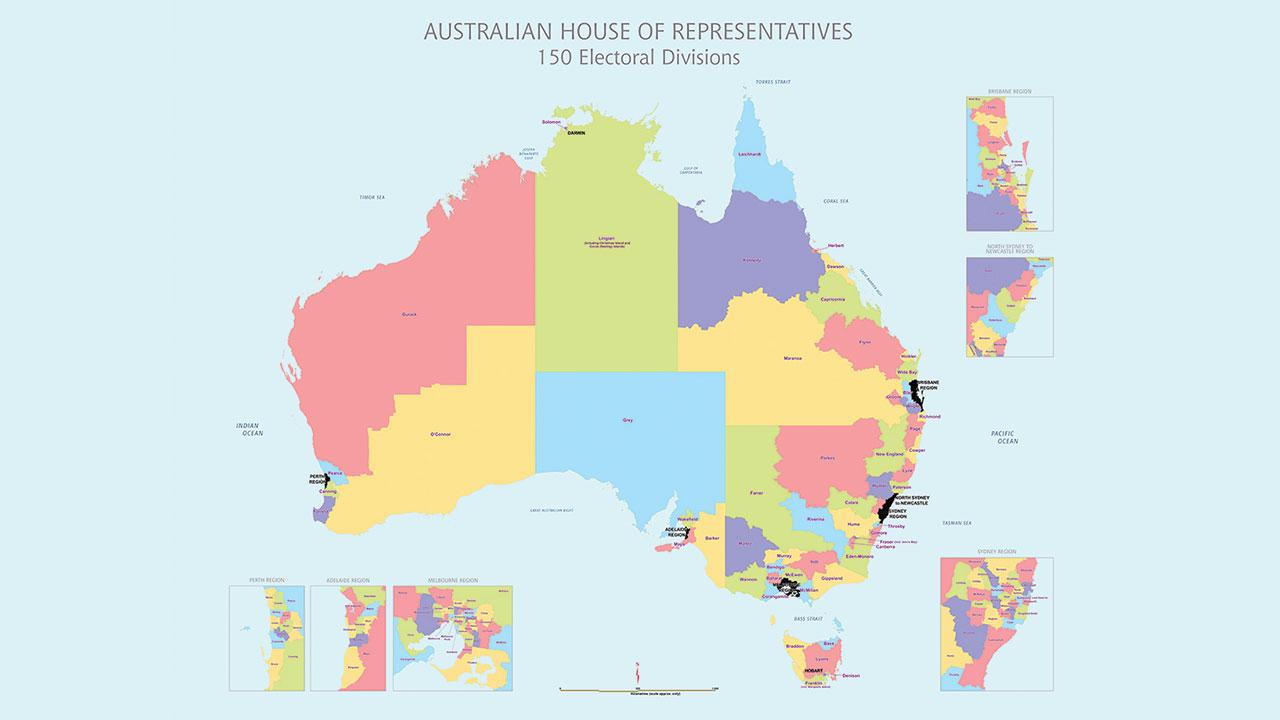

Federal Electoral Boundaries Understanding The Shift In Greater Edmonton

May 09, 2025

Federal Electoral Boundaries Understanding The Shift In Greater Edmonton

May 09, 2025