Frankfurt Stock Exchange: DAX Remains Stable Following Record Run

Table of Contents

DAX Performance Analysis: A Closer Look at Recent Stability

The DAX index, a key indicator of the German stock market's health, has demonstrated resilience in the face of potential volatility. Analyzing its recent performance is crucial for understanding current market trends and predicting future movements.

-

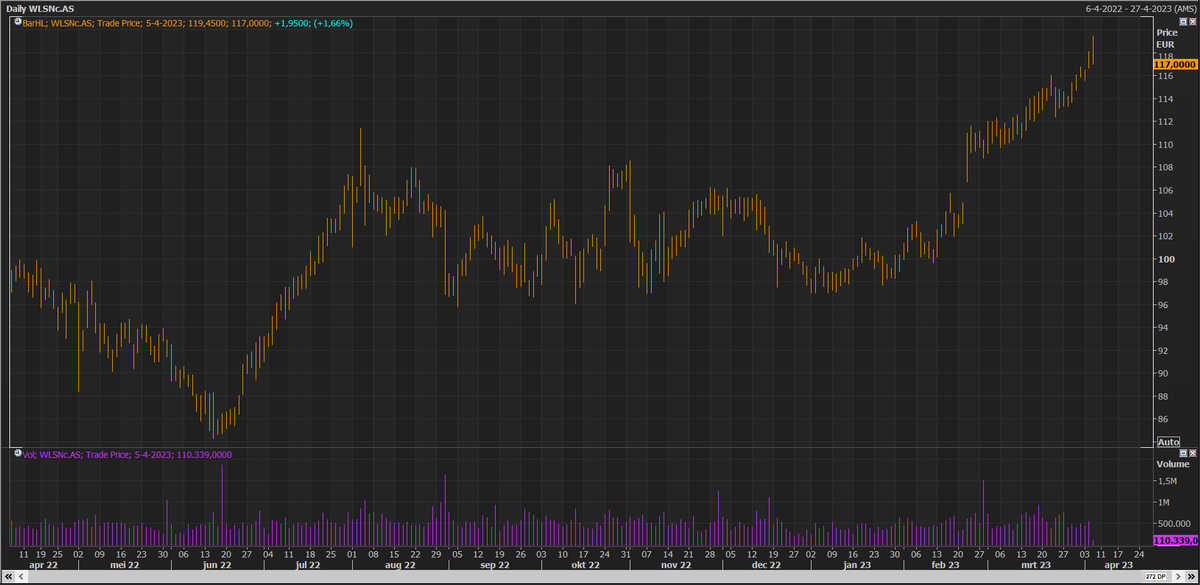

DAX Performance Over the Past Month: Over the past month ( insert specific dates and percentage changes here), the DAX has shown [describe the trend - e.g., a slight upward trend, consolidation around a specific level, minor corrections]. This relative stability contrasts with the significant gains experienced in the preceding period. ( Insert a relevant chart or graph here visualizing the DAX performance.)

-

Comparison with Other Major European Indices: Comparing the DAX's performance against other leading European indices like the CAC 40 (France) and FTSE 100 (UK) reveals its relative strength or weakness. ( Include a comparative chart showing DAX against CAC 40 and FTSE 100, mentioning specific performance differences.) This comparative analysis helps contextualize the DAX's stability within the broader European economic landscape.

-

Trading Volume and Price Movements: Analyzing trading volume provides further insights into market sentiment. High trading volume accompanying price increases suggests strong conviction, while low volume might indicate consolidation or indecision. Conversely, high volume during price decreases signals significant selling pressure. (Insert data on trading volume and its correlation with price movements.)

-

Significant Events Impacting the DAX: External factors significantly influence the DAX. Recent interest rate decisions by the European Central Bank (ECB), key economic data releases (e.g., German GDP growth, inflation figures), and geopolitical events all play a role. (Discuss specific events and their impact on the DAX, providing links to reliable news sources.)

Economic Factors Influencing DAX Stability

The stability of the DAX is intrinsically linked to the health of the German and Eurozone economies. Understanding key economic indicators is vital for interpreting the market's behavior.

-

State of the German and Eurozone Economies: The German economy, a significant driver of the Eurozone, currently shows [ describe the current economic situation - e.g., moderate growth, signs of slowing down, etc. ]. The Eurozone's overall economic outlook also impacts the DAX. (Include data on GDP growth, unemployment rates, and other relevant economic indicators for both Germany and the Eurozone.)

-

Key Economic Indicators and Their Impact: Inflation rates significantly impact investor behavior. High inflation can erode purchasing power and discourage investment, while low inflation can foster a positive environment. Similarly, interest rate changes influence borrowing costs and investment decisions. (Analyze the impact of inflation, interest rates, and other key economic indicators on the DAX.)

-

Potential Future Economic Scenarios: Forecasting future economic scenarios is crucial for informed investment decisions. Potential risks such as a global recession, energy price volatility, or geopolitical instability could all impact the DAX's stability. (Discuss potential future economic scenarios and their likely effects on the DAX.)

The Role of Corporate Earnings in Maintaining DAX Stability

Strong corporate earnings are fundamental to a healthy stock market. Analyzing the performance of DAX-listed companies offers valuable insights into the index's stability.

-

Recent Corporate Earnings Reports: The recent earnings reports from major DAX-listed companies reveal [ summarize the overall trend – e.g., strong earnings growth, mixed results, profit warnings, etc. ]. ( Mention specific companies and their performance, linking to relevant financial news sources.)

-

Sector-Specific Performance: Analyzing sector-specific performance helps identify areas of strength and weakness within the DAX. For example, the automotive sector might be experiencing challenges, while the technology sector might be thriving. (Provide a sectoral analysis of DAX performance, highlighting key trends.)

-

Impact of Mergers and Acquisitions: Mergers and acquisitions can significantly impact individual company valuations and, consequently, the DAX's overall performance. (Discuss any significant M&A activity and its impact on the DAX.)

Investor Sentiment and Market Outlook for the DAX

Investor sentiment plays a crucial role in shaping market trends. Gauging current investor confidence is essential for understanding the DAX's potential future trajectory.

-

Current Investor Sentiment: Current investor sentiment towards the DAX appears to be [ describe the sentiment – e.g., cautiously optimistic, bearish, bullish, etc. ], based on [ mention sources like investor surveys, market analysts' reports, etc. ].

-

Short-Term and Long-Term Market Predictions: Short-term predictions for the DAX often focus on near-term economic data and events, while long-term predictions consider broader economic trends and structural changes. (Summarize short-term and long-term market predictions for the DAX from reputable sources.)

-

Risk Appetite and Investment Decisions: Investor risk appetite significantly influences investment strategies. During periods of high uncertainty, investors might shift towards less risky assets. (Discuss the current risk appetite and its implications for the DAX.)

-

Investment Strategies: Diversification is crucial for mitigating risk. Investors should consider diversifying their portfolios across different asset classes and sectors to reduce exposure to market volatility. (Offer advice on suitable investment strategies, emphasizing the importance of risk management.)

Conclusion

The Frankfurt Stock Exchange's DAX index has displayed remarkable resilience following its record-breaking run. While economic fundamentals and corporate earnings are pivotal, investor sentiment and market outlook remain paramount. This relative stability, however, doesn't guarantee future performance; continuous monitoring of key indicators remains essential.

Call to Action: Stay informed about the evolving dynamics of the DAX and the Frankfurt Stock Exchange. Regularly assess your investment strategy, considering the changing economic environment, to ensure your portfolio aligns with your financial objectives. Maintain a close watch on the DAX index for continuous insights into the German and broader European markets. Understanding the DAX is key to successful investing in the German economy.

Featured Posts

-

Evrovidenie Chto Stalo S Pobeditelyami Za Poslednee Desyatiletie

May 24, 2025

Evrovidenie Chto Stalo S Pobeditelyami Za Poslednee Desyatiletie

May 24, 2025 -

Emergency Services Respond To M56 Crash Car Overturn And Casualty

May 24, 2025

Emergency Services Respond To M56 Crash Car Overturn And Casualty

May 24, 2025 -

M6 Crash Live Updates And Traffic Delays

May 24, 2025

M6 Crash Live Updates And Traffic Delays

May 24, 2025 -

Leeds Interest In Kyle Walker Peters Intensifies

May 24, 2025

Leeds Interest In Kyle Walker Peters Intensifies

May 24, 2025 -

The New Single From Joy Crookes Carmen

May 24, 2025

The New Single From Joy Crookes Carmen

May 24, 2025

Latest Posts

-

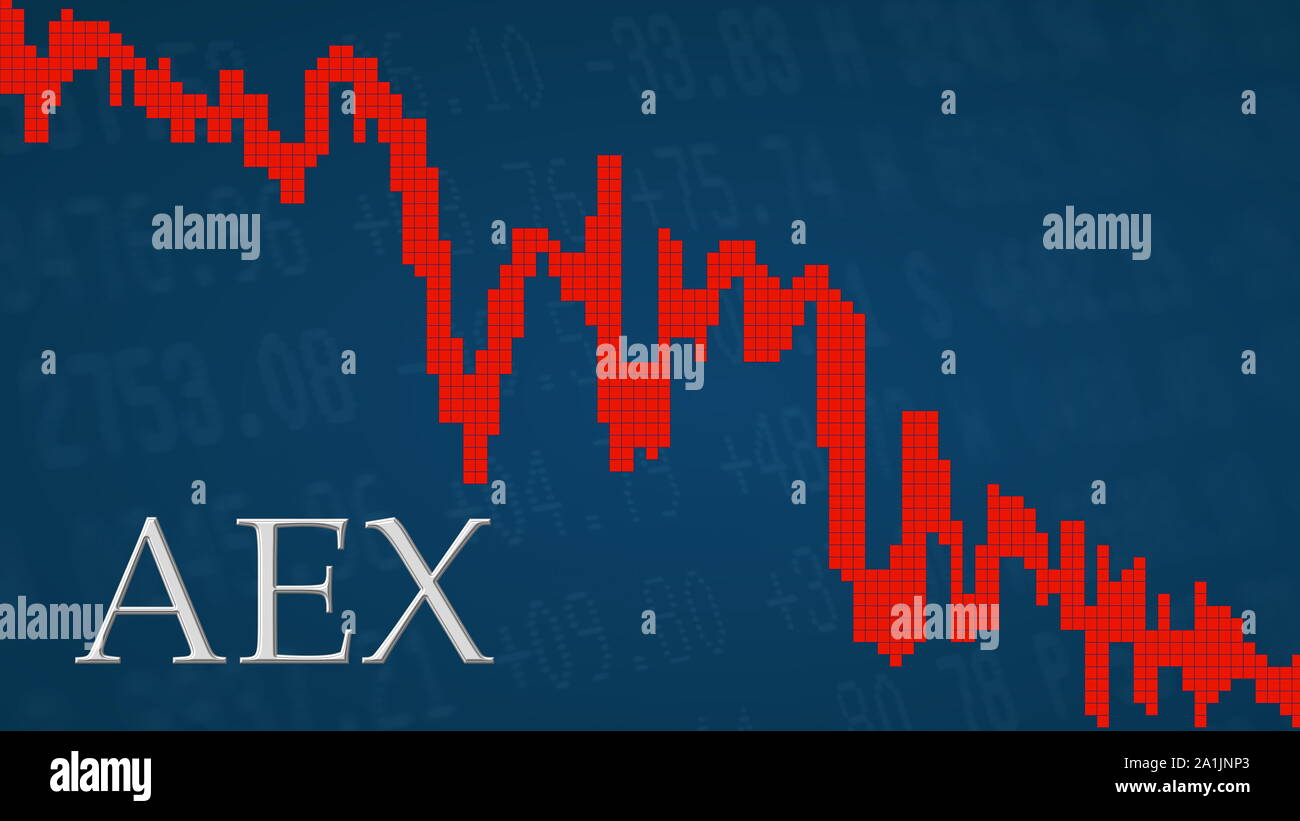

Amsterdam Stock Market Aex Index Falls Over 4 Hits 1 Year Low

May 24, 2025

Amsterdam Stock Market Aex Index Falls Over 4 Hits 1 Year Low

May 24, 2025 -

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025 -

Amsterdam Stock Index Plunges Over 4 Drop To Year Low

May 24, 2025

Amsterdam Stock Index Plunges Over 4 Drop To Year Low

May 24, 2025 -

Na Uitstel Trump Aex Fondsen Boeken Winsten

May 24, 2025

Na Uitstel Trump Aex Fondsen Boeken Winsten

May 24, 2025 -

Positief Beurzenherstel Na Trumps Besluit Aex Analyse

May 24, 2025

Positief Beurzenherstel Na Trumps Besluit Aex Analyse

May 24, 2025