House Bill Targets Harvard, Yale With Significant Endowment Tax Increase

Table of Contents

Keywords: House Bill, Endowment Tax, Harvard, Yale, Ivy League, University Endowments, Tax Increase, Wealth Redistribution, Higher Education Funding.

A proposed House Bill is shaking up the higher education landscape, targeting the colossal endowments of prestigious universities like Harvard and Yale with a significant tax increase. This unprecedented legislation aims to address wealth inequality and potentially reshape the funding model for elite institutions. The implications are far-reaching, impacting not only the universities themselves but also the broader debate on wealth redistribution and access to higher education. This article will delve into the specifics of the bill, its potential consequences, and the wider societal implications.

The Proposed House Bill: Key Provisions

The proposed House Bill outlines a substantial increase in taxes levied on university endowments exceeding a certain threshold. While the exact details are still subject to change, the current draft proposes a [Insert Proposed Percentage]% tax increase on the portion of an endowment exceeding [Insert Dollar Amount Threshold]. This directly impacts institutions like Harvard and Yale, known for their multi-billion dollar endowments.

- Specific tax rate proposed: [Insert Proposed Percentage]% on endowments exceeding [Insert Dollar Amount Threshold].

- Definition of "endowment" as defined in the bill: [Insert Definition from the bill – e.g., "permanently restricted net assets," including specifics on what is included and excluded].

- Exemptions (if any) for specific types of endowment spending: [Detail any exemptions, e.g., endowments dedicated solely to specific research projects, or those supporting specific scholarships meeting certain criteria].

- Mechanism for tax collection and enforcement: [Explain how the tax will be collected and enforced – e.g., annual reporting requirements, penalties for non-compliance, involvement of the IRS or other government agencies].

Impact on Harvard and Yale: Financial and Operational Consequences

The proposed endowment tax would have a significant impact on Harvard and Yale's financial health and operational capabilities. Given the size of their endowments – Harvard's endowment is estimated at [Insert Approximate Amount] and Yale's at [Insert Approximate Amount] – the tax burden would be substantial.

- Estimated tax burden on Harvard's endowment: [Insert Estimated Amount based on proposed tax rate and endowment size].

- Estimated tax burden on Yale's endowment: [Insert Estimated Amount based on proposed tax rate and endowment size].

- Potential cuts to financial aid programs: Reduced revenue could force cuts to existing financial aid programs, potentially limiting access for low-income students.

- Potential impact on research funding: Less funding could lead to reduced research initiatives and potentially hinder groundbreaking discoveries.

- Potential impact on faculty salaries: The university might be forced to freeze or reduce faculty salaries to offset the tax burden.

The Broader Debate: Wealth Redistribution and Higher Education Accessibility

The proposed endowment tax has ignited a passionate debate centered around wealth redistribution and equitable access to higher education. Proponents argue that this tax would help address the widening wealth gap and redirect funds towards more accessible public institutions.

- Arguments supporting the bill: These include addressing systemic inequalities, increasing funding for public universities and community colleges, and providing greater financial aid opportunities for deserving students from lower socioeconomic backgrounds.

- Arguments opposing the bill: Opponents argue that the tax could discourage philanthropy, harm research efforts, and inadvertently punish institutions already committed to providing financial aid. They also raise concerns about potential legal challenges and the overall impact on the higher education landscape.

- Potential unintended consequences: These could include decreased private donations to universities, a shift in university priorities away from research and towards cost-cutting measures, and increased tuition fees.

- Comparison to endowment tax policies in other countries: Examination of similar policies implemented globally, analyzing both their successes and failures, can provide valuable context.

Potential Alternatives and Future Implications

Instead of directly targeting endowments, alternative approaches could address wealth inequality and improve higher education accessibility.

- Increased federal funding for public universities: Significant increases in federal funding could alleviate financial pressure on public institutions and allow for increased affordability and accessibility.

- Targeted grants and scholarships for low-income students: Expanding existing programs or creating new ones dedicated to supporting underprivileged students would directly address the issue of accessibility.

- Reform of the student loan system: Overhauling the student loan system to make it more manageable and affordable could reduce financial burdens on students.

- Potential legal challenges to the bill: The bill's constitutionality could be challenged in court, leading to delays or potential overturning of the legislation.

Conclusion

This proposed House Bill targeting the endowments of universities like Harvard and Yale with a significant tax increase has ignited a heated national debate. The potential financial implications for these institutions are substantial, and the broader implications for wealth redistribution and access to higher education are profound. The arguments both for and against this legislation are complex, highlighting the need for careful consideration and alternative solutions.

Call to Action: Stay informed about the progress of this crucial House Bill and its potential impact on university endowments and higher education funding. Engage in the conversation surrounding the endowment tax debate and its implications for the future of higher education. Learn more about the proposed legislation and voice your opinion on this critical issue affecting university endowments and access to higher education.

Featured Posts

-

Duke Defeats Oregon Ducks Womens Basketball In Ncaa Tournament

May 13, 2025

Duke Defeats Oregon Ducks Womens Basketball In Ncaa Tournament

May 13, 2025 -

Which Team Do Newcastle Fans Want To Win The Championship Play Offs

May 13, 2025

Which Team Do Newcastle Fans Want To Win The Championship Play Offs

May 13, 2025 -

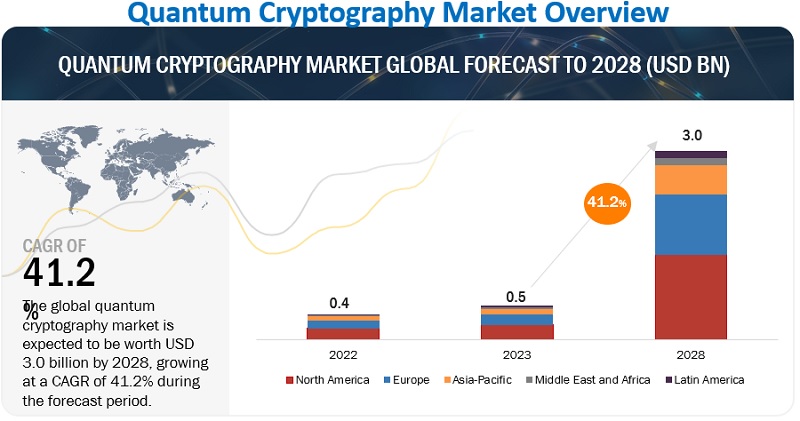

Post Quantum Cryptography Market To Reach Billions By 2030 Impact Of New Algorithms And Migration Timelines

May 13, 2025

Post Quantum Cryptography Market To Reach Billions By 2030 Impact Of New Algorithms And Migration Timelines

May 13, 2025 -

Chyby Byd Na Evropskem Trhu A Strategie Pro Zlepseni S Hybridnimi Vozy A Mistnim Managementem

May 13, 2025

Chyby Byd Na Evropskem Trhu A Strategie Pro Zlepseni S Hybridnimi Vozy A Mistnim Managementem

May 13, 2025 -

Aryna Sabalenka Reaches Italian Open Round Of 32

May 13, 2025

Aryna Sabalenka Reaches Italian Open Round Of 32

May 13, 2025

Latest Posts

-

News Highlights Top Company News For Friday 7 Pm Et

May 14, 2025

News Highlights Top Company News For Friday 7 Pm Et

May 14, 2025 -

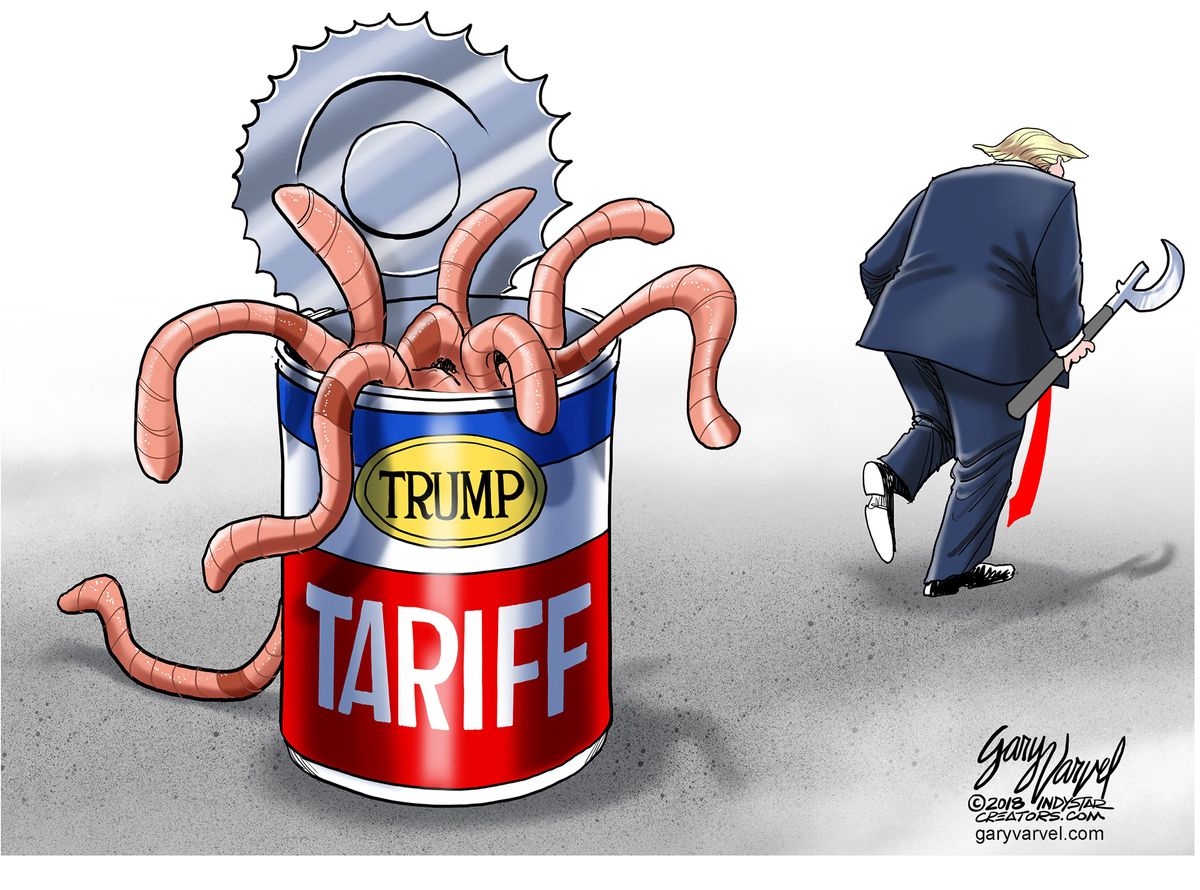

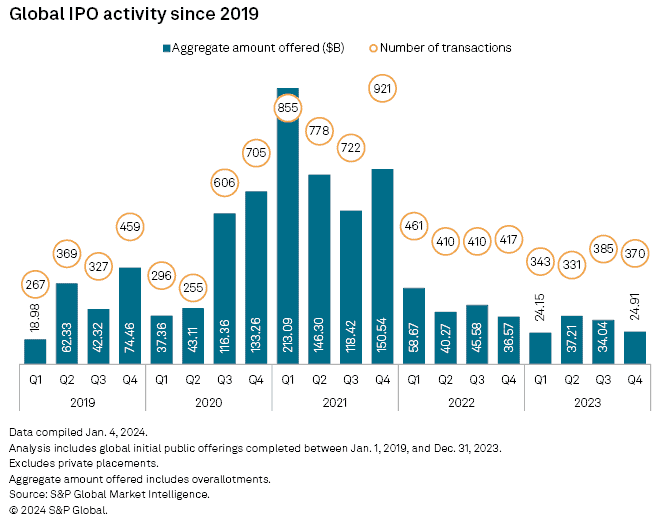

Ipo Slowdown The Role Of Tariffs And Global Uncertainty

May 14, 2025

Ipo Slowdown The Role Of Tariffs And Global Uncertainty

May 14, 2025 -

The Impact Of Tariffs On Ipo Activity A Current Market Analysis

May 14, 2025

The Impact Of Tariffs On Ipo Activity A Current Market Analysis

May 14, 2025 -

Ices Nyse Parent Surpasses Q1 Earnings Forecasts Due To High Trading Volume

May 14, 2025

Ices Nyse Parent Surpasses Q1 Earnings Forecasts Due To High Trading Volume

May 14, 2025 -

Intercontinental Exchange Ice Nyse Parent Exceeds Q1 Profit Expectations

May 14, 2025

Intercontinental Exchange Ice Nyse Parent Exceeds Q1 Profit Expectations

May 14, 2025