Impact Of G-7 De Minimis Tariff Talks On Chinese-Made Products

Table of Contents

Current De Minimis Thresholds and their Impact on Chinese Imports

De minimis thresholds represent the value of imported goods below which import duties or taxes are waived. These thresholds vary across G7 countries (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States), impacting the volume of Chinese imports that enter duty-free. Currently, these thresholds are relatively low in some G7 nations, leading to a substantial amount of Chinese-made products benefiting from this exemption.

The current low thresholds significantly impact the volume of Chinese imports. A large portion of smaller shipments, often those utilizing e-commerce platforms, currently bypass tariffs entirely.

- Specific examples of Chinese products currently affected: Consumer electronics (earbuds, phone accessories), clothing and apparel, textiles, small home goods, and numerous other low-cost items.

- Statistics on import value and volume from China falling under current de minimis rules: Precise figures are difficult to obtain due to variations in reporting and data collection across G7 nations. However, anecdotal evidence and industry reports suggest a substantial volume of Chinese imports benefit from these exemptions, particularly in the e-commerce sector.

- Impact on small businesses importing Chinese goods: Small businesses heavily rely on the current de minimis system to keep import costs low, enabling them to remain competitive. Changes to these thresholds could significantly increase their operating costs.

Proposed Changes to De Minimis Thresholds by the G-7

The G-7 negotiations are exploring various adjustments to the de minimis thresholds. Proposals range from increasing the thresholds (potentially leading to more goods being subject to tariffs) to maintaining the status quo or even decreasing them in some cases. The driving forces behind these proposals are multifaceted. Some nations aim to address perceived trade imbalances with China, while others seek to protect domestic industries from foreign competition.

- Specific proposals from different G-7 nations: Details on specific proposals are often kept confidential during negotiations; however, there are publicly available statements indicating a wide range of opinions among the G7 nations.

- Potential timelines for implementation of the new thresholds: The implementation timeline is uncertain, depending on the final agreement reached by the G7 nations. It could range from several months to a couple of years.

- Analysis of the potential economic impact of the proposed changes: The economic impact will vary depending on the magnitude of the changes. Increasing thresholds could lead to increased tariff revenue for G7 governments but could also increase prices for consumers.

Impact on Chinese Businesses and Exporters

Proposed changes to de minimis thresholds will significantly impact Chinese businesses exporting to G7 countries. Higher tariffs will inevitably increase the cost of goods, potentially reducing their competitiveness in the global market. This might necessitate a restructuring of supply chains and a re-evaluation of export strategies.

- Increased costs for Chinese exporters due to higher tariffs: Higher tariffs directly translate to increased costs, potentially squeezing profit margins and impacting the viability of some businesses.

- Potential loss of market share for Chinese businesses: Increased costs might lead to Chinese products becoming less price-competitive, resulting in a potential loss of market share to domestic producers or competitors from other nations.

- Strategies for Chinese businesses to mitigate the impact of tariff changes: Chinese businesses might need to diversify their export markets, invest in automation to reduce production costs, or explore strategies to improve product differentiation to justify higher prices.

Impact on Consumers in G-7 Countries

The changes to de minimis thresholds will likely affect consumers in G7 countries. Depending on the nature of the changes (increase or decrease), consumers could face price increases, reduced product availability, or a shift in the types of products available.

- Examples of products likely to experience price increases: Products currently benefiting from the de minimis exemption, particularly low-cost consumer goods imported from China, are most likely to see price increases if thresholds are raised or maintained.

- Potential for consumers to switch to domestically produced alternatives: Higher prices on Chinese imports could incentivize consumers to opt for domestically produced goods, even if they are slightly more expensive.

- The potential long-term economic effects on G7 consumers: Long-term effects are complex and depend on various factors. They could include increased inflation, changes in consumer spending patterns, and potential shifts in domestic manufacturing industries.

The Role of E-commerce in the De Minimis Debate

The de minimis debate significantly impacts cross-border e-commerce. Small online retailers who rely on importing low-value goods from China face the greatest challenges. Changes could disrupt their business models and increase their operational complexity.

- Challenges faced by small online businesses: These businesses often operate on tight margins and may struggle to absorb increased tariff costs.

- Potential regulatory changes affecting online marketplaces: Online marketplaces may face increased scrutiny and regulatory requirements to ensure compliance with any new de minimis thresholds.

Conclusion

The G-7 de minimis tariff talks hold significant implications for the import of Chinese-made products, affecting both businesses and consumers. Proposed changes to thresholds have the potential to reshape global trade dynamics, demanding proactive adaptation from Chinese exporters and strategic adjustments from importers in G7 nations. The impact on consumer prices and product availability remains a key consideration. Understanding the intricacies of these negotiations and their potential consequences is crucial for all stakeholders.

Call to Action: Stay informed about the evolving G-7 de minimis tariff negotiations to understand their impact on your business and effectively manage the import of Chinese-made products. Understanding the implications of G-7 de minimis tariff talks is crucial for navigating this changing trade landscape. Actively monitor updates from official government sources and industry organizations to remain prepared for any shifts in tariffs and trade policies.

Featured Posts

-

Follow F1 Live Timing For The Monaco Grand Prix

May 26, 2025

Follow F1 Live Timing For The Monaco Grand Prix

May 26, 2025 -

Zheng Qinwen Triumphs Over Sabalenka In Italian Open Quarterfinal

May 26, 2025

Zheng Qinwen Triumphs Over Sabalenka In Italian Open Quarterfinal

May 26, 2025 -

Canyon Aeroad Mathieu Van Der Poels Custom Ride For Tirreno Adriatico

May 26, 2025

Canyon Aeroad Mathieu Van Der Poels Custom Ride For Tirreno Adriatico

May 26, 2025 -

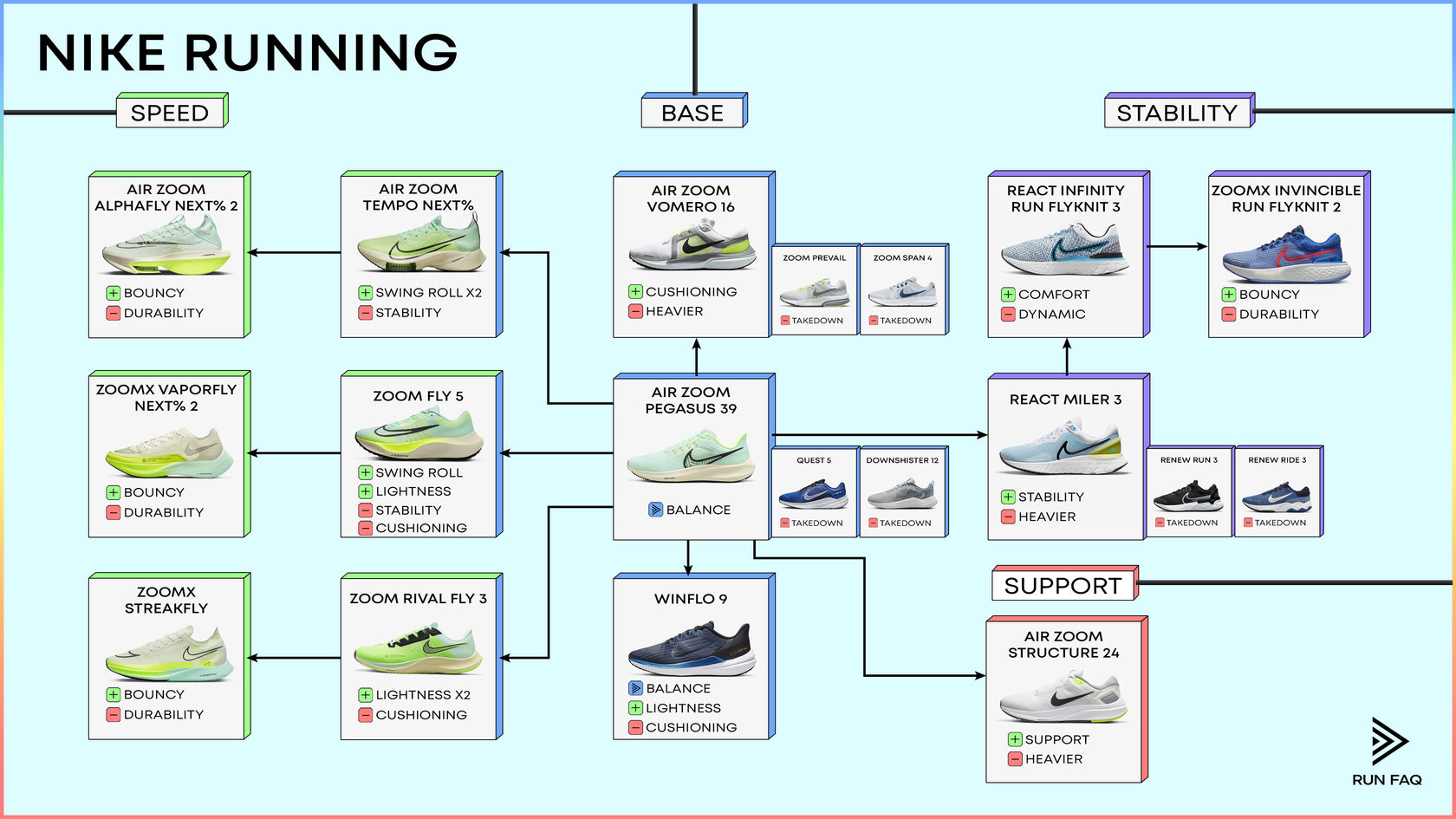

2025s Best Nike Running Shoes Matching Performance Needs With Style Preferences

May 26, 2025

2025s Best Nike Running Shoes Matching Performance Needs With Style Preferences

May 26, 2025 -

2025 Paris Roubaix Gravel Bike Tech Big Tyres And Ingenious Designs

May 26, 2025

2025 Paris Roubaix Gravel Bike Tech Big Tyres And Ingenious Designs

May 26, 2025

Latest Posts

-

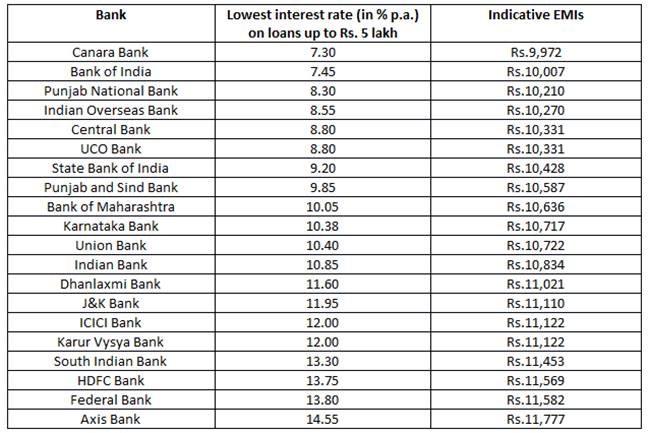

Understanding Finance Loans Interest Emis Tenure And The Application Process

May 28, 2025

Understanding Finance Loans Interest Emis Tenure And The Application Process

May 28, 2025 -

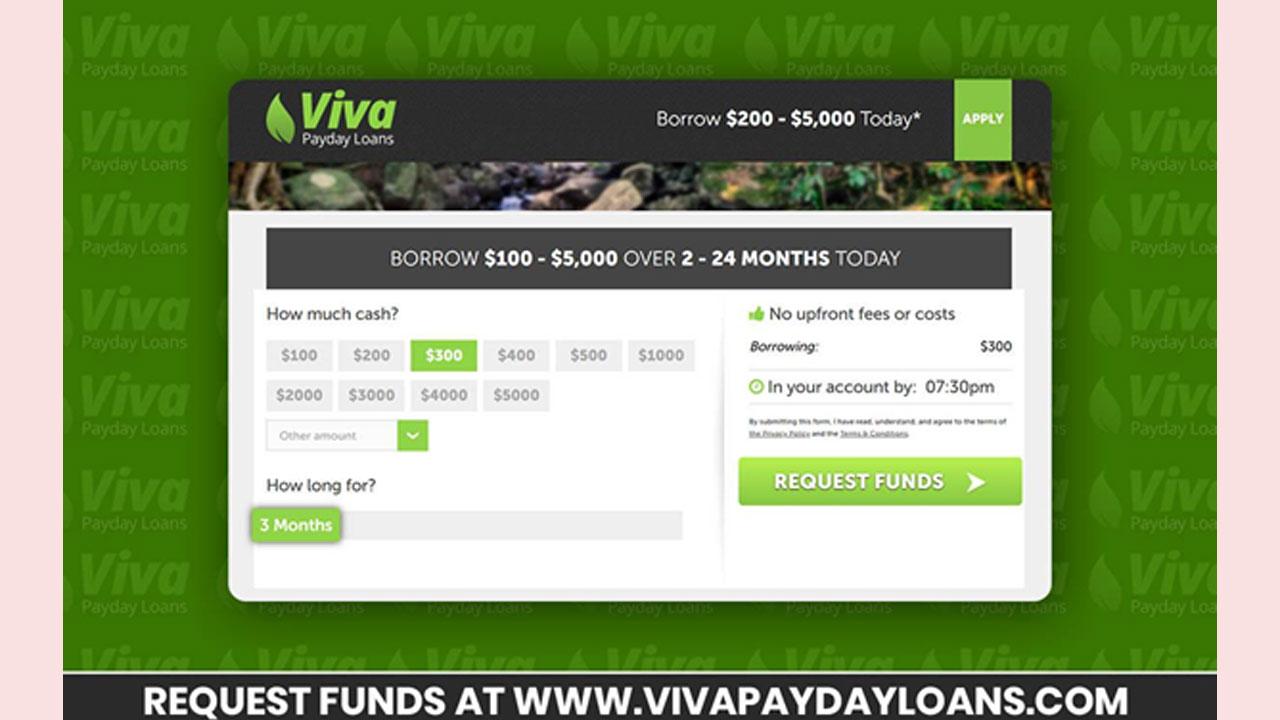

Find The Best Personal Loan For Bad Credit With Guaranteed Approval

May 28, 2025

Find The Best Personal Loan For Bad Credit With Guaranteed Approval

May 28, 2025 -

Best Tribal Loans Guaranteed Approval From Direct Lenders For Bad Credit Scores

May 28, 2025

Best Tribal Loans Guaranteed Approval From Direct Lenders For Bad Credit Scores

May 28, 2025 -

Finance Loans 101 A Beginners Guide To Loan Applications And Repayments

May 28, 2025

Finance Loans 101 A Beginners Guide To Loan Applications And Repayments

May 28, 2025 -

Bad Credit Personal Loans Up To 5000 No Credit Check Needed

May 28, 2025

Bad Credit Personal Loans Up To 5000 No Credit Check Needed

May 28, 2025