Impact Of SBI Holdings' XRP Distribution On Ripple XRP Price And News

Table of Contents

Historical Analysis of SBI Holdings' XRP Distributions and their Impact on Price

Past Distribution Events

SBI Holdings has conducted several XRP distributions over the years. Analyzing these past events provides valuable insights into their impact on XRP's price. While precise figures aren't always publicly disclosed immediately, news reports and market analysis often reveal approximate amounts and timing. For example:

- Example 1 (Date): A significant XRP distribution by SBI Holdings (estimated amount) coincided with a (percentage)% drop in XRP price within (timeframe). Trading volume increased by (percentage)%. News reports at the time attributed the price dip partly to the increased supply. [Link to relevant news article]

- Example 2 (Date): A smaller distribution (estimated amount) resulted in a less pronounced price movement, with a (percentage)% change in price and a (percentage)% increase in trading volume. Market sentiment at the time was generally (positive/negative), influencing the overall reaction to the distribution. [Link to relevant news article]

Analyzing these and other past events helps establish a historical correlation between the volume of SBI Holdings' XRP distributions and the resulting price fluctuation.

Correlation Between Distribution Volume and Price Volatility

The relationship between the size of the SBI Holdings XRP distribution and subsequent price volatility isn't always straightforward. Larger distributions often correlate with greater price fluctuations, but other factors play a crucial role:

- Overall Market Sentiment: A bullish market may absorb a large distribution with minimal price impact, while a bearish market might amplify the negative price pressure.

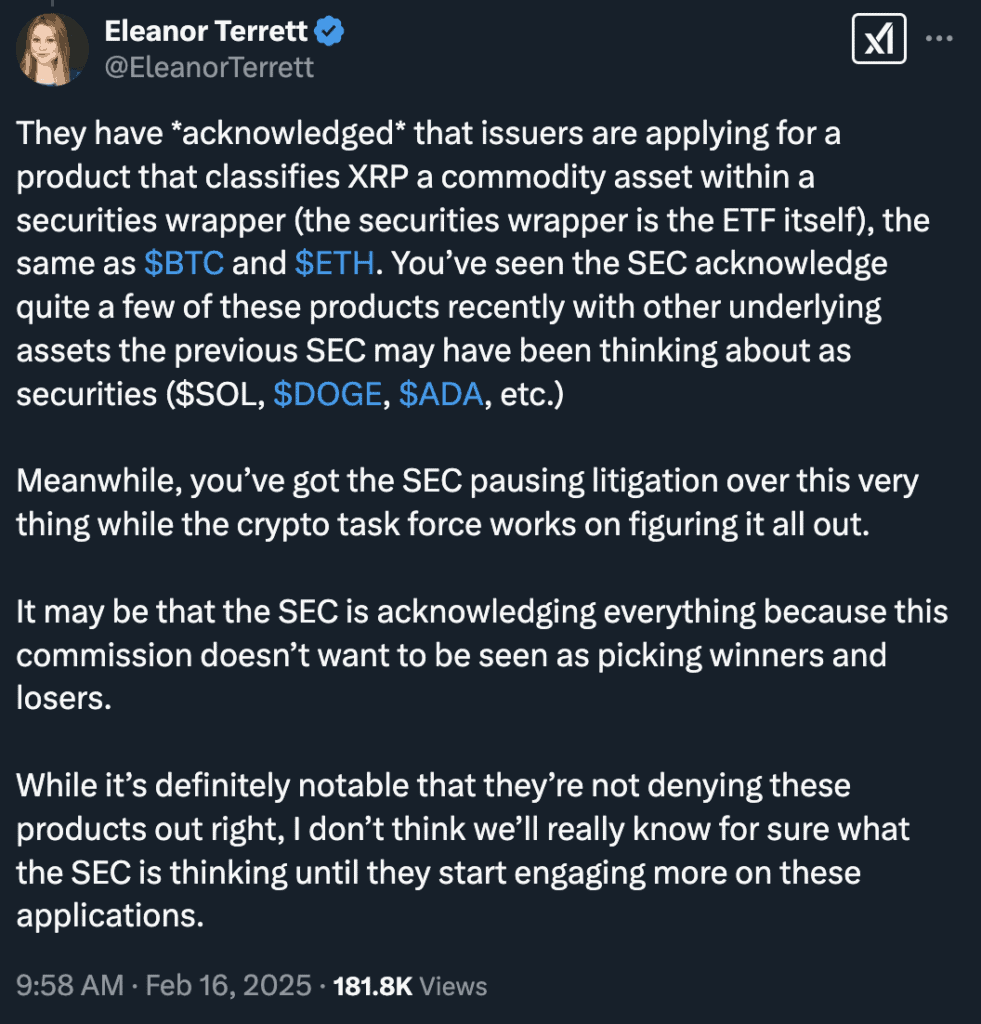

- Regulatory News: Positive or negative regulatory developments concerning XRP or cryptocurrencies in general can significantly overshadow the impact of an SBI Holdings XRP distribution.

- Trading Volume: Higher pre-existing trading volume can mitigate the price impact of a distribution by spreading the selling pressure across a larger number of trades.

Statistical analysis, comparing the volume of past SBI Holdings XRP distributions with corresponding price changes and trading volumes, could potentially reveal a stronger quantitative correlation. However, the complexity of market dynamics requires a multifaceted approach beyond a simple cause-and-effect relationship.

Market Liquidity and Trading Volume Affected by SBI Holdings' XRP Distributions

Increased Liquidity

Large SBI Holdings XRP distributions can temporarily increase XRP's trading volume and market liquidity. This occurs because:

- Increased Supply: The added XRP supply provides more opportunities for trading, leading to a higher number of buy and sell orders.

- Increased Trading Interest: The news surrounding the distribution itself often attracts more traders, further boosting volume.

Increased liquidity can benefit both buyers and sellers:

- Buyers: Easier to find sellers at acceptable prices.

- Sellers: Easier to find buyers and execute trades quickly.

However, increased liquidity can also lead to price volatility, which can be a drawback for some traders.

Potential for Price Manipulation

While not definitively proven, large-scale distributions could theoretically be used for price manipulation, although such actions would be subject to regulatory scrutiny. Transparency is key in mitigating this risk:

- Pre-announcement of Distributions: Public disclosure of planned distributions allows the market to anticipate and potentially absorb the impact.

- Gradual Releases: Staggering the distribution over time could lessen the impact on price.

- Regulatory Oversight: Robust regulatory frameworks are crucial to prevent or detect manipulative practices.

News Coverage and Market Sentiment Surrounding SBI Holdings' XRP Activities

Media Influence

Media coverage of SBI Holdings' XRP distributions significantly impacts investor sentiment. Major news outlets often report on these events, and the tone of their reporting influences market reaction:

- Positive Coverage: Emphasizing the distribution as a normal part of SBI Holdings' investment strategy can have a neutral or even positive effect.

- Negative Coverage: Portraying the distribution as a sign of weakening confidence in XRP can lead to sell-offs.

Analyzing the sentiment of news articles and social media posts surrounding SBI Holdings' XRP distributions provides a valuable indicator of market sentiment and its influence on price.

Impact on Investor Confidence

SBI Holdings' XRP activities influence investor confidence in both Ripple and XRP. Consistent, transparent reporting builds trust, while negative news or a lack of transparency can erode confidence:

- Positive Impact: Regular, predictable distributions, combined with positive news about Ripple's technological advancements, strengthens investor confidence.

- Negative Impact: Large, unexpected distributions, particularly amidst negative market sentiment or regulatory uncertainty, can damage investor trust.

Understanding the correlation between news sentiment and XRP price trends is crucial for making informed investment decisions.

Conclusion

SBI Holdings' XRP distributions have a demonstrable impact on XRP's price and market sentiment. Larger distributions tend to correlate with increased price volatility, while the overall market sentiment and news coverage significantly influence the reaction. Maintaining transparent reporting and gradual distribution strategies can help mitigate potential negative impacts. The interplay between distribution size, market liquidity, and news sentiment is complex and requires careful analysis.

Call to Action: Staying informed about SBI Holdings XRP distribution activities is crucial for anyone involved in the XRP market. Continuously monitoring news, market analysis, and the historical patterns of these distributions is essential for making informed decisions about your XRP holdings and trading strategies. Understanding the nuances of SBI Holdings XRP distribution events will help you better navigate the dynamic XRP market.

Featured Posts

-

Understanding Xrps Price Movement Derivatives Market Insights

May 07, 2025

Understanding Xrps Price Movement Derivatives Market Insights

May 07, 2025 -

Stephen Curry Injury Latest Updates From Coach Steve Kerr

May 07, 2025

Stephen Curry Injury Latest Updates From Coach Steve Kerr

May 07, 2025 -

Packers Steelers Trade Could Josh Jacobs Get His Wish For A Green Bay Wr 1

May 07, 2025

Packers Steelers Trade Could Josh Jacobs Get His Wish For A Green Bay Wr 1

May 07, 2025 -

Aces Fans React To Kelsey Plum And Kate Martins Interaction

May 07, 2025

Aces Fans React To Kelsey Plum And Kate Martins Interaction

May 07, 2025 -

Le Repechage De La Lnh Hors De Montreal Un Regret Pour La Ligue

May 07, 2025

Le Repechage De La Lnh Hors De Montreal Un Regret Pour La Ligue

May 07, 2025

Latest Posts

-

Ripple Xrp Price Surge Brazils Etf Approval And Trumps Social Media Post

May 08, 2025

Ripple Xrp Price Surge Brazils Etf Approval And Trumps Social Media Post

May 08, 2025 -

Xrp On The Brink Etf Applications Sec Shakeup And Ripples Potential

May 08, 2025

Xrp On The Brink Etf Applications Sec Shakeup And Ripples Potential

May 08, 2025 -

Lotto 6aus49 Gewinnzahlen Und Quoten Vom Mittwoch 9 April 2025

May 08, 2025

Lotto 6aus49 Gewinnzahlen Und Quoten Vom Mittwoch 9 April 2025

May 08, 2025 -

Is This Xrps Big Moment Etf Hopes Sec Changes And Ripples Impact

May 08, 2025

Is This Xrps Big Moment Etf Hopes Sec Changes And Ripples Impact

May 08, 2025 -

Ripple Xrp News Brazils First Spot Xrp Etf Approved Trumps Ripple Post Sparks Interest

May 08, 2025

Ripple Xrp News Brazils First Spot Xrp Etf Approved Trumps Ripple Post Sparks Interest

May 08, 2025