Impact Of Tariff Response: China's Easier Bank Lending And Lower Rates

Table of Contents

China's Tariff Response and Economic Slowdown

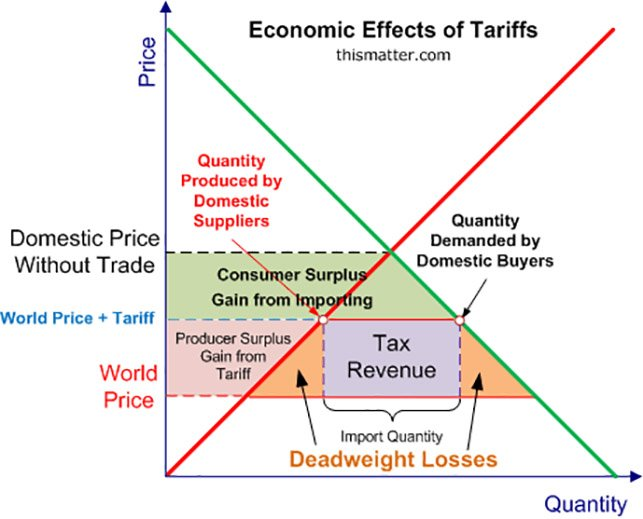

The initial impact of tariffs on China was substantial, leading to a noticeable economic slowdown. The "trade war" significantly decreased export demand, a cornerstone of China's economic model. This export contraction resulted in:

- Decreased export demand: Tariffs imposed by other countries made Chinese goods less competitive in international markets, reducing overall export volume and revenue.

- Reduced industrial production: Lower demand for Chinese exports led to reduced production in many industries, impacting factory output and employment.

- Slowdown in investment: Uncertainty surrounding future trade relations discouraged both domestic and foreign investment, hindering economic expansion.

- Increased uncertainty in the market: The fluctuating trade environment created significant uncertainty, impacting business decisions and consumer confidence.

The combination of these factors contributed significantly to the "economic slowdown China" experienced, prompting the government to intervene with proactive monetary policy adjustments.

Easing Monetary Policy: Lower Interest Rates and Increased Lending

To counteract the economic slowdown, the People's Bank of China (PBOC) implemented a series of measures focused on "monetary easing," primarily through lower interest rates and increased lending. These actions aimed to inject liquidity into the economy and stimulate growth. Specific measures included:

- Reduction in reserve requirement ratio (RRR): Lowering the RRR freed up capital for banks, allowing them to provide more loans.

- Lowering the benchmark lending rates (LPR): Reducing the LPR made borrowing cheaper for businesses and consumers, encouraging investment and spending.

- Increased liquidity injections into the banking system: The PBOC increased the money supply through open market operations, providing additional funds for lending.

- Targeted lending programs for specific sectors: The government implemented targeted lending programs to support key industries and businesses affected by the trade disputes.

These "interest rate cuts China" and other initiatives were designed to encourage "bank lending growth China" and overall economic activity.

Impact on Bank Lending and Credit Growth

The PBOC's policy changes had a significant impact on bank lending activities. The easier access to credit led to:

- Increased loan applications from businesses: Businesses took advantage of lower interest rates to secure loans for expansion, investment, and working capital.

- Growth in corporate and consumer credit: Both corporate and consumer borrowing increased, boosting overall credit growth.

- Potential risks associated with rapid credit expansion: The rapid expansion of credit also introduced risks, such as increased non-performing loans and potential financial instability.

- Government efforts to manage credit risk: The government implemented measures to manage these risks, including stricter regulations and increased scrutiny of lending practices. This "credit risk management" was crucial for maintaining "financial stability."

The increase in "loan disbursement" reflects the success of the PBOC's efforts to stimulate the economy, but careful monitoring of "credit expansion" was vital.

The Effectiveness of the Response: Assessing the Results

Assessing the effectiveness of the PBOC's monetary policy response requires analyzing various economic indicators. While the measures did stimulate lending and credit growth, their overall success in mitigating the negative effects of tariffs is complex.

- Analysis of economic indicators (GDP growth, inflation, unemployment): While GDP growth slowed, it didn't collapse, and inflation remained relatively controlled. Unemployment figures, however, require further scrutiny.

- Discussion of the challenges and limitations of the policy response: The effectiveness was hampered by external factors beyond the PBOC's control, such as persistent trade tensions and global economic uncertainty.

- Comparison with other countries' responses to trade tensions: Comparing China's response with those of other countries provides valuable insights into the effectiveness of different policy approaches to "trade war impact mitigation."

The "economic recovery China" experienced was partially driven by these monetary policies, but a complete assessment needs a wider contextual understanding.

Conclusion: Understanding the Impact of Tariff Response on China's Economy

In summary, China's response to tariffs involved a significant easing of bank lending and lowering interest rates to stimulate the economy. These policies resulted in increased loan applications, growth in corporate and consumer credit, and a partial mitigation of the economic slowdown. However, the rapid "credit expansion" introduced risks that required proactive "credit risk management." Understanding the intricate relationship between tariff response, bank lending, and China's economic trajectory is crucial for navigating the complexities of the global financial landscape. To stay informed, continue researching this topic by using search terms like "China's economic response to tariffs," "impact of monetary policy China," or "China bank lending trends."

Featured Posts

-

Chinas Economic Stimulus Lower Rates And Increased Bank Lending

May 08, 2025

Chinas Economic Stimulus Lower Rates And Increased Bank Lending

May 08, 2025 -

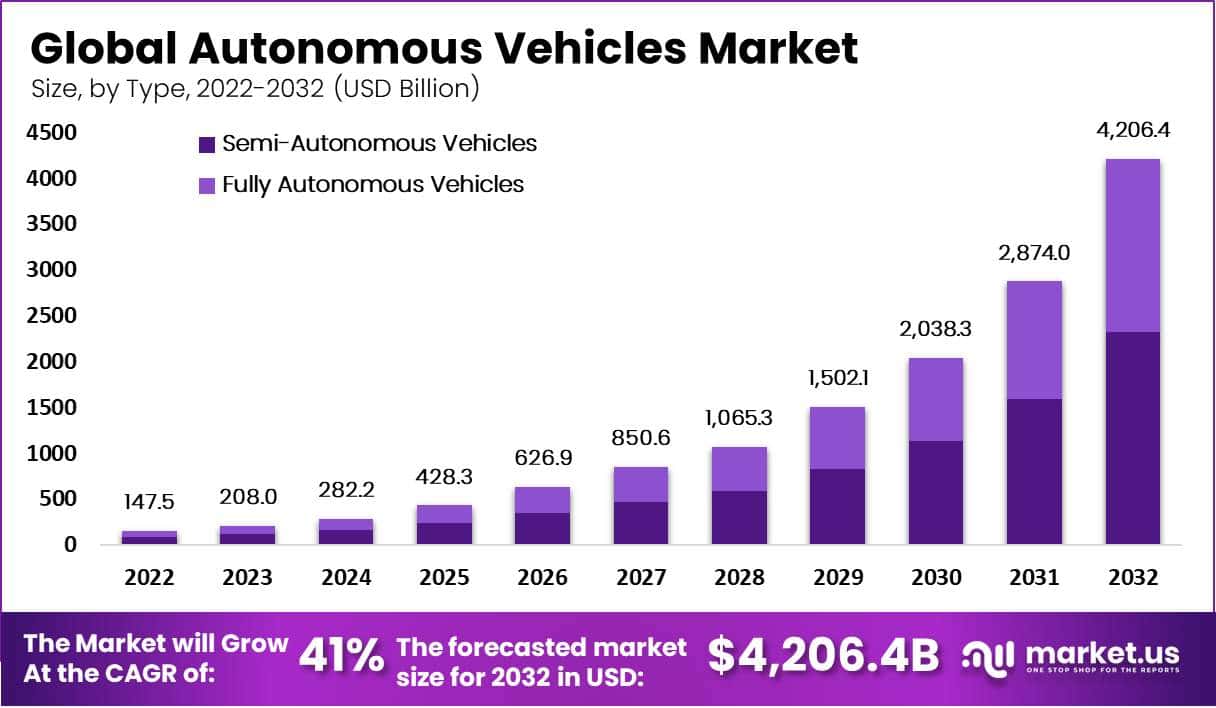

Uber Stock And The Rise Of Autonomous Vehicles An Investors Perspective

May 08, 2025

Uber Stock And The Rise Of Autonomous Vehicles An Investors Perspective

May 08, 2025 -

Analyzing The Impact Of Liberation Day Tariffs On Stock Market Performance

May 08, 2025

Analyzing The Impact Of Liberation Day Tariffs On Stock Market Performance

May 08, 2025 -

15 April 2025 Daily Lotto Winning Numbers

May 08, 2025

15 April 2025 Daily Lotto Winning Numbers

May 08, 2025 -

500 000 Evro Za Zhersona Zenit Delaet Predlozhenie Zayavlenie Zhurnalista

May 08, 2025

500 000 Evro Za Zhersona Zenit Delaet Predlozhenie Zayavlenie Zhurnalista

May 08, 2025