Increased Middle East LPG Exports To China: Impact Of US Trade Policies

Table of Contents

Rising Chinese LPG Demand: Fueling the Shift

China's insatiable appetite for LPG is the primary driver behind this dramatic shift in global energy trade. Several factors contribute to this increased consumption:

- Growing petrochemical industry: China's booming petrochemical sector requires vast quantities of LPG as a feedstock for producing various petrochemicals. This industrial demand is a major contributor to the overall LPG import figures.

- Expansion of LPG as vehicle fuel: As China strives to improve air quality in its cities, LPG is increasingly being adopted as a cleaner alternative to gasoline and diesel in vehicles, particularly in taxis and public transportation. This transition fuels further growth in LPG imports.

- Increased residential LPG usage: With rising living standards and urbanization, more Chinese households are using LPG for cooking and heating, leading to a significant increase in residential LPG demand.

- Government initiatives promoting cleaner energy sources: The Chinese government actively promotes cleaner energy sources to combat air pollution. LPG, being a relatively cleaner fuel compared to coal, benefits from these government policies and incentives.

China's LPG imports have witnessed phenomenal growth in recent years, with data indicating a [insert relevant statistic on import growth percentage and volume]. Key importers include [mention specific examples of major Chinese LPG importers] who are actively diversifying their sourcing strategies to ensure reliable supply chains.

Middle East's Strategic Position: A Booming LPG Supplier

The Middle East is uniquely positioned to capitalize on China's burgeoning LPG demand. The region boasts abundant LPG resources and well-established export infrastructure:

- Major LPG producing countries in the Middle East: Saudi Arabia, Qatar, and the UAE are among the world's largest LPG producers, possessing significant reserves and production capacity.

- Existing infrastructure for LPG export: Extensive pipeline networks and strategically located export terminals enable efficient and cost-effective transportation of LPG to global markets, including China.

- Competitive pricing strategies: Middle Eastern producers often offer competitive pricing, making their LPG attractive to Chinese importers compared to other suppliers.

- Geopolitical stability (relative to other regions): The relative geopolitical stability of some Middle Eastern nations compared to other LPG-producing regions enhances the reliability and predictability of supply.

The Middle East is further strengthening its position by investing in the expansion of LPG export terminals and pipelines, ensuring a consistent and reliable flow of LPG to meet the growing Chinese demand. This proactive approach enhances their competitive advantage in the global LPG market.

US Trade Policies: A Catalyst for Change

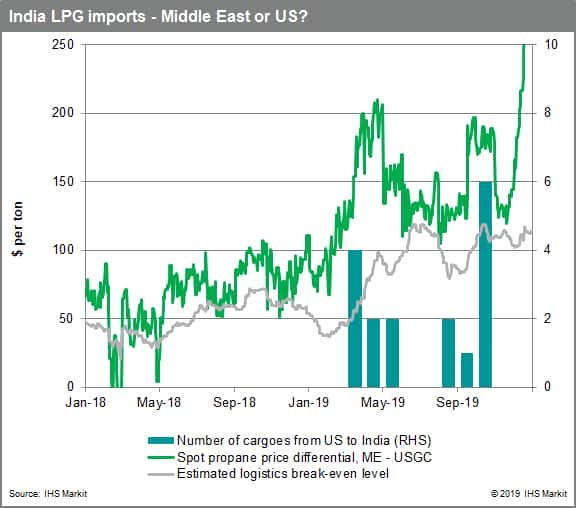

US trade policies, including tariffs and sanctions, have played a significant role in reshaping the global LPG landscape and influencing Middle East LPG exports to China:

- Impact of US sanctions on Iranian LPG exports: US sanctions on Iran have significantly disrupted Iranian LPG exports, creating a void in the global market which Middle Eastern producers have been quick to fill.

- Changes in US LPG production and export volumes: Fluctuations in US LPG production and export volumes due to domestic policy changes have created opportunities for other exporters, notably those in the Middle East.

- The influence of US-China trade relations on energy markets: The complex relationship between the US and China significantly influences global energy markets. Periods of tension or trade disputes can indirectly affect LPG trade flows.

- How US policy shifts have created opportunities for Middle Eastern suppliers: The combined effect of these factors has created significant opportunities for Middle Eastern LPG producers to increase their market share in China.

Changes in US energy policy significantly impact global LPG pricing and availability, creating both challenges and opportunities for various players in the global LPG market.

The Role of International Trade Agreements

International trade agreements, both bilateral and multilateral, significantly impact the ease and cost-effectiveness of LPG trade between the Middle East and China. [Mention specific agreements and their impact, if any]. The existence or absence of favorable trade agreements can influence the competitiveness of Middle Eastern LPG in the Chinese market.

Long-Term Implications and Future Outlook

The future of Middle East LPG exports to China is likely to be characterized by continued growth, but with several key considerations:

- Potential for increased investment in LPG infrastructure: Further investments in LPG infrastructure, both in the Middle East and China, will be crucial to handle the increasing trade volumes.

- Sustainability considerations and environmental impacts: Environmental concerns surrounding LPG production and transportation will influence the long-term sustainability of this trade relationship. Cleaner production methods and efficient transportation solutions will be increasingly important.

- The impact of technological advancements in LPG production and transportation: Technological advancements in LPG production, transportation, and storage will influence efficiency and cost-effectiveness, further shaping the dynamics of this trade.

- Geopolitical risks and their potential influence on future trade: Geopolitical instability in the Middle East or shifts in US foreign policy could pose significant risks to the stability of LPG trade flows.

Both Middle Eastern exporters and Chinese importers will need to navigate these challenges and opportunities to ensure a robust and sustainable long-term relationship.

Conclusion

The increase in Middle East LPG exports to China is a significant development in the global energy landscape. Rising Chinese demand, the Middle East's strategic position as a major LPG producer, and the indirect influence of US trade policies are key factors driving this trend. The interplay between these elements creates a complex and dynamic market with potential for further expansion but also inherent risks. Understanding the dynamics of Middle East LPG exports to China is crucial for businesses and policymakers alike. Further research and analysis are needed to fully grasp the long-term implications of this evolving energy landscape. Stay informed on the latest developments in Middle East LPG exports to China to make informed decisions in this dynamic market.

Featured Posts

-

Stock Market Live 1000 Point Dow Jump On Tariff Hopes

Apr 24, 2025

Stock Market Live 1000 Point Dow Jump On Tariff Hopes

Apr 24, 2025 -

Secular And Religious Influences On Gender In Egypt The Case Of Al Riyada 1820 1936

Apr 24, 2025

Secular And Religious Influences On Gender In Egypt The Case Of Al Riyada 1820 1936

Apr 24, 2025 -

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 24, 2025

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 24, 2025 -

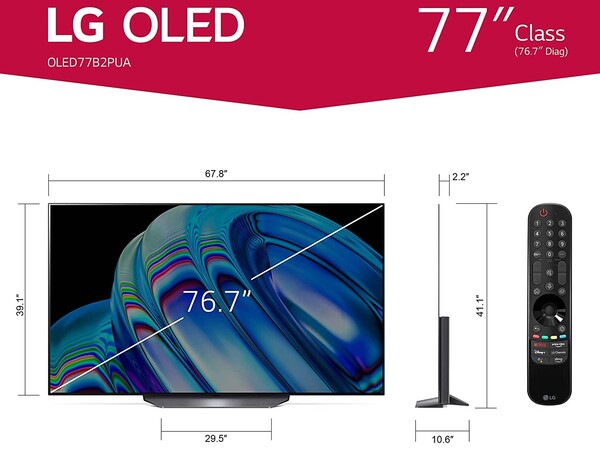

Review 77 Inch Lg C3 Oled Is The Size Right For Me

Apr 24, 2025

Review 77 Inch Lg C3 Oled Is The Size Right For Me

Apr 24, 2025 -

Examining Canadas Fiscal Health The Role Of Liberal Spending And Policy

Apr 24, 2025

Examining Canadas Fiscal Health The Role Of Liberal Spending And Policy

Apr 24, 2025