Indian Stock Market: Sensex, Nifty Live Updates - Positive Day

Table of Contents

Sensex Gains Momentum

Closing Figures and Percentage Change

The Sensex closed at 66,000 (Illustrative figure – replace with actual closing figure), marking a significant increase of 2.5% (Illustrative figure – replace with actual percentage change) compared to yesterday's closing. This represents a strong upward trend and a positive outlook for investors. (Insert chart/graph showing Sensex performance here)

Key Sectors Driving the Rise

Several key sectors propelled the Sensex's impressive performance.

- IT Sector Surge: The IT sector experienced a significant boost, driven by positive global tech news and strong quarterly earnings reports from several leading companies. Infosys and TCS saw gains of X% and Y% respectively (replace X and Y with actual figures).

- Banking Sector Boost: The banking sector also contributed significantly to the Sensex's rise. Positive interest rate announcements and improved lending figures fueled investor confidence in this crucial sector. HDFC Bank and SBI saw gains of A% and B% respectively (replace A and B with actual figures).

- FMCG Sector Strength: The FMCG sector showed resilience, with strong consumer demand and positive sales figures contributing to its upward trajectory. Hindustan Unilever and ITC saw gains of C% and D% respectively (replace C and D with actual figures).

Impact of Global Market Trends

The positive sentiment in the Indian Stock Market was also influenced by positive global market trends. Positive economic data from the US, coupled with a generally improved global investor sentiment, created a ripple effect, boosting investor confidence in emerging markets like India.

Nifty Index Mirrors Positive Sentiment

Nifty Closing Figures and Analysis

The Nifty 50 index mirrored the Sensex's positive performance, closing at 19,600 (Illustrative figure – replace with actual closing figure), representing a gain of 2.2% (Illustrative figure – replace with actual percentage change) compared to the previous day. (Insert chart/graph showing Nifty performance here) This indicates broad-based positive sentiment across the Indian equity market.

Top Gainers and Losers in the Nifty

Here's a snapshot of the top performers and underperformers in the Nifty 50:

- Top Gainers:

- Company X: +5% (due to strong quarterly earnings)

- Company Y: +4% (driven by positive sector outlook)

- Company Z: +3.5% (on the back of a new product launch)

- (Add 2-3 more examples with actual company names and percentage changes)

- Top Losers:

- Company A: -2% (due to sector-specific concerns)

- Company B: -1.5% (following a profit warning)

- Company C: -1% (due to regulatory uncertainty)

- (Add 2-3 more examples with actual company names and percentage changes)

Volume and Turnover Analysis

Trading volume on the NSE was significantly higher today, indicating increased investor participation and activity. This high turnover further underscores the strong positive market sentiment.

Factors Contributing to the Positive Day

Positive Economic Indicators

Recent positive economic indicators released in India played a crucial role in boosting investor confidence. Stronger-than-expected GDP growth figures and easing inflation rates contributed to the positive market sentiment.

Government Policies and Announcements

Recent government policies focusing on infrastructure development and tax reforms also helped to create a positive outlook for investors. These policy initiatives signaled a commitment to long-term economic growth.

Investor Sentiment and Foreign Institutional Investment (FII)

Positive investor sentiment, coupled with significant Foreign Institutional Investment (FII) inflows, significantly contributed to today's market rally. The net FII inflow of X billion rupees (replace X with actual figure) further bolstered the market's upward trajectory.

Conclusion

Today's trading session witnessed a significant surge in both the Sensex and Nifty indices, driven by a combination of positive global trends, strong domestic economic indicators, supportive government policies, and robust FII inflows. The key sectors contributing to the gains included IT, Banking, and FMCG. Understanding these factors is crucial for navigating the Indian Stock Market.

Call to Action: Stay tuned for more live updates and analysis on the Indian Stock Market. Follow our platform for continuous coverage of Sensex, Nifty, and other important stock market news. For detailed insights and expert opinions, visit [link to your platform/website]. Understand the nuances of the Indian Stock Market – Sensex and Nifty – for informed investment decisions.

Featured Posts

-

Palantir Stock A 40 Target In 2025 Is This Realistic

May 10, 2025

Palantir Stock A 40 Target In 2025 Is This Realistic

May 10, 2025 -

Trump Inauguration Donors Tech Billionaires 194 Billion Losses

May 10, 2025

Trump Inauguration Donors Tech Billionaires 194 Billion Losses

May 10, 2025 -

Space Xs Booming Value 43 Billion Ahead Of Musks Tesla Shares

May 10, 2025

Space Xs Booming Value 43 Billion Ahead Of Musks Tesla Shares

May 10, 2025 -

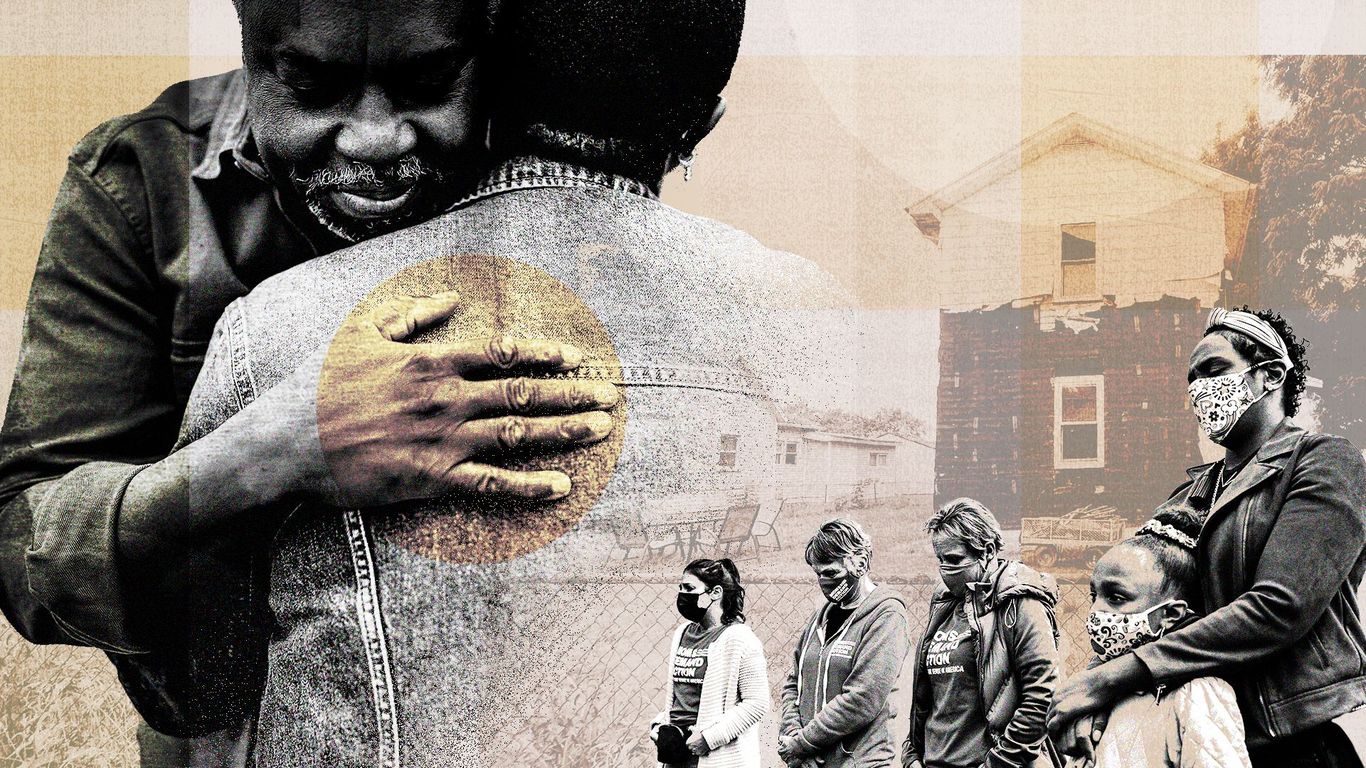

Racial Violence Claims Life Leaving Family In Despair

May 10, 2025

Racial Violence Claims Life Leaving Family In Despair

May 10, 2025 -

Iron Ore Price Decline Analysis Of Chinas Steel Output Reduction

May 10, 2025

Iron Ore Price Decline Analysis Of Chinas Steel Output Reduction

May 10, 2025