Investing In Apple (AAPL): Identifying Key Price Levels For Success

Table of Contents

Understanding Apple's Stock Performance History

Analyzing Apple's historical stock price is fundamental to predicting future movements and identifying opportune entry points. This involves examining long-term growth trends and pinpointing crucial support and resistance levels.

Long-Term Growth Trends:

To understand the Apple stock price trajectory, we need to look at the big picture. Apple's historical stock data reveals a pattern of significant growth punctuated by periods of correction.

- Major Product Launches: The introduction of the iPhone, iPad, and Apple Watch dramatically shifted the Apple stock price, leading to substantial price surges. These product launches often coincide with periods of increased investor confidence and buying pressure.

- Market Share Gains: Apple's consistent market share gains in smartphones, wearables, and services have fueled its long-term growth, impacting the AAPL stock chart positively. Analyzing market share data alongside the Apple stock price provides valuable insights.

- Economic Conditions: Global economic downturns can influence the Apple stock price, leading to temporary corrections. However, Apple's strong financial position and loyal customer base often allow it to weather economic storms relatively well. For instance, review Apple's performance during previous recessions to understand its resilience.

- Financial Reports and Analyses: Scrutinizing Apple's quarterly and annual financial reports provides a deep dive into the company's financial health, offering a valuable context for understanding the Apple stock price movements. Key metrics like revenue growth and earnings per share should be closely monitored. Look at analyst reports and forecasts from reputable financial institutions to gain further insight into future projections.

Identifying Support and Resistance Levels:

Technical analysis is crucial for identifying key support and resistance levels in the Apple stock price. These levels often act as magnets, attracting buying or selling pressure.

- Chart Patterns: Identifying chart patterns such as head and shoulders, double tops, and double bottoms can help predict potential reversals in the Apple stock price. Studying these patterns requires experience and a thorough understanding of technical analysis.

- Moving Averages: Using moving averages, like the 50-day and 200-day moving averages, can help identify trends and potential support/resistance levels. A break above the 200-day moving average is often considered a bullish signal.

- Technical Indicators: Other technical indicators, such as Relative Strength Index (RSI) and MACD, can provide additional confirmation of trends and potential buying or selling opportunities related to the Apple stock price.

Analyzing Current Market Conditions and Apple's Financials

A successful Apple stock investment strategy requires a holistic approach that considers both the company's fundamentals and the broader macroeconomic environment.

Fundamental Analysis of Apple:

Evaluating Apple's financial health is crucial for assessing its long-term viability and potential for growth. This involves analyzing its financial statements.

- Key Financial Metrics: Closely examining key financial metrics such as revenue growth, profit margins, debt levels, and free cash flow provides valuable insights into Apple's financial strength. Compare these metrics to industry averages and historical trends.

- Analyst Ratings and Forecasts: Consolidating information from reputable analysts' reports on Apple provides further perspective on their valuation and future earnings projections which can help guide your understanding of the Apple stock price. However, remember that analyst opinions are not guarantees.

Considering Macroeconomic Factors:

Macroeconomic factors play a significant role in influencing the Apple stock price and broader market sentiment.

- Interest Rates: Rising interest rates can negatively impact technology stocks, including Apple, by increasing borrowing costs and reducing investor appetite for riskier assets.

- Inflation: High inflation can erode consumer spending and impact Apple's sales, potentially putting downward pressure on the AAPL stock price.

- Global Economic Growth: Global economic slowdown can dampen demand for Apple products, leading to a decline in the Apple stock price.

Developing Your Apple Stock Investment Strategy

Based on your analysis of Apple's stock price history, current financials, and macroeconomic factors, you can now develop a robust investment strategy.

Setting Realistic Price Targets:

Determining realistic price targets involves combining technical and fundamental analysis, alongside your risk tolerance and investment horizon.

- Investment Strategies: Different strategies exist, such as buy-and-hold (long-term), value investing (buying undervalued assets), or swing trading (short-to-medium-term). The best strategy depends on your individual circumstances and risk profile.

- Price Targets and Stop-Loss Orders: Setting realistic price targets and stop-loss orders is essential for managing risk. Stop-loss orders automatically sell your shares if the price drops to a predetermined level, limiting potential losses.

Managing Risk and Diversification:

Effective risk management is crucial to protect your investment. Diversification is key.

- Risk Mitigation Strategies: Diversifying your portfolio beyond just Apple stock reduces your overall risk. Invest in other sectors and asset classes to mitigate potential losses.

- Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the Apple stock price. This strategy mitigates the risk of investing a lump sum at a market peak.

Conclusion

Successfully investing in Apple (AAPL) requires a comprehensive understanding of its stock price performance, current market conditions, and the company's financial health. By identifying key support and resistance levels, conducting thorough fundamental analysis, and developing a well-defined investment strategy, you can significantly improve your chances of achieving your investment goals. Remember to always conduct your own thorough research before investing in any stock. Start your journey towards smart Apple stock investing today! Understanding the Apple stock price is a continuous process that requires vigilance and adaptability.

Featured Posts

-

Pobeditel Evrovideniya 2014 Konchita Vurst Istoriya Kamingauta I Mechty O Roli Devushki Bonda

May 24, 2025

Pobeditel Evrovideniya 2014 Konchita Vurst Istoriya Kamingauta I Mechty O Roli Devushki Bonda

May 24, 2025 -

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 24, 2025

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 24, 2025 -

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 24, 2025

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 24, 2025 -

Apple Stock Investment Analyzing A 254 Price Target

May 24, 2025

Apple Stock Investment Analyzing A 254 Price Target

May 24, 2025 -

Konchita Vurst Evrovidenie 2014 Zhizn Kaming Aut I Plany Na Buduschee

May 24, 2025

Konchita Vurst Evrovidenie 2014 Zhizn Kaming Aut I Plany Na Buduschee

May 24, 2025

Latest Posts

-

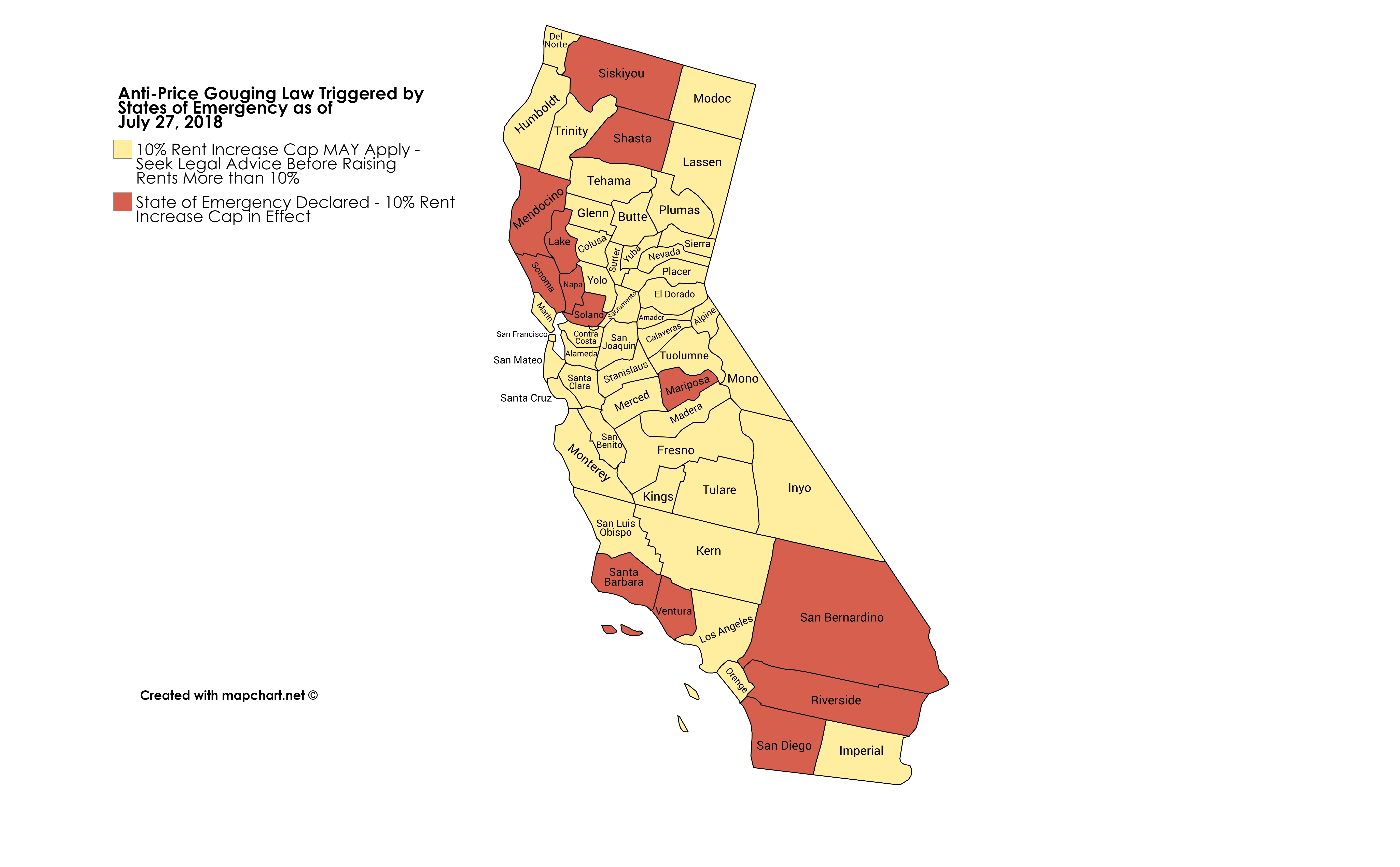

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

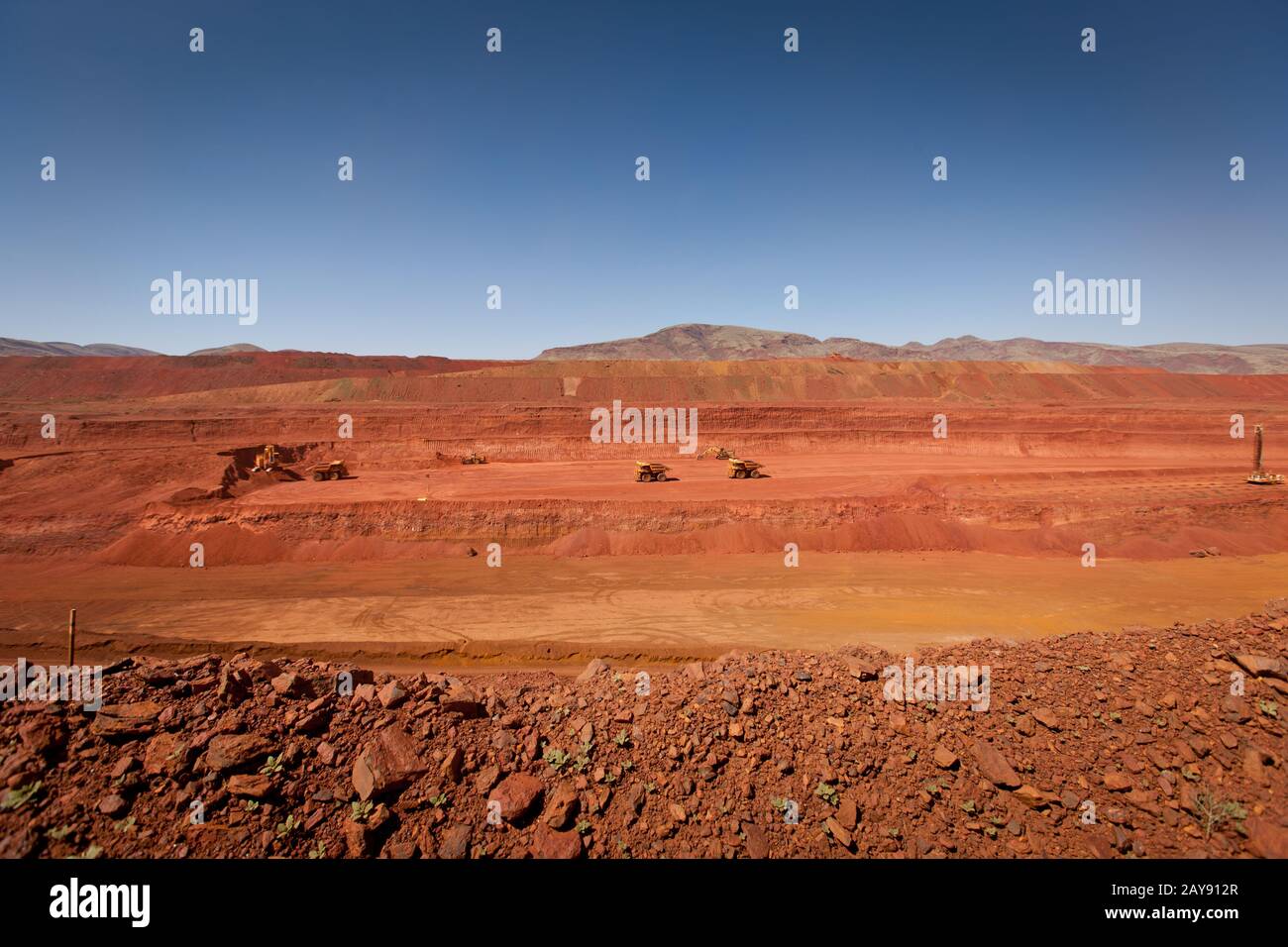

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025