Investors Shouldn't Worry: BofA's View On Elevated Stock Market Valuations

Table of Contents

BofA's Rationale for a Positive Outlook Despite High Valuations

BofA's positive outlook on the stock market isn't blind optimism; it's rooted in a careful analysis of several key economic indicators and market trends. Their argument rests on three significant pillars: strong corporate earnings growth, sustained low interest rates, and resilient economic fundamentals.

Strong Corporate Earnings Growth

BofA's research indicates robust corporate earnings growth significantly exceeding initial expectations. This isn't just a fleeting trend; it's a sustained pattern observed across diverse sectors. For instance, BofA's reports highlight a double-digit percentage growth in earnings for several major sectors, including technology and consumer staples.

- Increased profitability across various sectors: Many companies are streamlining operations and improving efficiency, leading to higher profit margins.

- Strong revenue growth driven by increased consumer spending and global expansion: The combination of a healthy consumer market and successful international expansion has fueled substantial revenue increases.

- Positive revisions in earnings forecasts: Analysts are consistently upwardly revising their earnings forecasts, further bolstering the case for continued growth.

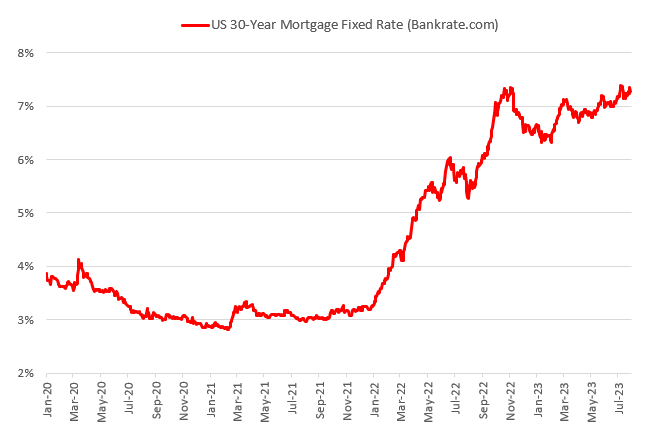

Sustained Low Interest Rates

The current low interest rate environment plays a crucial role in supporting higher stock market valuations. BofA's assessment suggests that these rates are likely to remain low for the foreseeable future. This has several positive impacts on the market:

- Low borrowing costs benefit companies: Companies can access capital at affordable rates, facilitating investments in expansion and innovation.

- Increased investment and expansion opportunities: With cheap access to funds, businesses can pursue growth strategies, ultimately boosting profits and stock prices.

- Attractive yields compared to bonds: The relatively low yields offered by bonds make stocks a more attractive investment option for many investors seeking higher returns.

Resilient Economic Fundamentals

BofA's analysis points to a strong foundation underpinning the economy, mitigating risks associated with high stock market valuations. Several key indicators support this assessment:

- Strong consumer spending: Consumer confidence remains relatively high, leading to robust spending that fuels economic growth.

- Robust job market: Low unemployment rates contribute to increased consumer spending and overall economic stability.

- Government stimulus measures: While tapering, government stimulus continues to support economic activity and provide a safety net.

Addressing Investor Concerns about Overvaluation

While acknowledging the elevated stock market valuations, BofA addresses investor concerns by providing context and highlighting mitigating factors.

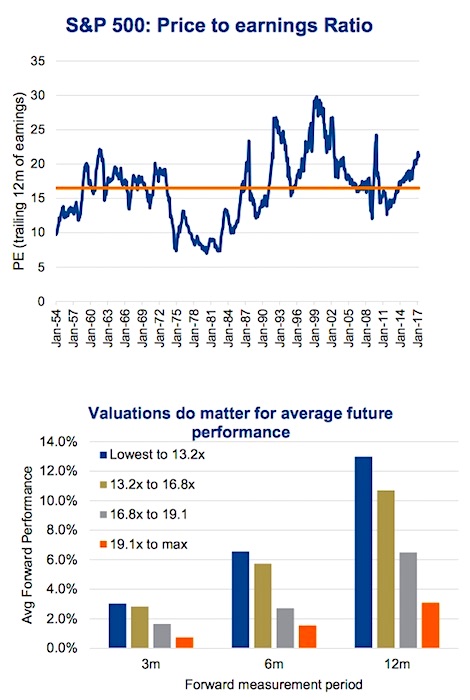

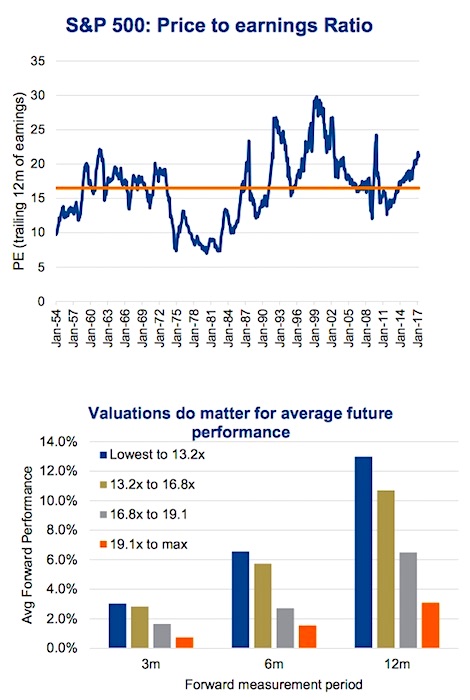

Comparing Current Valuations to Historical Data

BofA's analysts have meticulously compared current valuations to historical averages and market cycles. Their research shows that periods of high valuations are not uncommon and have been followed by periods of sustained growth in the past. By placing current valuations within a historical context, they argue that the current level is not inherently unsustainable. This analysis often involves visually compelling charts and graphs illustrating the cyclical nature of market valuations.

- Historical context of high valuations: History demonstrates that high valuations are not always a precursor to market crashes.

- Analysis of market cycles and corrections: The market naturally goes through periods of correction, which are often followed by renewed growth.

- Long-term growth potential: BofA emphasizes the long-term growth potential of the underlying businesses, suggesting that current valuations reflect this future growth.

Factors Mitigating Valuation Risks

BofA identifies several factors that could offset potential risks associated with high stock market valuations:

- Technological innovation: Technological advancements continue to drive productivity gains and create new economic opportunities.

- Global growth opportunities: Emerging markets present significant growth potential, diversifying investment risks.

- Strong corporate governance: Improved corporate governance practices enhance investor confidence and reduce risk.

Conclusion: Why Investors Shouldn't Worry about Stock Market Valuations (According to BofA)

BofA's bullish outlook on stock market valuations is based on a compelling combination of factors: robust corporate earnings growth, sustained low interest rates, and resilient economic fundamentals. While acknowledging the elevated stock market valuations, their analysis suggests that these valuations are not necessarily unsustainable and are supported by a strong underlying economic backdrop. Addressing lingering concerns, BofA highlights the historical context of market cycles and points to several mitigating factors that could offset potential risks.

While acknowledging the elevated stock market valuations, consider BofA's analysis and develop a well-informed investment strategy. Don't let concerns about valuations overshadow the potential for continued growth. Understanding the nuances of stock market valuations is crucial for making sound investment decisions.

Featured Posts

-

Navigating The Chinese Market The Struggles Faced By Bmw Porsche And Other Automakers

Apr 26, 2025

Navigating The Chinese Market The Struggles Faced By Bmw Porsche And Other Automakers

Apr 26, 2025 -

The End Of An Era Point72s Exit From An Emerging Markets Fund

Apr 26, 2025

The End Of An Era Point72s Exit From An Emerging Markets Fund

Apr 26, 2025 -

Blue Origin Cancels Launch Vehicle Subsystem Issue Delays Mission

Apr 26, 2025

Blue Origin Cancels Launch Vehicle Subsystem Issue Delays Mission

Apr 26, 2025 -

Analysis Of Trumps Time Interview His View On A Congressional Stock Trading Ban

Apr 26, 2025

Analysis Of Trumps Time Interview His View On A Congressional Stock Trading Ban

Apr 26, 2025 -

Us China Geopolitical Competition A Focus On A Key Military Base

Apr 26, 2025

Us China Geopolitical Competition A Focus On A Key Military Base

Apr 26, 2025

Latest Posts

-

Open Ai Streamlines Voice Assistant Creation At 2024 Developer Conference

Apr 26, 2025

Open Ai Streamlines Voice Assistant Creation At 2024 Developer Conference

Apr 26, 2025 -

Revolutionizing Voice Assistant Development Open Ais New Tools

Apr 26, 2025

Revolutionizing Voice Assistant Development Open Ais New Tools

Apr 26, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcement

Apr 26, 2025

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcement

Apr 26, 2025 -

Open Ais 2024 Event Easier Voice Assistant Creation Unveiled

Apr 26, 2025

Open Ais 2024 Event Easier Voice Assistant Creation Unveiled

Apr 26, 2025 -

Creating Ethical And Inclusive Ai A Conversation With Microsofts Design Chief

Apr 26, 2025

Creating Ethical And Inclusive Ai A Conversation With Microsofts Design Chief

Apr 26, 2025