Is A Wall Street Rally Set To Undercut The DAX's Strong Performance?

Table of Contents

The Current State of the DAX and Wall Street

The DAX has recently enjoyed significant gains, fueled by several key factors. Strong German exports, particularly in the automotive and manufacturing sectors, have contributed significantly to its robust performance. Additionally, a rebound in industrial production and positive consumer sentiment have further bolstered the index.

- Recent DAX performance data: As of [Insert Date], the DAX has shown a [Insert Percentage]% increase/decrease over the past [Time Period] (e.g., month, quarter, year).

- Key sectors driving DAX growth: The automotive, industrial goods, and technology sectors have been primary drivers of the DAX's recent growth.

- Underlying economic factors supporting the DAX: Strong domestic demand, coupled with a recovery in global trade, has provided a solid foundation for the DAX's positive performance.

Meanwhile, Wall Street has experienced a substantial rally, driven by a confluence of factors. Positive earnings reports from major corporations, expectations of a moderation in interest rate hikes, and generally improved investor sentiment have all contributed to the upward momentum.

- Recent performance of major US indices: The Dow Jones, S&P 500, and Nasdaq have all seen significant gains in recent weeks/months, with percentage increases of [Insert Percentages] respectively.

- Key sectors driving the Wall Street rally: Technology, consumer discretionary, and energy sectors have been key contributors to the Wall Street rally.

- Factors influencing investor confidence in the US market: The resilience of the US economy and hopes for a "soft landing" have boosted investor confidence.

Analyzing the Correlation Between DAX and Wall Street

Historically, the DAX and major US indices have exhibited a moderate to strong positive correlation. This means that movements in one market often mirror movements in the other. However, the strength of this correlation can vary significantly depending on several factors.

- Data illustrating historical correlation: [Include a chart or graph depicting the historical correlation between the DAX and a major US index like the S&P 500].

- Periods of strong correlation and divergence: Periods of global economic uncertainty tend to increase correlation, while periods of sector-specific growth can lead to divergence.

- Factors influencing the strength of the correlation: Global events like geopolitical instability, trade wars, and pandemics significantly influence the correlation between these markets. Economic cycles also play a role; during periods of global economic expansion, correlation is typically stronger.

Potential reasons for a strong correlation include the interconnectedness of the global economy, where global events impact both markets simultaneously. However, factors like sector-specific growth, differing monetary policies, and the Euro/Dollar exchange rate can lead to periods of divergence.

Economic Indicators to Watch

Several key economic indicators can provide insights into the future performance of both the DAX and Wall Street. Closely monitoring these indicators is crucial for understanding potential future scenarios.

- Inflation rates: High inflation can dampen consumer spending and corporate investment, impacting both markets negatively. Current inflation rates in the US and the Eurozone are [Insert Data] and trends are [Insert Analysis].

- Interest rates: Interest rate hikes can curb economic growth and negatively affect stock markets. The current trajectory of interest rates in the US and Europe will be crucial in determining market performance.

- Unemployment rates: Low unemployment usually indicates a strong economy, boosting market confidence. Current unemployment data for both the US and Germany are [Insert Data] and any shifts are a key market indicator.

- Consumer confidence: Consumer confidence reflects the overall optimism of consumers towards the economy. High consumer confidence typically correlates with a positive market outlook.

The Euro's Influence on the DAX

The Euro/Dollar exchange rate significantly influences the DAX's performance. A strong Euro makes German exports more expensive, potentially hurting the competitiveness of German companies and negatively impacting the DAX. Conversely, a weak Euro can boost exports and positively affect the index. The current Euro/Dollar exchange rate is [Insert Data] and its projected trajectory is [Insert Analysis].

Potential Scenarios and Investment Strategies

Several scenarios could unfold based on the interplay between the Wall Street rally and the DAX's performance:

- Scenario 1: Wall Street rally continues, impacting DAX positively: A sustained Wall Street rally could boost global investor sentiment, positively affecting the DAX as well.

- Scenario 2: Wall Street rally slows, DAX maintains strength: If the Wall Street rally loses steam, the DAX might continue its upward trajectory driven by its own underlying economic strengths.

- Scenario 3: Wall Street rally negatively impacts DAX: A sudden reversal on Wall Street could trigger a sell-off in global markets, potentially impacting the DAX negatively.

Suitable investment strategies depend on the unfolding scenario. Diversification across different asset classes and geographical markets is crucial. Hedging techniques, such as using options or futures contracts, can help mitigate risk. Furthermore, sector-specific investment opportunities can arise depending on the prevailing economic environment.

Conclusion

The DAX has demonstrated impressive strength, but the current Wall Street rally introduces uncertainty. While historical correlation suggests a link between the two markets, economic indicators like inflation, interest rates, and the Euro/Dollar exchange rate will significantly influence future performance. The potential scenarios outlined above highlight the need for careful monitoring and adaptable investment strategies. Whether a Wall Street rally will undercut the DAX's performance remains to be seen, but understanding the interplay between these two major markets is crucial for making informed investment decisions.

Call to Action: Stay informed about the evolving relationship between Wall Street and the DAX. Regularly monitor key economic indicators and adjust your investment strategies accordingly to navigate this dynamic market environment. Understanding the dynamics of a Wall Street rally and its potential impact on the DAX is crucial for effective investment decision-making. Learn more about optimizing your investment portfolio in relation to Wall Street and DAX performance.

Featured Posts

-

Emergency Services Respond To M56 Crash Car Overturn And Casualty

May 24, 2025

Emergency Services Respond To M56 Crash Car Overturn And Casualty

May 24, 2025 -

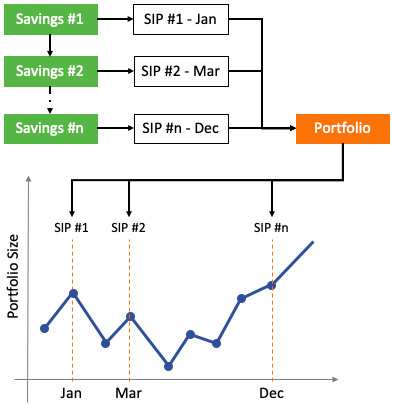

Pertimbangan Investasi Pada Mtel Dan Mbma Implikasi Penambahan Ke Msci Small Cap Index

May 24, 2025

Pertimbangan Investasi Pada Mtel Dan Mbma Implikasi Penambahan Ke Msci Small Cap Index

May 24, 2025 -

Bbc Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025

Bbc Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025 -

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025 -

Evrovidenie 2025 Prognoz Konchity Vurst Chetyre Potentsialnykh Pobeditelya

May 24, 2025

Evrovidenie 2025 Prognoz Konchity Vurst Chetyre Potentsialnykh Pobeditelya

May 24, 2025

Latest Posts

-

Aex Index A 4 Decline Sends Market To 12 Month Low

May 24, 2025

Aex Index A 4 Decline Sends Market To 12 Month Low

May 24, 2025 -

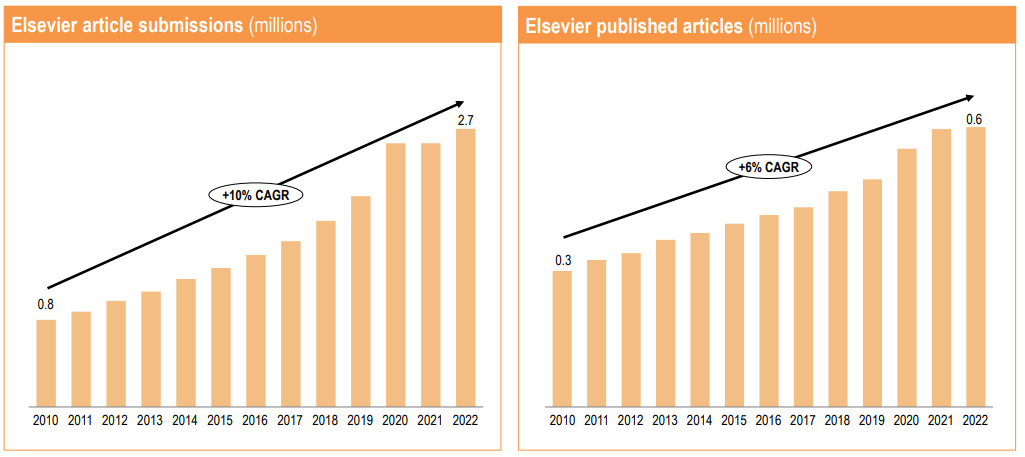

Sterke Prestaties Relx Ai Technologie Overbrugt Economische Uitdagingen

May 24, 2025

Sterke Prestaties Relx Ai Technologie Overbrugt Economische Uitdagingen

May 24, 2025 -

Analyse Aex Winsten Na Uitstel Van Trumps Plannen

May 24, 2025

Analyse Aex Winsten Na Uitstel Van Trumps Plannen

May 24, 2025 -

Relx Succes In Economisch Moeilijke Tijden De Rol Van Ai In Groei En Winstgevendheid

May 24, 2025

Relx Succes In Economisch Moeilijke Tijden De Rol Van Ai In Groei En Winstgevendheid

May 24, 2025 -

2 Fall In Amsterdam Stock Exchange After Trumps Tariff Announcement

May 24, 2025

2 Fall In Amsterdam Stock Exchange After Trumps Tariff Announcement

May 24, 2025