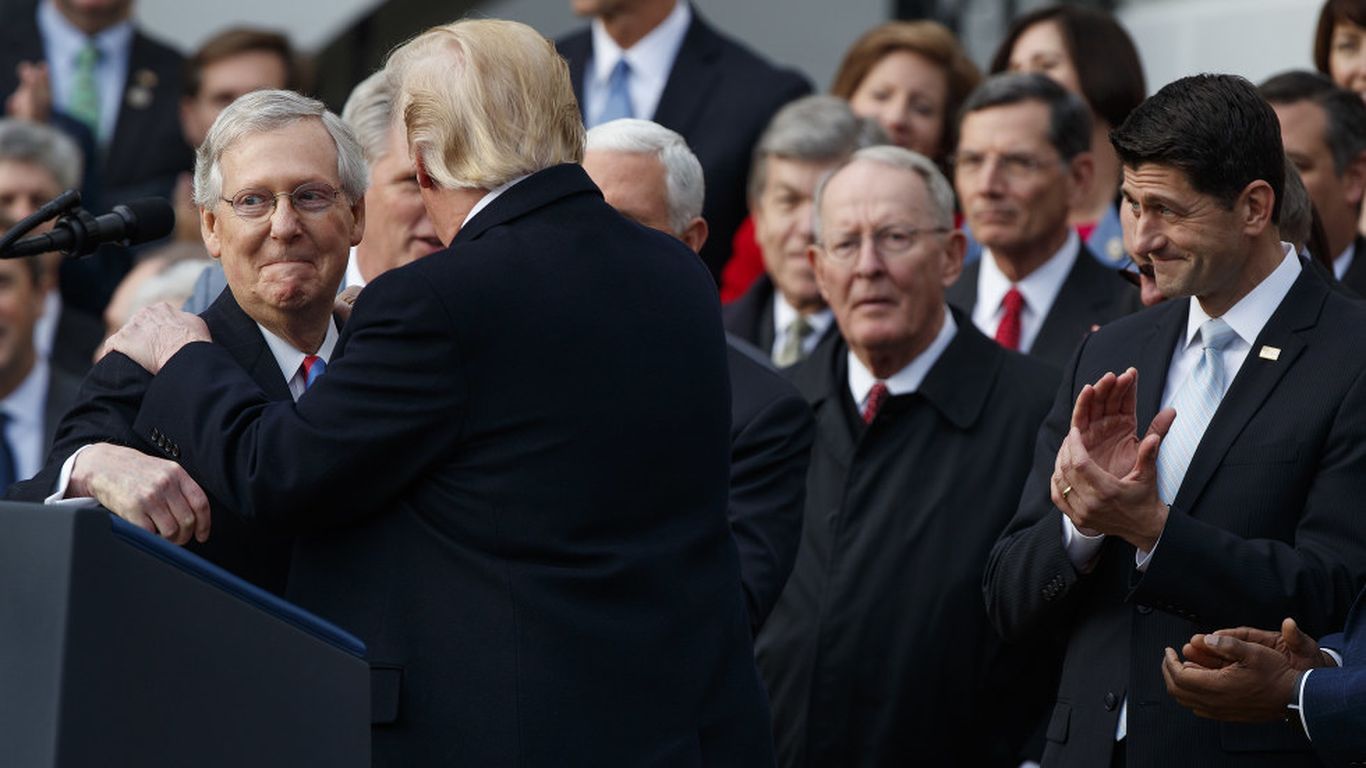

2% Fall In Amsterdam Stock Exchange After Trump's Tariff Announcement

Table of Contents

Immediate Market Reaction to Trump's Tariff Announcement

Sharp Decline in AEX Index

The AEX index plummeted by 2% within hours of President Trump's announcement of new tariffs. This swift and substantial drop reflected a palpable sense of uncertainty and fear among investors. The fall, which occurred primarily during the morning trading session on [Insert Date], wiped billions of euros off the market capitalization of Dutch companies. This immediate reaction showcased the sensitive dependence of the Amsterdam Stock Exchange on global trade stability.

- Heavily Impacted Stocks: Export-oriented companies, particularly those heavily reliant on trade with the United States, experienced the most significant losses. Companies in the [mention specific sectors, e.g., semiconductor, agricultural, manufacturing] sectors were particularly hard hit.

- High Trading Volume: The trading volume on the AEX significantly increased following the announcement, indicating a surge in both buying and selling activity as investors scrambled to react to the news. This heightened activity further amplified the market's negative response.

- Expert Opinion: Financial analysts, such as [Name and Affiliation of Analyst], commented that the drop reflected a "knee-jerk reaction" to the perceived threat of escalating trade tensions and the potential negative impact on Dutch exports. They emphasized the uncertainty surrounding the long-term implications of the tariffs.

Underlying Causes of the Stock Market Decline

Impact of Increased Trade Tensions

President Trump's latest tariff announcement targeted [Specify the targeted goods or sectors]. These new tariffs, coupled with existing trade disputes, exacerbate existing trade tensions between the US and the EU, directly impacting Dutch businesses. The Netherlands, with its export-driven economy, is particularly vulnerable to trade disruptions.

- Investor Confidence Eroded: The uncertainty surrounding the future of international trade directly erodes investor confidence. Fear of further retaliatory tariffs or sustained trade friction leads investors to seek safer, less volatile investment options.

- Potential for EU Retaliation: The EU is likely to respond with retaliatory measures against US goods, potentially escalating the trade war and further negatively impacting the global economy, including the Amsterdam Stock Exchange.

- Broader Implications for International Trade: This event highlights the interconnectedness of global markets and the fragility of international trade agreements. The instability caused by these tariffs could have far-reaching consequences for businesses and economies worldwide.

Long-Term Implications for the Amsterdam Stock Exchange and Investors

Uncertainty and Investor Behavior

The uncertainty created by these escalating trade disputes significantly impacts investor behavior. Long-term investment strategies are put on hold as investors grapple with unpredictable market conditions and the potential for further economic slowdown.

- Risk Mitigation Strategies: Investors are advised to diversify their portfolios to mitigate the risk associated with exposure to specific sectors or regions impacted by trade wars. This involves spreading investments across different asset classes and geographical regions.

- Potential for Economic Slowdown: Sustained trade tensions could lead to a global economic slowdown, further impacting the performance of the Amsterdam Stock Exchange and reducing overall investor returns.

- Government Response: The Dutch government's response to the trade dispute, including potential support measures for affected businesses, will significantly influence the long-term impact on the AEX.

Comparison to Previous Market Reactions to Trade Policy

Historical Context

This recent 2% drop in the AEX is not an isolated incident. The Amsterdam Stock Exchange, like other global markets, has experienced similar periods of volatility in response to previous trade disputes.

- Data Comparison: Comparing the current fall to similar past events (e.g., previous tariff announcements or trade disputes) reveals similarities and differences in market reaction, helping to understand the severity and potential duration of the current downturn. [Insert data comparing the current drop to previous similar events].

- Analyzing Market Responses: A comparative analysis of market responses highlights factors influencing the severity and duration of market corrections during periods of trade uncertainty.

- Market Recovery Potential: Historical data can shed light on potential recovery timelines, depending on factors such as the duration and scope of the trade dispute, and the response of governments and central banks.

Conclusion

The 2% fall in the Amsterdam Stock Exchange following President Trump's tariff announcement underscores the significant impact of global trade tensions on even seemingly stable markets. The immediate market reaction reflects investor concerns regarding the potential for reduced export revenues and broader economic uncertainty. The underlying causes stem from increased trade friction and the potential for retaliatory measures. Long-term implications remain uncertain, emphasizing the need for investors to adopt diversified strategies to mitigate risk. By learning from historical market reactions to similar events, we can better understand the potential trajectory of the AEX and prepare for future market volatility stemming from international trade policy.

Call to Action: Stay informed about developments concerning the Amsterdam Stock Exchange and international trade relations to make informed investment decisions. Follow reputable financial news sources for updates on the impact of Trump's tariffs on the Amsterdam Stock Exchange and adjust your investment strategy accordingly. Consider seeking professional financial advice to navigate market volatility stemming from trade policy announcements. Understanding the impact of Trump’s tariffs on the Amsterdam Stock Exchange is crucial for effective investment planning.

Featured Posts

-

Gryozy Lyubvi Ili Ilicha Otsenka Publikatsii V Gazete Trud

May 24, 2025

Gryozy Lyubvi Ili Ilicha Otsenka Publikatsii V Gazete Trud

May 24, 2025 -

Onko Tuukka Taponen F1 Kuljettaja Jo Taenae Vuonna Uudet Tiedot

May 24, 2025

Onko Tuukka Taponen F1 Kuljettaja Jo Taenae Vuonna Uudet Tiedot

May 24, 2025 -

French Politics Former Pm Challenges Macrons Decisions

May 24, 2025

French Politics Former Pm Challenges Macrons Decisions

May 24, 2025 -

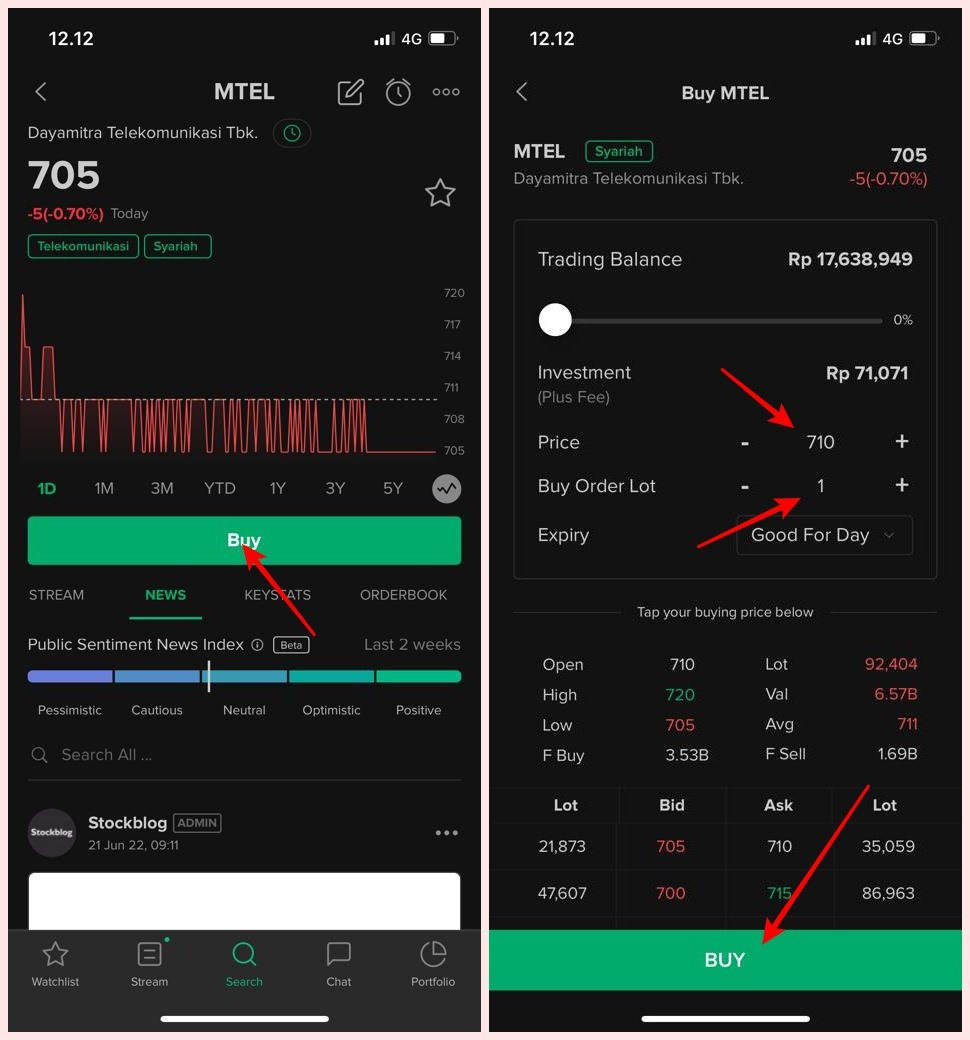

Analisis Saham Mtel And Mbma Setelah Masuk Msci Small Cap

May 24, 2025

Analisis Saham Mtel And Mbma Setelah Masuk Msci Small Cap

May 24, 2025 -

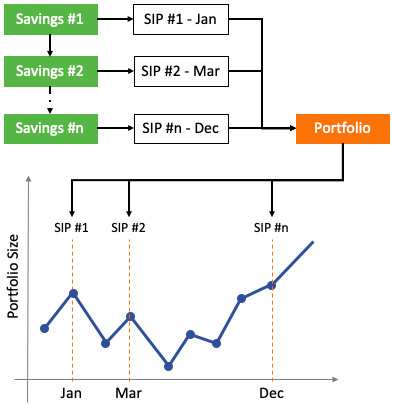

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025

Latest Posts

-

What Sam Altman Revealed About His New Device With Jony Ive

May 24, 2025

What Sam Altman Revealed About His New Device With Jony Ive

May 24, 2025 -

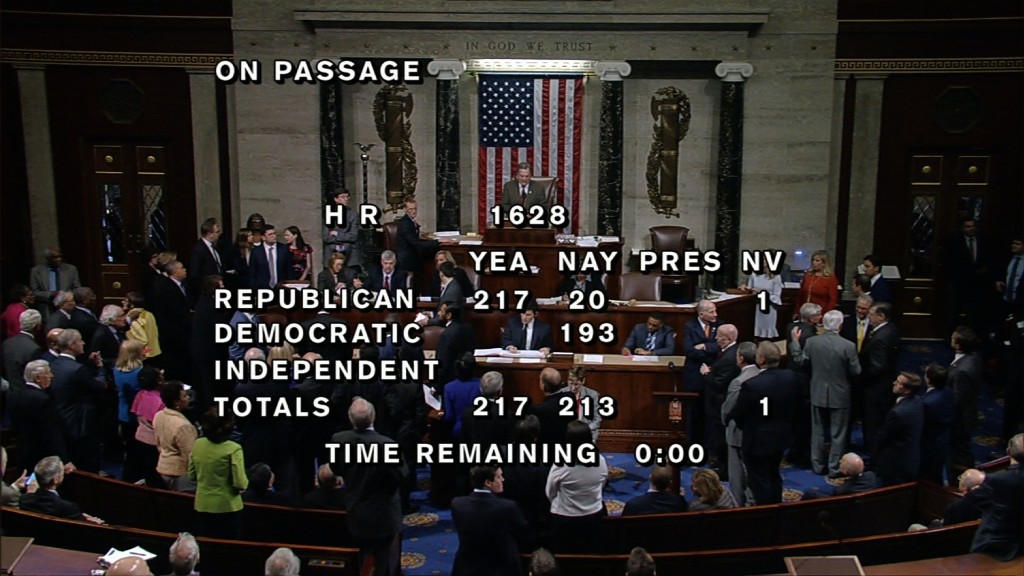

Market Reaction House Tax Bill Passage Affects Bonds Stocks And Bitcoin

May 24, 2025

Market Reaction House Tax Bill Passage Affects Bonds Stocks And Bitcoin

May 24, 2025 -

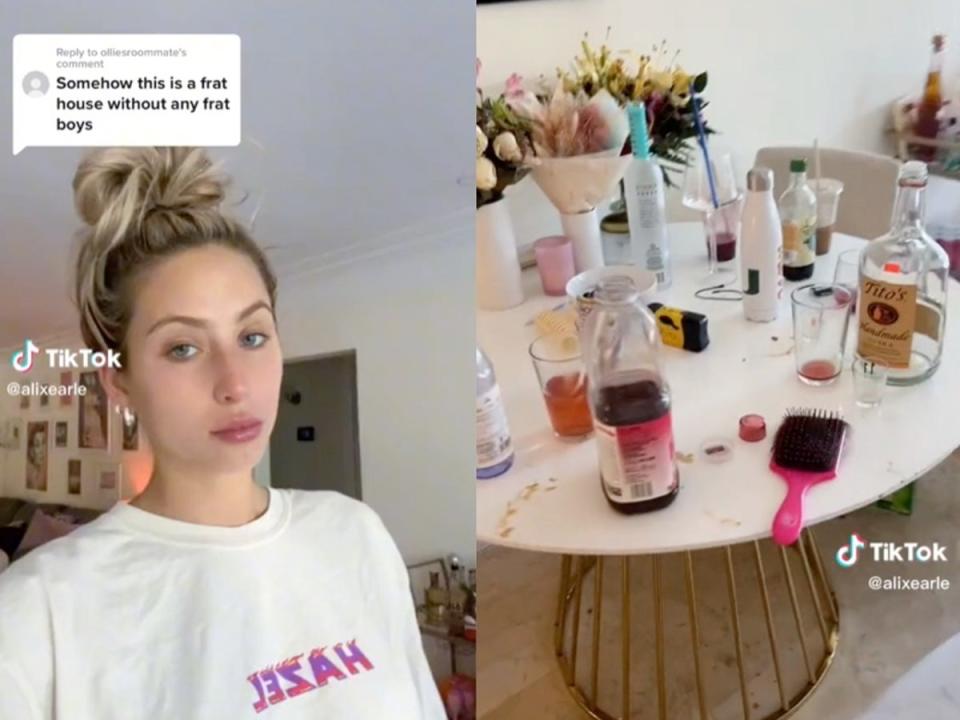

How Alix Earle Conquered Gen Z Marketing On Dancing With The Stars

May 24, 2025

How Alix Earle Conquered Gen Z Marketing On Dancing With The Stars

May 24, 2025 -

House Tax Bill Passes Impact On Stock Market Bonds And Bitcoin

May 24, 2025

House Tax Bill Passes Impact On Stock Market Bonds And Bitcoin

May 24, 2025 -

From Tik Tok To Dancing With The Stars Alix Earles Marketing Mastery

May 24, 2025

From Tik Tok To Dancing With The Stars Alix Earles Marketing Mastery

May 24, 2025