Is Canada's Liberal Government Financially Responsible? An In-Depth Look At The Numbers

Table of Contents

Government Spending and Revenue

Analyzing the financial stewardship of any government requires a close examination of its spending and revenue streams. Understanding these two fundamental components is crucial to assessing Canada's Liberal Government financial responsibility.

Analysis of Budgetary Allocations: The Liberal government's budgetary allocations reflect its policy priorities. Significant investments have been made in social programs, including healthcare and social services, alongside substantial commitments to infrastructure projects nationwide.

- Healthcare Spending: Increased funding for healthcare has been a hallmark of Liberal budgets, aiming to address issues like aging populations and increasing healthcare costs. However, critics argue that these increases haven't kept pace with the growing demands on the system.

- Infrastructure Investments: Significant funds have been allocated to infrastructure projects, aiming to stimulate economic growth and modernize Canada's aging infrastructure. These projects encompass transportation, clean energy, and social infrastructure.

- Comparison to Previous Years and Other Nations: Compared to previous Conservative governments, Liberal spending has generally trended upward, particularly in social programs. A comparison with other OECD countries reveals that Canada's spending on social programs falls within the average range, although specifics vary significantly by sector. (Charts and graphs would be included here illustrating this data).

- Keywords: Federal budget, government spending, fiscal policy, budgetary allocations, Canada's national debt, public spending.

Sources of Government Revenue: The primary sources of government revenue are taxation (personal and corporate income taxes, GST/HST), and various other levies and fees.

- Tax Policy Impacts: The Liberal government has implemented various tax policies, including adjustments to tax brackets and the introduction of various tax credits. The impact of these policies on revenue generation is complex and subject to ongoing debate. Some argue that tax increases have stifled economic growth, while others maintain that they are necessary to fund social programs and infrastructure projects.

- Economic Growth and Revenue: Strong economic growth generally leads to higher tax revenues. However, the relationship is not always linear; periods of slower growth can strain government finances. (Data on GDP growth and tax revenue correlation would be displayed here).

- Keywords: Taxation, tax revenue, tax policy, GDP, economic growth, fiscal sustainability.

National Debt and Deficit

The management of Canada's national debt and deficit is a crucial indicator of the Liberal government's financial responsibility.

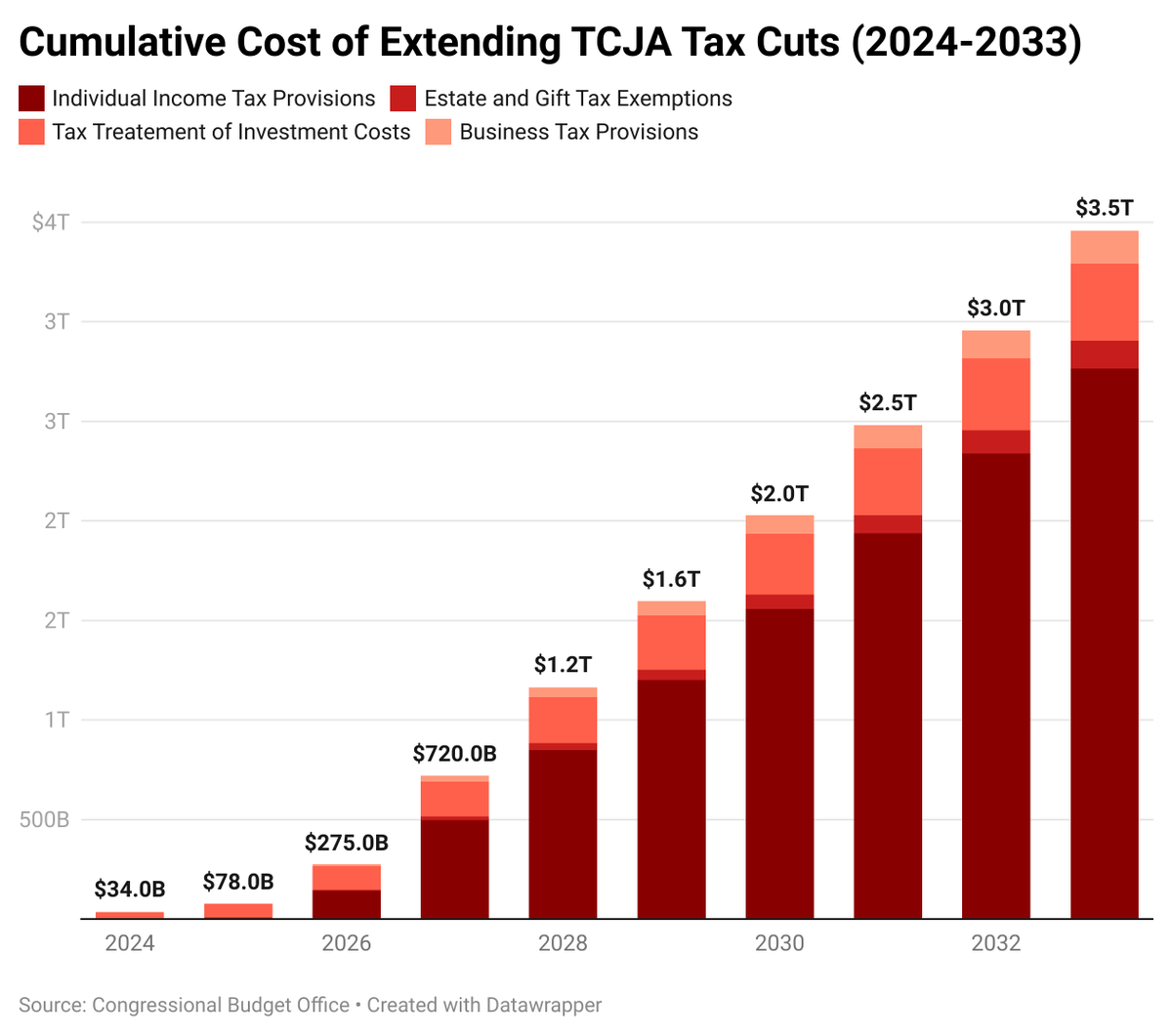

Debt-to-GDP Ratio: The debt-to-GDP ratio is a key metric used to assess a country's financial health. Under the Liberal government, this ratio has generally increased, reflecting increased government borrowing.

- Historical Context: The ratio has fluctuated significantly throughout Canada's history, influenced by economic cycles and government policies. The current level needs to be compared to historical highs and lows to determine its significance. (A visual representation of this data over time would be included).

- International Comparisons: Comparing Canada's debt-to-GDP ratio to other developed nations provides valuable context. While Canada's ratio may be higher than some countries, it might be lower than others, highlighting the nuances of international economic comparisons.

- Keywords: National debt, debt-to-GDP ratio, fiscal deficit, budget deficit, sovereign debt, government debt.

Debt Management Strategies: The Liberal government has employed various strategies to manage the national debt. These strategies include maintaining a relatively low cost of borrowing, prioritizing debt reduction efforts within a balanced approach.

- Borrowing Costs: Interest rates on government debt significantly impact the overall cost of servicing the debt. Lower interest rates reduce the burden on taxpayers, while higher rates increase the financial strain.

- Long-Term Plans: The government’s long-term plans for fiscal consolidation, including projected reductions in the deficit and debt, provide insights into its fiscal management approach. (Details about these plans would be included).

- Keywords: Debt management, fiscal consolidation, debt reduction, austerity measures, borrowing costs, interest rates.

Economic Performance Under Liberal Leadership

Assessing Canada's economic performance under the Liberal government provides further context for evaluating its financial responsibility.

GDP Growth and Employment Rates: Key economic indicators, such as GDP growth and employment rates, reflect the overall health of the economy.

- Growth Comparisons: Comparing GDP growth and employment rates under the Liberal government to previous administrations and international counterparts offers insights into its economic success. (Data illustrating this comparison would be included).

- Challenges and Successes: The Liberal government has faced various economic challenges, including global economic slowdowns and commodity price fluctuations. Its ability to navigate these challenges and deliver positive economic outcomes is crucial for evaluating its overall financial performance.

- Keywords: Economic growth, GDP growth, unemployment rate, employment rate, economic performance, inflation.

Impact of Government Policies on the Economy: The effectiveness of government policies in influencing economic outcomes is a critical factor.

- Fiscal Stimulus: The government's use of fiscal stimulus, including infrastructure investments and tax credits, has aimed to stimulate economic growth and create jobs. The effectiveness of these measures requires careful analysis. (Data and research on the impacts would be included).

- Long-Term Effects: The long-term consequences of government policies are often difficult to predict. Evaluating both the short-term and long-term effects is essential for a comprehensive assessment.

- Keywords: Fiscal stimulus, infrastructure investment, economic policy, monetary policy, government intervention.

Conclusion:

Assessing whether Canada's Liberal government is financially responsible requires a nuanced understanding of its spending priorities, revenue generation strategies, debt management, and the broader economic context. While significant investments in social programs and infrastructure have been made, resulting in a rise in the national debt, this needs to be weighed against the potential long-term economic benefits. The impact of the government's policies on key economic indicators like GDP growth and employment needs to be carefully examined.

Overall, a balanced assessment requires consideration of both the positive and negative aspects of the Liberal government's financial management. Further research is needed to fully understand the long-term implications of current policies. Stay informed about Canada's Liberal Government's financial decisions and continue to research the complexities of Canada's Liberal Government financial responsibility to form your own informed opinion. Consult government websites like the Department of Finance Canada and reputable economic analysis from organizations like the Parliamentary Budget Officer for more detailed information.

Featured Posts

-

India And Saudi Arabia To Jointly Develop Two Major Oil Refineries

Apr 24, 2025

India And Saudi Arabia To Jointly Develop Two Major Oil Refineries

Apr 24, 2025 -

Oil Market Summary Latest Prices And Analysis April 23 2024

Apr 24, 2025

Oil Market Summary Latest Prices And Analysis April 23 2024

Apr 24, 2025 -

Understanding The Canadian Dollars Recent Volatility Against Global Currencies

Apr 24, 2025

Understanding The Canadian Dollars Recent Volatility Against Global Currencies

Apr 24, 2025 -

Stock Market Today Dow And S And P 500 Live Updates For April 23rd

Apr 24, 2025

Stock Market Today Dow And S And P 500 Live Updates For April 23rd

Apr 24, 2025 -

Canadian Conservative Platform Focus On Tax Cuts And Fiscal Responsibility

Apr 24, 2025

Canadian Conservative Platform Focus On Tax Cuts And Fiscal Responsibility

Apr 24, 2025