Is XRP A Commodity? The SEC's Stance And Ongoing Debate

Table of Contents

The SEC's Case Against XRP: A Security or Not?

The SEC's core argument against Ripple centers on the classification of XRP as a security, primarily based on the Howey Test. This legal precedent defines an investment contract—and therefore a security—based on four key elements:

- Investment of Money: Investors provided Ripple with money in exchange for XRP tokens.

- Common Enterprise: The success of the investment depended on Ripple's efforts and the collective success of the XRP ecosystem.

- Expectation of Profits: Investors purchased XRP with the expectation of future profits, driven by Ripple's activities and market growth.

- Profits Derived from the Efforts of Others: Investors' profits were largely dependent on Ripple's efforts in developing and promoting the XRP ecosystem.

The SEC contends that Ripple's sales and distribution of XRP, particularly through private placements and programmatic sales, constitute the offer and sale of unregistered securities. This alleged violation of securities law forms the basis of their lawsuit. The SEC's stance on XRP could potentially set a precedent for how other cryptocurrencies are regulated, significantly impacting the entire cryptocurrency market. The SEC XRP lawsuit, therefore, is a landmark case with profound implications for cryptocurrency regulation.

Arguments for XRP as a Commodity

Conversely, strong arguments exist for classifying XRP as a commodity. Proponents point to several key characteristics:

- Decentralized Nature of XRP Ledger: Unlike many cryptocurrencies, XRP operates on a decentralized, open-source ledger, the XRP Ledger, reducing direct control by any single entity. This inherent decentralization differentiates XRP from centrally controlled securities.

- Open-Source Code and Community Governance: The XRP Ledger's open-source nature and community governance further support the argument for commodity status. The development and evolution of the ledger are not solely determined by Ripple.

- Use of XRP for Payments and Remittances: XRP's primary function is facilitating fast and low-cost cross-border payments. This use case aligns more closely with a commodity used for transactional purposes than a security offered for investment.

- Comparison with Other Commodities like Gold or Oil: Similar to gold or oil, XRP's price is largely determined by market forces of supply and demand, rather than solely by the efforts of a central issuer.

These factors, along with expert opinions and legal analysis supporting the XRP commodity classification, challenge the SEC's assertion that XRP is a security. The decentralized nature of the XRP Ledger and its use for payments strengthen the argument that it functions more like a commodity than an investment contract.

The Ongoing Legal Battle and its Implications

The Ripple vs. SEC lawsuit is ongoing, with significant implications for the broader cryptocurrency market. Potential outcomes range from a complete SEC victory solidifying a restrictive regulatory approach to a ruling favoring Ripple, potentially offering greater regulatory clarity (or uncertainty) for other crypto projects.

- Potential for Regulatory Clarity on Cryptocurrencies: A decisive ruling could provide much-needed regulatory clarity for the cryptocurrency industry, reducing uncertainty for investors and businesses.

- Impact on Investor Confidence: The outcome will significantly affect investor confidence in the crypto market, potentially leading to increased or decreased investment depending on the ruling.

- Future of XRP's Price and Adoption: The classification of XRP will inevitably impact its price and adoption rate, with a commodity classification potentially boosting its use in payments.

- Implications for Other Crypto Projects: The precedent set by this case could influence the regulatory treatment of other cryptocurrencies, potentially leading to further legal challenges.

The global regulatory landscape varies considerably, with different jurisdictions adopting different approaches to classifying and regulating cryptocurrencies. The Ripple SEC lawsuit updates are closely monitored worldwide.

The Future of XRP and its Classification

Predicting the future of XRP and its classification is challenging, given the ongoing legal battles and evolving regulatory environment. However, several potential developments could shape the landscape:

- Potential Changes in XRP's Functionality and Use Cases: Future developments might alter XRP's functionality and broaden its use cases, potentially influencing its classification.

- Impact of Technological Advancements on XRP's Classification: Technological advancements within the cryptocurrency space could impact how regulators view XRP and its classification.

- The Need for Clear and Consistent Regulatory Frameworks: The need for comprehensive and consistent regulatory frameworks for cryptocurrencies globally is paramount.

The uncertainty surrounding XRP's future highlights the importance of ongoing dialogue and clear, consistent regulatory approaches.

Conclusion: Understanding the XRP Commodity Debate and Moving Forward

The debate surrounding whether XRP is a commodity is complex and far-reaching. The SEC's argument, primarily based on the Howey Test, contrasts sharply with arguments emphasizing XRP's decentralized nature and use as a payment facilitator. The outcome of the Ripple vs. SEC lawsuit will have a profound impact on the cryptocurrency market and investor confidence. Staying informed about developments in this case and the wider regulatory landscape is crucial. Continue researching the "XRP commodity" debate, exploring diverse perspectives, and forming your own informed opinion. Understanding the intricacies surrounding XRP's classification is essential for navigating the evolving world of digital assets. The future of XRP, and indeed the cryptocurrency market, hinges on achieving regulatory clarity and establishing fair, consistent guidelines.

Featured Posts

-

Bantuan Persekolahan Tabung Baitulmal Sarawak 2025 Manfaat 125 Anak Asnaf Di Sibu

May 01, 2025

Bantuan Persekolahan Tabung Baitulmal Sarawak 2025 Manfaat 125 Anak Asnaf Di Sibu

May 01, 2025 -

Ev Mandate Pushback Car Dealerships Renew Their Fight

May 01, 2025

Ev Mandate Pushback Car Dealerships Renew Their Fight

May 01, 2025 -

Neispricana Prica Zdravkova Prva Ljubav I Inspiracija Za Pesmu Kad Sam Se Vratio

May 01, 2025

Neispricana Prica Zdravkova Prva Ljubav I Inspiracija Za Pesmu Kad Sam Se Vratio

May 01, 2025 -

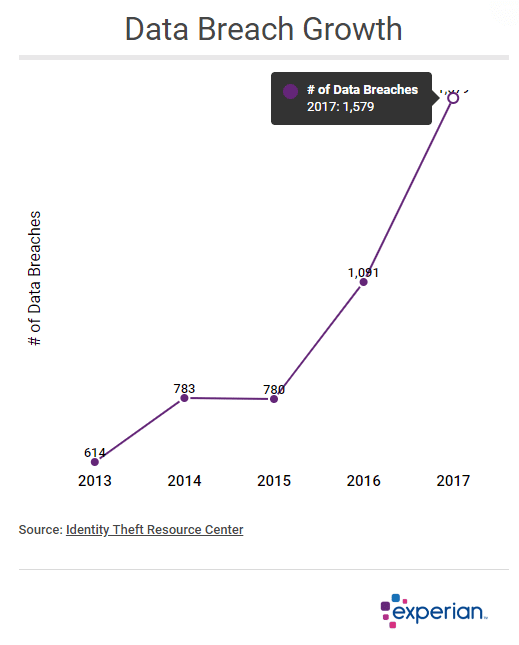

T Mobile Penalty 16 Million For Repeated Data Breaches

May 01, 2025

T Mobile Penalty 16 Million For Repeated Data Breaches

May 01, 2025 -

Scotlands Six Nations 2025 Prospects Realistic Expectations Or False Hope

May 01, 2025

Scotlands Six Nations 2025 Prospects Realistic Expectations Or False Hope

May 01, 2025

Latest Posts

-

Disney Cruise Line Announces Two Ships For Alaska In Summer 2026

May 01, 2025

Disney Cruise Line Announces Two Ships For Alaska In Summer 2026

May 01, 2025 -

Essential Cruise Packing What Not To Pack

May 01, 2025

Essential Cruise Packing What Not To Pack

May 01, 2025 -

Norwegian Cruise Line Holdings Ltd Nclh Earnings Beat Fuels Stock Surge

May 01, 2025

Norwegian Cruise Line Holdings Ltd Nclh Earnings Beat Fuels Stock Surge

May 01, 2025 -

Cruising In 2025 The Key Features Of The Years New Ships

May 01, 2025

Cruising In 2025 The Key Features Of The Years New Ships

May 01, 2025 -

What To Leave Behind When Packing For A Cruise

May 01, 2025

What To Leave Behind When Packing For A Cruise

May 01, 2025