Is XRP A Good Investment? A Detailed Analysis

Table of Contents

Understanding XRP's Technology and Functionality

XRP, native to the Ripple network, isn't just another cryptocurrency; it's designed to be a bridge currency, facilitating faster and cheaper international transactions. Unlike cryptocurrencies reliant on Proof-of-Work (PoW) consensus mechanisms, Ripple uses a unique consensus method, resulting in significantly faster transaction speeds and lower energy consumption. The Ripple protocol aims to streamline cross-border payments by connecting different financial institutions, bypassing the traditional correspondent banking system.

- Scalability of the XRP Ledger: The XRP Ledger is highly scalable, capable of handling thousands of transactions per second, a crucial advantage over many other cryptocurrencies.

- Energy Efficiency: Its energy-efficient consensus mechanism makes XRP a more environmentally friendly option compared to PoW cryptocurrencies like Bitcoin.

- Use Cases Beyond Cross-Border Payments: While primarily known for its role in international remittances and payments, XRP's potential extends to micropayments and other financial applications. Its speed and low fees make it suitable for various scenarios where rapid and cost-effective transactions are crucial.

The Ripple vs. SEC Lawsuit and its Impact on XRP's Price

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts XRP's price and investor sentiment. The SEC alleges that XRP is an unregistered security, while Ripple contends that XRP is a currency, not a security. This legal uncertainty creates volatility in the XRP market.

- Summary of Key Arguments: The SEC's argument centers around the investment contract nature of XRP sales, while Ripple emphasizes XRP's decentralized nature and its use in facilitating cross-border transactions.

- Analysis of Expert Opinions and Market Predictions: Expert opinions are divided, with some predicting a positive outcome for Ripple, leading to increased adoption and price appreciation, while others foresee a negative outcome with potential long-term implications for the cryptocurrency.

- Impact on Trading Volume and Liquidity: The lawsuit has undoubtedly influenced trading volume and liquidity. While the uncertainty remains, the market has shown resilience, with trading activity continuing, albeit with increased volatility.

Market Analysis and Price Prediction for XRP

Analyzing XRP's price history reveals periods of significant growth and decline, influenced by various factors. Its current market capitalization reflects its standing among other cryptocurrencies, though it fluctuates based on market sentiment and regulatory news.

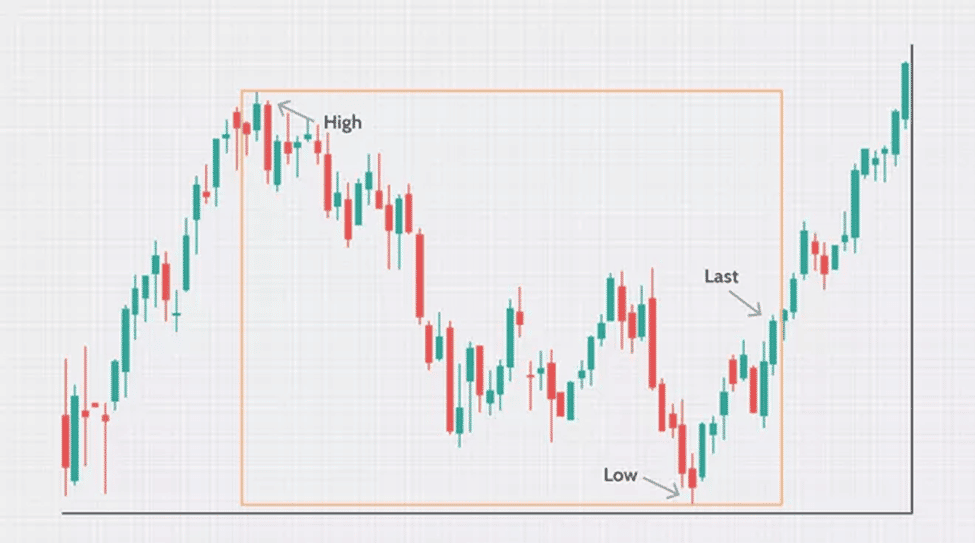

- Key Technical Indicators for XRP: Technical indicators like moving averages and relative strength index (RSI) can provide insights into short-term price trends, but should be used cautiously.

- Analysis of Adoption Rates Among Financial Institutions: Increased adoption by financial institutions could boost XRP's price, signaling growing confidence in its technology and utility.

- Comparison to Other Cryptocurrencies: Comparing XRP's performance and market position to other cryptocurrencies in the same segment offers a broader perspective on its potential. Analyzing its strengths and weaknesses relative to competitors helps investors make a more informed assessment.

Risks and Potential Rewards of Investing in XRP

Investing in XRP, like any cryptocurrency, involves considerable risk. Price volatility is inherent, and regulatory uncertainty remains a key factor. Security risks associated with cryptocurrency exchanges and wallets also need consideration.

- Specific Risks Associated with XRP: XRP's price is heavily dependent on the outcome of the Ripple-SEC lawsuit, making it a high-risk investment.

- Strategies for Mitigating Investment Risks: Diversification is key. Don't invest more than you can afford to lose, and spread your investments across different assets.

- Potential Long-Term Benefits of XRP Investment: If Ripple wins the lawsuit and the cryptocurrency gains wider adoption, the potential for significant returns is substantial. Its utility in the global payments system presents a compelling long-term narrative.

Conclusion: Is XRP a Good Investment?

Whether XRP is a "good" investment depends entirely on your risk tolerance and investment goals. While its technology holds promise for faster and cheaper cross-border payments, the ongoing legal battle creates significant uncertainty. The potential rewards are considerable if Ripple prevails, but the risks associated with the lawsuit and the inherent volatility of the cryptocurrency market cannot be ignored. Conduct thorough research, understand the risks, and make informed decisions based on your individual circumstances. Learn more about XRP investments, consider XRP as part of a diversified portfolio, and begin your XRP research today.

Featured Posts

-

Tbs Patienten Wachten Jaren Gevolgen Van Overvolle Klinieken

May 02, 2025

Tbs Patienten Wachten Jaren Gevolgen Van Overvolle Klinieken

May 02, 2025 -

Duponts Masterclass Frances Rugby Victory Over Italy

May 02, 2025

Duponts Masterclass Frances Rugby Victory Over Italy

May 02, 2025 -

1 Mayis Kocaeli Arbedeyle Goelgelenen Kutlamalar

May 02, 2025

1 Mayis Kocaeli Arbedeyle Goelgelenen Kutlamalar

May 02, 2025 -

Juridische Strijd Kampen Eist Stroomnetaansluiting Van Enexis

May 02, 2025

Juridische Strijd Kampen Eist Stroomnetaansluiting Van Enexis

May 02, 2025 -

Rugby Frances Dominant Performance Precedes Ireland Match

May 02, 2025

Rugby Frances Dominant Performance Precedes Ireland Match

May 02, 2025

Latest Posts

-

1 Mayis Kocaeli Kutlamalar Sirasinda Meydana Gelen Arbede Hakkinda Bilgiler

May 02, 2025

1 Mayis Kocaeli Kutlamalar Sirasinda Meydana Gelen Arbede Hakkinda Bilgiler

May 02, 2025 -

Kocaeli Nde 1 Mayis Siddet Ve Protestolar

May 02, 2025

Kocaeli Nde 1 Mayis Siddet Ve Protestolar

May 02, 2025 -

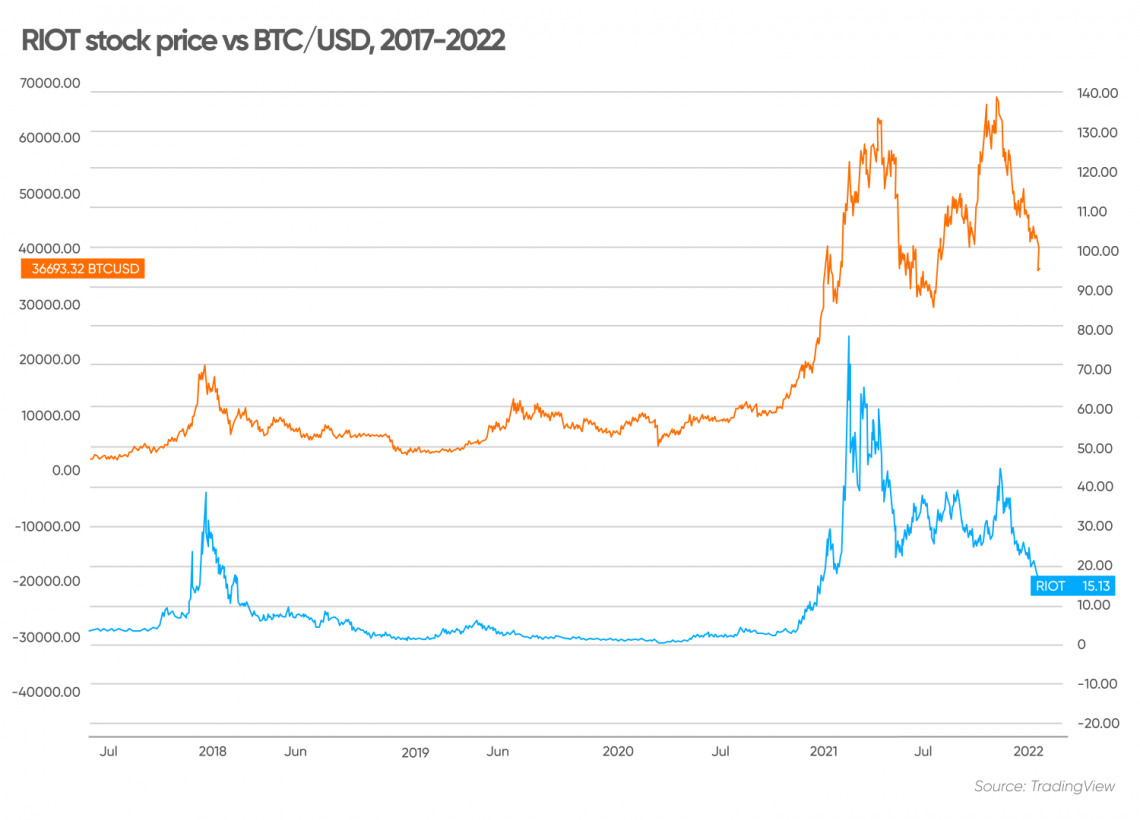

Riot Stock Price Analysis Navigating The 52 Week Low

May 02, 2025

Riot Stock Price Analysis Navigating The 52 Week Low

May 02, 2025 -

1 Mayis Kocaeli Arbedeyle Goelgelenen Kutlamalar

May 02, 2025

1 Mayis Kocaeli Arbedeyle Goelgelenen Kutlamalar

May 02, 2025 -

Is Riot Platforms Stock A Buy At Its 52 Week Low Riot

May 02, 2025

Is Riot Platforms Stock A Buy At Its 52 Week Low Riot

May 02, 2025