JBS (JBSS3) Withdraws From Banco Master Asset Acquisition Talks

Table of Contents

JBS's Official Statement and Reasons for Withdrawal

JBS's official statement regarding the withdrawal from the Banco Master asset acquisition is crucial for understanding the situation. While the specifics may vary depending on the actual press release, we can speculate on potential reasons based on common occurrences in M&A deals. The keywords here are crucial for SEO: JBS statement, withdrawal reasons, official announcement, press release, strategic decision.

-

Summary of JBS's official press release: [Insert a summary of the actual press release once available. This section should directly quote relevant parts of the official statement, linking to the source if possible].

-

Key reasons given for the withdrawal (if any): [Discuss any reasons cited by JBS in their statement. For example, were there disagreements over valuation, due diligence issues, or unforeseen regulatory hurdles?]

-

Speculation on unstated reasons (supported by credible sources): [Based on industry knowledge and reputable sources, offer informed speculation on potential underlying factors that might not have been explicitly stated. This could include internal restructuring at JBS, a shift in their strategic priorities, or a better alternative investment opportunity].

-

Impact on JBS's short-term and long-term strategies: The withdrawal could impact JBS's short-term growth projections, especially if the acquisition was a significant part of their expansion plans. In the long term, it might lead to a reevaluation of their acquisition strategy or a shift towards alternative investment avenues within the Brazilian market.

Impact on Banco Master and its Future

The unexpected withdrawal by JBS leaves Banco Master in a precarious position. The keywords here are Banco Master, future prospects, asset sale, financial stability, alternative buyers. The consequences are multifaceted and depend heavily on the nature of the assets involved and Banco Master's overall financial health.

-

Potential impact on Banco Master's financial health: The failure to secure the deal could negatively impact Banco Master's financial stability, particularly if the assets were intended to alleviate financial burdens or boost liquidity.

-

Likelihood of finding alternative buyers for the assets: Banco Master will likely need to actively seek alternative buyers for the assets. The success of this endeavor will depend on factors such as market conditions, the attractiveness of the assets, and the overall economic climate in Brazil.

-

Analysis of potential strategic implications for Banco Master: Banco Master might need to readjust its strategic plans in light of JBS's withdrawal. This could involve exploring different divestment strategies, focusing on internal growth, or seeking partnerships to achieve its goals.

-

Discussion of Banco Master's future plans: The future direction of Banco Master will depend on how effectively they can adapt to this setback. Close monitoring of their announcements and financial reports is crucial.

Market Reaction and Investor Sentiment

The market's reaction to JBS's withdrawal from the Banco Master deal offers valuable insights into investor sentiment. We will analyze the immediate impact on stock prices and trading volume, along with expert opinions. The keywords here are market reaction, investor sentiment, stock prices, JBSS3 stock price, trading volume, analyst opinions.

-

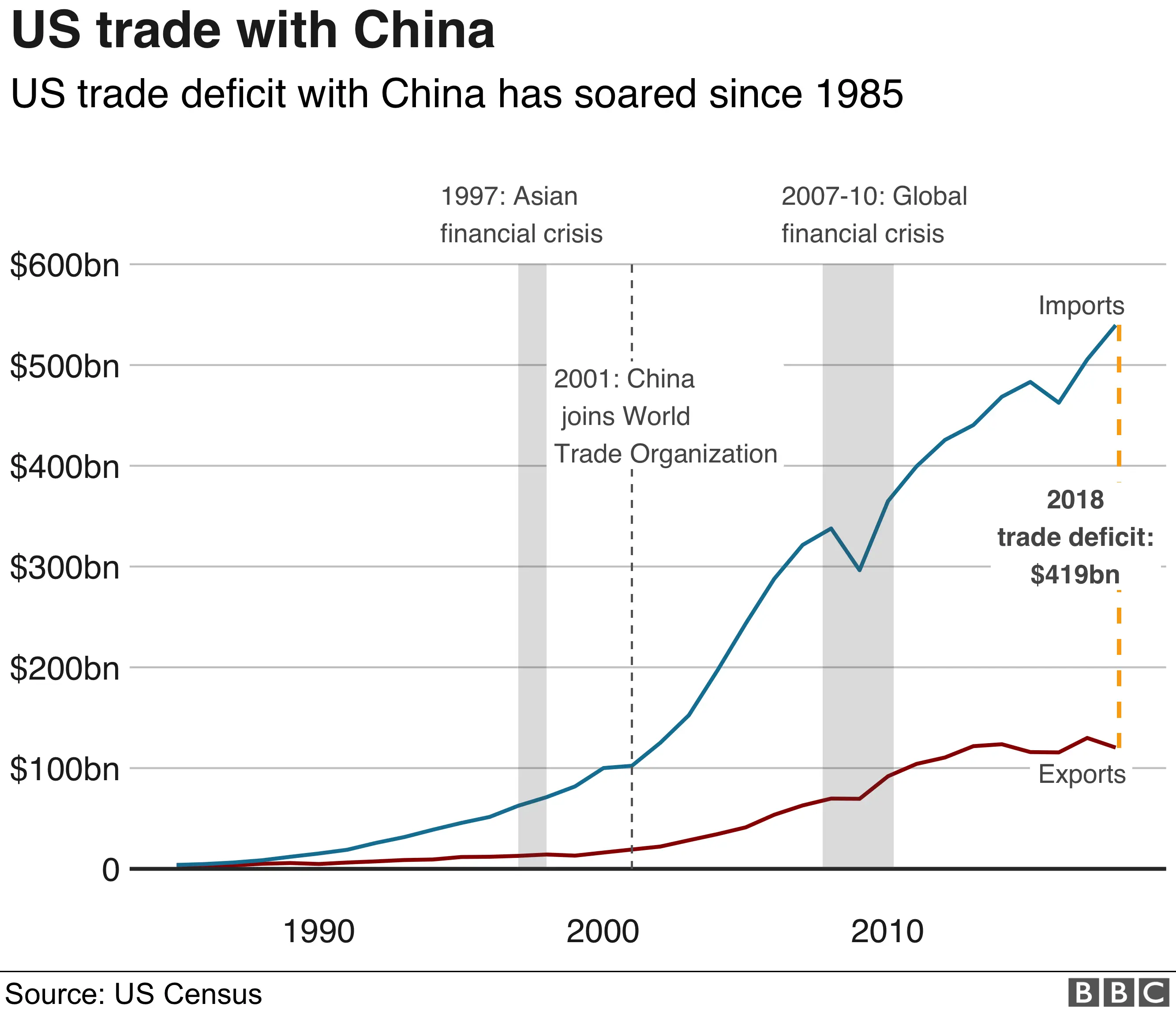

Immediate stock market reaction to the news (JBSS3 and Banco Master, if applicable): [Detail the immediate changes in JBSS3 stock price and trading volume following the announcement. Include data and charts if available].

-

Analysis of trading volume following the announcement: Increased trading volume usually indicates higher investor interest and potentially heightened volatility. Analyze the significance of trading volume changes following the news.

-

Expert opinions and analyst forecasts: [Include insights from financial analysts and experts regarding the impact of the withdrawal on JBS, Banco Master, and the broader Brazilian market. Quote reputable sources to support your analysis].

-

Overall investor sentiment and confidence: Summarize the overall investor sentiment towards JBS and Banco Master in the aftermath of the withdrawal, highlighting any shifts in confidence levels.

Alternative Investment Opportunities in the Brazilian Market

Given JBS's withdrawal, investors might look for alternative investment opportunities within the dynamic Brazilian market. The keywords here are Brazilian market, investment opportunities, alternative acquisitions, M&A activity, investment strategies.

-

Examples of similar companies or assets that might be attractive alternatives: [Suggest alternative companies or assets in the Brazilian market that present similar investment opportunities to the Banco Master acquisition].

-

Overview of investment opportunities in the Brazilian market: [Provide a brief overview of attractive sectors and investment possibilities within the Brazilian economy].

-

Potential risks and rewards associated with these alternatives: [Always emphasize the importance of conducting thorough due diligence before making any investment decisions. Highlight both potential rewards and the inherent risks of investing in emerging markets].

Conclusion

JBS's (JBSS3) withdrawal from the Banco Master asset acquisition talks has created significant uncertainty, affecting both companies and the broader Brazilian market. The reasons behind the withdrawal, whether explicitly stated or speculated upon, underscore the complexities of M&A deals and the ever-changing dynamics of the financial landscape. Investors need to closely monitor the unfolding situation, analyzing the impact on both companies and searching for new investment opportunities within the Brazilian market.

Call to Action: Stay informed about the evolving situation and other significant developments in the Brazilian market by regularly checking for updates on the JBS (JBSS3) and Banco Master situation. Continue researching investment opportunities in the Brazilian market to stay ahead of the curve. Monitor the JBSS3 stock price and related financial news for further insights. Understanding the intricacies of the Brazilian market and the ramifications of this significant M&A development is crucial for strategic investment decisions.

Featured Posts

-

Jbs Abandoning Banco Master Assets Acquisition Bid Jbss 3 Implications

May 18, 2025

Jbs Abandoning Banco Master Assets Acquisition Bid Jbss 3 Implications

May 18, 2025 -

Medicaid Cuts A Republican Rift

May 18, 2025

Medicaid Cuts A Republican Rift

May 18, 2025 -

Millions Lost Office365 Executive Email Compromise Exploited

May 18, 2025

Millions Lost Office365 Executive Email Compromise Exploited

May 18, 2025 -

King Day 2024 Celebration Plans Vs Abolition Debate

May 18, 2025

King Day 2024 Celebration Plans Vs Abolition Debate

May 18, 2025 -

Eurovision 2025 Uk Entry Announced Amidst Most Controversial Acts

May 18, 2025

Eurovision 2025 Uk Entry Announced Amidst Most Controversial Acts

May 18, 2025

Latest Posts

-

Analysis Trumps 30 China Tariffs Projected To Remain Until 2025

May 18, 2025

Analysis Trumps 30 China Tariffs Projected To Remain Until 2025

May 18, 2025 -

Gold Prices Decline Amidst Us China Trade Optimism

May 18, 2025

Gold Prices Decline Amidst Us China Trade Optimism

May 18, 2025 -

Gold Slumps As Traders Secure Gains On Us China Trade Hopes

May 18, 2025

Gold Slumps As Traders Secure Gains On Us China Trade Hopes

May 18, 2025 -

Gary Mar On Carneys Cabinet A Call For Accountable Governance

May 18, 2025

Gary Mar On Carneys Cabinet A Call For Accountable Governance

May 18, 2025 -

Gold Price Dip Profit Taking After Us China Trade Deal Optimism

May 18, 2025

Gold Price Dip Profit Taking After Us China Trade Deal Optimism

May 18, 2025