Mixed Week For CAC 40: Friday Losses Balanced By Overall Stability (March 7, 2025)

Table of Contents

Early Week Gains: Factors Contributing to Positive Momentum

The CAC 40 started the week on a strong note, fueled by a confluence of positive factors. This positive market sentiment and index performance were driven by several key developments.

Positive Economic Indicators

Several positive economic indicators released earlier in the week boosted investor confidence and contributed to the initial gains in the CAC 40. Specifically:

- Strong Employment Numbers: France reported unexpectedly strong employment figures, exceeding analyst expectations and signaling robust economic growth. This positive data significantly impacted investor confidence and the overall market sentiment.

- Positive GDP Growth: Preliminary estimates suggested a healthy rate of GDP growth, further reinforcing the positive economic outlook for France. This contributed to improved market sentiment, a crucial factor in the early week CAC 40 performance.

- Increased Consumer Spending: Early indicators pointed towards a rise in consumer spending, suggesting a resilient domestic economy and supporting the overall positive economic picture. This strengthened the positive market sentiment and boosted investor confidence.

These positive economic indicators fuelled significant investor confidence and played a substantial role in the positive early-week performance of the CAC 40. The key factors here are economic growth, unemployment rate, and GDP, all contributing to a positive market outlook.

Strong Corporate Earnings Reports

Several major CAC 40 companies released strong corporate earnings reports, exceeding market expectations and driving positive investor sentiment. Notable examples include:

- [Company A]: Exceeded profit forecasts, driven by strong sales in [sector]. This positive company performance greatly impacted their stock price and positively influenced the overall CAC 40.

- [Company B]: Announced record profits, fueled by increased market share in [sector]. This strong performance from a major CAC 40 company boosted investor confidence and market sentiment.

- [Company C]: Reported better-than-expected revenue growth, indicating a healthy business outlook. This strong financial result contributed positively to the overall market performance of the CAC 40.

These strong corporate earnings reports, showcasing positive company performance and strong financial results, further propelled the CAC 40 upwards at the beginning of the week. Analyzing company performance is crucial for understanding index movement.

Global Market Sentiment

The positive market sentiment wasn't confined to France; a generally positive outlook in global markets also contributed to the CAC 40's early-week gains. Positive trends in other major global markets created a ripple effect, influencing international investment and boosting the CAC 40's performance. This positive global market sentiment played a crucial role in the early-week upward trend. Key factors were the overall global markets, market sentiment, and positive international investment.

Friday's Losses: Understanding the Downturn

The positive momentum of the early week was abruptly reversed on Friday, as the CAC 40 experienced a significant decline. Several factors contributed to this downturn.

Impact of the ECB Interest Rate Hike

The unexpected interest rate hike announced by the ECB on Thursday was a major catalyst for Friday's losses. The increased interest rates raised concerns about inflation and its potential impact on economic growth, prompting investors to take a more cautious approach. This unexpected change directly impacted market sentiment, leading to profit-taking and a sell-off in the CAC 40. Key factors at play here were interest rates, inflation, and its effect on overall market sentiment.

Profit-Taking and Market Corrections

Following the early week gains, some investors engaged in profit-taking, selling their positions to secure their profits. This contributed to the downward pressure on the CAC 40. Moreover, the decline may also be viewed as a necessary market correction, adjusting after the earlier gains. The concepts of profit-taking and market correction are crucial in understanding market volatility and risk management.

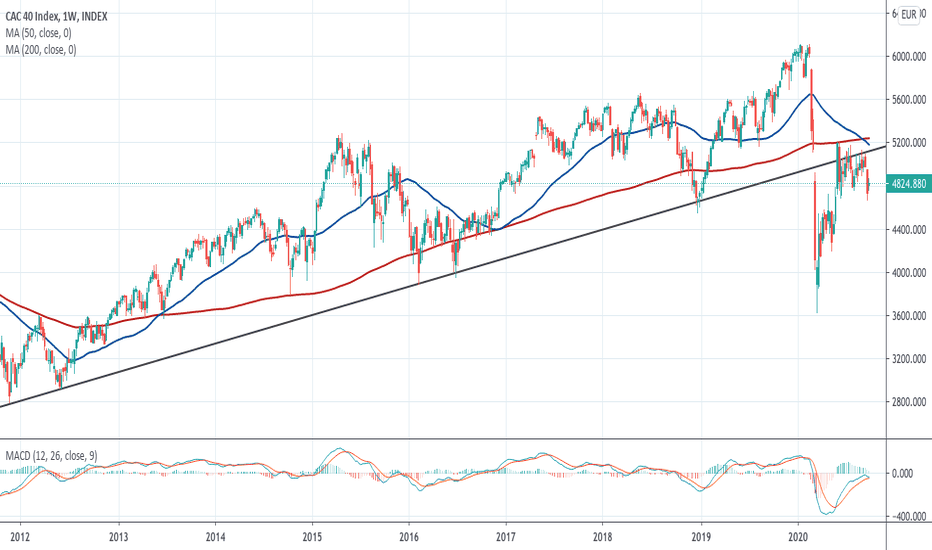

Technical Analysis

A closer look at technical indicators reveals that the CAC 40 had reached a point of resistance, possibly contributing to the sell-off. This resistance level was a significant technical indicator suggesting a potential downturn. Technical analysis, using chart patterns, support levels, and resistance levels, provides valuable insights into market trends.

Overall Weekly Stability: A Balanced Perspective

Despite Friday's significant losses, the overall weekly performance of the CAC 40 demonstrated resilience. The initial gains cushioned the impact of the Friday decline, resulting in a relatively stable performance for the week. This highlights the market's resilience to short-term fluctuations. This stability is important for long-term investment strategies and demonstrates the importance of risk assessment in market analysis.

Conclusion: Analyzing the Mixed Week for the CAC 40

This week's performance of the CAC 40 presented a mixed picture. Positive economic indicators and strong corporate earnings reports fueled early gains, but the unexpected ECB interest rate hike and subsequent profit-taking led to significant losses on Friday. However, the overall stability demonstrated the resilience of the French stock market, suggesting a longer-term market outlook remaining relatively stable. The future performance of the CAC 40 will likely depend on factors such as global economic conditions, geopolitical events, and further announcements from the ECB.

Stay updated on the latest CAC 40 news and analysis to make informed investment decisions. Track the CAC 40's performance and gain valuable insights into the French and global stock markets. Understanding the interplay between economic data, corporate performance, and global market sentiment is crucial for navigating the complexities of the CAC 40 and French stock market.

Featured Posts

-

Avoid Memorial Day Travel Delays 2025 Flight Booking Guide

May 25, 2025

Avoid Memorial Day Travel Delays 2025 Flight Booking Guide

May 25, 2025 -

Amundi Msci World Ex Us Ucits Etf A Deep Dive Into Net Asset Value

May 25, 2025

Amundi Msci World Ex Us Ucits Etf A Deep Dive Into Net Asset Value

May 25, 2025 -

Royal Philips 2025 Annual General Meeting Of Shareholders Key Updates

May 25, 2025

Royal Philips 2025 Annual General Meeting Of Shareholders Key Updates

May 25, 2025 -

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 25, 2025

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 25, 2025 -

Cac 40 Index Finishes Week Lower But Shows Weekly Resilience March 7 2025

May 25, 2025

Cac 40 Index Finishes Week Lower But Shows Weekly Resilience March 7 2025

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025 -

Overnight Disasters 17 Celebrities Whose Careers Imploded

May 25, 2025

Overnight Disasters 17 Celebrities Whose Careers Imploded

May 25, 2025 -

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025 -

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025