Navigating The Dragon's Den: Preparing Your Pitch For Investment

Table of Contents

Understanding Your Audience: Investor Needs and Expectations

Before crafting your pitch, you must deeply understand your target audience: potential investors. This involves more than just knowing their names; it means understanding their investment criteria and preferences.

Identifying Your Ideal Investor Profile

Tailoring your pitch is crucial. Not all investors are created equal. Consider these factors when identifying your ideal investor profile:

- Industry Experience: Do they have a proven track record in your sector?

- Investment Focus: Are they primarily interested in seed funding, Series A, or later-stage investments? Do they focus on specific niches within your industry?

- Risk Tolerance: Are they comfortable with high-growth, high-risk ventures, or do they prefer safer, more established businesses?

Thorough due diligence on potential investors is paramount. Research their past investments, their portfolio companies, and their overall investment philosophy. Understanding their preferences allows you to craft a pitch that resonates with their specific interests and risk appetite. This targeted approach significantly improves your chances of securing funding.

Key Investor Concerns and How to Address Them

Investors have key concerns you must proactively address in your pitch. These often include:

- Market Size and Potential: Demonstrate a large addressable market and significant growth potential for your business. Provide solid market research to support your claims.

- Competitive Landscape: Show a clear understanding of your competitors and highlight your unique value proposition – what sets you apart?

- Team Expertise: Showcase the experience and skills of your team, emphasizing their ability to execute your business plan.

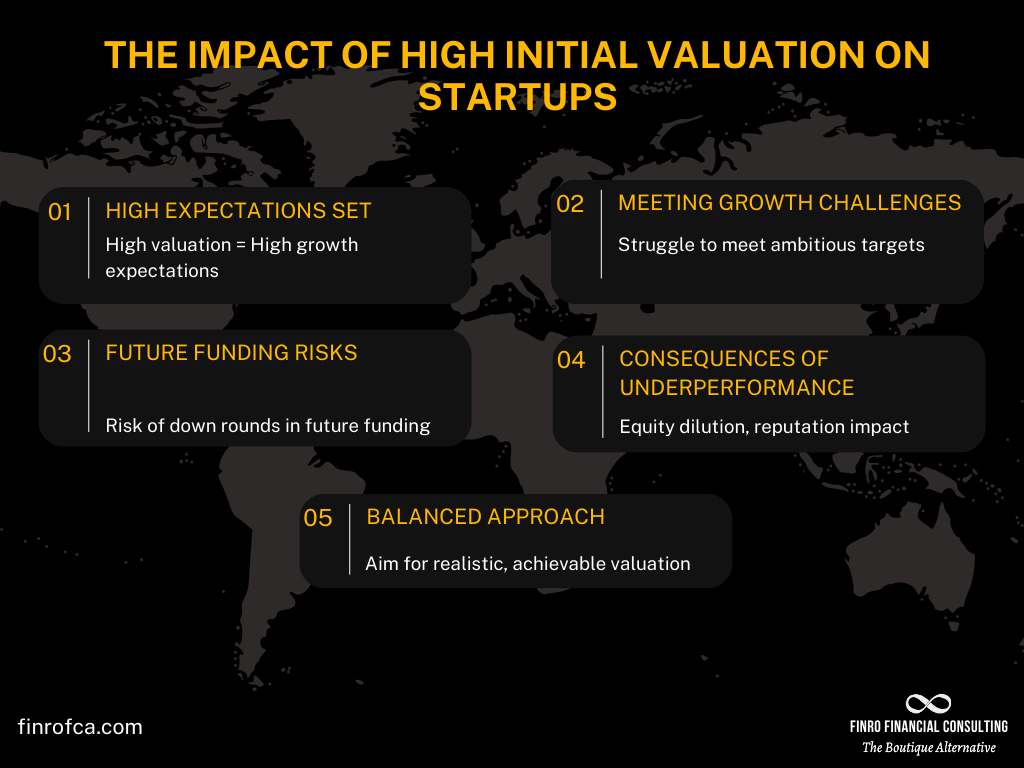

- Financial Projections: Provide realistic and well-supported financial projections, demonstrating a clear path to profitability.

- Exit Strategy: Outline a plausible exit strategy for investors, detailing how they can eventually realize a return on their investment. This shows forethought and understanding of the investment landscape.

Addressing these concerns effectively requires data-driven arguments and a strong understanding of your market position. For example, instead of simply stating your market is large, present data on market size, growth rate, and your projected market share.

Crafting a Compelling Narrative: Storytelling for Investment

A successful pitch is more than just a presentation of facts and figures; it's a compelling narrative that captures the imagination and inspires confidence.

The Power of a Concise and Engaging Story

Investors are drawn to stories. Your pitch should clearly articulate:

- The Problem: Clearly define the problem your business solves.

- Your Solution: Explain how your product or service uniquely addresses this problem.

- The Market Opportunity: Demonstrate the size and potential of the market you're targeting.

- Your Team's Capabilities: Highlight the expertise and experience of your team, emphasizing their ability to execute your plan.

- The "Why": Convey the passion and purpose behind your venture. What drives you?

Conciseness is key. Keep your story focused, avoiding unnecessary jargon or details. Practice delivering your pitch within a strict time limit. Successful startup narratives often focus on a clear problem and a compelling solution, backed by a passionate team.

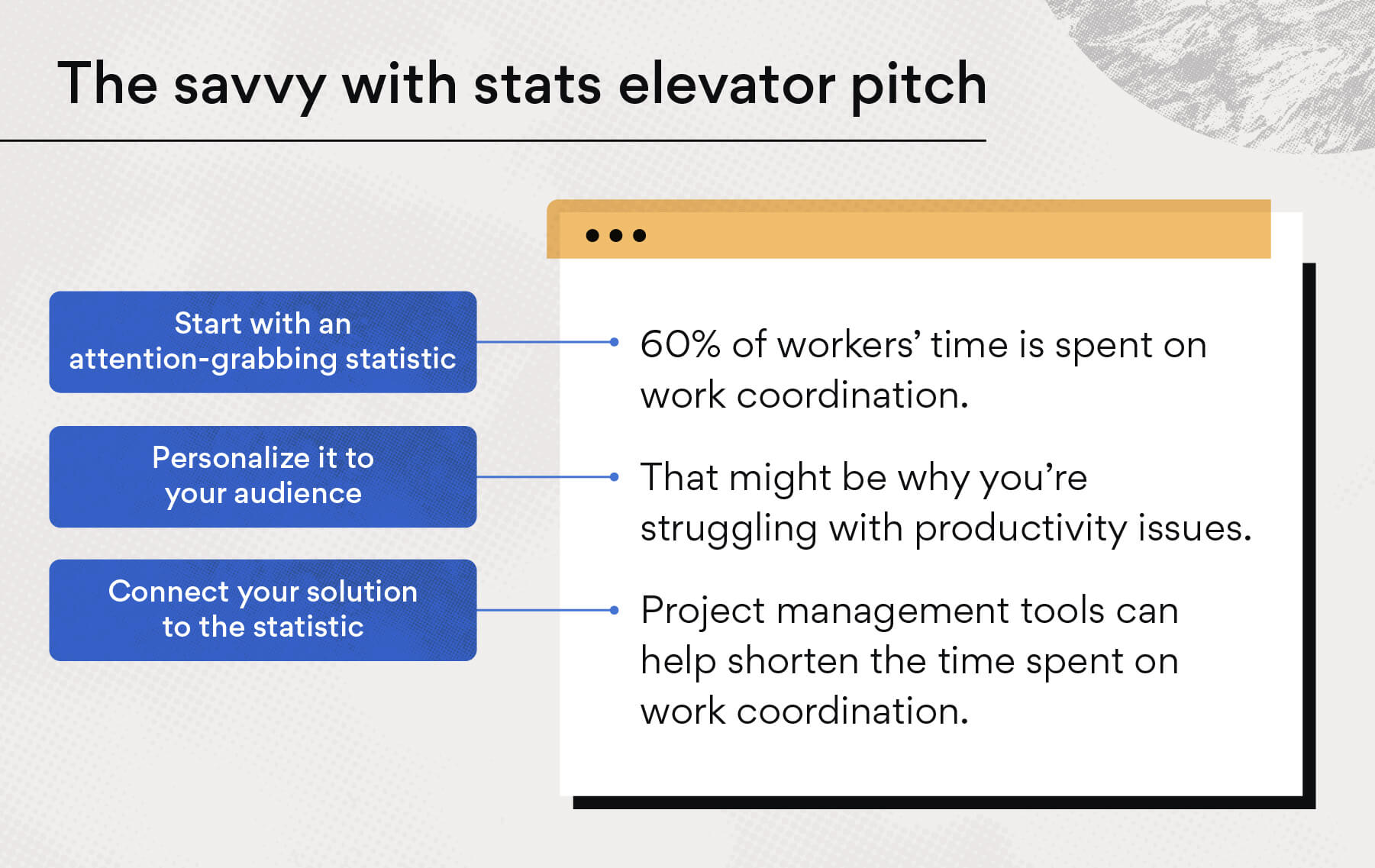

Data-Driven Storytelling: Supporting Your Claims with Evidence

While storytelling is crucial, your narrative must be supported by concrete data.

- Visual Aids: Use charts, graphs, and KPIs to visually represent your progress and projections.

- Financial Projections: Present realistic and well-researched financial projections, outlining revenue, expenses, and profitability.

- Market Analysis: Include credible market research data to support your claims about market size and growth potential.

Avoid speculation; base your claims on evidence. The difference between speculation and substantiated claims is crucial for building investor trust.

Mastering the Art of Delivery: Pitch Presentation and Q&A

Even the best pitch falls flat without effective delivery. Practice and preparation are key.

Practicing Your Pitch: Refining Your Delivery

- Mock Audience: Practice your pitch in front of a mock audience – friends, mentors, or colleagues – to get feedback and refine your delivery.

- Record and Review: Record your pitch and review it critically. Identify areas for improvement in your presentation style, clarity, and pacing.

- Seek Feedback: Actively seek constructive criticism from trusted sources. Be open to suggestions and willing to iterate on your pitch.

Confident and clear communication is vital. Practice until you can deliver your pitch smoothly and naturally, even under pressure. Learn to manage your nerves and maintain composure.

Handling Tough Questions: Anticipating and Addressing Investor Queries

Prepare for challenging questions, such as:

- Financial Questions: Be ready to defend your financial projections and explain your assumptions.

- Competitive Questions: Articulate your competitive advantages and strategies for navigating a competitive landscape.

- Team Questions: Be prepared to address questions about your team's experience and capabilities.

Practice formulating concise and insightful answers. Demonstrating preparedness and problem-solving skills is critical. Gracefully handling challenging questions shows your adaptability and competence.

Post-Pitch Follow-Up: Maintaining Momentum

The pitch itself is only one part of the process. Effective follow-up is crucial for securing investment.

Sending a Thank-You Note and Following Up

- Personalized Thank You: Send a personalized thank-you note reiterating your key points and expressing your gratitude for the investor's time.

- Additional Information: Provide any additional information requested promptly and professionally.

- Professional Communication: Maintain professional and courteous communication throughout the process.

Showing continued interest and professionalism demonstrates your commitment and respect for the investor's time and consideration.

Handling Rejection and Learning from Feedback

Rejection is a part of the process. Instead of viewing it as a setback, approach it as a learning opportunity.

- Request Feedback: Request feedback on your pitch to identify areas for improvement.

- Iterate and Improve: Use the feedback you receive to refine your pitch and make it even stronger for future presentations.

- Maintain a Positive Attitude: Maintain a positive attitude and persevere in your pursuit of investment.

Learning from setbacks is vital for future success. Use rejection as fuel to refine your approach to preparing your pitch for investment.

Successfully Navigating the Dragon's Den

In conclusion, successfully securing investment requires a multifaceted approach. Understanding your audience, crafting a compelling narrative, mastering your delivery, and following up effectively are all crucial components of preparing your pitch for investment. By mastering these elements and approaching the process with thorough preparation and a positive attitude, you significantly increase your chances of securing the funding your business needs to thrive. Start refining your pitch today and confidently approach potential investors!

Featured Posts

-

Bkpm Incar Rp3 6 Triliun Investasi Di Pekanbaru Tahun Ini

May 01, 2025

Bkpm Incar Rp3 6 Triliun Investasi Di Pekanbaru Tahun Ini

May 01, 2025 -

Pasifika Sipoti April 4th At A Glance

May 01, 2025

Pasifika Sipoti April 4th At A Glance

May 01, 2025 -

French Rugby The Six Nations 2025 Challenge

May 01, 2025

French Rugby The Six Nations 2025 Challenge

May 01, 2025 -

Dragons Den Investment How To Secure Funding For Your Venture

May 01, 2025

Dragons Den Investment How To Secure Funding For Your Venture

May 01, 2025 -

Spotlight On Splice A Cay Fest Film Analysis

May 01, 2025

Spotlight On Splice A Cay Fest Film Analysis

May 01, 2025

Latest Posts

-

Pinpointing Success A Geographic Analysis Of The Countrys New Business Hot Spots

May 02, 2025

Pinpointing Success A Geographic Analysis Of The Countrys New Business Hot Spots

May 02, 2025 -

Rust A Retrospective Review Following The On Set Accident

May 02, 2025

Rust A Retrospective Review Following The On Set Accident

May 02, 2025 -

Stock Market Valuation Concerns Bof As Response To Investor Anxiety

May 02, 2025

Stock Market Valuation Concerns Bof As Response To Investor Anxiety

May 02, 2025 -

The Strategic Importance Of Effective Middle Management For Organizational Success

May 02, 2025

The Strategic Importance Of Effective Middle Management For Organizational Success

May 02, 2025 -

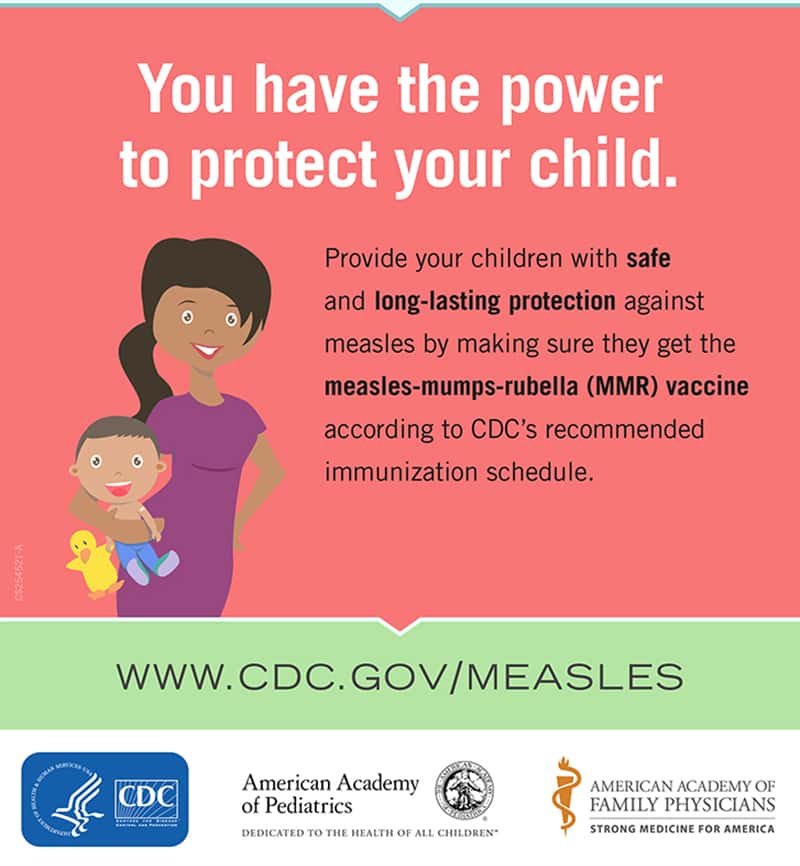

Us Vaccine Safety And The Current Measles Epidemic

May 02, 2025

Us Vaccine Safety And The Current Measles Epidemic

May 02, 2025