Net Asset Value (NAV) Explained: Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net value of an asset after deducting liabilities. For an ETF like the Amundi Dow Jones Industrial Average UCITS ETF, it's a crucial indicator of its underlying value.

Definition of NAV and its Calculation:

NAV is calculated using a simple formula:

(Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV per Share

Let's illustrate with an example: Imagine an ETF with total assets of $10 million and total liabilities of $100,000, and 1 million outstanding shares. The NAV per share would be: ($10,000,000 - $100,000) / 1,000,000 = $9.90.

NAV and ETF Pricing:

While the NAV influences the ETF's market price, they are not always identical. Market price fluctuates throughout the trading day based on supply and demand, while the NAV is calculated at the end of the trading day. Discrepancies can arise due to factors such as trading volume and investor sentiment. Intraday fluctuations can cause the market price to temporarily deviate from the NAV.

Components of NAV for the Amundi Dow Jones Industrial Average UCITS ETF:

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF includes:

- Assets: This primarily comprises the value of the ETF's holdings, which track the Dow Jones Industrial Average. This includes shares of companies like Apple, Microsoft, and Nike. The value of these holdings directly impacts the ETF's NAV.

- Liabilities: These include the ETF's operating expenses, management fees, and any other outstanding obligations.

- Dividend Distributions: Dividend payments from the underlying holdings reduce the ETF's assets and consequently, its NAV. However, investors receive these dividends directly, offsetting the reduction in NAV.

Understanding NAV in the Context of the Amundi Dow Jones Industrial Average UCITS ETF

The Amundi Dow Jones Industrial Average UCITS ETF aims to replicate the performance of the Dow Jones Industrial Average. Understanding its NAV helps investors assess its performance and make informed decisions.

Specifics of the Amundi Dow Jones Industrial Average UCITS ETF:

- Investment Strategy: The ETF uses a passive investment strategy, aiming to mirror the composition and performance of the Dow Jones Industrial Average.

- Holdings and NAV Fluctuations: The ETF's NAV fluctuates based on the performance of its underlying holdings (the 30 companies in the Dow Jones Industrial Average). A rise in the value of these companies increases the NAV, and vice-versa.

- Expense Ratio's Impact on NAV: The ETF's expense ratio (a small annual fee) reduces the NAV slightly over time.

Tracking Error:

Tracking error measures how closely the ETF's performance matches its benchmark (the Dow Jones Industrial Average). A high tracking error indicates that the ETF’s performance deviates significantly from its benchmark, which might affect the NAV. Factors influencing tracking error include transaction costs and the timing of asset purchases and sales.

NAV and Investment Decisions:

Investors can use NAV data to:

- Evaluate ETF Performance: Compare the NAV over time to assess the ETF's growth or decline.

- Make Buy/Sell Decisions: While not the sole factor, NAV can be a valuable data point when considering buying or selling the ETF, especially when considering the market price in relation to the NAV.

How to Access and Interpret NAV Data for the Amundi Dow Jones Industrial Average UCITS ETF

Accurate NAV data for the Amundi Dow Jones Industrial Average UCITS ETF can be found through:

- Official Sources: The Amundi website is the primary source. Reputable financial news websites and brokerage platforms also provide this information.

- Data Frequency: NAV is typically calculated and published daily, at the close of the market.

- Interpreting the Data: Monitor changes in the NAV over time to gauge the ETF's performance. Compare the NAV to the market price to identify potential buying or selling opportunities.

Conclusion: Mastering Net Asset Value (NAV) for Successful ETF Investing

Understanding Net Asset Value (NAV) is critical for successful ETF investing. By monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF, you can gain valuable insights into its performance and make informed investment decisions. Remember to consider the NAV alongside other factors before buying or selling. Improve your ETF investment strategy by understanding your ETF's NAV. Learn more about NAV and the Amundi Dow Jones Industrial Average UCITS ETF today to make sound investment choices.

Featured Posts

-

Beurzen Herstellen Na Trump Uitstel Aex Fondsen Stijgen

May 24, 2025

Beurzen Herstellen Na Trump Uitstel Aex Fondsen Stijgen

May 24, 2025 -

How To Interpret The Net Asset Value Of The Amundi Djia Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Of The Amundi Djia Ucits Etf

May 24, 2025 -

Investing In Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Nav Perspective

May 24, 2025

Investing In Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Nav Perspective

May 24, 2025 -

Amsterdam Exchange Down 2 Following Latest Trump Tariff Announcement

May 24, 2025

Amsterdam Exchange Down 2 Following Latest Trump Tariff Announcement

May 24, 2025 -

Finding Your Dream Country Home For Under 1 Million

May 24, 2025

Finding Your Dream Country Home For Under 1 Million

May 24, 2025

Latest Posts

-

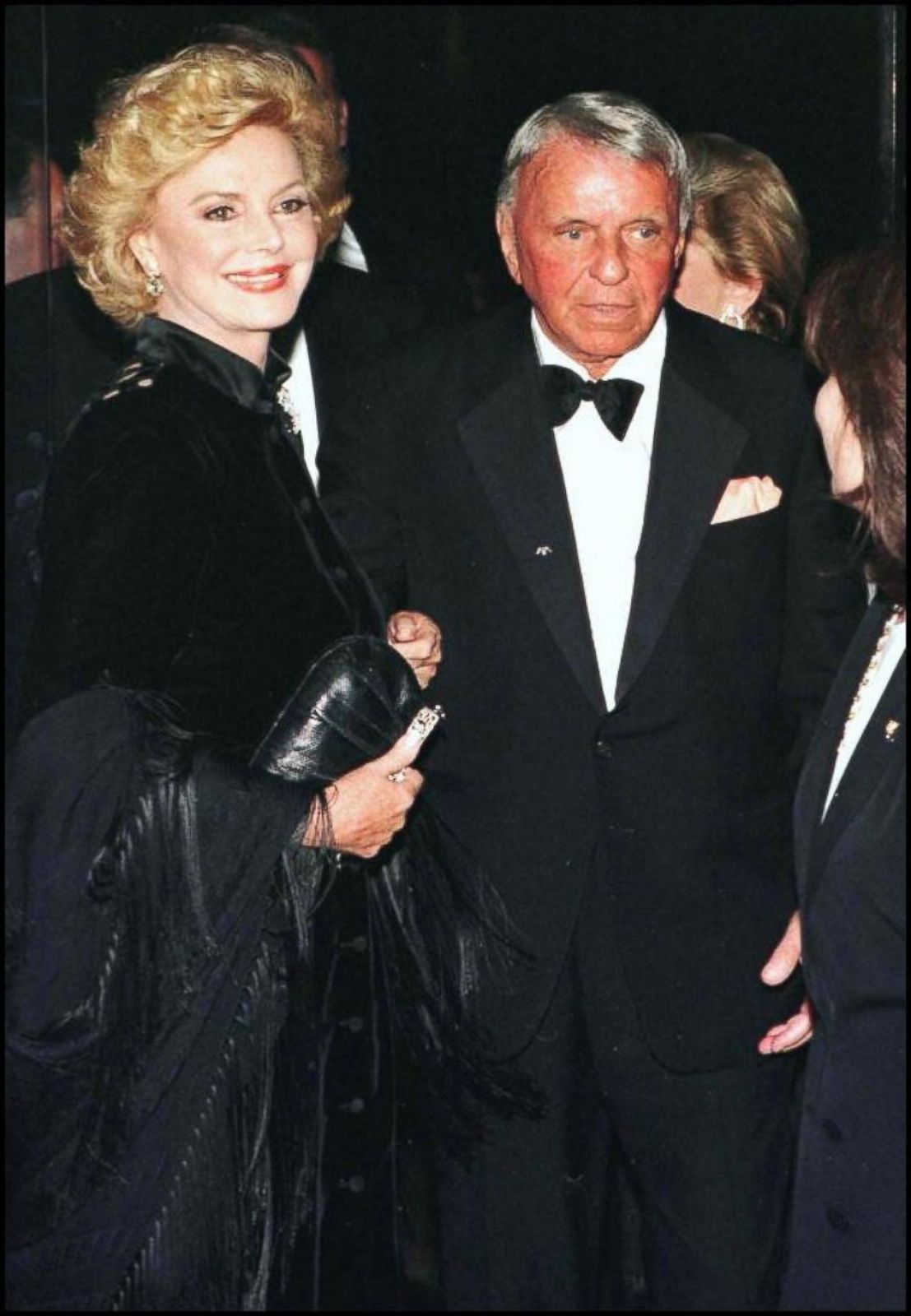

Frank Sinatra And His Four Wives Exploring His Love Life

May 24, 2025

Frank Sinatra And His Four Wives Exploring His Love Life

May 24, 2025 -

17 Celebrities Who Destroyed Their Careers Overnight

May 24, 2025

17 Celebrities Who Destroyed Their Careers Overnight

May 24, 2025 -

Frank Sinatras Four Marriages A Look At His Wives And Relationships

May 24, 2025

Frank Sinatras Four Marriages A Look At His Wives And Relationships

May 24, 2025 -

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025 -

The Woody Allen Controversy Sean Penns Endorsement And The Renewed Focus On Sexual Abuse Claims

May 24, 2025

The Woody Allen Controversy Sean Penns Endorsement And The Renewed Focus On Sexual Abuse Claims

May 24, 2025