Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc: Analysis And Implications

Table of Contents

What is Net Asset Value (NAV)?

NAV represents the net asset value of a single share in an ETF. It's calculated by taking the total value of all the assets held in the ETF's portfolio (like stocks, bonds, and other securities), subtracting any liabilities, and then dividing by the total number of outstanding shares. For ETF investors, the NAV provides a snapshot of the underlying asset value of each share.

Introducing Amundi MSCI All Country World UCITS ETF USD Acc

The Amundi MSCI All Country World UCITS ETF USD Acc (we'll refer to it as the "Amundi World ETF" for brevity) aims to track the performance of the MSCI All Country World Index. This index provides broad exposure to global equities across developed and emerging markets. This makes it attractive to investors seeking global diversification in their portfolios. Its investment objective is to replicate the performance of the index as closely as possible.

This article will analyze the NAV of the Amundi World ETF and discuss its implications for investors.

Factors Influencing the NAV of Amundi MSCI All Country World UCITS ETF USD Acc

Several factors influence the NAV of the Amundi World ETF. Understanding these is crucial for interpreting its price movements and making informed investment choices.

Currency Fluctuations

Since the Amundi World ETF holds assets denominated in various currencies, fluctuations in exchange rates significantly impact its NAV, particularly against the USD.

- Example: A weakening Euro (EUR) against the USD will reduce the USD value of assets held in EUR, lowering the ETF's NAV.

- Mechanism: The ETF's NAV is calculated in USD. Changes in exchange rates directly affect the USD equivalent of the underlying assets.

- Hedging Strategies: While the Amundi World ETF may not fully hedge currency risk, understanding this risk is essential. Investors can consider hedging strategies through other instruments if they wish to mitigate currency fluctuations.

Market Performance of Underlying Assets

The performance of the global equity markets directly impacts the Amundi World ETF's NAV. The ETF's holdings are diversified across various sectors and geographies, but overall market trends will be reflected in its NAV.

- Key Indices: The S&P 500, MSCI Emerging Markets Index, and other major global indices significantly affect the ETF's performance and thus, its NAV.

- Sector Influence: Strong performance in technology or energy sectors will positively impact the NAV, while poor performance in these or other sectors will have the opposite effect.

- Global Economic Conditions: Recessions or economic booms in major economies will significantly affect the underlying assets and, consequently, the NAV.

Expense Ratio and Management Fees

The ETF's expense ratio and management fees are deducted from the assets under management, impacting the NAV over time. Although seemingly small, these costs compound over the long term.

- Long-Term Impact: A seemingly small difference in expense ratios between two similar ETFs can lead to significant differences in long-term returns.

- Comparison is Key: Compare the expense ratio of the Amundi World ETF to other similar ETFs before investing.

Dividend Distributions

Dividend payments from the underlying companies in the ETF's portfolio will influence the NAV.

- Timing: The NAV will typically decrease slightly on the ex-dividend date (the date after which a buyer of the stock is no longer entitled to the dividend).

- Effect: Investors receive the dividend payment separately. Thus, the NAV adjusts downward to reflect the distribution of assets to shareholders.

Analyzing Historical NAV Trends of Amundi MSCI All Country World UCITS ETF USD Acc

Analyzing historical NAV data provides valuable insights into the ETF's performance and potential risks. (Note: Actual charts would be included here in a published article.)

Long-Term Performance

Historical NAV data reveal long-term growth patterns. We can observe periods of significant growth and periods of decline, comparing this to the performance of benchmark indices like the MSCI All Country World Index to assess how effectively the ETF tracks its benchmark.

- Growth Periods: Identify periods of strong NAV growth driven by positive market trends and overall economic health.

- Decline Periods: Analyze periods of NAV decline and the contributing factors, such as market corrections or global economic downturns.

Short-Term Volatility

Short-term NAV fluctuations are common and often influenced by various factors.

- Geopolitical Events: Major geopolitical events, such as wars or political instability, can cause significant short-term fluctuations.

- Economic News: Important economic announcements (interest rate changes, inflation data, etc.) can trigger market reactions and NAV volatility.

Comparison to Similar ETFs

Comparing the NAV performance of the Amundi World ETF with similar globally diversified ETFs provides a benchmark for evaluating its performance. (Specific competing ETFs would be named here, with their performance data compared and contrasted).

- Performance Differences: Highlight any performance differences and analyze the reasons behind them (expense ratios, investment strategies, etc.).

Implications of NAV for Investors in Amundi MSCI All Country World UCITS ETF USD Acc

Understanding NAV fluctuations is crucial for informed investment decisions and risk management.

Investment Strategy Considerations

Monitoring the NAV helps implement effective investment strategies.

- Dollar-Cost Averaging: Investing a fixed amount at regular intervals, regardless of NAV fluctuations, can mitigate risk.

- Buy-and-Hold Strategy: A long-term buy-and-hold strategy can be more effective when the NAV reflects long-term growth potential.

Risk Management

NAV analysis assists in risk management.

- Identifying Risks: Significant and sustained NAV declines may signal underlying market risks.

- Opportunities: Periods of NAV decline might present buying opportunities for long-term investors.

Tax Implications

Changes in NAV and dividend distributions have tax implications.

- Capital Gains Tax: Profits from selling shares (when the selling price exceeds the purchase price) are subject to capital gains tax.

- Dividend Tax: Dividend payments are also subject to taxation. The NAV reflects the after-tax value of the ETF’s assets following dividend distributions.

Conclusion: Making Informed Decisions with Amundi MSCI All Country World UCITS ETF USD Acc NAV

Understanding the factors influencing the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for investors. By analyzing historical NAV trends, comparing it with similar ETFs, and considering the impact of market forces, currency fluctuations, and fees, investors can make more informed decisions. Regularly monitoring the NAV, combined with a well-defined investment strategy, allows for effective risk management and maximizes the potential for long-term growth. By understanding the NAV and its fluctuations, you can make better-informed investment decisions and optimize your global equity exposure.

Featured Posts

-

Losses On Frankfurt Stock Exchange Dax Closes Below 24 000

May 25, 2025

Losses On Frankfurt Stock Exchange Dax Closes Below 24 000

May 25, 2025 -

Joy Crookes Unveils Carmen Her Latest Single

May 25, 2025

Joy Crookes Unveils Carmen Her Latest Single

May 25, 2025 -

Avrupa Borsalari Buguenkue Kapanista Karisik Bir Tablo

May 25, 2025

Avrupa Borsalari Buguenkue Kapanista Karisik Bir Tablo

May 25, 2025 -

Car Overturns On M56 Motorway Crash Causes Casualties

May 25, 2025

Car Overturns On M56 Motorway Crash Causes Casualties

May 25, 2025 -

Serious M6 Crash Live Traffic News And Route Diversions

May 25, 2025

Serious M6 Crash Live Traffic News And Route Diversions

May 25, 2025

Latest Posts

-

Waiting For The Call A Reflection

May 25, 2025

Waiting For The Call A Reflection

May 25, 2025 -

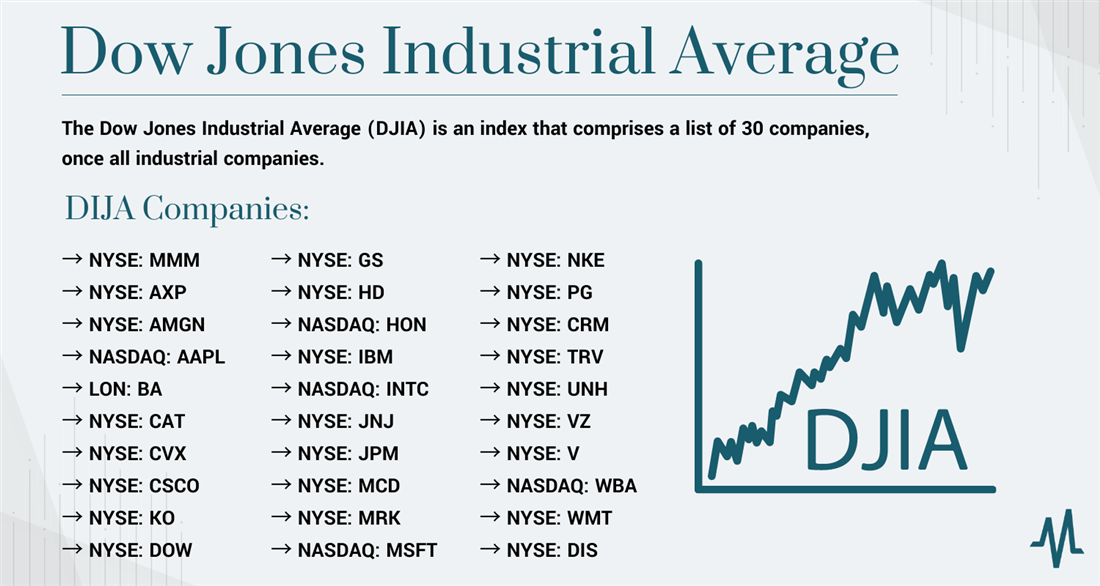

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025 -

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist A Guide To Net Asset Value

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist A Guide To Net Asset Value

May 25, 2025 -

Police Helicopter Pursuit Unbelievable Refueling Stop At 90mph

May 25, 2025

Police Helicopter Pursuit Unbelievable Refueling Stop At 90mph

May 25, 2025