Oil Price Volatility And Its Consequences For Airline Operations

Table of Contents

Fuel Costs as a Major Expense for Airlines

Fuel represents a substantial portion of an airline's operating costs, typically ranging from 20% to 40%, depending on factors such as route length, aircraft type, and fuel efficiency. This makes airlines extremely vulnerable to even minor shifts in global oil prices.

Percentage of Operating Costs:

Fuel costs represent a significant portion of an airline's operating expenses. For many airlines, fuel costs constitute between 20% and 40% of total operating costs. This high percentage means that even a small percentage increase in fuel prices can significantly impact profitability. Low-cost carriers (LCCs), with their already lean margins, are particularly sensitive to fuel price increases.

- Impact of Price Increases: Even a seemingly small increase of 5-10% in oil prices can dramatically reduce airline profit margins, potentially pushing them into losses, especially during periods of low passenger demand.

- Low-Cost vs. Full-Service Airlines: The impact of oil price volatility differs between low-cost carriers and full-service airlines. LCCs, operating on razor-thin margins, are more exposed to fuel price shocks compared to full-service airlines, which have more diverse revenue streams.

- Fuel Hedging Strategies: Airlines employ various fuel hedging strategies, such as purchasing fuel futures contracts, to mitigate the risk of price volatility. However, these strategies are not without risk, and inaccurate predictions can lead to significant financial losses.

Impact of Oil Price Volatility on Airline Ticket Pricing

Airlines respond to changes in fuel costs by adjusting their ticket prices. This dynamic interaction between fuel costs and ticket prices is a key determinant of airline profitability and passenger numbers.

Price Adjustments and Consumer Demand:

The elasticity of demand for air travel plays a critical role in how airlines react to rising fuel costs.

- Demand Elasticity: During periods of high oil prices, the demand for air travel may decrease, especially for price-sensitive travelers. This necessitates a careful balancing act between maintaining revenue and preserving passenger numbers.

- Price Increases and Passenger Numbers: Significant price increases can lead to a drop in passenger numbers, offsetting any potential gains from increased fuel surcharges. Airlines need to carefully consider the price sensitivity of their target market when adjusting fares.

- Ancillary Revenue: Airlines may try to compensate for increased fuel costs by increasing revenue from ancillary services like baggage fees, seat selection, and onboard meals. This strategy helps mitigate the direct impact of fuel price hikes on profitability.

Route Optimization and Network Planning

Fluctuating fuel prices significantly impact airlines' route planning and network strategies.

- Flight Frequency and Route Cancellations: Airlines might reduce flight frequencies on less profitable routes or even cancel them altogether if fuel costs become unsustainable.

- Fuel-Efficient Aircraft and Optimized Flight Paths: The adoption of more fuel-efficient aircraft and the optimization of flight paths are crucial strategies to reduce fuel consumption and mitigate the impact of price volatility.

- Data Analytics for Fuel Cost Prediction: Airlines leverage advanced data analytics and forecasting models to predict future fuel costs and adjust their network planning accordingly, enabling more proactive and effective responses to market changes.

Operational Efficiency and Cost-Cutting Measures

To mitigate the effects of oil price volatility, airlines implement various operational strategies aimed at improving fuel efficiency and reducing overall costs.

Implementing Fuel-Saving Strategies:

Airlines are constantly seeking ways to reduce their fuel consumption. These strategies include:

- Lighter Aircraft and Aerodynamic Designs: Using lighter aircraft materials and incorporating aerodynamic design improvements minimizes fuel burn.

- Fuel-Efficient Flying Techniques: Comprehensive crew training programs focusing on fuel-efficient flying techniques are essential for optimizing fuel consumption.

- Technological Advancements: The adoption of advanced flight planning software and other technological solutions contributes to more efficient fuel management and reduces overall fuel burn.

The Long-Term Implications for Airline Sustainability

The long-term sustainability of the airline industry is inextricably linked to its ability to manage and mitigate the risks associated with oil price volatility. This necessitates a shift towards sustainable alternatives.

Investment in Sustainable Aviation Fuel (SAF)

Investment in Sustainable Aviation Fuel (SAF) is crucial for reducing the industry’s reliance on fossil fuels and mitigating the impact of oil price volatility.

- Challenges and Opportunities of SAF Adoption: While SAF offers a promising solution, its current production levels are limited, and the cost of SAF is significantly higher than conventional jet fuel.

- Government Policies and Incentives: Government policies and financial incentives play a crucial role in driving the development and adoption of SAF.

- Collaboration for a Sustainable Future: Collaboration between airlines, fuel producers, and governments is essential to accelerate SAF production, improve its cost-effectiveness, and build a sustainable future for the aviation industry.

Conclusion

Oil price volatility presents a significant and ongoing challenge for airline operations, impacting nearly every aspect of their business, from fuel costs and ticket pricing to route planning and long-term sustainability. To navigate this turbulent landscape, airlines must proactively implement a range of strategies, including effective fuel hedging, continuous improvements in operational efficiency, and investments in sustainable aviation fuel. Understanding the multifaceted consequences of oil price volatility is crucial for ensuring the long-term financial stability and environmental responsibility of the airline industry. Continuous monitoring of oil price volatility and proactive adaptation are essential for airlines to thrive in this dynamic and ever-changing market.

Featured Posts

-

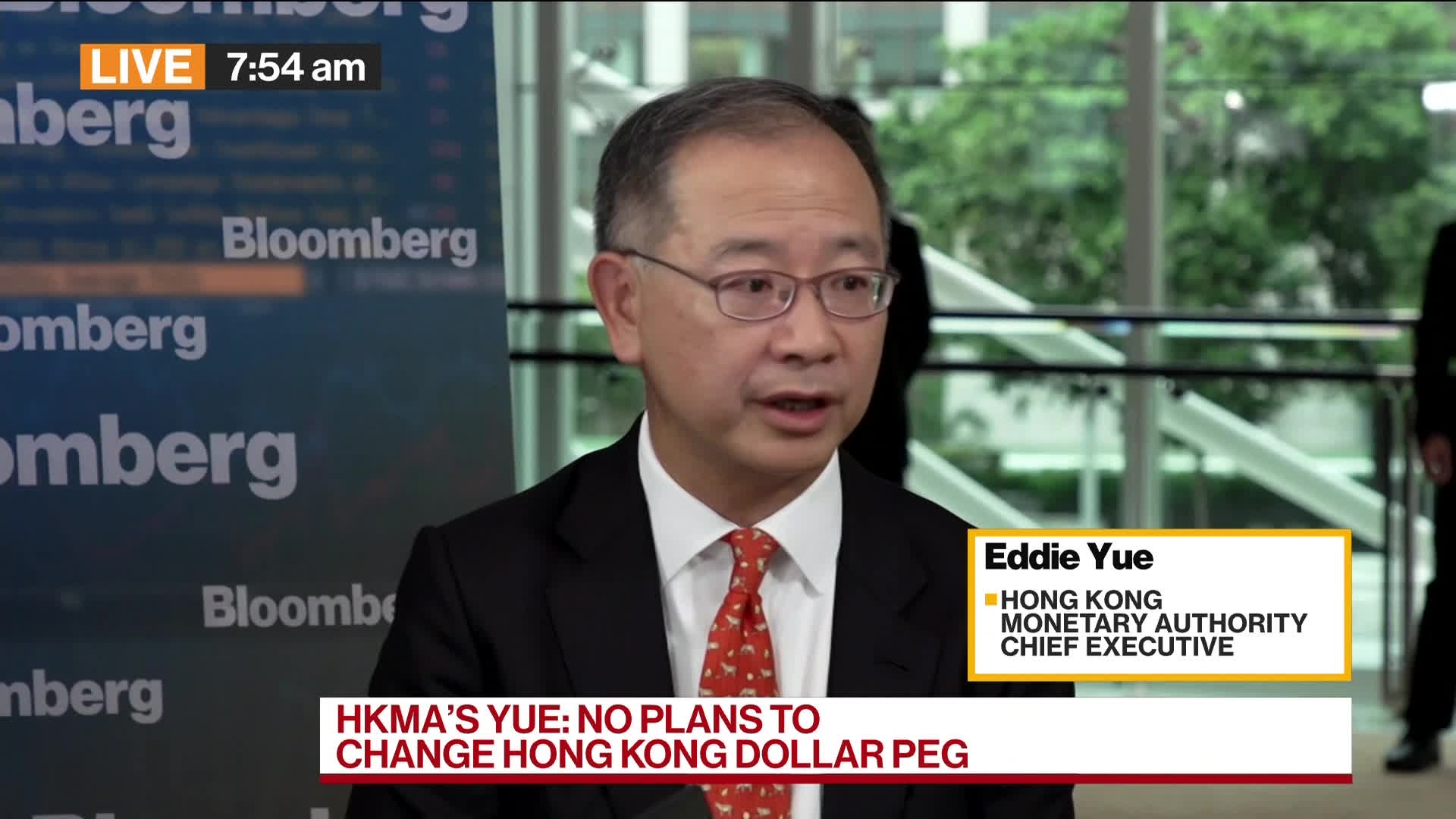

Hkma Buys Us Dollars To Uphold Hong Kong Dollar Peg

May 04, 2025

Hkma Buys Us Dollars To Uphold Hong Kong Dollar Peg

May 04, 2025 -

Understanding The Recent Gold Price Decline Two Weekly Losses In 2025

May 04, 2025

Understanding The Recent Gold Price Decline Two Weekly Losses In 2025

May 04, 2025 -

Sheins Faltering London Ipo A Tariff Induced Setback

May 04, 2025

Sheins Faltering London Ipo A Tariff Induced Setback

May 04, 2025 -

Post Roe America How Otc Birth Control Changes The Landscape

May 04, 2025

Post Roe America How Otc Birth Control Changes The Landscape

May 04, 2025 -

Migrants Desperate Eight Hour Treetop Hideout From Ice

May 04, 2025

Migrants Desperate Eight Hour Treetop Hideout From Ice

May 04, 2025

Latest Posts

-

Morning Coffee Hockey Oilers Game Outlook Against Montreal

May 04, 2025

Morning Coffee Hockey Oilers Game Outlook Against Montreal

May 04, 2025 -

First Round Nhl Playoffs Key Factors And Predictions

May 04, 2025

First Round Nhl Playoffs Key Factors And Predictions

May 04, 2025 -

Canadiens Vs Oilers Your Morning Coffee Hockey Preview

May 04, 2025

Canadiens Vs Oilers Your Morning Coffee Hockey Preview

May 04, 2025 -

Stanley Cup Playoffs Understanding The Crucial First Round

May 04, 2025

Stanley Cup Playoffs Understanding The Crucial First Round

May 04, 2025 -

Will The Oilers Bounce Back Against The Canadiens A Morning Coffee Preview

May 04, 2025

Will The Oilers Bounce Back Against The Canadiens A Morning Coffee Preview

May 04, 2025