Post-Suspension Rally: Chinese Equities Rise On Renewed US Trade Optimism And Positive Economic Signals

Table of Contents

Renewed US Trade Optimism Fuels Market Recovery

Recent positive developments in US-China trade relations have played a crucial role in reviving investor confidence and igniting the post-suspension rally in Chinese equities. The easing of trade tensions has created a more predictable and less volatile environment, encouraging investment and boosting market sentiment.

- Specific examples of easing trade tensions: While a comprehensive trade deal remains elusive, positive developments such as paused tariff increases and renewed high-level dialogue have calmed market anxieties. The willingness of both sides to engage in further discussions signals a potential path towards a more stable trade relationship.

- Impact on investor sentiment and market confidence: This improved outlook has significantly boosted investor sentiment. The fear of escalating trade wars, which previously dampened market activity, has subsided, leading to increased investment flows into Chinese equities.

- Sectors benefiting from this improved outlook: The technology and manufacturing sectors, which were particularly hard-hit by the trade war, are experiencing a strong rebound. Improved access to US markets and reduced tariff burdens are expected to boost their profitability and growth. The Shanghai Composite Index, for example, saw a significant percentage increase of X% following the positive trade news.

- Relevant data: Specific data points, such as increased foreign direct investment (FDI) into China and rising valuations of Chinese companies listed on international exchanges, further corroborate the positive impact of renewed trade optimism.

Analysis of Trade Deal Implications for Chinese Companies

The potential long-term effects of improved trade relations on Chinese companies are significant. Reduced trade barriers should lead to increased exports, improved supply chains, and enhanced access to global markets. This will positively impact profitability and fuel economic growth.

- Industries most affected by the trade war and their recovery: Sectors like technology and agriculture, which were severely impacted by tariffs and trade restrictions, are poised for substantial recovery. Increased market access will enable them to compete more effectively on a global scale.

- Impact on foreign investment in Chinese companies: The improved trade environment is expected to attract increased foreign investment, further bolstering the growth of Chinese companies and driving the post-suspension rally forward.

Positive Economic Signals Boost Investor Confidence

Beyond the easing of trade tensions, positive economic indicators from China have significantly contributed to the post-suspension rally. Strong GDP growth, robust industrial production, and rising consumer spending signal a healthy and resilient economy.

- Specific data points supporting the positive economic narrative: Recent data reveals a steady increase in GDP growth, exceeding expectations in [mention specific quarter/year]. Industrial production figures also show robust expansion, indicating strong manufacturing activity. Consumer spending, a key driver of economic growth, has also demonstrated significant increases.

- Government policies contributing to this growth: Government policies aimed at stimulating domestic demand and supporting key industries have played a vital role in fostering this positive economic climate. Initiatives focused on infrastructure development and technological innovation have further contributed to the growth momentum.

- Impact of these positive signals on investor confidence: The robust economic data strengthens investor confidence, making Chinese equities a more attractive investment proposition. This increased confidence is directly reflected in the surge in market activity.

- Comparison with previous quarters/years: Comparing the current economic data with previous quarters or years underscores the significant improvement and the strength of the recovery. This reinforces the positive narrative driving the post-suspension rally.

Domestic Consumption and its Role in the Rally

Domestic consumption is playing a pivotal role in China's economic recovery and subsequent market rally. Rising disposable incomes and government stimulus packages are driving consumer spending, contributing significantly to the overall economic growth.

- Contribution of domestic consumption to the economic recovery: Robust domestic consumption is mitigating the negative impacts of external factors, like trade uncertainties, making the Chinese economy more resilient.

- Role of government stimulus packages in boosting consumer spending: Targeted government measures, such as tax cuts and subsidies, have injected further momentum into consumer spending, creating a positive feedback loop for economic growth.

- Impact of rising disposable incomes on various sectors: Sectors like consumer staples, retail, and entertainment are benefiting directly from the increased spending power of Chinese consumers.

Sector-Specific Performance During the Post-Suspension Rally

The post-suspension rally has witnessed diverse performances across various sectors within the Chinese equity market. Some sectors have outperformed others, reflecting the differentiated impact of the underlying factors driving the rally.

- Top-performing sectors and reasons: The technology sector, driven by technological innovation and government support, has been a top performer. Renewable energy and consumer staples have also shown significant gains, reflecting strong domestic demand and long-term growth potential.

- Underperforming sectors and contributing factors: Certain sectors, possibly those still heavily reliant on exports to specific markets or those facing increased regulatory scrutiny, might exhibit underperformance.

- Correlation between sector performance and the overall market trend: While the overall market shows a positive trend, individual sectors display varying degrees of performance, reflecting specific industry dynamics and investor sentiment.

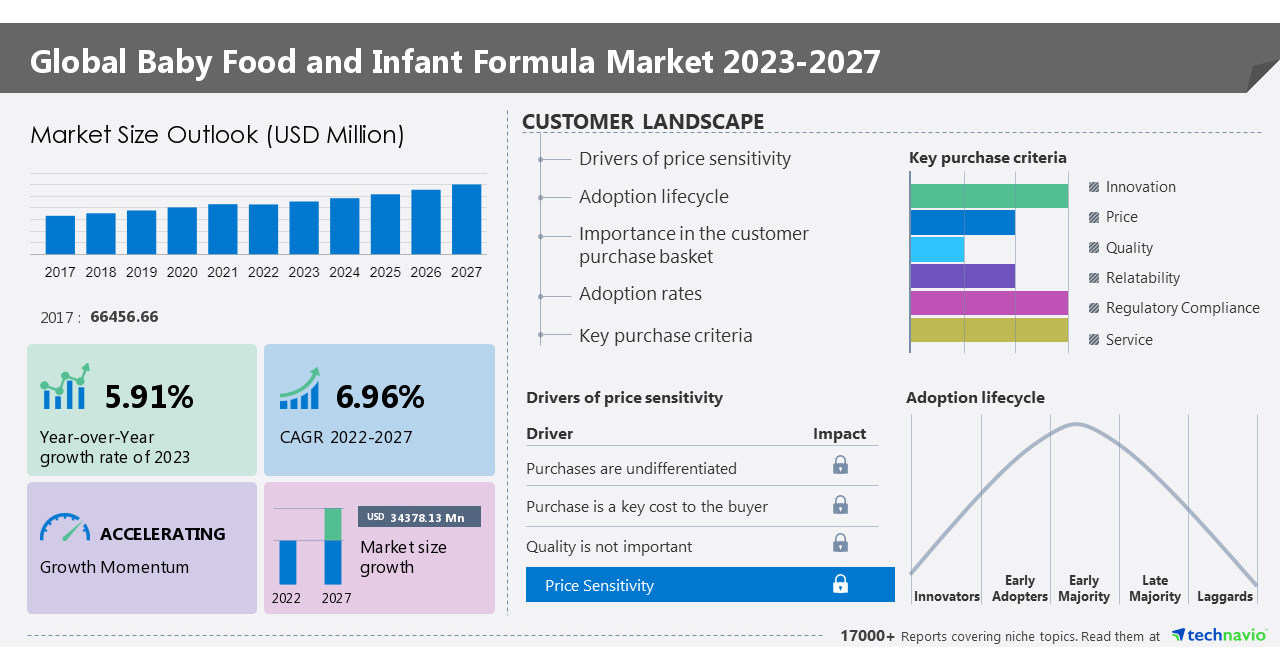

- Charts and graphs: Visual representations of sector performance data will strengthen the analysis and improve reader understanding.

Risks and Potential Setbacks for the Post-Suspension Rally

While the current outlook is positive, several risks and challenges could potentially hinder continued growth and impact the post-suspension rally. It's crucial to acknowledge these potential setbacks.

- Geopolitical risks: Ongoing trade negotiations, global economic uncertainty, and geopolitical tensions could create volatility and negatively impact investor confidence.

- Domestic policy uncertainties: Regulatory changes and shifts in government policy could also affect market sentiment and investment decisions.

- Potential for market correction: After a significant rally, a market correction is always a possibility. Investors should be prepared for periods of volatility.

- Strategies to mitigate these risks: Diversification, careful risk management, and staying informed about market developments are crucial strategies to mitigate potential risks.

Conclusion

The post-suspension rally in Chinese equities is primarily driven by renewed US trade optimism and robust economic signals from within China. The market has witnessed significant gains across various sectors, though some sectors have outperformed others. While the current outlook appears positive, investors must remain aware of potential risks and uncertainties, including geopolitical factors and domestic policy changes. To capitalize on the post-suspension rally, monitor the Chinese equity market closely, understand the opportunities and challenges, and conduct thorough due diligence before making any investment decisions. Learn to identify potential setbacks and implement effective risk mitigation strategies to navigate the complexities of this dynamic market and potentially benefit from the ongoing post-suspension rally in Chinese equities.

Featured Posts

-

Votre Sejour Au Lioran Au C Ur D Onet Le Chateau

May 07, 2025

Votre Sejour Au Lioran Au C Ur D Onet Le Chateau

May 07, 2025 -

Rihannas Casual Santa Monica Dinner Style And Comfort Combined

May 07, 2025

Rihannas Casual Santa Monica Dinner Style And Comfort Combined

May 07, 2025 -

Is Xrp A Commodity Sec Classification And The Ongoing Debate

May 07, 2025

Is Xrp A Commodity Sec Classification And The Ongoing Debate

May 07, 2025 -

After 10 Week High Bitcoin Approaches The 100 000 Mark

May 07, 2025

After 10 Week High Bitcoin Approaches The 100 000 Mark

May 07, 2025 -

Nba Slaps Anthony Edwards With 50 000 Fine Over Fan Interaction

May 07, 2025

Nba Slaps Anthony Edwards With 50 000 Fine Over Fan Interaction

May 07, 2025

Latest Posts

-

Ethereum Price Forecast Comprehensive Analysis Of Market Trends And Predictions

May 08, 2025

Ethereum Price Forecast Comprehensive Analysis Of Market Trends And Predictions

May 08, 2025 -

Son Dakika Bitcoin Haberleri Fiyat Ve Degisimler

May 08, 2025

Son Dakika Bitcoin Haberleri Fiyat Ve Degisimler

May 08, 2025 -

Predicting Ethereums Price Key Factors And Future Market Analysis

May 08, 2025

Predicting Ethereums Price Key Factors And Future Market Analysis

May 08, 2025 -

Bitcoin Fiyati Anlik Deger Ve Piyasa Analizi

May 08, 2025

Bitcoin Fiyati Anlik Deger Ve Piyasa Analizi

May 08, 2025 -

Future Of Ethereum A Deep Dive Into Price Predictions And Market Factors

May 08, 2025

Future Of Ethereum A Deep Dive Into Price Predictions And Market Factors

May 08, 2025