Posthaste: Addressing The Overvalued Canadian Dollar

Table of Contents

Factors Contributing to a Potentially Overvalued Canadian Dollar

Several key factors contribute to the perception that the Canadian dollar might be overvalued. Let's examine some of the most significant influences.

Strong Commodity Prices

Canada's economy is heavily reliant on its resource sector. High commodity prices, particularly for oil and natural gas, significantly impact the Canadian dollar's value.

- Increased Demand: Strong global demand for Canadian resources leads to increased exports, boosting the demand for the Canadian dollar (CAD) in international markets.

- Market Volatility: However, this reliance also creates volatility. Fluctuations in global commodity markets can cause significant shifts in the CAD's exchange rate. A sudden drop in oil prices, for example, could weaken the Canadian dollar considerably.

- Resource-Based Economy: Canada's heavy reliance on a resource-based economy means its currency is inherently more sensitive to global commodity price changes than economies more diversified in manufacturing or services.

Interest Rate Differentials

Interest rate differences between Canada and other major economies play a crucial role in influencing the CAD's value.

- Attracting Foreign Investment: When the Bank of Canada sets higher interest rates compared to other countries, like the United States, it attracts foreign investment. International investors seek higher returns, leading to increased demand for the Canadian dollar.

- Comparison to Global Rates: A comparison of Canadian interest rates with those of the US Federal Reserve, the European Central Bank, and other key global banks provides critical context for understanding this dynamic. Higher rates in Canada relative to these major economies tend to strengthen the CAD.

- Monetary Policy: The Bank of Canada's monetary policy decisions directly influence interest rates and, consequently, the value of the Canadian dollar.

Safe-Haven Status

Canada's reputation as a politically stable and economically sound nation contributes to its currency's strength.

- Foreign Investment during Uncertainty: During periods of global economic or political uncertainty, investors often seek safe havens for their assets. Canada's perceived stability makes the Canadian dollar an attractive option, increasing its demand.

- Economic Stability: Canada's relatively robust economic fundamentals, including a diversified economy (though still heavily reliant on resources), contribute to its safe-haven status.

- Political Stability: Canada's stable political environment further enhances its appeal as a safe investment destination.

Economic Consequences of an Overvalued Canadian Dollar

An overvalued Canadian dollar has both positive and negative implications for the Canadian economy.

Impact on Exports

A strong CAD makes Canadian exports more expensive on the global market, reducing their competitiveness.

- Reduced Export Competitiveness: This hurts export-oriented industries, making it harder for Canadian businesses to compete with companies in countries with weaker currencies.

- Job Losses and Reduced Growth: This can lead to job losses in sectors like manufacturing and agriculture, potentially hindering overall economic growth.

- Trade Balance: A strong CAD can worsen Canada's trade balance, as exports become less attractive while imports become more affordable.

Impact on Imports

While an overvalued Canadian dollar makes imports cheaper for consumers, it can negatively impact domestic industries.

- Increased Consumer Spending: Cheaper imports can boost consumer spending, as goods become more affordable.

- Domestic Production Challenges: However, domestic industries face increased competition from cheaper imports, potentially leading to reduced production and job losses in those sectors.

- Global Competition: Canadian producers struggle to compete with lower-priced goods from abroad.

Impact on Tourism

The strong Canadian dollar affects both inbound and outbound tourism.

- Inbound Tourism: While it makes Canada a more expensive destination for international tourists, potentially reducing inbound tourism, the impact depends on the overall attractiveness of the country and other factors.

- Outbound Tourism: Conversely, it allows Canadians to travel abroad more affordably, potentially increasing outbound tourism.

- Travel Costs: The exchange rate significantly influences travel costs for both Canadians travelling internationally and foreign tourists visiting Canada.

Potential Solutions and Mitigation Strategies

Addressing the potential negative consequences of an overvalued Canadian dollar requires a multifaceted approach.

Diversification of the Canadian Economy

Reducing Canada's reliance on resource-based industries is crucial.

- Innovation and Growth in Other Sectors: Investing in innovation and fostering growth in sectors such as technology, clean energy, and advanced manufacturing can diversify the economy and reduce its vulnerability to commodity price swings.

- Long-Term Economic Stability: Economic diversification leads to a more resilient and stable economy, less susceptible to short-term shocks.

Government Policies

Government policies can play a role in influencing the exchange rate, though directly manipulating it is often challenging.

- Fiscal Policy: Government spending and taxation policies can influence the overall demand in the economy, indirectly affecting the exchange rate.

- Monetary Policy: The Bank of Canada's monetary policy, primarily through interest rate adjustments, directly impacts the exchange rate. However, this needs to be carefully balanced with other economic goals.

Conclusion

The Canadian dollar's exchange rate is a complex issue with various contributing factors and wide-ranging consequences. Understanding the interplay between commodity prices, interest rate differentials, and Canada's safe-haven status is crucial to assessing its potential overvaluation. The impact on exports, imports, and tourism highlights the need for a strategic response. Diversification of the Canadian economy and carefully considered government policies are key to mitigating the negative consequences of a strong CAD. Stay informed about fluctuations in the Canadian dollar exchange rate and its potential implications for your personal finances and your business. Further research into the overvalued Canadian dollar and its long-term effects is encouraged.

Featured Posts

-

Spk Nin Aciklamasi Kripto Para Piyasalarinda Degisim Ruezgarlari

May 08, 2025

Spk Nin Aciklamasi Kripto Para Piyasalarinda Degisim Ruezgarlari

May 08, 2025 -

Best Krypto Stories A Definitive List

May 08, 2025

Best Krypto Stories A Definitive List

May 08, 2025 -

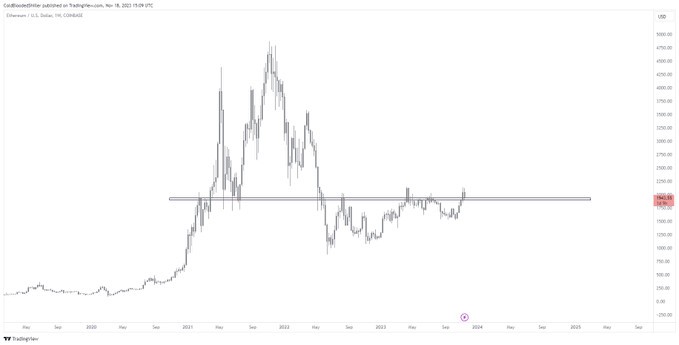

Ethereum Price Forecast Is 2 700 The Next Target After Accumulation

May 08, 2025

Ethereum Price Forecast Is 2 700 The Next Target After Accumulation

May 08, 2025 -

Py Ays Ayl Ke Pysh Nzr Lahwr Myn Askwlwn Ke Awqat Kar Myn Tbdyly

May 08, 2025

Py Ays Ayl Ke Pysh Nzr Lahwr Myn Askwlwn Ke Awqat Kar Myn Tbdyly

May 08, 2025 -

Ethereums Bullish Run Analyzing Price Strength And Future Outlook

May 08, 2025

Ethereums Bullish Run Analyzing Price Strength And Future Outlook

May 08, 2025