Posthaste: Signs Of A Correction In The Canadian Real Estate Market

Table of Contents

Declining Sales Activity Across Major Canadian Cities

A significant indicator of a potential market correction is a noticeable decline in sales activity. Compared to the frenzied pace of previous years, many major Canadian cities are experiencing a slowdown in transactions. This decrease isn't just a temporary blip; it represents a substantial shift in market dynamics.

- Sales figures comparison: Year-over-year and month-over-month sales data from the Canadian Real Estate Association (CREA) and Statistics Canada reveal a concerning trend. For example, Toronto saw a [insert percentage]% decrease in sales in [insert month/year] compared to the same period last year. Similar declines are observed in Vancouver, Calgary, and Montreal.

- Specific examples of market segments: The slowdown isn't uniform across all property types. Condos, particularly in downtown cores, are experiencing slower sales than detached homes in suburban areas. This suggests a nuanced correction rather than a complete market crash.

- Regional variations: While the overall trend points towards a cooling market, regional variations exist. Some smaller cities might still see robust activity, while others face more pronounced slowdowns.

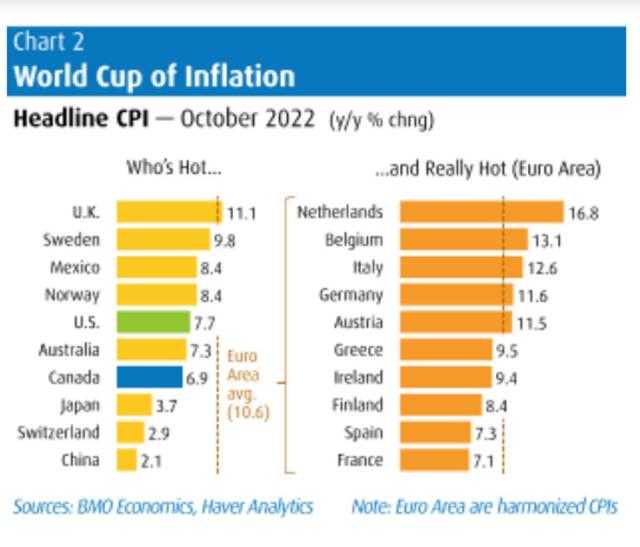

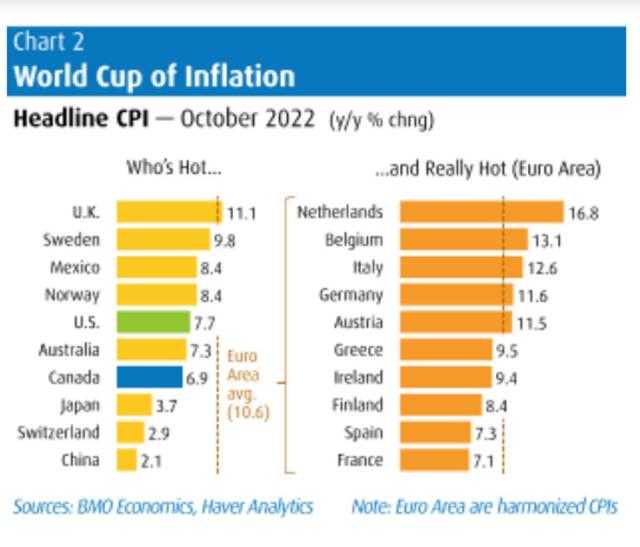

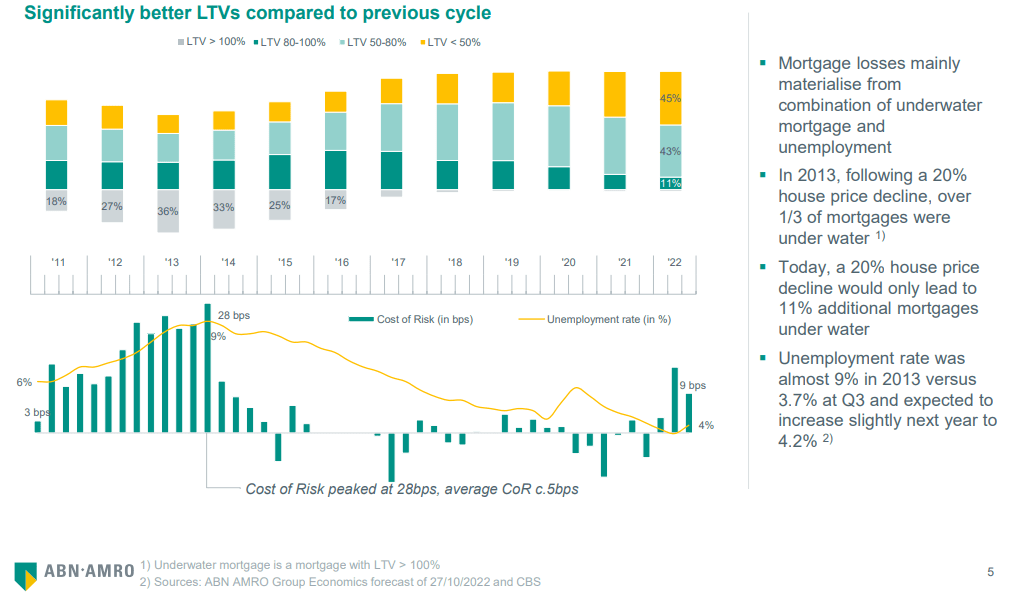

Rising Interest Rates and Their Impact

The Bank of Canada's aggressive interest rate hikes are playing a significant role in shaping the Canadian real estate market. Higher interest rates directly impact affordability, making it more expensive for potential buyers to secure mortgages.

- Current interest rate levels and projections: The current benchmark interest rate is [insert current rate], and further increases are anticipated [cite source], significantly impacting mortgage affordability.

- Impact on affordability calculations: Higher rates increase monthly mortgage payments, reducing the purchasing power of buyers. The stress test, which assesses a buyer's ability to handle higher interest rates, further limits borrowing capacity.

- Effect on different buyer segments: First-time homebuyers are particularly vulnerable to rising rates, as they often have less financial flexibility. Investors, too, are feeling the pinch, as higher borrowing costs reduce the profitability of rental properties.

Inventory Levels and Increased Housing Supply

The increased availability of homes for sale is another critical sign of a cooling market. After years of low inventory, many Canadian cities are now seeing a rise in listings, impacting pricing dynamics.

- Months of inventory data: The number of months it would take to sell all current listings at the current sales rate (months of inventory) is increasing in many cities, signifying a shift from a seller's market towards a more balanced one.

- Comparison to previous years: Comparing current inventory levels to those of previous years highlights the significant increase in housing supply.

- Specific property types: The increase in inventory is not uniform across all property types, with some segments showing a more significant rise than others.

Price Adjustments and Increased Days on Market

As inventory rises and demand softens, we're witnessing price adjustments and homes staying on the market longer. These are clear indicators of a market cooling down.

- Average price changes: Year-over-year and month-over-month average price changes show a slowdown in price appreciation, or even price reductions in some areas.

- Average days on market: Homes are spending considerably more time on the market compared to the previous seller's market, indicating less competition among buyers.

- Examples of price reductions: Anecdotal evidence from real estate agents suggests increased instances of price reductions to attract buyers in a more competitive market.

Shifting Buyer Sentiment and Market Psychology

The media's portrayal of the housing market and overall economic uncertainty heavily influence buyer sentiment. Decreased buyer confidence can lead to reduced demand, contributing to a market correction.

- Surveys on consumer confidence: Surveys showing a decline in consumer confidence in the housing market reflect the changing market psychology.

- Expert opinions: Real estate analysts and economists are increasingly voicing concerns about the potential for further market adjustments.

- Potential for further adjustments: The current market conditions suggest the possibility of further price adjustments and a prolonged period of slower sales activity.

Conclusion: Navigating the Canadian Real Estate Market Correction

The confluence of declining sales, rising interest rates, increased inventory, and price adjustments strongly suggests a potential Canadian real estate market correction. This isn't necessarily a crash, but a significant shift from the rapid growth seen in recent years. Buyers should approach the market cautiously, considering their financial capacity and long-term affordability in the context of rising interest rates. Sellers might need to adjust their pricing expectations and be prepared for a longer time on market.

Stay informed about potential shifts in the Canadian real estate market correction by regularly checking reliable sources like CREA and Statistics Canada, and by consulting with experienced real estate professionals for personalized advice tailored to your specific circumstances. Understanding the nuances of this evolving market is crucial for making informed decisions in the Canadian real estate landscape.

Featured Posts

-

Vstuplenie Ukrainy V Nato Poslednie Zayavleniya Evrokomissara

May 22, 2025

Vstuplenie Ukrainy V Nato Poslednie Zayavleniya Evrokomissara

May 22, 2025 -

Women And Finance 3 Costly Errors To Avoid

May 22, 2025

Women And Finance 3 Costly Errors To Avoid

May 22, 2025 -

Understanding Core Weave Stock Recent News And Investor Sentiment

May 22, 2025

Understanding Core Weave Stock Recent News And Investor Sentiment

May 22, 2025 -

Virginia Fuel Prices Gas Buddys Report Shows Recent Decrease

May 22, 2025

Virginia Fuel Prices Gas Buddys Report Shows Recent Decrease

May 22, 2025 -

Voedselexport Vs Daalt Abn Amro Analyseert Impact Heffingen

May 22, 2025

Voedselexport Vs Daalt Abn Amro Analyseert Impact Heffingen

May 22, 2025

Latest Posts

-

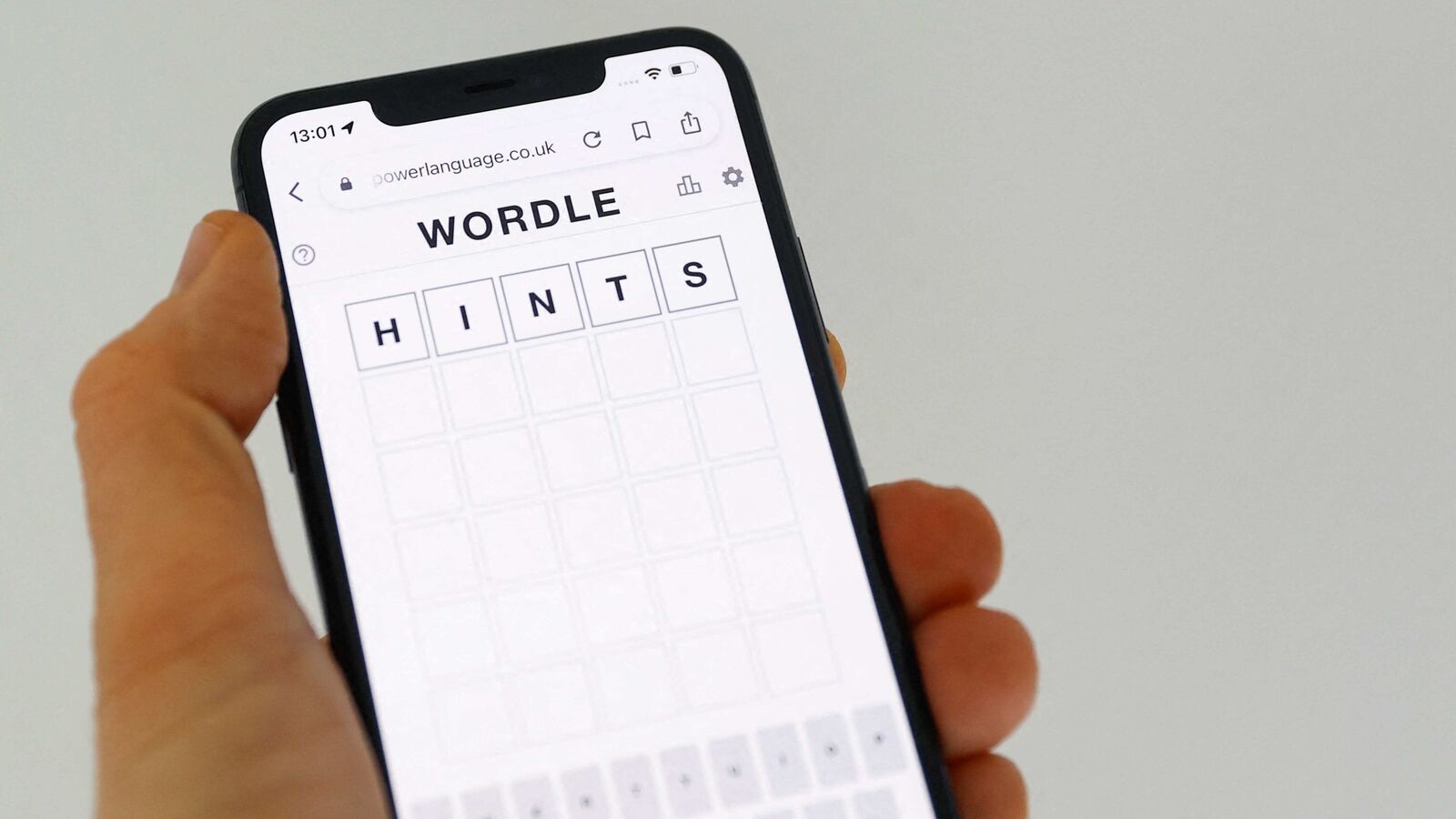

Saturday Wordle March 8th Puzzle 1358 Hints And Answer

May 22, 2025

Saturday Wordle March 8th Puzzle 1358 Hints And Answer

May 22, 2025 -

Wordle Game 370 March 20th Hints Clues And Solution

May 22, 2025

Wordle Game 370 March 20th Hints Clues And Solution

May 22, 2025 -

March 8th Wordle Solution 1358 Hints And Full Answer

May 22, 2025

March 8th Wordle Solution 1358 Hints And Full Answer

May 22, 2025 -

Wordle 370 Hints And Clues For Thursday March 20th

May 22, 2025

Wordle 370 Hints And Clues For Thursday March 20th

May 22, 2025 -

Wordle Answer Today March 8th Hints And Solution For Puzzle 1358

May 22, 2025

Wordle Answer Today March 8th Hints And Solution For Puzzle 1358

May 22, 2025