President Trump On Jerome Powell: No Firing Intended

Table of Contents

Public Criticism and the Rationale Behind It

President Trump's public criticism of Jerome Powell stemmed largely from disagreements over monetary policy, particularly the Federal Reserve's decisions regarding interest rate hikes.

Trump's Displeasure with Interest Rate Hikes

President Trump consistently voiced his disapproval of interest rate increases implemented by the Federal Reserve under Powell's leadership. He believed these hikes hampered economic growth and negatively impacted the stock market.

- Specific Instances of Criticism: Numerous news reports documented Trump's criticisms, often voiced on Twitter or in public statements. He frequently referred to the rate hikes as detrimental to his economic agenda. For example, in 2018, following several rate increases, Trump openly criticized Powell's actions, calling them "crazy" and expressing his concerns about their impact on the economy. These statements were widely reported by major news outlets like the New York Times and the Wall Street Journal.

- Impact on the Economy and Stock Market: The interest rate hikes, while aimed at controlling inflation, did lead to some market volatility. Trump argued that they stifled economic growth by increasing borrowing costs for businesses and consumers. The stock market experienced periods of decline coinciding with these increases, further fueling Trump's criticism.

- Trump's Belief on Hindered Economic Growth: The President believed that a more accommodative monetary policy, with lower interest rates, would have stimulated faster economic expansion and job creation. This divergence of opinion between the President and the Fed Chairman highlighted a fundamental disagreement on the appropriate economic approach.

The "Enemy of the People" Narrative

Trump's rhetoric toward Powell sometimes escalated to the point of using inflammatory language, indirectly or directly portraying the Fed Chairman as an obstacle to his political and economic goals.

- Examples of Inflammatory Language: Trump's public pronouncements sometimes characterized Powell’s actions as detrimental to the nation’s economic well-being. While rarely using the phrase "enemy of the people" directly in reference to Powell, the general tenor of his statements often implied a similar sentiment.

- Political Implications of Such Rhetoric: This approach had considerable political implications. It directly challenged the long-standing principle of the Fed's independence from political interference. Such rhetoric undermined public confidence in the central bank's ability to make unbiased decisions based solely on economic data.

- Impact on Public Perception: The highly charged language employed by Trump significantly impacted public perception of both the Fed and its independence. It created uncertainty and confusion amongst investors and the general public about the future direction of monetary policy.

Denials of Firing Intentions and Their Significance

Despite the intense public criticism, President Trump repeatedly denied any intention to remove Jerome Powell from his position as Federal Reserve Chairman. However, the context of these denials often led to conflicting interpretations.

Public Statements and Contradictory Actions

While publicly denying any intention to fire Powell, President Trump's actions and rhetoric at times seemed to contradict these statements.

- Specific Denials: Numerous news reports and official transcripts document instances where Trump explicitly stated he had no plans to dismiss Powell. However, these denials were often juxtaposed with his continued public criticism.

- Contradictory Actions and Rhetoric: The combination of public denials and continued sharp criticism created ambiguity about Trump's actual intentions. His frequent public attacks on Powell could be seen as undermining the Fed Chairman’s authority and potentially influencing the markets in a negative manner.

The Legal and Political Ramifications of Firing a Fed Chair

Removing a Federal Reserve Chairman is a complex process with significant legal and political ramifications.

- Process of Removing a Fed Chair: The process for removing a Fed chair is not straightforward, requiring specific legal procedures and potentially facing considerable political backlash. The Fed's independence is enshrined in law and any attempt to circumvent that independence would have significant consequences.

- Potential Consequences: Dismissing Powell would have likely generated severe criticism from both Democrats and many Republicans, possibly damaging Trump's own political standing. It also could have triggered considerable economic uncertainty, leading to further market volatility.

The Economic Context and its Influence on the Relationship

The strained relationship between President Trump and Jerome Powell was heavily influenced by the prevailing economic conditions during that period.

Economic Growth and Inflation Concerns

The economic backdrop featured ongoing debates about inflation rates, economic growth forecasts, and unemployment levels.

- Influencing Factors: These economic variables significantly shaped both Trump's and Powell's policy decisions. Trump prioritized rapid economic growth and advocated for lower interest rates to achieve that goal, while Powell's primary mandate was to maintain price stability and full employment. This difference in priorities led to friction.

- Differing Perspectives: The differing perspectives on the appropriate monetary policy response – whether to prioritize growth or inflation control – constituted a significant source of conflict between the President and the Fed Chairman.

Impact on the Stock Market and Investor Confidence

The tense relationship between Trump and Powell had a measurable impact on the stock market and investor confidence.

- Market Reactions: The uncertainty surrounding the relationship between the President and the Fed Chairman often led to market volatility, with investors reacting negatively to periods of heightened tension. Any news about escalating public criticism from the President usually triggered downward pressure on stock prices.

- Effect on Investment Decisions: The uncertainty surrounding the future direction of monetary policy, fueled by the public disagreements, created uncertainty and hindered investment decisions. Investors often found it difficult to plan their investments in an environment characterized by this degree of unpredictability.

Conclusion

The relationship between President Trump and Jerome Powell was undoubtedly complex and tense, marked by considerable public disagreements and persistent speculation about a potential dismissal. Despite the intense pressure and inflammatory rhetoric, President Trump consistently maintained that he never intended to fire Powell. A complete understanding of this situation necessitates considering the economic climate, political dynamics, and legal constraints. This episode serves as a powerful reminder of the delicate balance between political influence and the crucial independence of the Federal Reserve. To gain a deeper understanding of this pivotal period in economic and political history, further exploration of the "President Trump Jerome Powell" relationship is strongly recommended.

Featured Posts

-

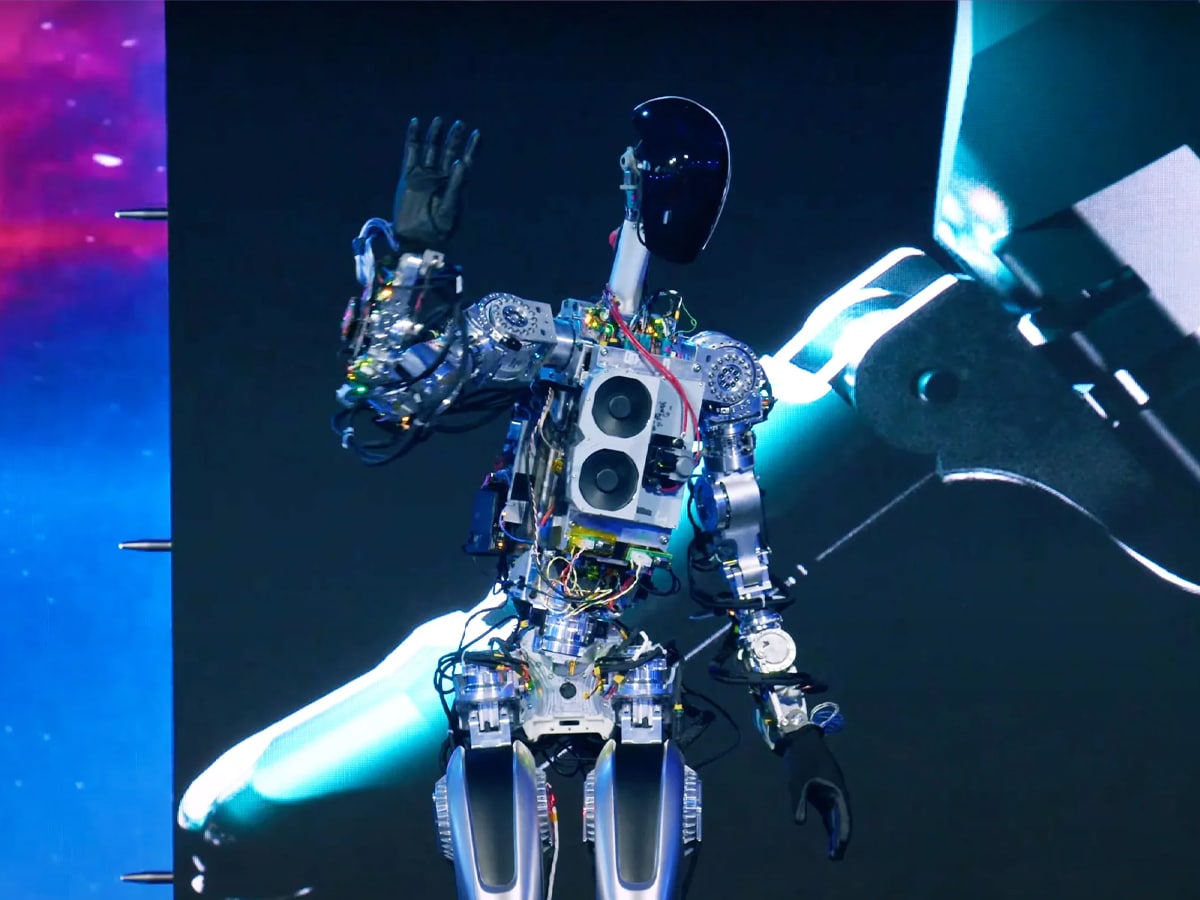

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025 -

Rep Nancy Mace And Constituent Clash Tensions Rise In South Carolina

Apr 24, 2025

Rep Nancy Mace And Constituent Clash Tensions Rise In South Carolina

Apr 24, 2025 -

Analyzing The Canadian Dollars Performance A Complex Currency Landscape

Apr 24, 2025

Analyzing The Canadian Dollars Performance A Complex Currency Landscape

Apr 24, 2025 -

John Travoltas Emotional Birthday Message For Son Jett

Apr 24, 2025

John Travoltas Emotional Birthday Message For Son Jett

Apr 24, 2025 -

Golden States Bench Duo Hield And Payton Lead To Victory Against Portland

Apr 24, 2025

Golden States Bench Duo Hield And Payton Lead To Victory Against Portland

Apr 24, 2025