Private Equity Buys Boston Celtics For $6.1 Billion: Fan Concerns And Future Outlook

Table of Contents

The Deal Details: Who Bought the Celtics and What Does it Mean?

The sale of the Boston Celtics represents one of the largest transactions in sports history, significantly impacting the team's ownership and future direction. Understanding the intricacies of this deal is crucial for fans and analysts alike.

The Private Equity Firm:

While the specific private equity firm involved remains undisclosed (replace with actual firm name if available, and add details about the firm's history and investment strategy, including any previous sports investments), their acquisition signals a shift towards a more financially driven approach to team management. This could potentially lead to both opportunities and challenges for the Celtics.

- Key Players Involved: (Insert names of key individuals involved in the transaction from both the selling and buying sides).

- Financial Structure: The deal likely involved a leveraged buyout (LBO), a common strategy in private equity where significant debt is used to finance the acquisition. (Add further detail on the financial structure if available, citing reputable financial news sources).

- Franchise Valuation: The $6.1 billion valuation reflects not only the Celtics' on-court success but also the franchise's strong brand, loyal fanbase, and lucrative media rights deals. The team's rich history, consistent playoff appearances, and location in a major media market all contributed to this record-breaking price.

- Reputable News Sources: (Insert links to articles from reputable sources like the Wall Street Journal, Bloomberg, ESPN, etc., covering the deal).

Fan Concerns: Ticket Prices, Player Personnel, and the Team's Identity

The significant investment in the Boston Celtics naturally leads to concerns amongst the passionate fanbase. Will the new ownership prioritize profits over the team’s success and fan experience?

Rising Ticket Prices:

One of the most pressing concerns for fans is the potential increase in ticket prices. Private equity firms are known for their focus on maximizing returns, and this could translate to higher costs for fans.

- Historical Trends: Analysis of similar NBA team acquisitions reveals a common pattern of rising ticket prices following ownership changes. (Include data or examples supporting this claim).

- Season Ticket Holders: Season ticket holders, who represent a significant portion of the Celtics' loyal fanbase, could face substantial price increases, potentially impacting their ability to continue attending games.

- Increased Stadium Costs: Beyond ticket prices, fans can also expect potential increases in the cost of concessions, parking, and other in-stadium expenses.

Changes in Player Personnel:

The change in ownership could significantly impact player recruitment and roster management. The new owners may prioritize cost-cutting measures or implement different strategies for acquiring talent.

- Player Acquisition Strategies: The new ownership might employ a more analytical approach to player evaluation, focusing on data-driven decision-making and prioritizing cost-effective acquisitions.

- Impact on Team Chemistry: Significant changes to the roster could disrupt team chemistry and affect on-court performance. The transition period might be challenging as players adapt to new management and potential coaching changes.

- Trades and Salary Cap Implications: The new ownership may make strategic trades to manage the team's salary cap and optimize player value. This could result in the departure of beloved players.

Maintaining the Celtics' Identity:

Preserving the Celtics' rich history, unique culture, and connection with its passionate fanbase is paramount. This legacy is a crucial asset that needs careful safeguarding under new ownership.

- Significance of the Celtics' Legacy: The Celtics' history and their role in Boston's cultural landscape are deeply embedded in the city's identity. Maintaining this connection is crucial for long-term success.

- Challenges in Maintaining Identity: The potential for prioritizing financial gain over preserving tradition poses a significant risk. The new ownership must carefully balance financial objectives with the team's cultural significance.

- Community Engagement: Sustaining fan loyalty requires a commitment to community engagement. The new owners need to invest in initiatives that connect the team with its fanbase and maintain the team's strong ties to Boston.

Future Outlook: Potential for Success and Challenges Ahead

The future of the Boston Celtics under private equity ownership presents both potential opportunities and significant challenges.

On-Court Performance:

The impact of the ownership change on the team's on-court performance remains to be seen. The new owners' commitment to winning and investment in player development will be critical determinants of future success.

- Commitment to Winning: A strong commitment to winning, demonstrated through investments in player development, coaching, and team infrastructure, will be crucial.

- Current Roster Evaluation: A thorough evaluation of the current roster and potential for improvement will determine the strategic direction of player acquisitions.

- Coaching and Management Decisions: The new owners may make changes to the coaching staff or management team, impacting team strategy and performance.

Long-Term Financial Stability:

The long-term financial implications of the sale are complex. While the private equity firm's financial resources are substantial, managing the franchise effectively and sustainably is crucial for long-term success.

- Financial Resources and Investment Strategies: The private equity firm's extensive financial resources provide a strong foundation for the Celtics' long-term financial stability.

- Revenue Generation and Franchise Growth: Strategies to increase revenue streams, such as enhancing fan engagement, expanding merchandise sales, and securing lucrative sponsorships, will be vital.

- Risks and Uncertainties: Despite the significant financial backing, inherent risks associated with the NBA landscape and broader economic conditions exist, necessitating prudent financial management.

Conclusion:

The sale of the Boston Celtics for $6.1 billion marks a pivotal moment for the franchise. While fan concerns about ticket prices, player personnel, and the preservation of the team's identity are understandable and need addressing, the future also holds potential for remarkable success. The new ownership group's substantial financial resources and strategic vision could lead to enhanced on-court performance and long-term financial stability. However, responsible management and a genuine commitment to the Celtics' rich legacy will be essential for maintaining the team's connection with its passionate and dedicated fanbase. Stay informed about the Boston Celtics and its new ownership to understand the ongoing impact of this monumental transaction. Continue following updates on the Boston Celtics and private equity acquisition for the latest news and analysis.

Featured Posts

-

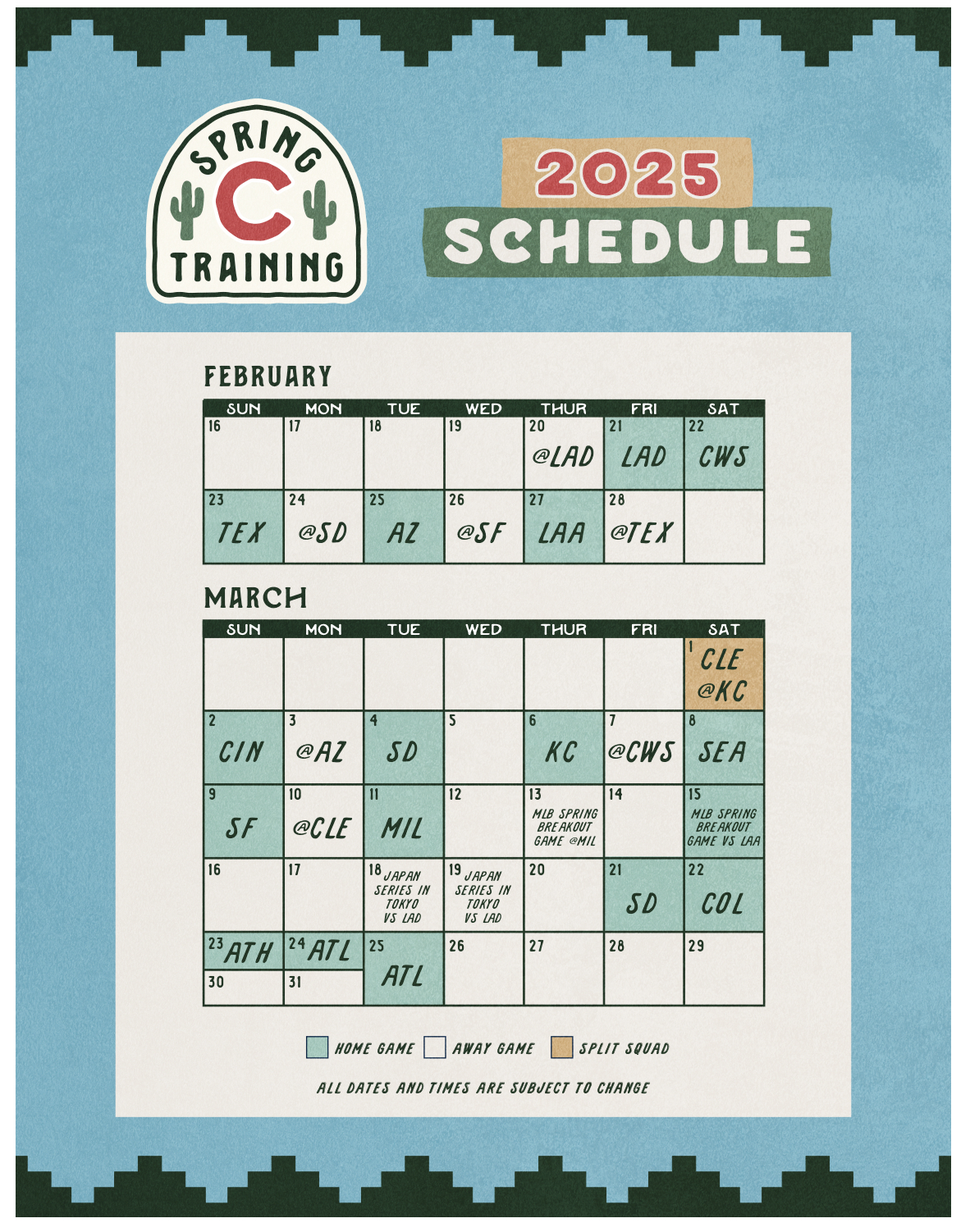

Free Live Stream Seattle Mariners Vs Chicago Cubs Spring Training Game Today

May 17, 2025

Free Live Stream Seattle Mariners Vs Chicago Cubs Spring Training Game Today

May 17, 2025 -

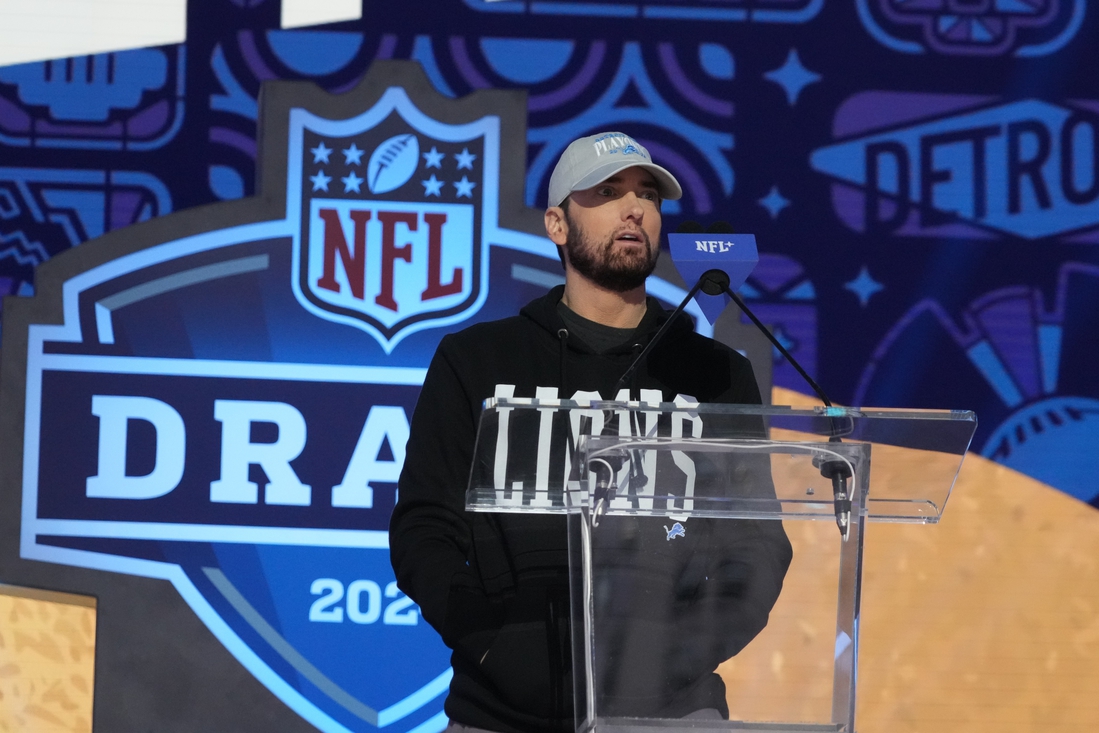

Eminem And The Wnba A Detroit Comeback Story

May 17, 2025

Eminem And The Wnba A Detroit Comeback Story

May 17, 2025 -

Juste Jocyte Palieka Villeurbanne Karjeros Etapo Pabaiga

May 17, 2025

Juste Jocyte Palieka Villeurbanne Karjeros Etapo Pabaiga

May 17, 2025 -

Private Equity Buys Boston Celtics For 6 1 Billion Fan Concerns And Future Outlook

May 17, 2025

Private Equity Buys Boston Celtics For 6 1 Billion Fan Concerns And Future Outlook

May 17, 2025 -

47 Rise In Indias Real Estate Investments Q1 2024 Report

May 17, 2025

47 Rise In Indias Real Estate Investments Q1 2024 Report

May 17, 2025