Rethinking Retirement: Is This New Investment Approach A Good Fit?

Table of Contents

The Shift Away from Traditional Pension Plans and Annuities

The retirement landscape has changed dramatically. The days of relying solely on a generous employer-sponsored pension are largely over for many. This shift necessitates a rethinking retirement strategy and a proactive approach to securing your financial future.

The declining role of employer-sponsored pensions

Defined-benefit pension plans, once the cornerstone of retirement security for many, are becoming increasingly rare. The rise of defined-contribution plans like 401(k)s and individual retirement accounts (IRAs) places more responsibility on individual savers.

- Rising healthcare costs: Medical expenses in retirement are significantly higher than in previous generations, placing a larger burden on personal savings.

- Longer lifespans: People are living longer, requiring larger retirement nest eggs to cover their expenses for an extended period.

- Market volatility impacting pension funds: Fluctuations in the stock market can severely impact the value of pension funds, creating uncertainty for retirees.

This shift necessitates exploring robust pension plan alternatives and prioritizing retirement income security through diversified investment strategies.

The limitations of annuities

Annuities, often touted as a guaranteed income stream, offer some advantages, but also present limitations that warrant careful consideration before committing.

- Guaranteed income vs. potential for lower returns: While annuities provide a predictable income stream, the returns may be lower than other investment options, potentially hindering long-term growth.

- Surrender charges: Early withdrawal penalties can significantly impact your ability to access your funds if needed.

- Inflation risk: The fixed income provided by an annuity may not keep pace with inflation, eroding its purchasing power over time.

These drawbacks highlight the need to explore annuity alternatives and consider a broader range of retirement income solutions that offer flexibility and growth potential.

Exploring Alternative Investment Strategies for Rethinking Retirement

Rethinking retirement involves embracing a diverse approach to investing. Instead of relying solely on traditional methods, consider these alternative strategies:

Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) provide a low-cost, diversified way to gain exposure to the broader market. They offer significant benefits for long-term retirement growth.

- Low expense ratios: Lower fees translate to higher returns over time.

- Diversification benefits: Investing across various sectors reduces risk by not being overly reliant on any single company or industry.

- Ease of investing: They are readily accessible through most brokerage accounts.

Index funds are a cornerstone of effective retirement investment strategies and contribute significantly to long-term investment plans. Their simplicity makes them ideal for index fund retirement strategies.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) can be a valuable addition to your retirement portfolio. They offer diversification and potentially higher yields than traditional bonds.

- Passive income generation: REITs distribute a significant portion of their income as dividends, providing a steady stream of passive income.

- Potential for capital appreciation: REIT values can appreciate over time, providing capital gains in addition to dividend income.

- Diversification benefits: REITs offer exposure to the real estate market, providing diversification beyond stocks and bonds.

REITs are a key component of building a diversified retirement portfolio and represent solid alternative retirement investments within a comprehensive REIT retirement planning strategy.

Investing in Emerging Markets

Investing in emerging markets presents an opportunity for potentially higher returns, but also comes with significantly higher risk.

- Growth potential: Emerging markets often exhibit faster economic growth than developed markets, offering the potential for higher investment returns.

- Higher risk tolerance required: These investments are volatile and carry a greater risk of loss.

- Careful due diligence needed: Thorough research and understanding of the specific risks are crucial before investing.

Emerging markets can be a part of high-growth retirement strategies, but only for investors with a high risk tolerance and a well-defined aggressive retirement investment plan that includes robust risk management in retirement.

Personalizing Your Rethinking Retirement Plan

Developing a successful rethinking retirement strategy requires a personalized approach tailored to your individual circumstances.

Assessing Risk Tolerance and Time Horizon

Your investment strategy must align with your individual risk tolerance and time horizon.

- Age: Younger investors generally have a longer time horizon and can tolerate more risk.

- Risk appetite: Your comfort level with potential losses will influence your investment choices.

- Financial goals: Whether you aim for early retirement or specific lifestyle goals will shape your investment strategy.

- Expected income needs: Estimating your retirement income needs helps determine the necessary investment growth.

Understanding these factors is crucial for building a successful personalized retirement plan and navigating the retirement planning timeline effectively. Conducting a thorough retirement risk assessment is the first step.

Seeking Professional Financial Advice

Consulting a financial advisor offers invaluable support in navigating the complexities of retirement planning.

- Expertise in retirement planning: Financial advisors possess the knowledge and experience to guide you through the process.

- Personalized investment recommendations: They can develop a customized investment strategy tailored to your specific needs and goals.

- Tax optimization strategies: They can help you minimize your tax burden and maximize your retirement savings.

Seeking guidance from a retirement financial advisor provides access to comprehensive retirement planning services and expert retirement advice, ensuring you make informed decisions.

Conclusion

Rethinking retirement requires a shift away from solely relying on traditional pension plans and annuities. By diversifying your investment portfolio with index funds, ETFs, REITs, and potentially emerging markets (with careful risk management), you can build a more robust and resilient retirement plan. Remember to personalize your approach based on your risk tolerance, time horizon, and financial goals. Don't let outdated retirement strategies leave you unprepared. Start rethinking your retirement today by exploring the investment options discussed in this article and seeking professional financial guidance. Take control of your future and build a retirement that reflects your aspirations.

Featured Posts

-

New Orleans Jailbreak 11 Inmates Including Murder Suspects Escape

May 18, 2025

New Orleans Jailbreak 11 Inmates Including Murder Suspects Escape

May 18, 2025 -

Jbs Jbss 3 Withdraws From Banco Master Asset Acquisition Talks

May 18, 2025

Jbs Jbss 3 Withdraws From Banco Master Asset Acquisition Talks

May 18, 2025 -

Jbs Jbss 3 Ends Banco Master Asset Purchase Negotiations

May 18, 2025

Jbs Jbss 3 Ends Banco Master Asset Purchase Negotiations

May 18, 2025 -

Kahnawake Casino Lawsuit 220 Million Claim Against Mohawk Council And Grand Chief

May 18, 2025

Kahnawake Casino Lawsuit 220 Million Claim Against Mohawk Council And Grand Chief

May 18, 2025 -

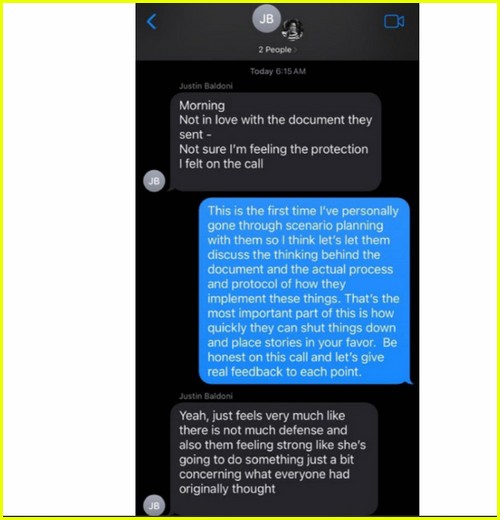

The Justin Baldoni Lawsuit And The Selena Gomez Taylor Swift Rift

May 18, 2025

The Justin Baldoni Lawsuit And The Selena Gomez Taylor Swift Rift

May 18, 2025

Latest Posts

-

Uncensored Snl G105 Airs Audiences Live Swear Words

May 18, 2025

Uncensored Snl G105 Airs Audiences Live Swear Words

May 18, 2025 -

Snl Live Tv Controversy Audience Profanity Captured On G105

May 18, 2025

Snl Live Tv Controversy Audience Profanity Captured On G105

May 18, 2025 -

Snl Audience Swears Live On Tv The G105 Incident

May 18, 2025

Snl Audience Swears Live On Tv The G105 Incident

May 18, 2025 -

Weekend Update Interrupted Snl Audience Outburst Sparks Controversy

May 18, 2025

Weekend Update Interrupted Snl Audience Outburst Sparks Controversy

May 18, 2025 -

Snl Audience Interruption Casts Shocked Reaction Goes Viral

May 18, 2025

Snl Audience Interruption Casts Shocked Reaction Goes Viral

May 18, 2025