SEC Vs. Ripple: The XRP Commodity Debate And Its Implications

Table of Contents

The SEC's Case Against Ripple

The SEC's case against Ripple hinges on whether XRP qualifies as a security under the Howey Test. This test, established in the 1946 Supreme Court case SEC v. W.J. Howey Co., defines an investment contract (and thus a security) based on four criteria:

The Howey Test and XRP

The SEC argues that XRP satisfies all four prongs of the Howey Test:

- Investment of Money: Investors provided Ripple with money in exchange for XRP.

- Common Enterprise: Investors’ fortunes are tied together with the success of Ripple and the overall XRP market.

- Expectation of Profits: Investors purchased XRP with the expectation of future profits derived from Ripple’s efforts.

- Efforts of Others: Investors were relying on Ripple’s efforts to develop and promote XRP to increase its value.

The SEC cites Ripple's various sales of XRP, including institutional placements and programmatic sales, as evidence supporting their claim. Their broader regulatory goal is to establish clearer guidelines for the cryptocurrency market, aiming to protect investors from fraudulent activities and ensure market integrity.

Ripple's Defense

Ripple vehemently denies that XRP is a security. Their defense strategy centers on several key arguments:

- Decentralization: Ripple emphasizes XRP's increasing decentralization, arguing that it operates independently of Ripple's control. They highlight the growing number of exchanges and independent validators participating in the XRP Ledger.

- Utility as a Payment Token: Ripple emphasizes XRP's utility as a fast, efficient, and low-cost payment token, distinct from the investment-focused nature of many ICOs.

- Comparison to other Cryptocurrencies: Ripple argues that XRP's characteristics are similar to other cryptocurrencies not deemed securities by the SEC, highlighting a lack of consistent regulatory approach.

Ripple points to the significant differences between their XRP sales and the typical structure of Initial Coin Offerings (ICOs), arguing that their sales were primarily focused on facilitating the adoption and utility of XRP as a payment token, rather than raising capital. They've presented expert testimony supporting their claims, challenging the SEC's interpretation of the Howey Test as applied to XRP.

Implications for the Crypto Market

The SEC vs. Ripple case carries significant implications for the entire cryptocurrency industry, far beyond just XRP's fate.

Regulatory Uncertainty

The outcome will significantly impact regulatory clarity in the US crypto market. A ruling against Ripple could create a chilling effect, discouraging innovation and investment. Other crypto projects might face increased scrutiny, leading to uncertainty and potentially hindering the development of new technologies. The decision will also impact how other countries regulate cryptocurrencies.

Impact on XRP Price

XRP's price has historically shown significant volatility correlated with developments in the legal proceedings. A positive ruling for Ripple could lead to substantial price increases, while an SEC victory could trigger a significant price drop. The uncertainty surrounding the case already impacts trading volume and investor sentiment.

Global Regulatory Implications

The SEC's actions and Ripple's response have international implications. The outcome could influence how other countries approach the regulation of cryptocurrencies. Different jurisdictions may adopt varying regulatory stances, creating a fragmented global landscape for crypto assets. This could lead to jurisdictional arbitrage and challenges in establishing a consistent international regulatory framework.

Potential Outcomes and Future of XRP

Several scenarios are possible in the SEC vs. Ripple case:

Possible Scenarios

- SEC Victory: An SEC victory would likely result in a significant drop in XRP's price and could lead to Ripple facing substantial penalties. It would set a strong precedent for future SEC actions against other crypto projects.

- Ripple Victory: A Ripple victory would significantly boost XRP's price and potentially set a precedent for a more lenient approach to crypto regulation in the US.

- Negotiated Settlement: A settlement could involve Ripple agreeing to certain restrictions or paying fines, potentially mitigating the negative impact on XRP and establishing a path towards clearer regulatory parameters.

Regardless of the outcome, appeals are likely, extending the legal battle for a considerable time.

Long-Term Implications for Crypto Regulation

The SEC vs. Ripple case will likely have lasting effects on crypto regulation. It could lead to the development of clearer regulatory frameworks or contribute to further fragmentation of regulatory approaches globally. The outcome will impact investor protection, market stability, and the future of innovation in the cryptocurrency space.

Conclusion

The SEC vs. Ripple case is a landmark legal battle with far-reaching consequences for the cryptocurrency industry. The outcome will significantly impact XRP's future, investor confidence, and the overall regulatory landscape. Understanding the intricacies of this debate is essential for navigating the complexities of the crypto market. Stay informed about the developments in the SEC vs. Ripple case and its implications for your XRP holdings and broader cryptocurrency investments. Continue researching the SEC vs. Ripple debate to make informed decisions in the evolving world of digital assets.

Featured Posts

-

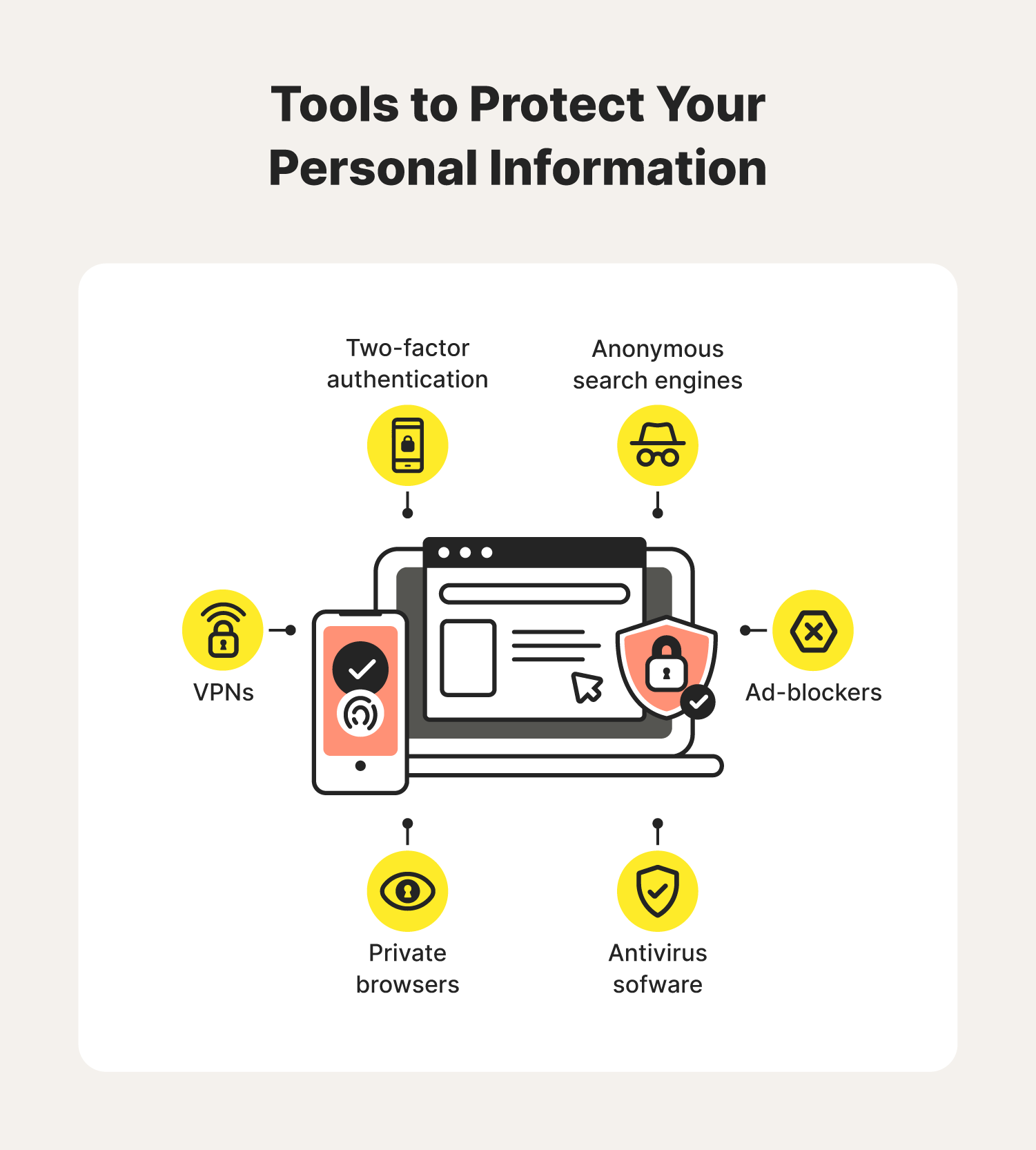

Secure Data Transfer Protecting Your Information

May 08, 2025

Secure Data Transfer Protecting Your Information

May 08, 2025 -

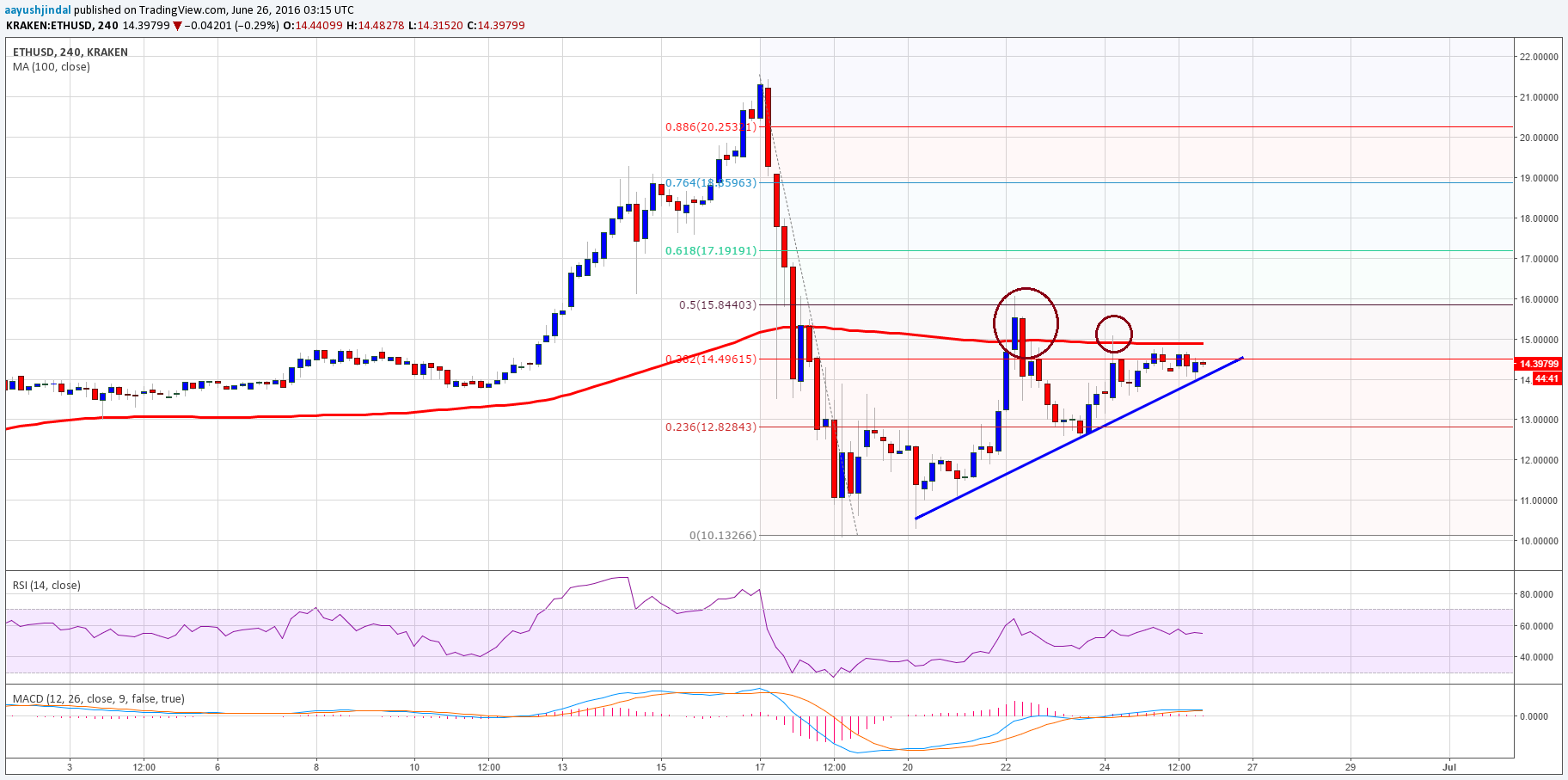

Ethereum Price Analysis Bullish Activity And Upside Targets

May 08, 2025

Ethereum Price Analysis Bullish Activity And Upside Targets

May 08, 2025 -

Investment Spotlight Whats Driving Dogecoin Shiba Inu And Suis Growth

May 08, 2025

Investment Spotlight Whats Driving Dogecoin Shiba Inu And Suis Growth

May 08, 2025 -

Oklahoma City Thunder Vs Houston Rockets Game Preview How To Watch And Betting Odds

May 08, 2025

Oklahoma City Thunder Vs Houston Rockets Game Preview How To Watch And Betting Odds

May 08, 2025 -

Andor Season 2 Could Rebel Characters Appear A Timeline Analysis

May 08, 2025

Andor Season 2 Could Rebel Characters Appear A Timeline Analysis

May 08, 2025