Shein's London IPO: Tariffs Create Uncertainty For Fast Fashion Giant

Table of Contents

The Allure of a London Listing for Shein

Shein's phenomenal growth, driven by its incredibly low prices and vast online presence, has made it a global fast-fashion powerhouse. An IPO, particularly in a prestigious market like London, offers several compelling advantages:

-

Global Financial Hub: London's status as a leading global financial center provides access to a diverse pool of international investors, potentially attracting significant capital for future expansion. This is crucial for Shein's continued growth and ambition to solidify its market dominance.

-

Enhanced Brand Visibility: A successful London IPO would dramatically increase Shein's brand visibility and global recognition, solidifying its position as a key player in the competitive fast fashion industry. This increased profile would be invaluable for attracting new customers and partners.

-

Access to Capital: The IPO would provide substantial funding for future growth initiatives, including investments in technology, supply chain optimization, and expansion into new markets. This capital injection is vital for maintaining Shein's rapid expansion strategy.

-

Improved Corporate Governance: Listing on the London Stock Exchange would necessitate adherence to stringent regulatory requirements, enhancing Shein's corporate governance and transparency – a crucial step in building investor confidence and long-term sustainability.

-

Key Benefits of a London Listing:

- Increased brand visibility and international recognition.

- Access to significant capital for future growth and acquisitions.

- Enhanced corporate governance and increased investor trust.

- Attracting top talent and improving overall operational efficiency.

The Tariff Threat to Shein's IPO Plans

Shein's current business model relies heavily on low-cost manufacturing, primarily in China. This reliance exposes the company to significant risks associated with rising global trade tensions and potential tariff increases on imported goods.

-

Impact on Profitability: Increased tariffs on clothing imports would directly impact Shein's profit margins, potentially reducing its competitiveness against other fast fashion brands. This could lead to price increases, potentially impacting consumer demand.

-

Supply Chain Vulnerability: Shein's extensive and complex global supply chain is highly susceptible to disruptions caused by trade wars and geopolitical uncertainty. Any significant increase in tariffs could severely impact the company's ability to maintain its low-price strategy.

-

Tariff Risks and Mitigation Strategies:

- Current Tariff Rates: A detailed analysis of current tariff rates on clothing imports into major markets (e.g., the US, EU) is crucial to assess the immediate impact.

- Potential Future Increases: Monitoring and forecasting potential future tariff increases based on evolving global trade policies is essential.

- Manufacturing Diversification: Shein could mitigate tariff risks by diversifying its manufacturing base, exploring production in countries with more favorable trade agreements.

- Price Adjustments: Strategically adjusting prices to absorb some of the tariff burden may be necessary to maintain market share.

- Supply Chain Optimization: Improving supply chain efficiency and resilience is key to minimizing disruptions caused by tariffs.

Alternative Strategies and Future Scenarios for Shein

If the Shein London IPO proves too risky due to tariff uncertainties, Shein may explore alternative strategies:

-

Alternative Listing Locations: Other major stock exchanges, such as Hong Kong or New York, could offer less volatile environments for an IPO. Each location presents unique advantages and challenges concerning regulatory requirements and investor profiles.

-

Strategic Partnerships: Forming strategic partnerships or even mergers with other companies in the fashion or technology sectors could help mitigate risks and enhance Shein's resilience to trade disputes.

-

Sustainable Sourcing: Investing in more sustainable and ethical sourcing practices not only improves the company's brand image but also potentially reduces its vulnerability to trade disputes by diversifying its supply chain. This could appeal to ethically conscious consumers.

-

Manufacturing Relocation: Shifting manufacturing to countries with more favorable trade relations, or even investing in domestic production in key markets, could reduce reliance on potentially vulnerable supply chains.

-

Exploring Alternative Paths:

- Hong Kong or New York IPOs: Assessing the suitability and potential benefits of listing on these alternative exchanges.

- Strategic Partnerships/Acquisitions: Identifying potential partners or acquisition targets to expand market reach and diversify the business.

- Sustainable and Ethical Sourcing Initiatives: Investing in initiatives that enhance supply chain transparency and ethical practices.

- Manufacturing Location Diversification Costs and Benefits: Conducting a thorough cost-benefit analysis of relocating manufacturing facilities.

Conclusion

The Shein London IPO presents a substantial opportunity for growth, yet the looming threat of tariffs introduces significant uncertainty. Shein needs to carefully assess the risks and rewards before proceeding. Successfully navigating these trade-related challenges will be crucial for its long-term success. Continuous monitoring of international trade policy developments and proactive adaptation of its business strategies will be essential for Shein to achieve its ambitious goals. Keep an eye on the Shein London IPO developments to understand the future trajectory of this fast-fashion giant.

Featured Posts

-

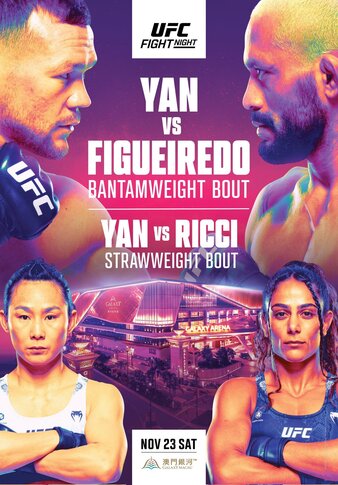

Ufc Fight Night Sandhagen Vs Figueiredo A Complete Preview And Predictions

May 04, 2025

Ufc Fight Night Sandhagen Vs Figueiredo A Complete Preview And Predictions

May 04, 2025 -

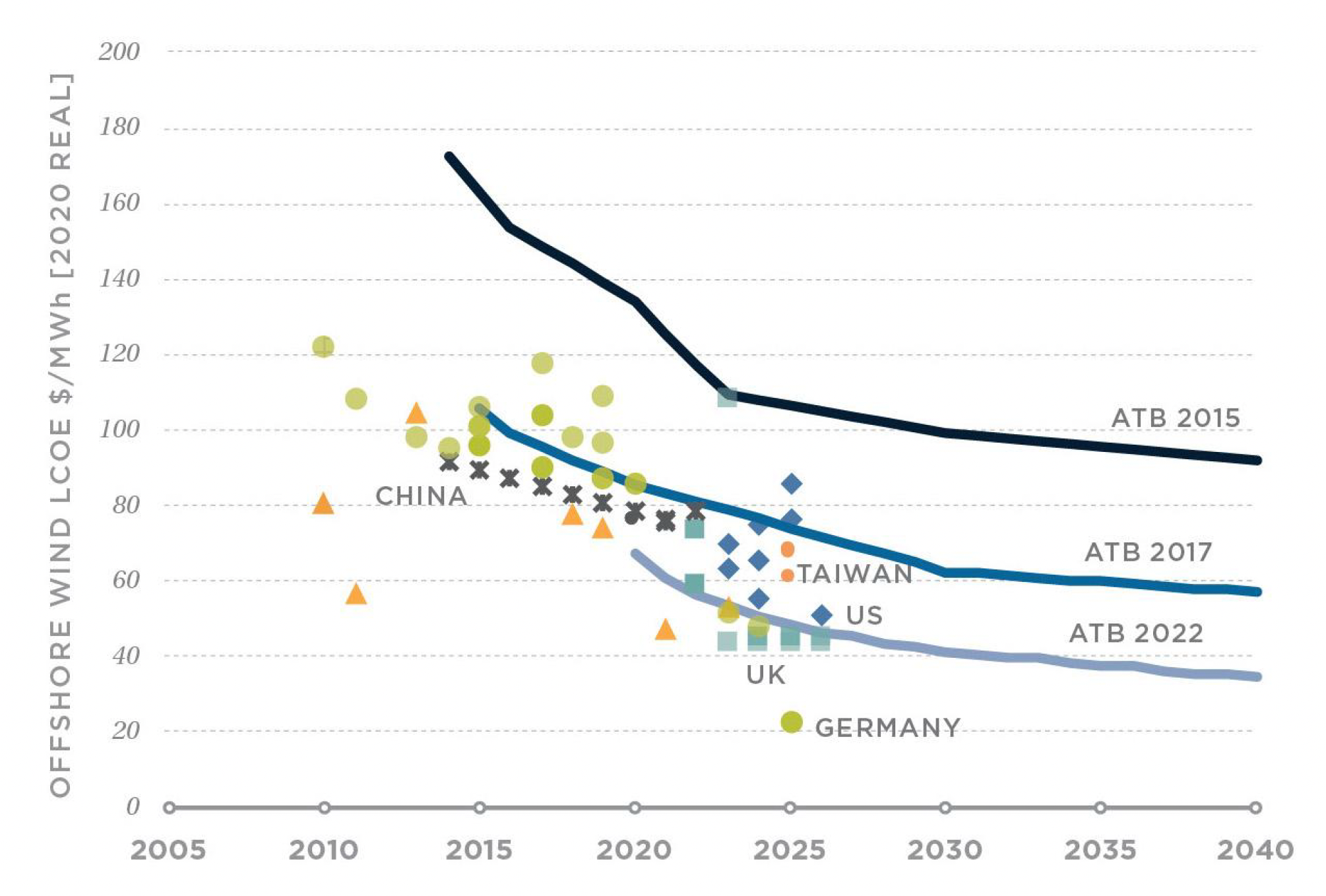

Is The Offshore Wind Boom Over Examining The Cost Factor

May 04, 2025

Is The Offshore Wind Boom Over Examining The Cost Factor

May 04, 2025 -

Nicolai Tangen Managing Investments Amidst Trumps Trade Wars

May 04, 2025

Nicolai Tangen Managing Investments Amidst Trumps Trade Wars

May 04, 2025 -

Long Term Impact Of Toxic Chemicals From Ohio Train Derailment On Buildings

May 04, 2025

Long Term Impact Of Toxic Chemicals From Ohio Train Derailment On Buildings

May 04, 2025 -

Analysis Broadcoms Proposed V Mware Price Hike And Its Impact On At And T

May 04, 2025

Analysis Broadcoms Proposed V Mware Price Hike And Its Impact On At And T

May 04, 2025

Latest Posts

-

May 2025 Ufc Events A Comprehensive Fight Card Schedule With Ufc 315

May 04, 2025

May 2025 Ufc Events A Comprehensive Fight Card Schedule With Ufc 315

May 04, 2025 -

Sydney Sweeneys Heartbreak Karaoke Post Davino Split

May 04, 2025

Sydney Sweeneys Heartbreak Karaoke Post Davino Split

May 04, 2025 -

Complete Ufc Schedule For May 2025 Including Ufc 315 Details

May 04, 2025

Complete Ufc Schedule For May 2025 Including Ufc 315 Details

May 04, 2025 -

Ufc On Espn 67 A Comprehensive Review Of The Sandhagen Vs Figueiredo Event

May 04, 2025

Ufc On Espn 67 A Comprehensive Review Of The Sandhagen Vs Figueiredo Event

May 04, 2025 -

When Does The Ufc Des Moines Fight Card Begin Tonight

May 04, 2025

When Does The Ufc Des Moines Fight Card Begin Tonight

May 04, 2025