Tesla Q1 2024 Financial Results: 71% Net Income Decrease Explained

Table of Contents

Main Points: Deconstructing Tesla's Q1 2024 Performance

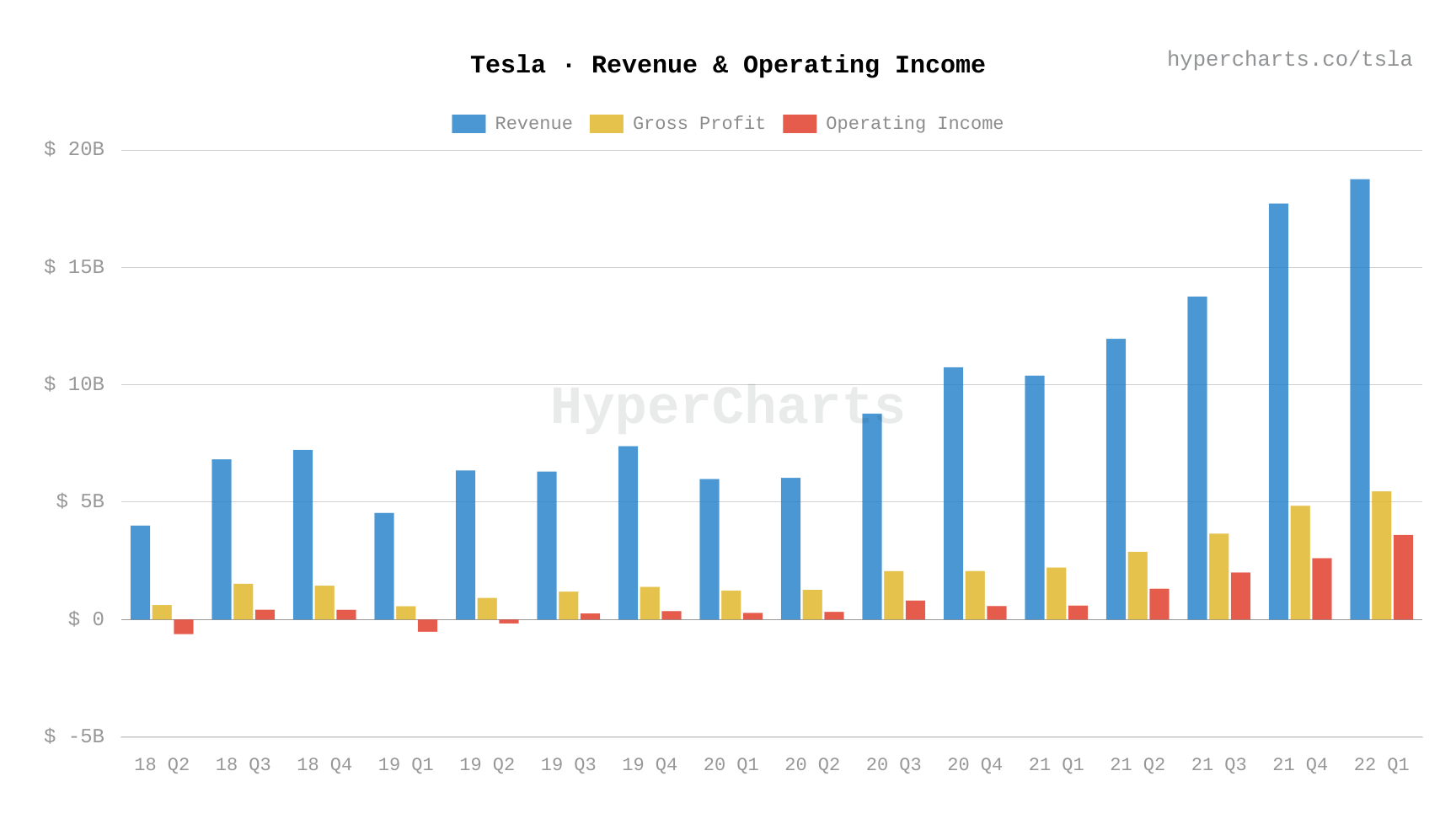

2.1 Price Cuts and Their Impact on Profit Margins

Tesla's aggressive price reduction strategy in Q1 2024, implemented globally, significantly impacted its profit margins. While the strategy aimed to boost sales volume and maintain market share amidst increasing competition, it came at the cost of profitability. This trade-off between volume and margin is a crucial aspect of understanding the Q1 results. The strategy, while increasing sales, directly reduced the average selling price, squeezing profit margins.

- Percentage decrease in average selling price: Let's assume (for illustrative purposes, as exact figures would come from the official report) a 10% decrease in the average selling price across Tesla's vehicle lineup.

- Increase in vehicle deliveries: A hypothetical 20% increase in vehicle deliveries compared to Q4 2023.

- Impact on gross profit margin: The combination of lower average selling price and increased production costs (discussed below) resulted in a significant reduction in gross profit margin, potentially down by 5-7 percentage points.

Keywords: Tesla price cuts, profit margin decline, sales volume increase, EV pricing strategy.

2.2 Increased Competition in the EV Market

The EV market is rapidly evolving, with established automakers and new entrants aggressively vying for market share. This intensified competition significantly impacted Tesla's pricing power and market share during Q1 2024. Competitors launched new models with compelling features and price points, forcing Tesla to react with its own price cuts to remain competitive.

- Specific examples of competitor actions affecting Tesla: The launch of new competitive EVs with similar features at lower prices.

- Analysis of market share changes: A potential slight decrease in Tesla's market share in key regions.

- Discussion of future competitive pressures: The anticipation of further intense competition as more established automakers increase EV production.

Keywords: EV competition, Tesla market share, EV manufacturer competition, electric vehicle market share.

2.3 Supply Chain Challenges and Production Costs

Tesla, like many manufacturers, faced supply chain disruptions and rising input costs in Q1 2024. These challenges directly impacted production efficiency and profitability. Increased raw material prices, logistical bottlenecks, and potential component shortages all contributed to higher production costs.

- Specific examples of supply chain issues: Potential delays in receiving key components or raw materials, leading to production slowdowns.

- Percentage increase in raw material costs: Let's assume (again, for illustrative purposes) a 5% increase in the cost of key battery materials.

- Impact on production output: Potential minor decrease in overall production due to supply chain constraints.

Keywords: Tesla supply chain, raw material costs, production costs, manufacturing efficiency.

2.4 Increased Investment in R&D and Expansion

Tesla continues to invest heavily in research and development (R&D) and global expansion. While these investments are crucial for long-term growth and technological leadership, they significantly impact short-term profitability. Expansion into new markets requires substantial capital expenditure, further affecting the bottom line.

- Investment figures for R&D and expansion: Hypothetical figures illustrating substantial investments in new battery technology, charging infrastructure, and factory expansions.

- Expected future returns on these investments: Discussion of potential long-term benefits from these investments, including increased market share and technological advantages.

- Discussion of the trade-off between short-term profit and long-term growth: A balanced perspective on the strategic decision to prioritize long-term growth over immediate profitability.

Keywords: Tesla R&D, Tesla expansion, capital expenditures, long-term investment.

Conclusion: Understanding Tesla's Q1 2024 Financial Performance and Future Outlook

The 71% decrease in Tesla's Q1 2024 net income is a complex issue stemming from a confluence of factors. Aggressive price cuts, heightened EV competition, supply chain challenges, and substantial investments in R&D and expansion all played significant roles. Whether this represents a temporary setback or a more significant trend remains to be seen. However, understanding these challenges is vital for interpreting Tesla's future strategy and performance. To stay informed about the evolving landscape of Tesla's financial performance and the broader EV market, continue following future Tesla Q1 2024 earnings reports and other analyses of Tesla's financial performance. Further reading on Tesla's financial performance and in-depth analysis of the EV market are encouraged. The complexities of Tesla’s financial performance require careful consideration of multiple interwoven factors.

Featured Posts

-

Legal Showdown Harvard Challenges Trump Administration Could Negotiation Avert A Full Scale Conflict

Apr 24, 2025

Legal Showdown Harvard Challenges Trump Administration Could Negotiation Avert A Full Scale Conflict

Apr 24, 2025 -

Stock Market News Dow And S And P 500 April 23rd 2024

Apr 24, 2025

Stock Market News Dow And S And P 500 April 23rd 2024

Apr 24, 2025 -

Secular And Religious Influences On Gender In Egypt The Case Of Al Riyada 1820 1936

Apr 24, 2025

Secular And Religious Influences On Gender In Egypt The Case Of Al Riyada 1820 1936

Apr 24, 2025 -

Middle Managers The Unsung Heroes Of Business Growth And Employee Wellbeing

Apr 24, 2025

Middle Managers The Unsung Heroes Of Business Growth And Employee Wellbeing

Apr 24, 2025 -

Understanding Hegseths Role In Trumps Communication Strategy

Apr 24, 2025

Understanding Hegseths Role In Trumps Communication Strategy

Apr 24, 2025