The Real Safe Bet: Investing In Stability And Growth

Table of Contents

Understanding Risk Tolerance and Investment Goals

Before diving into specific investment strategies, a crucial first step is self-assessment. Understanding your risk tolerance and defining your investment goals are foundational to investing in stability and growth. Your risk profile—conservative, moderate, or aggressive—dictates your comfort level with potential losses and the types of investments suitable for you.

Conservative investors prioritize capital preservation and typically opt for lower-return, lower-risk options. Moderate investors seek a balance between risk and return, while aggressive investors are willing to accept higher risk for potentially higher returns.

Equally important is defining your investment goals. Are you saving for retirement in 20 years, or aiming for a down payment on a house in five? Short-term goals necessitate lower-risk investments, while long-term goals allow for a more aggressive approach.

- Consider your age and financial situation. Younger investors generally have a longer time horizon and can tolerate more risk.

- Determine your comfort level with potential losses. Honest self-assessment is key to avoiding impulsive decisions during market downturns.

- Establish clear, measurable investment objectives. Set specific, achievable, relevant, and time-bound (SMART) goals.

Diversification: The Cornerstone of Stable Growth

Diversification is the bedrock of any successful long-term investment strategy, especially when investing in stability and growth. It's the principle of "don't put all your eggs in one basket." By spreading your investments across different asset classes, you reduce the impact of any single investment performing poorly.

Asset classes include stocks (equities), bonds (fixed income), real estate, commodities, and alternative investments. Stocks represent ownership in companies and offer higher growth potential but also higher risk. Bonds, on the other hand, represent loans to governments or corporations and offer lower risk and more predictable returns. Real estate provides diversification and potential for long-term appreciation.

- Don't put all your eggs in one basket. Diversification is your shield against market fluctuations.

- Spread investments across different sectors and geographies. Reducing exposure to a single sector or country minimizes the impact of localized economic downturns.

- Consider using ETFs or mutual funds for diversified exposure. These offer instant diversification across a range of assets with a single investment.

Investing in Blue-Chip Stocks for Stability

Blue-chip stocks represent shares in established, financially sound companies with a long history of profitability and consistent dividend payments. These companies are often leaders in their respective industries, offering a degree of stability that's attractive for those investing in stability and growth. Think Coca-Cola, Johnson & Johnson, or Microsoft – companies with proven track records and resilience.

Because of their established positions and strong financials, blue-chip stocks generally exhibit lower volatility than smaller, growth-oriented companies. However, it's crucial to remember that even blue-chip stocks can experience price fluctuations.

- Research company financials and history before investing. Due diligence is crucial regardless of the investment type.

- Look for companies with a history of consistent dividend payments. Dividends provide a regular income stream and can contribute to long-term growth.

- Consider investing in index funds that track blue-chip indices. This provides instant diversification across a basket of blue-chip companies.

The Role of Bonds in a Stable Investment Portfolio

Bonds are debt instruments that represent a loan to a government or corporation. They offer a fixed income stream and are generally considered lower-risk than stocks, making them a valuable component for those investing in stability and growth. Government bonds are typically considered the safest, while corporate bonds carry slightly more risk but potentially higher returns.

Bonds play a crucial role in balancing portfolio risk. While they may not offer the same growth potential as stocks, they provide stability and can act as a buffer during stock market downturns.

- Bonds offer predictable income streams. This provides a reliable source of cash flow, especially important during retirement.

- They can act as a buffer against stock market volatility. Bonds often perform well when stocks are declining, helping to reduce overall portfolio risk.

- Consider diversifying your bond holdings across maturities and issuers. This further reduces risk and improves overall portfolio stability.

Long-Term Growth Strategies: Reinvesting and Compound Interest

The magic of long-term investing in stability and growth lies in the power of compounding. Reinvesting dividends and capital gains allows your earnings to generate even more earnings over time. This snowball effect can significantly boost your returns over the long term.

Patience is crucial. Avoid emotional decision-making and frequent trading. Market fluctuations are inevitable, but long-term investors can ride out these short-term bumps. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, can help mitigate the risk associated with market timing.

- Let your investments grow over time. The longer your money is invested, the greater the potential for growth through compounding.

- Avoid frequent trading and emotional decisions. Discipline is key to long-term success.

- Consider dollar-cost averaging to mitigate risk. This strategy helps to smooth out market volatility.

Conclusion

Building a portfolio that successfully balances investing in stability and growth requires a multifaceted approach. Diversification across asset classes, incorporating blue-chip stocks and bonds, and employing long-term strategies like reinvesting dividends are key components. Remember to align your investment strategy with your risk tolerance and financial goals. Begin your journey towards financial security with smart investing in stability and growth. Take the first step towards a secure financial future; learn more about investing in stability and growth today.

Featured Posts

-

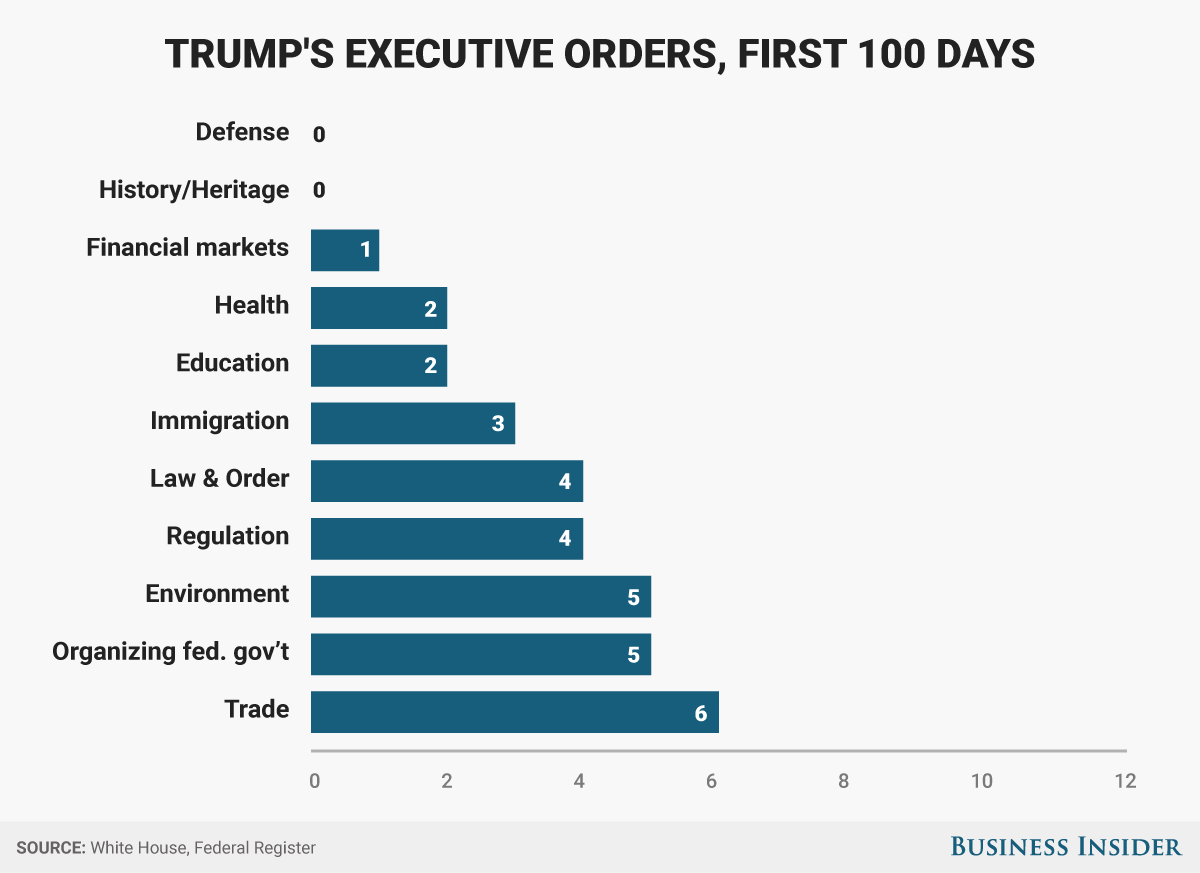

Stock Market Reaction Analyzing Trumps China Tariff Proposal And Uk Trade Implications

May 10, 2025

Stock Market Reaction Analyzing Trumps China Tariff Proposal And Uk Trade Implications

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025 -

1078 2025 R5

May 10, 2025

1078 2025 R5

May 10, 2025 -

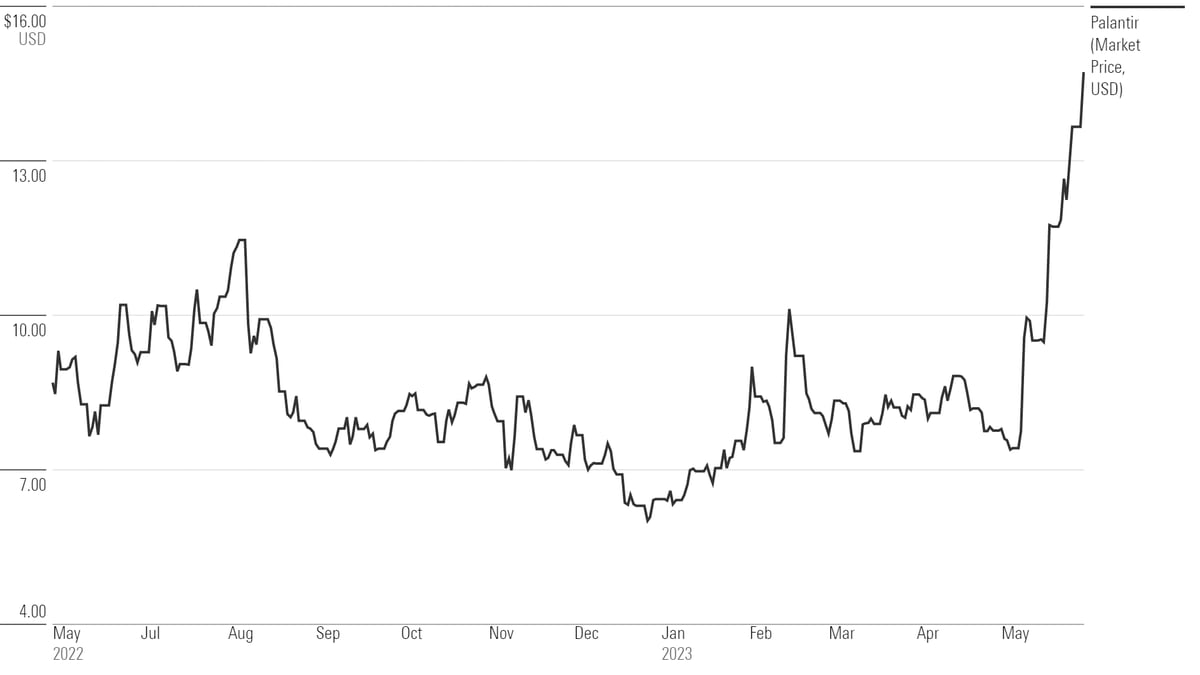

Should You Buy Palantir Stock Now A Pre May 5th Analysis

May 10, 2025

Should You Buy Palantir Stock Now A Pre May 5th Analysis

May 10, 2025 -

Discovering The Medieval Story Of Merlin And Arthur A Book Cover Analysis

May 10, 2025

Discovering The Medieval Story Of Merlin And Arthur A Book Cover Analysis

May 10, 2025