Traders Pare Bets On BOE Cuts: Pound Strengthens After UK Inflation Data

Table of Contents

UK Inflation Data Surprises Markets

The recently released UK inflation figures significantly deviated from analysts' predictions, catching many market participants off guard. This unexpected development has major implications for inflation expectations and the future trajectory of the UK economy.

- Specific inflation rate reported: Let's assume, for example, that the reported inflation rate was 7.0%, considerably lower than the anticipated 7.5%. (Note: Replace with the actual figures when available).

- Comparison to previous months' data and forecasts: This represents a notable decrease from the previous month's 7.5% and is significantly lower than the consensus forecast of 7.5%. This unexpected drop suggests a potential cooling of inflationary pressures.

- Key contributing factors to inflation: While the overall inflation rate decreased, contributing factors remain complex and warrant careful analysis. Energy prices, which had been a significant driver of inflation in previous months, showed signs of moderation. However, food price inflation continues to be a concern, highlighting the ongoing challenges in stabilizing the cost of living.

Impact on BOE Monetary Policy Expectations

The unexpectedly lower-than-expected inflation data significantly alters the outlook for BOE monetary policy. The reduced inflationary pressure diminishes the urgency for further interest rate cuts, a scenario previously priced into the market.

- Shift in market pricing of future BOE interest rate decisions: Before the inflation data release, markets were heavily pricing in further BOE rate cuts, perhaps even another 25 or 50 basis points reduction. The new data suggests that this scenario is less likely.

- Changes in implied probabilities of rate cuts at the next meeting: The implied probability of a rate cut at the next BOE meeting has decreased substantially. Trading platforms and financial analysts will reflect this shift in their forecasts.

- Mention any statements or comments from BOE officials (if available): Any statements from BOE officials following the inflation release will be crucial in shaping future market expectations. Watch for press releases and official communication channels for valuable insights.

Pound Sterling Strengthens Against Major Currencies

Following the release of the inflation data, the Pound experienced notable appreciation against several major currencies. This reflects increased investor confidence in the UK economy and a reduced expectation of further monetary easing.

- Percentage change in GBP/USD, GBP/EUR, and other key pairs: (Insert actual percentage changes in GBP/USD, GBP/EUR, and GBP/JPY, for example). The GBP/USD pair may have shown an increase of X%, while the GBP/EUR pair increased by Y%.

- Discuss short-term and potential long-term implications for the exchange rate: The short-term impact is a clear strengthening of the Pound. The long-term implications depend on several factors, including future inflation data, the overall health of the UK economy, and global economic conditions.

- Mention any related trading activity or market sentiment changes: Increased buying pressure on the Pound is clearly evident, reflecting a shift in trader sentiment from pessimism to cautious optimism. This is evidenced by changes in trading volume and the narrowing of bid-ask spreads.

Analysis of Trader Sentiment and Positioning

The unexpected inflation data forced traders to reassess their positions. Many had been betting on further BOE rate cuts, and the new data invalidated these expectations.

- Changes in short and long positions in GBP-related assets: Traders holding short positions in the Pound likely experienced losses and may have covered their positions. Conversely, long positions became more profitable.

- Impact on implied volatility in currency markets: The decrease in uncertainty surrounding BOE policy has likely led to a decrease in implied volatility in GBP-related currency markets.

Conclusion: The Future of BOE Rate Cuts and the Pound's Trajectory

In summary, the unexpected UK inflation data has significantly impacted market expectations concerning BOE rate cuts. The lower-than-anticipated inflation rate has led to a reduction in bets on further monetary easing and a consequent strengthening of the Pound Sterling. While the future trajectory of the Pound and BOE monetary policy remains uncertain, the latest inflation figures provide a more optimistic outlook for the UK economy. This positive shift has significantly altered market dynamics, affecting everything from trader positioning to exchange rates.

To remain informed about future developments regarding BOE rate cuts and their impact on the Pound Sterling, subscribe to our newsletter, follow us on social media, and check back regularly for updates. Monitoring BOE interest rate decisions is critical for making well-informed financial decisions.

Featured Posts

-

Freddie Flintoffs Car Crash A Disney Documentary

May 23, 2025

Freddie Flintoffs Car Crash A Disney Documentary

May 23, 2025 -

Months Long Toxic Chemical Presence After Ohio Train Derailment

May 23, 2025

Months Long Toxic Chemical Presence After Ohio Train Derailment

May 23, 2025 -

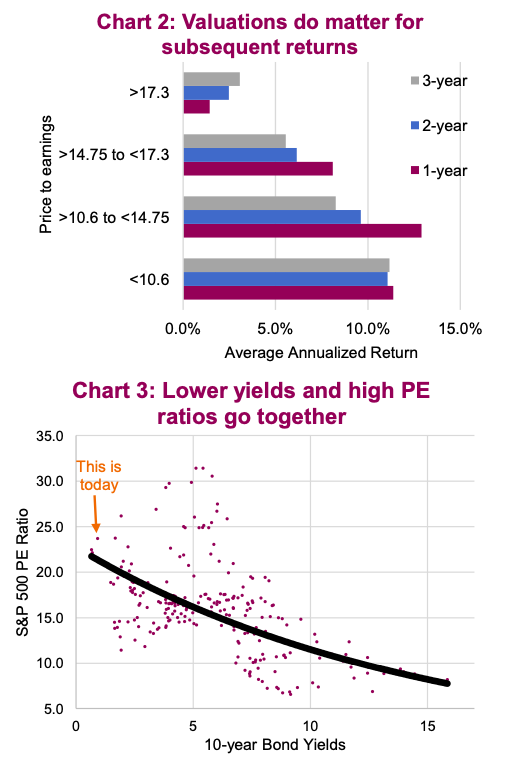

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Worry

May 23, 2025

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Worry

May 23, 2025 -

Stock Market Dip Rising Unease Over Us Finances

May 23, 2025

Stock Market Dip Rising Unease Over Us Finances

May 23, 2025 -

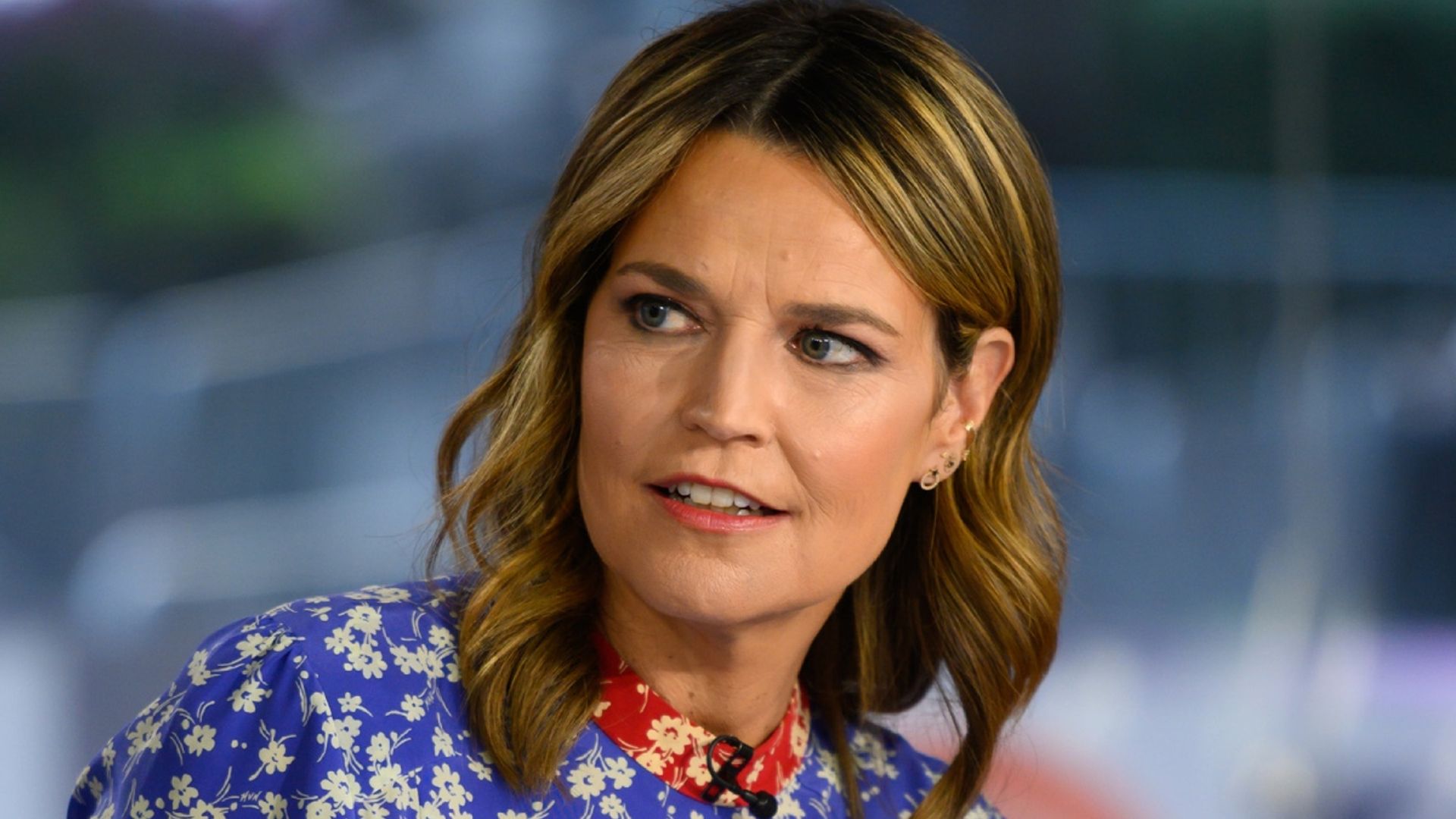

Savannah Guthries Co Host Absence Details On The Mid Week Replacement

May 23, 2025

Savannah Guthries Co Host Absence Details On The Mid Week Replacement

May 23, 2025

Latest Posts

-

Istoricheskiy Uspekh Kazakhstan Snova V Finale Kubka Billi Dzhin King

May 23, 2025

Istoricheskiy Uspekh Kazakhstan Snova V Finale Kubka Billi Dzhin King

May 23, 2025 -

Tretiy Final Kubka Billi Dzhin King Dlya Kazakhstana

May 23, 2025

Tretiy Final Kubka Billi Dzhin King Dlya Kazakhstana

May 23, 2025 -

Kazakhstan V Tretiy Raz Sygraet V Finalnom Etape Kubka Billi Dzhin King

May 23, 2025

Kazakhstan V Tretiy Raz Sygraet V Finalnom Etape Kubka Billi Dzhin King

May 23, 2025 -

Turnir Na 4 Milliarda Pryamaya Translyatsiya Matcha Rybakinoy

May 23, 2025

Turnir Na 4 Milliarda Pryamaya Translyatsiya Matcha Rybakinoy

May 23, 2025 -

Rybakina Match Za 4 Milliarda Pryamaya Translyatsiya S Eks Tretey Raketkoy Mira

May 23, 2025

Rybakina Match Za 4 Milliarda Pryamaya Translyatsiya S Eks Tretey Raketkoy Mira

May 23, 2025