Trump Calls For Ban On Congressional Stock Trading: Full Time Interview Analysis

Table of Contents

Analysis of Trump's Statements in the Interview

Specific Quotes and Their Interpretation

Trump's call for a ban on congressional stock trading wasn't a fleeting comment; it was a central theme woven throughout the interview. He expressed deep concern about the perception, and reality, of conflicts of interest within Congress.

- "It's a disgrace, absolutely a disgrace," Trump stated, highlighting his strong feelings on the matter. This quote underscores the ethical concerns at the heart of the debate.

- "They're making decisions based on their own financial interests, not the interests of the American people," he claimed. This directly addresses the core issue: the potential for insider trading and conflicts of interest influencing legislative decisions.

- "A total ban is the only way to fix this," he asserted, emphasizing the need for a complete overhaul of the current system. This reflects a belief that current regulations are insufficient to address the problem.

The interview's context – a climate of increasing public distrust in government and ongoing investigations into congressional stock trading – amplified the impact of his words.

Trump's Rationale Behind the Call for a Ban

Trump's rationale for supporting a ban stems from a broader concern about restoring public trust in government. He argues that the current system allows for, and even encourages, unethical behavior.

- Erosion of Public Trust: He repeatedly emphasized the damage done to public trust by the perception, even if not always the reality, of lawmakers prioritizing personal gain over public service.

- Potential for Insider Trading: Trump highlighted the inherent conflict of interest inherent in lawmakers possessing access to non-public information that could influence their investment decisions.

- Need for Transparency: He advocated for increased transparency and accountability in government, arguing that a ban would be a significant step toward achieving this goal.

While some might argue that a ban is overly restrictive or impractical, Trump's position reflects a growing sentiment that stronger measures are necessary to address the issue.

The Current State of Congressional Stock Trading

Existing Regulations and Their Effectiveness

Currently, there are some regulations governing congressional stock trading, but their effectiveness is widely debated. The Stop Trading on Congressional Knowledge (STOCK) Act of 2012 aimed to increase transparency and prevent insider trading, but loopholes and weak enforcement have been criticized.

- The STOCK Act: While intending to prevent insider trading, it has been criticized for its lack of robust enforcement mechanisms.

- Disclosure Requirements: While lawmakers are required to disclose their stock trades, the timing and nature of these disclosures often leave room for ambiguity and potential manipulation.

- Limited Penalties: The penalties for violating existing regulations are often viewed as insufficient deterrents.

Numerous instances have emerged where lawmakers have been accused of engaging in questionable stock trading activities, highlighting the shortcomings of current regulations.

Public Perception and the Demand for Reform

Public opinion on congressional stock trading is overwhelmingly negative. Polls consistently show widespread dissatisfaction with the current system and strong support for reform.

- Public Distrust: A significant portion of the public believes that lawmakers use their positions to enrich themselves at the expense of the public good.

- Calls for Reform: Numerous organizations and advocacy groups are actively campaigning for stricter regulations and greater transparency in congressional stock trading.

- Examples of Controversy: High-profile cases involving alleged insider trading by members of Congress have further fueled public outrage and demand for reform.

The persistent negative public perception underscores the urgent need for meaningful action to address this issue.

Potential Impacts of a Ban on Congressional Stock Trading

Economic and Political Consequences

A ban on congressional stock trading could have significant economic and political consequences.

- Impact on the Stock Market: Some argue that a ban could negatively impact market liquidity, while others believe that it would increase investor confidence.

- Campaign Finance: The ban might lead to changes in campaign finance, as lawmakers may seek alternative ways to raise funds.

- Political Landscape: A ban could shift the political landscape, potentially affecting the balance of power and influencing legislative outcomes.

The overall economic and political impact of a ban remains a subject of ongoing debate and requires careful analysis.

Practical Challenges of Implementing a Ban

Implementing a ban on congressional stock trading presents several practical challenges.

- Legislative Hurdles: Passing such a ban would require overcoming significant legislative hurdles and navigating potential opposition from lawmakers with vested interests.

- Enforcement Difficulties: Enforcing a ban effectively would require robust oversight mechanisms and potentially significant increases in resources.

- Potential Legal Challenges: The ban could face legal challenges on grounds of constitutionality or infringement on individual rights.

Alternative approaches, such as strengthening existing regulations, enhancing transparency, and improving enforcement, should also be considered.

Conclusion

Trump's call for a ban on congressional stock trading, as expressed in his recent interview, highlights a growing concern about ethics and transparency in government. His statements, coupled with the ongoing debate surrounding congressional stock trading and the public's demand for reform, underscores the need for serious consideration of potential solutions. While a complete ban presents significant challenges, the current system's shortcomings are undeniable. The debate surrounding "Trump Calls for Ban on Congressional Stock Trading" is critical to restoring public trust. We urge readers to research the topic further, contact their representatives to voice their opinions on potential solutions, and participate in the ongoing conversation about how best to address conflicts of interest in Congress. Let’s work together to ensure that our representatives prioritize the interests of their constituents above personal financial gain.

Featured Posts

-

The Post Roe Landscape Examining The Significance Of Otc Birth Control

Apr 26, 2025

The Post Roe Landscape Examining The Significance Of Otc Birth Control

Apr 26, 2025 -

Nintendos Intervention Ryujinx Switch Emulator Development Ceases

Apr 26, 2025

Nintendos Intervention Ryujinx Switch Emulator Development Ceases

Apr 26, 2025 -

Gold Price Record Rally Bullion As A Trade War Safe Haven

Apr 26, 2025

Gold Price Record Rally Bullion As A Trade War Safe Haven

Apr 26, 2025 -

The Karen Read Case A Year By Year Account Of The Legal Proceedings

Apr 26, 2025

The Karen Read Case A Year By Year Account Of The Legal Proceedings

Apr 26, 2025 -

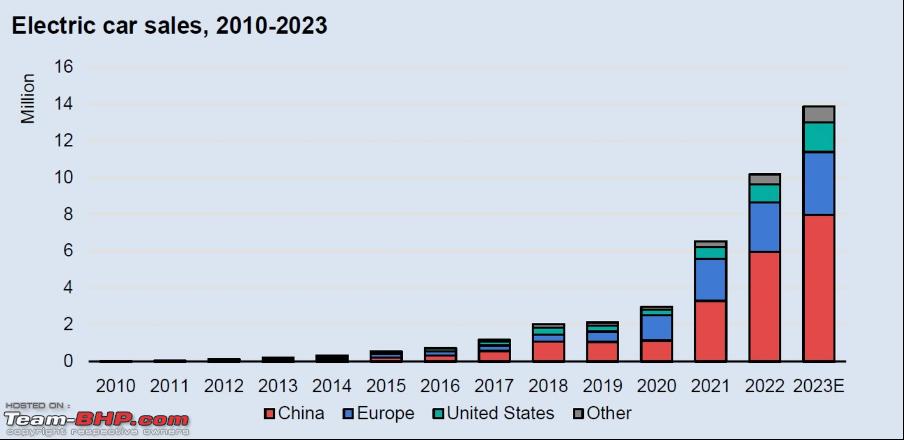

Evaluating The Potential Of Chinese Made Vehicles For Global Consumers

Apr 26, 2025

Evaluating The Potential Of Chinese Made Vehicles For Global Consumers

Apr 26, 2025

Latest Posts

-

Erfassung Der Herpetofauna Thueringens Der Neue Amphibien Und Reptilienatlas

Apr 27, 2025

Erfassung Der Herpetofauna Thueringens Der Neue Amphibien Und Reptilienatlas

Apr 27, 2025 -

Reptilien Und Amphibien In Thueringen Ein Detaillierter Atlas

Apr 27, 2025

Reptilien Und Amphibien In Thueringen Ein Detaillierter Atlas

Apr 27, 2025 -

Thueringen Artenvielfalt Von Eidechsen Und Molchen Im Neuen Atlas

Apr 27, 2025

Thueringen Artenvielfalt Von Eidechsen Und Molchen Im Neuen Atlas

Apr 27, 2025 -

Neuer Atlas Dokumentiert Amphibien Und Reptilien In Thueringen

Apr 27, 2025

Neuer Atlas Dokumentiert Amphibien Und Reptilien In Thueringen

Apr 27, 2025 -

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025