U.S. Federal Reserve: Rate Decision And The Mounting Economic Challenges

Table of Contents

The Fed's Rate Hike and its Rationale

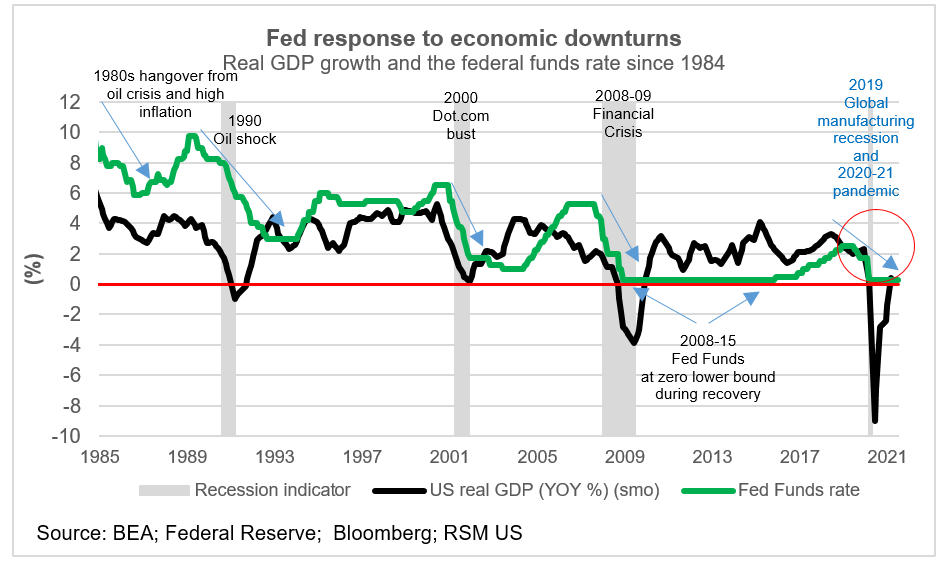

The U.S. Federal Reserve recently announced another interest rate hike, continuing its aggressive campaign to combat persistent inflation. This decision, made by the Federal Open Market Committee (FOMC), aims to cool down the overheating economy and bring inflation back to its target rate of 2%.

-

Goal 1: Inflation Control: The primary goal of the Fed's rate hikes is to curb inflation. By increasing interest rates, borrowing becomes more expensive, reducing consumer spending and business investment, thereby lessening the demand-pull pressures that fuel inflation.

-

Goal 2: Managing Unemployment: While aiming to curb inflation, the Fed also seeks to avoid triggering a significant increase in unemployment. Finding the right balance between controlling inflation and maintaining a healthy labor market is a delicate act of economic policy.

-

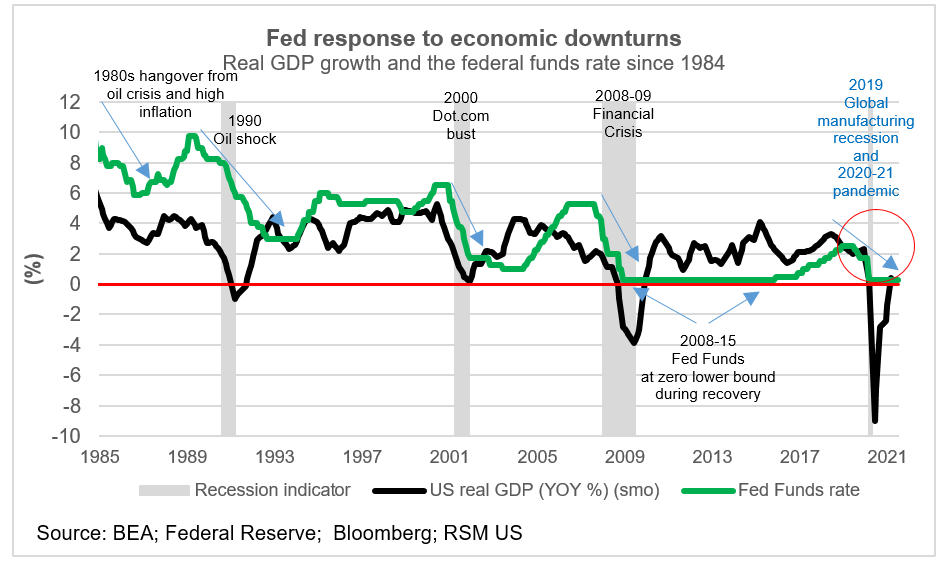

Influence of Geopolitical Factors: The current inflationary environment is significantly influenced by geopolitical factors. The war in Ukraine has disrupted global supply chains, driving up energy and food prices. Supply chain disruptions, exacerbated by the pandemic's lingering effects, further contribute to inflationary pressures.

-

Data & Statistics: The current inflation rate, as measured by the Consumer Price Index (CPI), remains stubbornly high, exceeding the Fed's target. The FOMC carefully considers various economic indicators, including CPI, GDP growth, unemployment rates, and consumer confidence, when making its rate decisions.

Economic Challenges Facing the U.S.

The U.S. economy is currently facing a complex array of challenges, creating a difficult environment for both the Federal Reserve and businesses.

-

High Inflation: Persistently high inflation erodes purchasing power, impacting consumers' ability to afford essential goods and services. Businesses face increased input costs, leading to potential price increases and reduced profit margins. This high inflation is a major driver of the Fed's aggressive interest rate policy.

-

The Labor Market: While unemployment remains relatively low, wage growth has not kept pace with inflation, leaving many workers with reduced real income. This creates a challenging situation for households, potentially dampening consumer spending.

-

Recession Risk: The combination of high inflation and rising interest rates raises concerns about a potential recession. Indicators like slowing GDP growth and declining consumer confidence contribute to this risk.

-

Sectoral Impacts: The housing market is particularly sensitive to interest rate changes, with rising mortgage rates leading to a slowdown in home sales and construction. Consumer spending, a significant driver of economic growth, is also likely to be affected by reduced purchasing power and increased borrowing costs.

Potential Impacts of the Rate Decision

The Fed's rate hike decision carries significant implications for the U.S. economy, both in the short term and the long term.

-

Impact on Borrowing Costs: Increased interest rates directly impact borrowing costs for consumers and businesses. Mortgages, auto loans, and business loans become more expensive, potentially dampening investment and spending. This “interest rate effect” is the core mechanism of the Fed's monetary policy.

-

Effects on Investment and Growth: Higher borrowing costs can discourage businesses from investing in expansion or new projects, leading to slower economic growth. This can create a negative feedback loop, impacting job creation and overall economic performance.

-

Housing Market Slowdown: The housing market is highly sensitive to interest rate changes. Rising mortgage rates typically lead to a decrease in home sales and construction activity, potentially impacting related industries.

-

Differentiated Impacts: The impact of the rate hike will vary across different sectors. Small businesses, often more reliant on borrowing, may be disproportionately affected compared to larger corporations with greater financial resources.

Alternative Approaches and Future Outlook

The Fed's approach to managing the current economic challenges is not without debate.

-

Quantitative Tightening: The Fed's quantitative tightening (QT) policy, involving reducing its balance sheet, is another tool used to control inflation. This involves selling off assets, reducing the money supply. However, the effectiveness and potential side effects of QT are subjects of ongoing discussion among economists.

-

Future Rate Adjustments: Future interest rate adjustments by the Fed will heavily depend on incoming economic data. If inflation remains stubbornly high, further rate hikes are likely. However, if inflation shows signs of cooling down, the Fed may pause or even reverse course.

-

Uncertainties and Risks: Forecasting future economic performance is inherently uncertain. Unexpected shocks, such as further geopolitical instability or unforeseen supply chain disruptions, could significantly influence the economic outlook.

-

Expert Opinions: Economists hold differing views on the Fed's strategy and its effectiveness. Some argue that the Fed is acting too aggressively, risking a recession. Others contend that stronger action is needed to control inflation decisively.

Conclusion

The U.S. Federal Reserve's recent rate decision is a critical response to the mounting economic challenges, but its impact remains uncertain. High inflation, fluctuating unemployment, and the threat of recession demand careful consideration of the long-term consequences. Understanding the interplay between the Federal Reserve’s actions, the current economic climate, and the potential for future rate adjustments is vital for both businesses and consumers. Stay informed about the latest developments from the U.S. Federal Reserve to effectively navigate these turbulent economic times. Continuing to monitor the U.S. Federal Reserve's actions and their implications for the U.S. economy is crucial.

Featured Posts

-

Trade Disruptions How The Bubble Blaster Crisis Affects Chinese Exports

May 09, 2025

Trade Disruptions How The Bubble Blaster Crisis Affects Chinese Exports

May 09, 2025 -

El Bolso Practico De Dakota Johnson Descubre El Diseno Hereu

May 09, 2025

El Bolso Practico De Dakota Johnson Descubre El Diseno Hereu

May 09, 2025 -

Mans 3 K Babysitting Bill Leads To 3 6 K Daycare Cost A Costly Lesson

May 09, 2025

Mans 3 K Babysitting Bill Leads To 3 6 K Daycare Cost A Costly Lesson

May 09, 2025 -

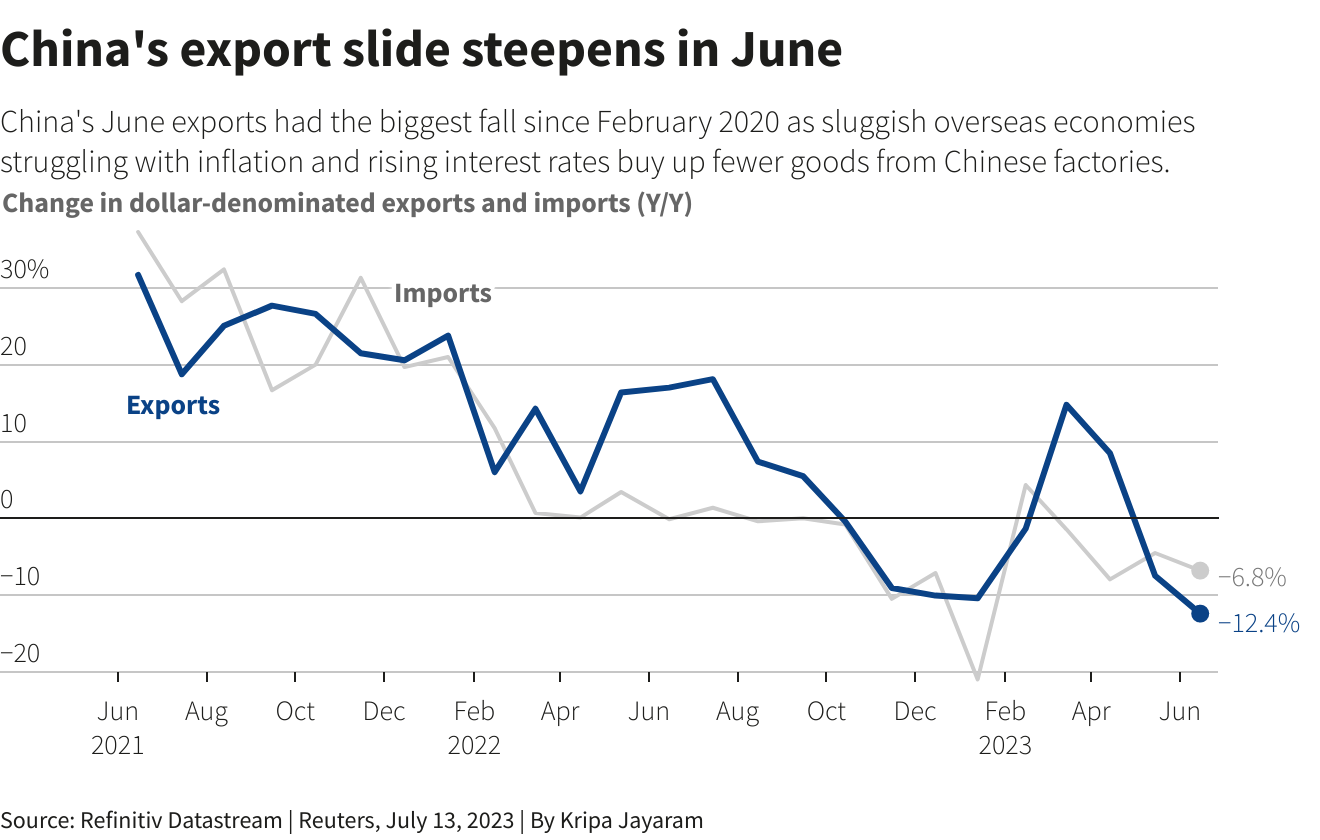

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 09, 2025

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 09, 2025 -

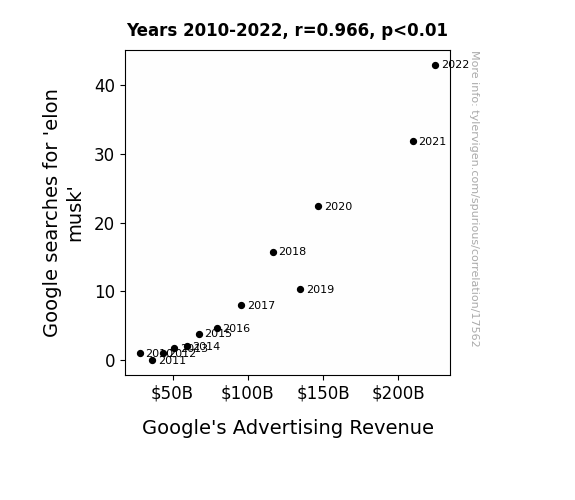

Examining The Correlation Between Us Economy And Elon Musks Wealth

May 09, 2025

Examining The Correlation Between Us Economy And Elon Musks Wealth

May 09, 2025