U.S. Tariff Pause Triggers 8% Stock Market Rise On Euronext Amsterdam

Table of Contents

The Impact of the U.S. Tariff Pause on Global Markets

The imposition of U.S. tariffs on various goods had previously created considerable uncertainty and volatility in global trade. These tariffs, impacting sectors ranging from technology to manufacturing, significantly hampered international commerce, leading to increased costs for businesses and consumers alike. The unexpected pause, however, offered a temporary reprieve. This breather had a substantial impact, not just on investor confidence but also on import/export dynamics and global economic forecasts.

- Impact on Investor Confidence: The pause signaled a potential de-escalation of trade tensions, boosting investor confidence and encouraging investment in previously hesitant markets.

- Changes in Import/Export Dynamics: The reduction in tariff barriers facilitated smoother trade flows, leading to reduced costs and potentially increased volumes of goods exchanged internationally.

- Shift in Global Economic Forecasts: Many economists revised their global economic growth forecasts upwards, factoring in the potential positive effects of reduced trade friction. The positive sentiment spread beyond just the impacted sectors, benefiting global markets broadly. The ripple effect was felt across major stock exchanges worldwide, though Euronext Amsterdam experienced a particularly pronounced reaction.

Euronext Amsterdam's Specific Response to the Tariff News

The 8% surge on Euronext Amsterdam was particularly noteworthy. Several factors contributed to this disproportionately positive response. Many companies listed on Euronext Amsterdam have significant exposure to sectors directly affected by U.S. tariffs. The tariff pause, therefore, offered immediate relief, leading to a surge in investor optimism and speculation. This was fueled by a general increase in positive investor sentiment.

- Analysis of Specific Stock Performance: Companies heavily reliant on transatlantic trade, particularly in technology and manufacturing, witnessed substantial gains. A detailed analysis of individual stock performance reveals a clear correlation between the extent of tariff exposure and the magnitude of stock price increases.

- Comparison to Other European Stock Exchanges' Performance: While other European exchanges also experienced positive growth following the tariff news, the increase on Euronext Amsterdam significantly outpaced many of its counterparts, highlighting the exchange's unique sensitivity to U.S. trade policy.

- Specific Companies that Saw Significant Gains: [Insert examples of specific companies listed on Euronext Amsterdam that experienced significant gains. Include ticker symbols for SEO purposes, e.g., ASML (ASML.AS) or STM (STM.AS)]. These examples will bolster the analysis and add credibility.

Analyzing the Sustainability of the Market Rise

While the 8% rise on Euronext Amsterdam was undeniably significant, its sustainability remains uncertain. The market's positive reaction is based on a temporary pause, not a permanent resolution of trade disputes. Several factors could reverse this upward trend.

- Potential for Renewed Tariff Pressures: Any renewed escalation of trade tensions or the re-imposition of tariffs could quickly reverse the current positive sentiment and trigger a market correction.

- Impact of Broader Economic Factors: Macroeconomic factors such as inflation and interest rate changes could also influence the market's trajectory, independent of tariff developments.

- Expert Opinions on the Future of the Market: [Insert quotes or summaries from relevant financial experts discussing the long-term outlook for Euronext Amsterdam and the global market in light of the tariff pause].

Implications for Investors and Traders

The market volatility surrounding the U.S. tariff situation highlights the importance of prudent risk management. Investors should carefully assess their portfolio's exposure to sectors sensitive to trade policy changes. Diversification is key to mitigating potential losses.

- Strategies for Mitigating Risk: Investors might consider diversifying their holdings across various sectors and geographies to reduce their reliance on specific markets heavily influenced by U.S. trade policies. Hedging strategies could also be explored.

- Opportunities for Potential Gains: The current market situation presents opportunities for strategic investors. Thorough research and a well-defined investment strategy are crucial to capitalize on potential gains while managing risk.

- Recommendations for Diversifying Investments: Investors should consider broadening their portfolio to include assets less sensitive to trade wars and tariff fluctuations, such as real estate, precious metals, or alternative investments.

Conclusion: Understanding the U.S. Tariff Pause and its Euronext Amsterdam Implications

The 8% surge on Euronext Amsterdam, directly attributable to the pause in U.S. tariffs, underscores the significant impact of trade policy on global markets. While the positive reaction is encouraging, its sustainability hinges on the continuation of de-escalation and broader economic stability. The impact on global markets and investor sentiment demonstrates the interconnectedness of the global economy.

To navigate this volatile landscape, staying informed about developments concerning U.S. tariffs and their implications for Euronext Amsterdam and other global markets is crucial. We encourage further research on U.S. tariff policies and their effects on global stock exchanges to make informed investment decisions. Understanding these dynamics is essential for managing risk and capitalizing on potential opportunities in a constantly evolving global market.

Featured Posts

-

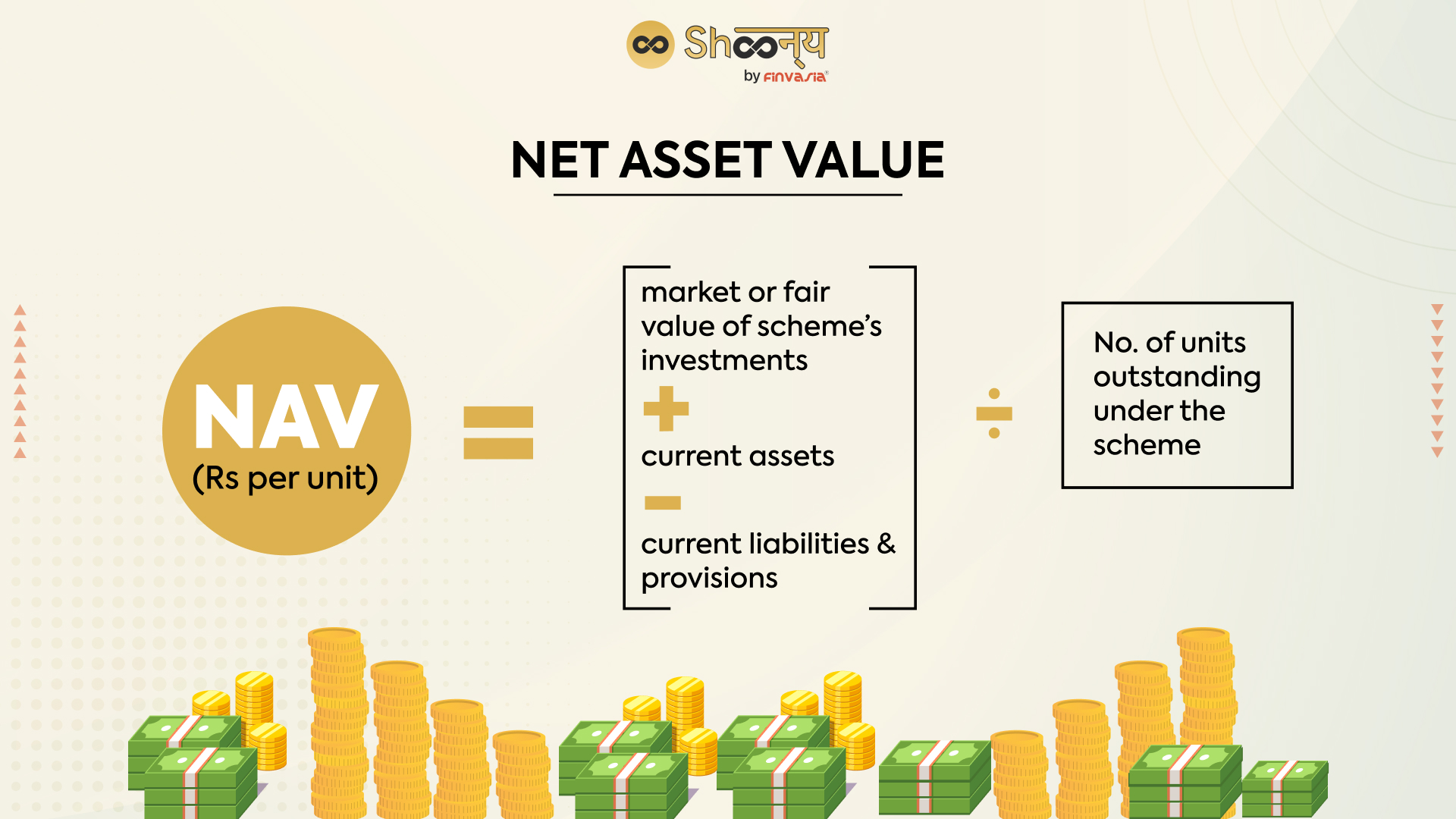

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

2025 Porsche Cayenne Interior And Exterior Images

May 24, 2025

2025 Porsche Cayenne Interior And Exterior Images

May 24, 2025 -

Serious M6 Crash Causes Major Traffic Disruption

May 24, 2025

Serious M6 Crash Causes Major Traffic Disruption

May 24, 2025 -

Ferrari Launches Flagship Facility In Bangkok Bangkok Post

May 24, 2025

Ferrari Launches Flagship Facility In Bangkok Bangkok Post

May 24, 2025 -

Beurzenherstel Na Trump Uitstel Aex Fondsen Boeken Winsten

May 24, 2025

Beurzenherstel Na Trump Uitstel Aex Fondsen Boeken Winsten

May 24, 2025

Latest Posts

-

What Sam Altman Revealed About His New Device With Jony Ive

May 24, 2025

What Sam Altman Revealed About His New Device With Jony Ive

May 24, 2025 -

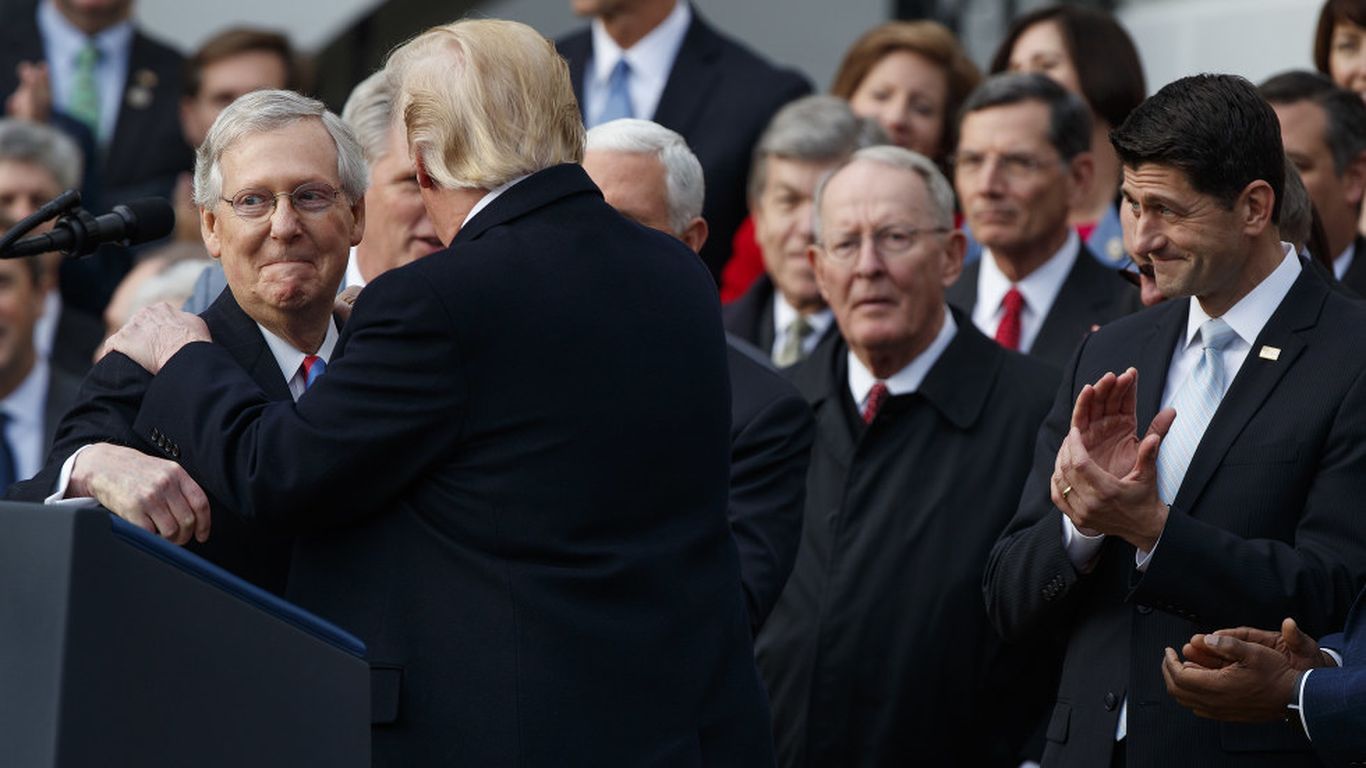

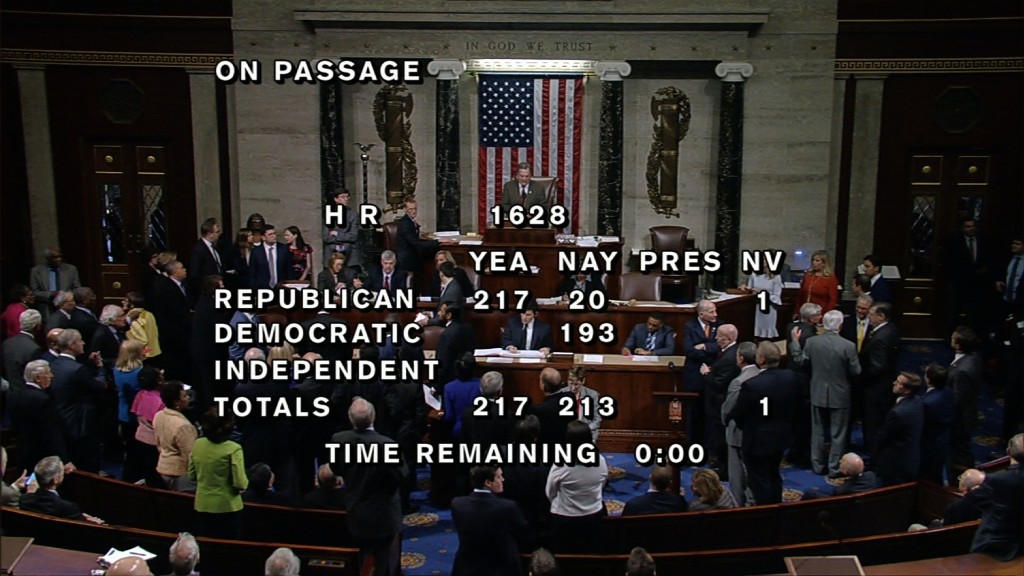

Market Reaction House Tax Bill Passage Affects Bonds Stocks And Bitcoin

May 24, 2025

Market Reaction House Tax Bill Passage Affects Bonds Stocks And Bitcoin

May 24, 2025 -

How Alix Earle Conquered Gen Z Marketing On Dancing With The Stars

May 24, 2025

How Alix Earle Conquered Gen Z Marketing On Dancing With The Stars

May 24, 2025 -

House Tax Bill Passes Impact On Stock Market Bonds And Bitcoin

May 24, 2025

House Tax Bill Passes Impact On Stock Market Bonds And Bitcoin

May 24, 2025 -

From Tik Tok To Dancing With The Stars Alix Earles Marketing Mastery

May 24, 2025

From Tik Tok To Dancing With The Stars Alix Earles Marketing Mastery

May 24, 2025