UK Inflation Data Drives Pound Higher, BOE Rate Cut Bets Diminish

Table of Contents

Lower-Than-Expected Inflation Figures Boost the Pound

The latest UK inflation report revealed lower-than-anticipated inflation figures, providing a significant boost to the Pound Sterling. This positive economic news contrasted sharply with predictions and previous trends, triggering a noticeable market reaction.

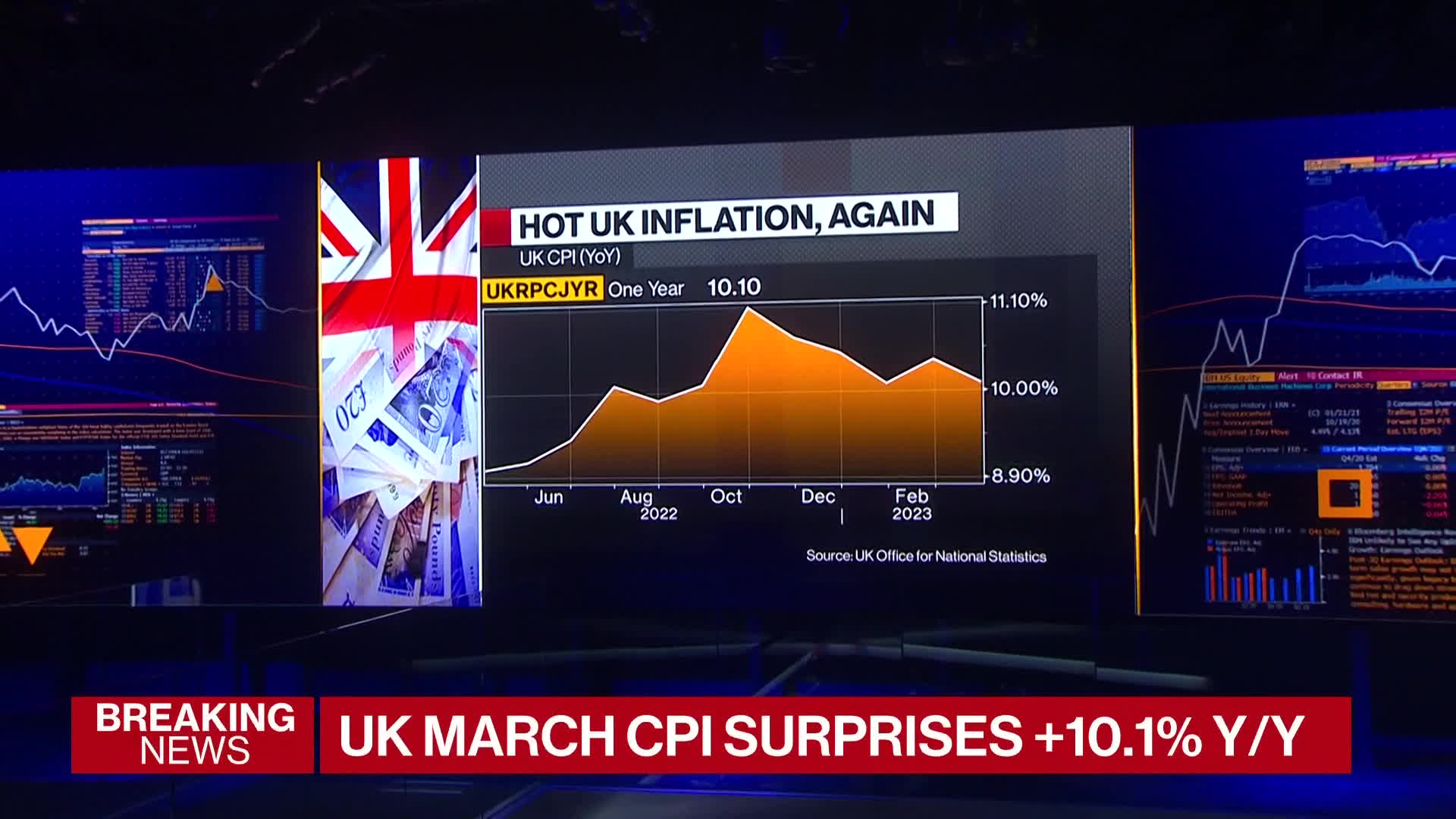

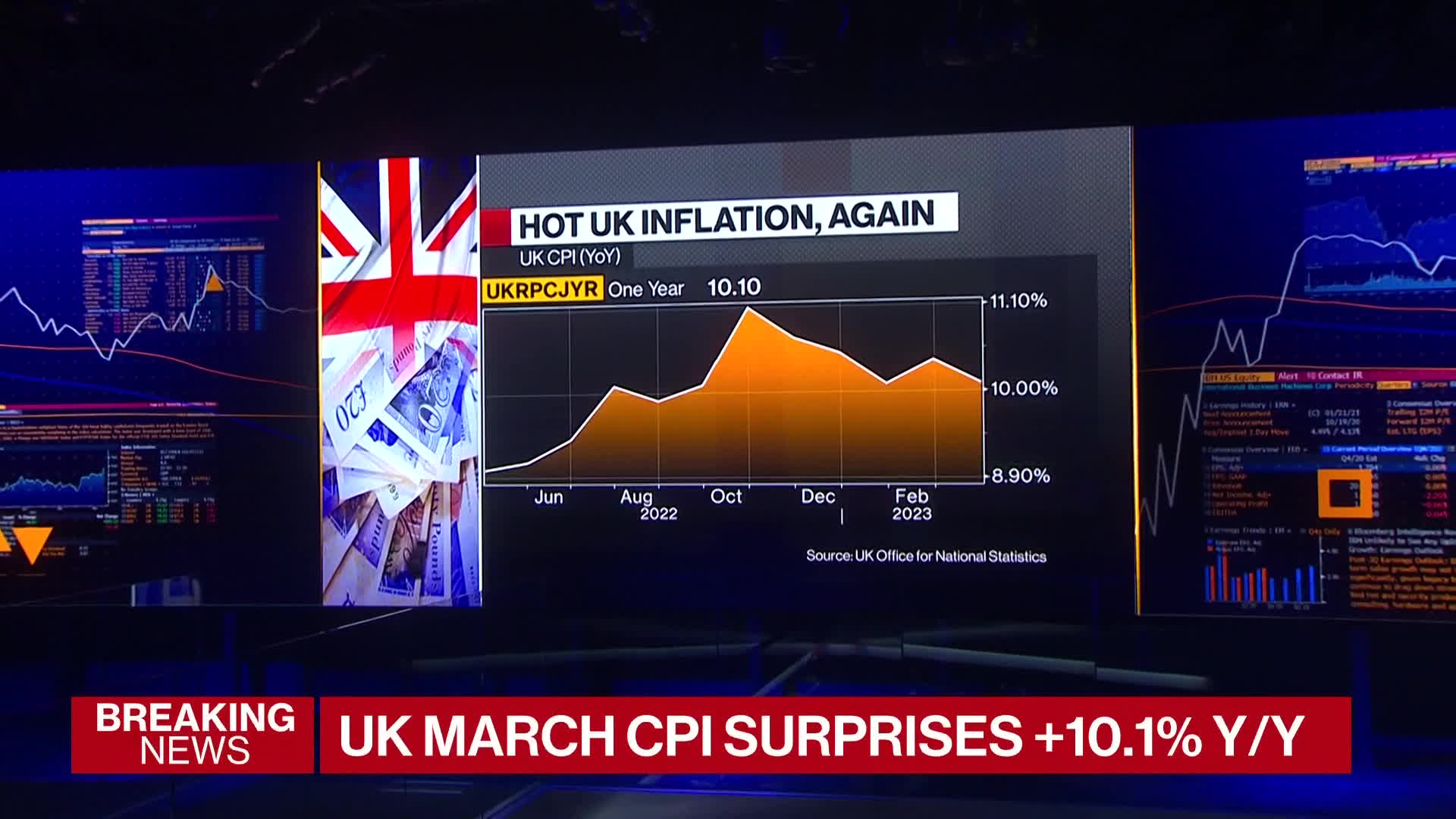

Details of the Inflation Report

The Office for National Statistics (ONS) released data showing a [Insert Actual Percentage Change]% decrease in the Consumer Price Index (CPI) and a [Insert Actual Percentage Change]% change in the Retail Price Index (RPI) compared to the previous month. This was significantly lower than the [Insert Predicted Percentage Change]% CPI increase predicted by analysts.

- Highlighting the Percentage Change: The substantial drop in inflation marks a significant shift from the rising inflation trend observed in recent months.

- Contributing Factors: Several factors contributed to this unexpected decline. Falling energy prices played a major role, alongside easing supply chain pressures and a potential moderation in consumer demand.

- Comparison to Other Economies: Compared to other major economies like the Eurozone and the United States, the UK's inflation rate now sits at a [Insert Comparative Position - e.g., lower, higher] level.

Market Reaction to the Inflation Data

The market reacted swiftly to the positive inflation news, with the GBP appreciating considerably against other major currencies.

- Immediate Impact on GBP Exchange Rate: The Pound experienced a sharp rise against the US dollar (USD) and the Euro (EUR), reaching a [Insert Exchange Rate Figures] level.

- Significant Currency Trading Volume Changes: Trading volume in GBP pairs increased significantly as investors adjusted their positions based on the new information.

- Visualizing GBP Performance: [Insert Chart/Graph showing GBP performance against USD and EUR].

Diminished Expectations of BOE Rate Cuts

The unexpectedly low inflation figures have significantly altered expectations regarding future Bank of England (BOE) interest rate decisions. The probability of further interest rate cuts has diminished considerably.

BOE Monetary Policy and its Influence

The BOE's primary mandate is to maintain price stability and support sustainable economic growth. The recent inflation data suggests that the BOE may no longer feel the pressure to implement further interest rate cuts.

- Previous Trajectory of BOE Interest Rates: The BOE previously embarked on a series of interest rate [hikes/cuts] in response to [inflationary pressures/economic slowdown].

- BOE's Forward Guidance: Following the inflation release, the BOE [released a statement/held a press conference] suggesting a more [hawkish/dovish] approach to monetary policy going forward.

- Impact on Yield Curve and Government Bond Yields: The reduced expectation of further rate cuts has led to a [steepening/flattening] of the yield curve and an increase in government bond yields.

Impact on Investors and Businesses

The diminished expectations of BOE rate cuts have significant implications for investors and businesses operating in the UK.

- Impact on Borrowing Costs: Reduced rate cut expectations mean borrowing costs for businesses and consumers are likely to remain [high/stable/low].

- Effects on Investment in the UK: This could impact investment decisions, with businesses potentially feeling more/less inclined to invest given the prevailing interest rate environment.

- Outlook for Economic Growth: The lower inflation and the potential for a less aggressive monetary policy may lead to more positive prospects for UK economic growth.

Looking Ahead: Future Outlook for the Pound and BOE Policy

Uncertainty remains regarding the future trajectory of the Pound and the BOE's monetary policy decisions. While the recent inflation data is positive, several factors could influence future developments.

Potential Risks and Uncertainties

Several risks and uncertainties could affect future inflation figures and the BOE's response.

- Potential for Future Inflation Surprises: While current inflation is lower than expected, there's always the risk of unexpected surges in the future.

- Lingering Concerns About the UK Economy: Brexit-related uncertainties and other domestic economic challenges could still impact inflation and economic growth.

- Sustainability of the Pound's Strength: The current strength of the Pound may not be sustainable in the long term, depending on various global and domestic factors.

Predictions and Expert Opinions

Economists and financial analysts offer varied perspectives on the future path of the Pound and BOE policy.

- Consensus View on Future Interest Rate Movements: Many analysts believe that the BOE is unlikely to cut interest rates further in the near future.

- Differing Opinions: Some experts express concerns about potential future inflationary pressures, while others are more optimistic about the UK's economic outlook.

- Prediction for GBP Performance: [Insert prediction for GBP performance with a caveat that predictions are inherently uncertain].

Conclusion

The recent UK inflation data has had a significant positive impact on the Pound Sterling, diminishing expectations of further BOE interest rate cuts. This shift in monetary policy outlook has implications for investors, businesses, and the broader UK economy. While the current situation is positive, uncertainties remain, particularly regarding the sustainability of the Pound's strength and the possibility of future inflationary pressures.

Call to Action: Stay informed about crucial UK inflation data and BOE policy announcements to make informed decisions regarding your investments and financial planning. Understanding the intricacies of UK inflation and its influence on the Pound is crucial for navigating the complexities of the financial markets. Monitor future UK inflation data and BOE statements for further insights into the GBP's trajectory and the BOE's monetary policy response.

Featured Posts

-

Exploring The Allegations A Critical Analysis Of The Blake Lively Case

May 22, 2025

Exploring The Allegations A Critical Analysis Of The Blake Lively Case

May 22, 2025 -

The Unexpected Hot Weather Drink You Need This Summer

May 22, 2025

The Unexpected Hot Weather Drink You Need This Summer

May 22, 2025 -

5 Circuits Velo Pour Decouvrir La Region Nantaise Loire Vignoble Et Estuaire

May 22, 2025

5 Circuits Velo Pour Decouvrir La Region Nantaise Loire Vignoble Et Estuaire

May 22, 2025 -

Irish Actor Barry Ward A Conversation On Roles And Perceptions

May 22, 2025

Irish Actor Barry Ward A Conversation On Roles And Perceptions

May 22, 2025 -

Rio Tinto Vs Andrew Forrest Disagreement On Pilbaras Environmental Impact

May 22, 2025

Rio Tinto Vs Andrew Forrest Disagreement On Pilbaras Environmental Impact

May 22, 2025

Latest Posts

-

Investigating The Causes Of Core Weave Inc S Crwv Stock Price Jump

May 22, 2025

Investigating The Causes Of Core Weave Inc S Crwv Stock Price Jump

May 22, 2025 -

Understanding Core Weave Crwv Jim Cramers Perspective And Market Analysis

May 22, 2025

Understanding Core Weave Crwv Jim Cramers Perspective And Market Analysis

May 22, 2025 -

Core Weave Inc Crwv Deconstructing Tuesdays Stock Price Appreciation

May 22, 2025

Core Weave Inc Crwv Deconstructing Tuesdays Stock Price Appreciation

May 22, 2025 -

Core Weave Crwv Stock Price Movement Understanding Todays Activity

May 22, 2025

Core Weave Crwv Stock Price Movement Understanding Todays Activity

May 22, 2025 -

Jim Cramers Core Weave Crwv Investment A Deep Dive Into The Companys Prowess

May 22, 2025

Jim Cramers Core Weave Crwv Investment A Deep Dive Into The Companys Prowess

May 22, 2025