Understanding Key Price Levels For Apple Stock (AAPL)

Table of Contents

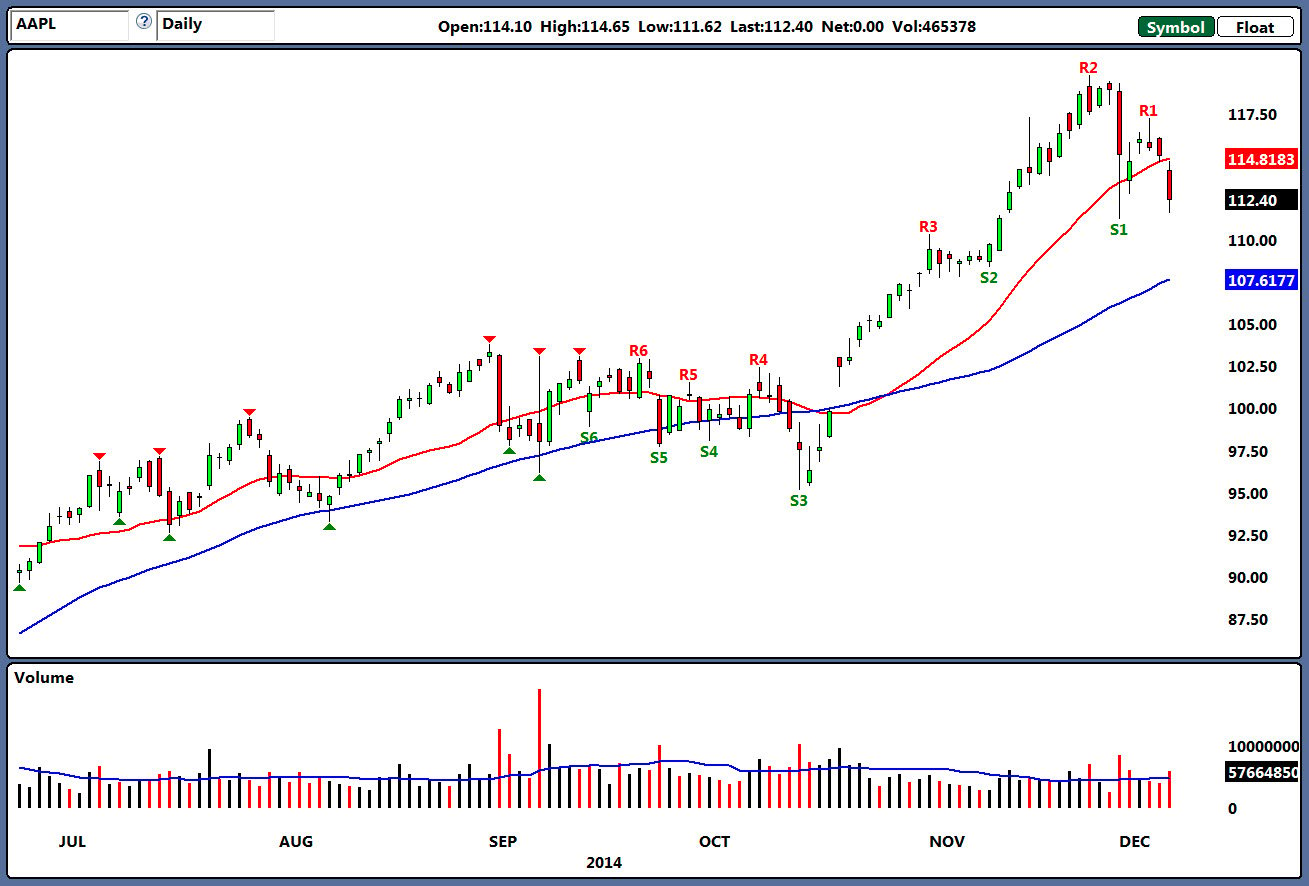

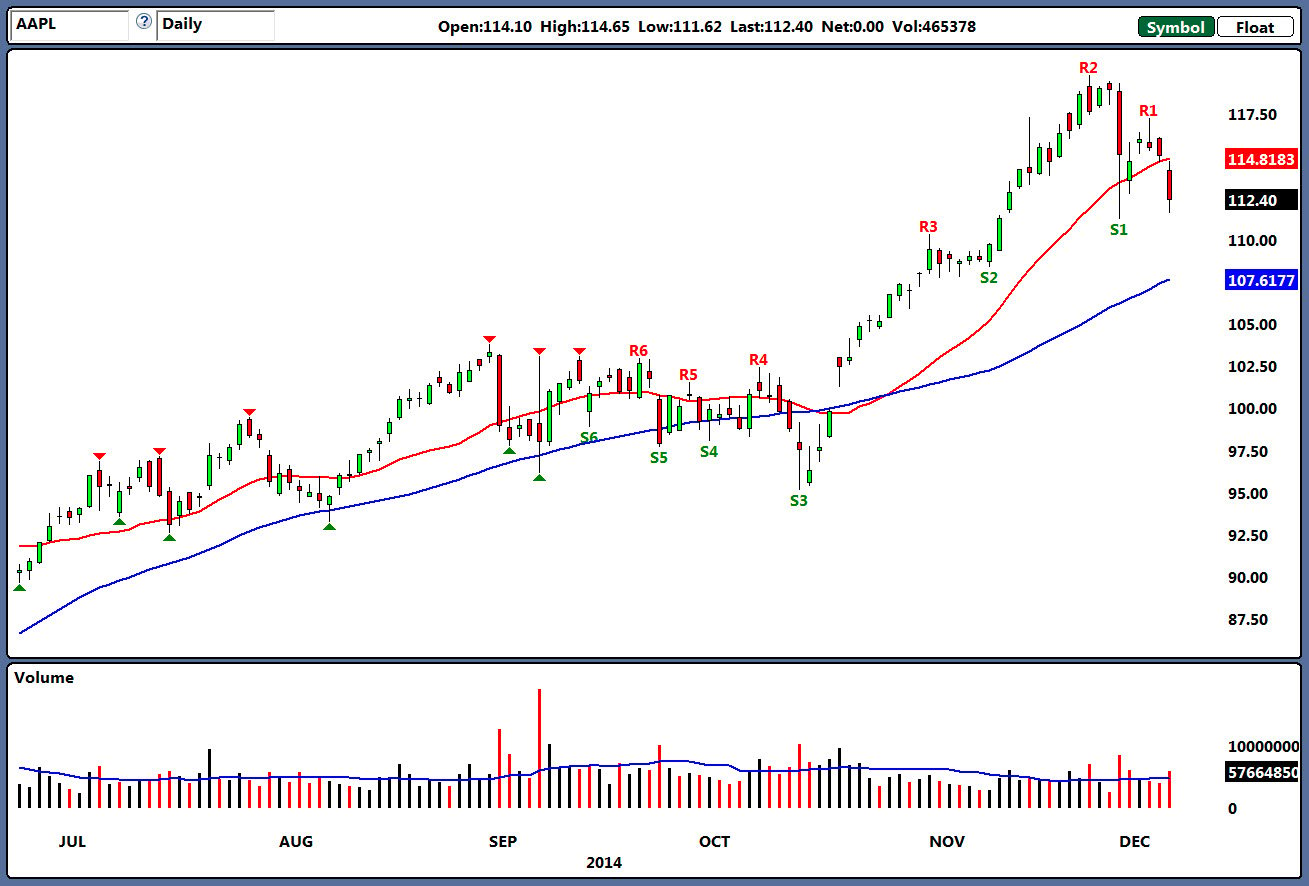

Investing in Apple (AAPL) can be lucrative, but timing the market is crucial. Understanding key price levels – points of support and resistance – is essential for making informed investment decisions. This article will explore significant price levels in Apple's stock history and discuss how to use this information to potentially maximize profits and minimize losses. We will analyze past performance and discuss how to apply this knowledge to your current AAPL investment strategy. Mastering Apple stock price levels is a key component of successful trading.

Identifying Support Levels for AAPL

What are Support Levels?

In technical analysis, support levels represent price points where buying pressure is strong enough to prevent a further decline in the stock price. Think of it as a floor beneath the price. When a stock's price approaches a support level, buyers often step in, preventing a significant drop. Visualizing this on a chart shows a "bouncing" effect, where the price repeatedly finds support at a particular level.

- Examples of historical support levels for AAPL: Analyzing AAPL's historical charts reveals several key support levels. For instance, the $130-$140 range has acted as support multiple times in recent years. Identifying these past levels can give clues to potential future support.

- Analyzing chart patterns to identify potential support: Technical chart patterns like double bottoms, head and shoulders inverses, and rising wedges often indicate strong support areas. Studying these patterns in AAPL's chart history can help predict future support.

- Factors influencing support levels (e.g., market sentiment, economic indicators): Support isn't static. Market sentiment, economic news (like interest rate hikes or inflation data), and overall market trends can all shift support levels. Positive news often strengthens support, while negative news might weaken it.

- The importance of volume confirmation at support levels: A strong support level is often confirmed by high trading volume. High volume at a support level indicates strong buying pressure, increasing the likelihood that the price will bounce.

Recognizing Resistance Levels in AAPL Stock

Understanding Resistance Levels

Resistance levels are price points where selling pressure is strong enough to prevent a further price increase. They act as a ceiling. When a stock's price approaches a resistance level, sellers often emerge, preventing a significant rally. On a chart, this manifests as the price repeatedly failing to break through a specific level.

- Examples of historical resistance levels for AAPL: AAPL has shown resistance at various points throughout its history; the $180-$190 range has often acted as a significant resistance barrier.

- Identifying resistance using chart patterns and technical indicators: Chart patterns like double tops, head and shoulders patterns, and falling wedges can highlight resistance areas. Technical indicators like the Relative Strength Index (RSI) can also signal overbought conditions, suggesting potential resistance.

- The role of psychological price levels (e.g., round numbers) as resistance: Round numbers like $150, $200, or $300 often act as psychological resistance levels because traders tend to take profits near these levels.

- Breakouts from resistance levels and their implications: When a stock price decisively breaks through a resistance level with significant volume, it often signals a potential bullish trend, suggesting further upside potential.

Using Key Price Levels to Develop an AAPL Trading Strategy

Combining Support and Resistance

Combining support and resistance levels allows traders to identify potential trading ranges, breakout opportunities, and key reversal points. The area between support and resistance defines a trading range. Breakouts above resistance or below support signal potential trend changes.

- Developing a risk management plan based on key price levels: Setting stop-loss orders just below support and take-profit targets just above resistance is crucial for risk management. This limits potential losses and secures profits.

- Setting stop-loss orders and take-profit targets: Stop-loss orders protect against significant losses, while take-profit targets ensure you lock in profits when the price reaches a predetermined level.

- The importance of patience and discipline in trading AAPL: Successfully using support and resistance requires patience and discipline. It's crucial to avoid impulsive trades and stick to your pre-defined strategy.

- The role of fundamental analysis in conjunction with technical analysis: While technical analysis using support and resistance is valuable, combining it with fundamental analysis (examining the company's financial health, competitive landscape, and future prospects) provides a more comprehensive trading approach.

Analyzing AAPL's Price History for Key Levels

Historical Context is Crucial

Studying AAPL's past price action is crucial for identifying recurring support and resistance levels. These levels often reappear over time, offering valuable insights for future price movements. Understanding the historical context of these levels provides context for current price action.

- Tools and resources for charting AAPL's price history (e.g., TradingView, Yahoo Finance): Many free and paid charting platforms (like TradingView, Yahoo Finance, and Bloomberg) offer tools to analyze historical price data, identify trends, and draw support and resistance lines.

- Examples of significant historical price movements and their relation to key levels: Analyzing past price spikes and crashes in relation to support and resistance levels helps identify potential patterns and predict future behavior.

- Long-term vs. short-term price level analysis for AAPL: Long-term analysis focuses on major support and resistance levels over years, while short-term analysis focuses on daily or weekly price fluctuations and more immediate support and resistance levels.

Conclusion

Understanding and utilizing key price levels for Apple stock (AAPL) is a crucial skill for any investor or trader. By identifying support and resistance levels through technical analysis and studying past price movements, you can significantly improve your trading strategy and potentially increase your chances of success.

Call to Action: Start analyzing Apple's (AAPL) key price levels today! Use the techniques described in this article to develop a robust trading strategy and make informed investment decisions. Mastering Apple stock price levels and understanding support and resistance is key to successful investing.

Featured Posts

-

Walker Peters To West Ham Examining The Transfer Offer

May 24, 2025

Walker Peters To West Ham Examining The Transfer Offer

May 24, 2025 -

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025 -

Ferraris Inaugural Bengaluru Service Centre What To Expect

May 24, 2025

Ferraris Inaugural Bengaluru Service Centre What To Expect

May 24, 2025 -

Emergency Services Respond To M56 Overturn Crash Motorway Casualty

May 24, 2025

Emergency Services Respond To M56 Overturn Crash Motorway Casualty

May 24, 2025 -

New Era Of Collaboration Bangladeshs Economic Growth In The European Market

May 24, 2025

New Era Of Collaboration Bangladeshs Economic Growth In The European Market

May 24, 2025

Latest Posts

-

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025