Village Roadshow Sale Finalized: Alcon's $417.5 Million Stalking Horse Bid Approved

Table of Contents

Details of the Alcon Acquisition

The deal, valued at $417.5 million, represents a complete takeover of Village Roadshow's core assets. This substantial sum covers a significant portion of Village Roadshow's debt, effectively restructuring its financial liabilities. The acquisition includes a wide range of assets, encompassing film production studios, distribution networks, and exhibition properties.

- Asset Acquisition: The deal includes key film and television assets, distribution rights, and potentially physical properties.

- Debt Restructuring: A significant portion of Village Roadshow's debt will be discharged as part of the acquisition.

- Conditions: The finalization of the sale was subject to standard regulatory approvals and court oversight.

The court approval process involved several hearings and legal arguments, ultimately leading to the judge's approval of the Alcon bid. Key players involved included:

- Judge [Insert Judge's Name]: Presided over the bankruptcy proceedings.

- Law Firms [Insert names of key law firms involved]: Represented both Alcon and Village Roadshow.

- Financial Advisors [Insert names of key financial advisors]: Provided expert guidance on the financial aspects of the deal.

Alcon's strategic rationale behind the acquisition likely centers on expanding its global reach and gaining access to Village Roadshow's established distribution networks and production capabilities within the Australian market. This acquisition significantly boosts Alcon's presence in the international film industry.

Implications for Village Roadshow

The Alcon acquisition marks a significant shift for Village Roadshow. While the details of post-acquisition operations are still emerging, it's expected that there will be substantial changes.

- Management Changes: New leadership is likely, with Alcon potentially installing its own management team.

- Restructuring Plans: Significant restructuring of operations is anticipated, potentially leading to streamlining and consolidation of various business units.

- Future Projects: The future pipeline of Village Roadshow films and productions remains to be seen, with Alcon likely shaping the future direction.

The sale's impact on Village Roadshow's film production, distribution, and exhibition businesses will depend heavily on Alcon's long-term strategy. While this acquisition offers the potential for revitalization, there are also potential concerns regarding job security for Village Roadshow employees.

Impact on Alcon Entertainment and the Broader Entertainment Industry

For Alcon Entertainment, the acquisition of Village Roadshow provides several key strategic advantages:

- Increased Market Share: This deal significantly increases Alcon's footprint and influence within the film industry, particularly in the Australian and Asian markets.

- Expanded Distribution Networks: Village Roadshow's extensive distribution network provides Alcon with a ready-made infrastructure for releasing its films globally.

- Access to Talent: The acquisition potentially grants access to a talented pool of filmmakers and production professionals previously associated with Village Roadshow.

The increased collaboration potential between Alcon and Village Roadshow's existing partners could lead to innovative film projects and distribution strategies. More broadly, this acquisition highlights the ongoing consolidation within the global entertainment industry, setting a precedent for future mergers and acquisitions, particularly in the Australian market.

The Significance of the Stalking Horse Bid

A stalking horse bid, in simple terms, is an initial bid made during bankruptcy proceedings to establish a baseline value for a company's assets. It acts as an anchor, encouraging other potential buyers to submit competing offers.

- Facilitating the Sale: The stalking horse bid initiated the bidding process, ensuring a fair and transparent sale.

- Setting a Floor Price: Alcon's bid provided a benchmark price, encouraging other potential bidders to submit higher offers.

- Strategic Advantage for Alcon: By securing the stalking horse position, Alcon gained an early advantage and established itself as a serious contender.

Alcon's decision to make a stalking horse bid reflects its strong commitment to acquiring Village Roadshow's assets and highlights the strategic value Alcon sees in this acquisition. The success of this stalking horse bid in securing the final deal underscores its significance as a tool in complex corporate transactions. This transaction mirrors similar acquisitions in the entertainment sector where larger studios acquire smaller companies to expand their reach and content libraries.

Conclusion

The finalized Village Roadshow sale to Alcon Entertainment for $417.5 million marks a significant chapter in the history of both companies. Alcon's successful stalking horse bid played a crucial role in securing this deal, resolving the protracted bankruptcy proceedings. This acquisition has significant implications for the Australian entertainment industry, influencing film production, distribution, and exhibition. The integration of Village Roadshow's assets into Alcon's operations will shape the future landscape of Australian and global entertainment.

Call to Action: Stay informed about the future of Village Roadshow and Alcon Entertainment following this significant acquisition. Follow our site for updates on the Village Roadshow sale and other major developments in the entertainment industry. Continue to follow this story for updates on the post-acquisition integration and Alcon's future plans. Learn more about the finalized Village Roadshow sale and its impact on the Australian media landscape.

Featured Posts

-

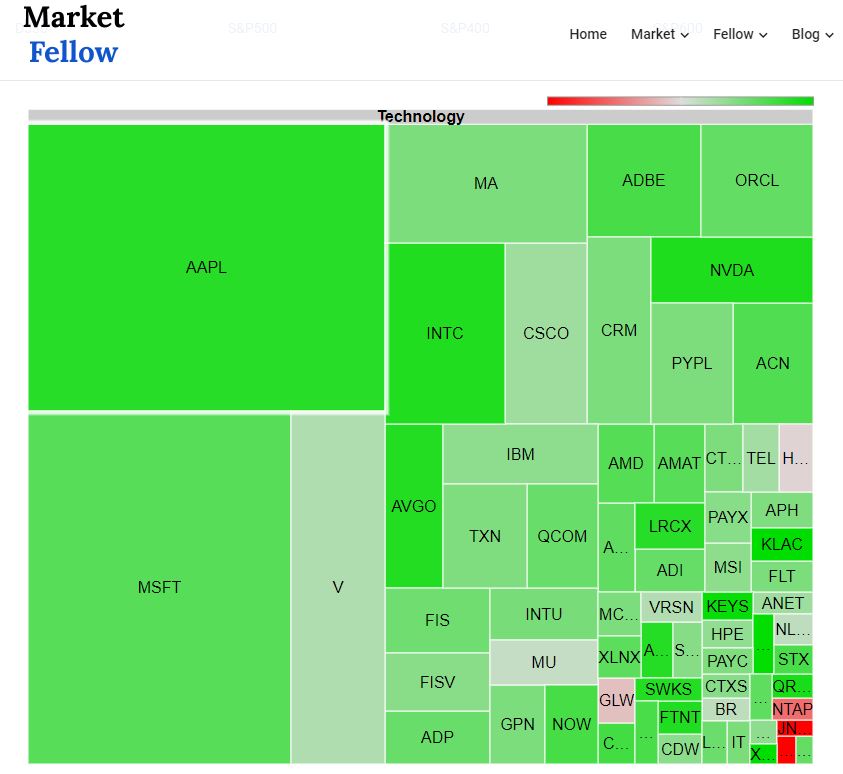

Real Time Stock Market Data Dow S And P 500 April 23rd

Apr 24, 2025

Real Time Stock Market Data Dow S And P 500 April 23rd

Apr 24, 2025 -

From Scatological Data To Engaging Audio An Ais Poop Podcast Revolution

Apr 24, 2025

From Scatological Data To Engaging Audio An Ais Poop Podcast Revolution

Apr 24, 2025 -

India Market Update Tailwinds Driving Nifty Gains

Apr 24, 2025

India Market Update Tailwinds Driving Nifty Gains

Apr 24, 2025 -

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025 -

Bold And The Beautiful Recap April 3 Liams Health Crisis And Hopes Housing Change

Apr 24, 2025

Bold And The Beautiful Recap April 3 Liams Health Crisis And Hopes Housing Change

Apr 24, 2025